- Undercharge for services rendered to another related party in order to minimise revenue for tax purposes. This would be most applicable in a situation where the firm providing the service is in a high tax rate country.

- Acquire goods at a mark-up, rather than at cost, from a related party. This would mainly apply where the party receiving goods wishes to overstate its purchases and thus reduce the profit.

- A related party entity may sell goods to another related party at below market rates in order to minimise sales, reduce revenue and thus avoid taxes such as value added tax, turnover tax or corporation tax

Wilfykil answered the question on February 25, 2019 at 11:48

- Briefly explain how firms or individuals could mitigate tax exposure through.

i) Stock dividends

ii) Share repurchases programmes.

iii) Registered venture capital entities.(Solved)

Briefly explain how firms or individuals could mitigate tax exposure through.

i) Stock dividends

ii) Share repurchases programmes.

iii) Registered venture capital entities.

Date posted: February 25, 2019. Answers (1)

- Discuss four tax incentives that could "have contributed to the growth of financial markets in your country.(Solved)

Discuss four tax incentives that could "have contributed to the growth of financial markets in your country.

Date posted: February 25, 2019. Answers (1)

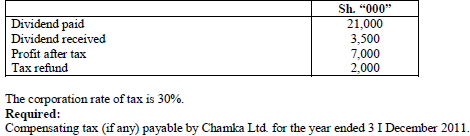

- The following information was provided by Chamka Ltd. for the year ended 31 December 2011.(Solved)

The following information was provided by Chamka Ltd. for the year ended 31 December 2011.

Date posted: February 25, 2019. Answers (1)

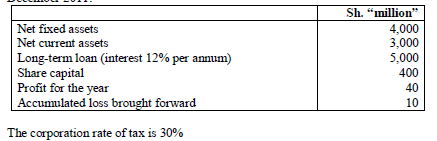

- Savana Holdings Ltd. is a foreign controlled company operating in your country.

The following information was extracted from the financial statements for the year ended 31...(Solved)

Savana Holdings Ltd. is a foreign controlled company operating in your country.

The following information was extracted from the financial statements for the year ended 31 December 2011:

Required:

i) Justify the argument that the company was thinly capitalized.

ii) Compute the company's interest tax shield.

Date posted: February 25, 2019. Answers (1)

- Mr. Maji Mengi knows very little about double taxation agreements. He is a consultant, who works in many countries and in many cases, he has...(Solved)

Mr. Maji Mengi knows very little about double taxation agreements. He is a consultant, who works in many countries and in many cases, he has ended up paying taxes on the same income more than once.

Required:

Explain to Mr. Maji Mengi the concept of double taxation treaty.

Date posted: February 25, 2019. Answers (1)

- Having read in the press about the benefits accruing to Kenya businessmen as a result of regional initiatives such as the East African Community and...(Solved)

Having read in the press about the benefits accruing to Kenya businessmen as a result of regional initiatives such as the East African Community and COMESA, Mr. Jitendra Kumar, a prominent foreign businessman has contacted you seeking your advice on how he could reduce his liability to tax arising from expansion of his business operations into Kenya

Required:

A report addressing in clear and concise details, the following matters raised by Mr. Jitendra Kumar.

(a) The tax objectives under the COMESA treaty.

(b) Rules of origin provisions under the COMESA treaty.

Date posted: February 25, 2019. Answers (1)

- Kenya has entered into double taxation agreements with a number of countries. Explain the meaning and implications of a double taxation relief.(Solved)

Kenya has entered into double taxation agreements with a number of countries. Explain the meaning and implications of a double taxation relief.

Date posted: February 25, 2019. Answers (1)

- Outline the benefits which may accrue to a country from being a signatory to the most favored nation's status agreement(Solved)

Outline the benefits which may accrue to a country from being a signatory to the most favored nation's status agreement

Date posted: February 25, 2019. Answers (1)

- Daniel Otwori, a resident of Kenya earned income from the countries listed below during the year ended 31 December 2006. Income from Kenya: ksh 1,765,000(Solved)

Daniel Otwori, a resident of Kenya earned income from the countries listed below during the year ended 31 December 2006. Income from Kenya: ksh 1,765,000

Income from United Kingdom (UK) UK £4,800 net Tax deducted amounted to UK £960. The average exchange rate during the year was 1 UK £ = 140 KSH, .A double taxation agreement exists between Kenya and United Kingdom.

Required:

The double taxation relief (in Kenya shillings) due to Daniel Otwori for the year ended 31 December 2006.

Date posted: February 25, 2019. Answers (1)

- A few countries and regions in the world have established themselves as tax havens. However, the anticipated inflow of investments has not been as high...(Solved)

A few countries and regions in the world have established themselves as tax havens. However, the anticipated inflow of investments has not been as high as expected by these countries and regions:

Required:

i. Briefly describe the concept of ‘tax havens’

ii. Summarize three benefits that might accrue to an investor in a tax haven

Date posted: February 25, 2019. Answers (1)

- Hodari Nkan is resident of Kenya. During the year ended 31 December 2010, he received the following income:(Solved)

Hodari Nkan is resident of Kenya. During the year ended 31 December 2010, he received the following income:

From Kenya: Sh. 720,000

From Zambia Sh. 540,000 (net of tax of sh. 78,000)

Assume that Kenya has a double taxation agreement with Zambia

Required:

The double taxation relief due to Hodari Nkan for the year ended 31 December 2010

Date posted: February 25, 2019. Answers (1)

- A generalized system of preference (GSP) applies where a country grants preferential treatment to goods and services received from another country.(Solved)

A generalized system of preference (GSP) applies where a country grants preferential treatment to goods and services received from another country.

Required:

Describe three general conditions to be fulfilled for goods or services from one country to benefit from a GSP.

Date posted: February 25, 2019. Answers (1)

- Explain how the tax legislation in your country attempts to prevent creative accounting by multinational companies(Solved)

Explain how the tax legislation in your country attempts to prevent creative accounting by multinational companies

Date posted: February 25, 2019. Answers (1)

- “Many objectives of the Common Market for Eastern and Southern African (COMESA) treaty remain elusive due to emerging challenges”. Highlight four such challenges(Solved)

“Many objectives of the Common Market for Eastern and Southern African (COMESA) treaty remain elusive due to emerging challenges”. Highlight four such challenges

Date posted: February 25, 2019. Answers (1)

- Identify and explain instances when a capital statement may be required.(Solved)

Identify and explain instances when a capital statement may be required.

Date posted: February 25, 2019. Answers (1)

- Outline the main types of duties to be levied on goods according to the provisions of the Customs and Excise Act (Cap.472).(Solved)

Outline the main types of duties to be levied on goods according to the provisions of the Customs and Excise Act (Cap.472).

Date posted: February 25, 2019. Answers (1)

- Giving appropriate examples, distinguish between forward and backward tax shifting.(Solved)

Giving appropriate examples, distinguish between forward and backward tax shifting.

Date posted: February 25, 2019. Answers (1)

- Define the term "shortfall distribution tax". Under what circumstances can a company be exempted from shortfall distribution tax?(Solved)

Define the term "shortfall distribution tax". Under what circumstances can a company be exempted from shortfall distribution tax?

Date posted: February 25, 2019. Answers (1)

- Write brief notes on the bodies the tax payer may appeal to incase he/she is aggrieved by the manner in which an objection for tax...(Solved)

Write brief notes on the bodies the tax payer may appeal to incase he/she is aggrieved by the manner in which an objection for tax assessment to the commissioner has been dealt with.

Date posted: February 25, 2019. Answers (1)

- Write brief notes on Objections by the taxpayer of an assessment done by the commissioner(Solved)

Write brief notes on Objections by the taxpayer of an assessment done by the commissioner

Date posted: February 25, 2019. Answers (1)