1. Benefits as a result of integration of the Departments into Domestic Taxes Departments

- The integration has eliminated duplicated of functions, leading to resource savings that can be applied to other critical areas such as automation.

- It has led to enhanced taxpayer compliance and risk assessment given that taxpayers are monitored for all taxes and there is more sharing of information.

- There is better relationship with the clients as they are no longer subjected to separate audits from income Tax and Vat officers. This is due to better co-ordinated approach to tax audits and taxpayers education.

- The management is able to monitor the effectiveness of tax audit and other programmes in totality as opposed to the previous situation where one programme was being performed across different departments.

- Integration has reduced the likely incidence of corruption as a taxpayer is now likely to be audited by a team, not an individual officer from a department.

- Information sharing is possible

2. Drawbacks from integration

- Lack of clear responsibilities

i) Previously, it was possible to place responsibilities for attaining targets on various commissioners be it for customs and excise VAT, Income Tax etc. Variations were easier to spot. Not possible now since all these are integrated into one.

ii) Tax payers do not clearly know who to report to at KRA i.e. whether they fall under Large Taxpayer Unit or otherwise. No clear guidelines.

- Inefficiency may crop in due to increased span of management by the supervisors.

- Loss of jobs for some staff from each of the merged departments. This could lead to apathy in the remaining staff who is not assured of their future jobs hence demoralisation

- Staff will be forced to relearn the operation of the other department that was merged with theirs.

- Lack of specialization because staff will be required to handle a diversity of duties arising from the merged departments

Wilfykil answered the question on February 26, 2019 at 05:22

- Fruit farm Ltd. produces pineapple juice for sale in both local and export markets. The company owns plantations in Sagan which supply pineapples to the...(Solved)

Fruit farm Ltd. produces pineapple juice for sale in both local and export markets. The company owns plantations in Sagan which supply pineapples to the processing factory located in Thika.

The following is a summary of the company’s income statement for the year ended 31 December 2006.

Required:

i) Capital allowances due to Fruit farm Ltd. for the year ended 31 December 2006

ii) Adjusted taxable profit or loss for the year to 31 December 2006.

Date posted: February 26, 2019. Answers (1)

- The following information relates to ABC Ltd. for the year ended 31 December 2006.(Solved)

The following information relates to ABC Ltd. for the year ended 31 December 2006.

- Profit before tax sh. 4,000,000

- Import duty refunded by the authority sh. 400,000

- Dividend distributed by .ABC Ltd. sh. 8,800,000

- Dividend distributed by ABC Ltd. Sh. 3,000,000

- Corporation tax rate 30%.

Required:

Compensating tax payable by ABC Ltd. for the year ended 31 December 2006.

Date posted: February 26, 2019. Answers (1)

- The following information was extracted from the books of Faida Ltd. for the year ended 31 December 2006(Solved)

The following information was extracted from the books of Faida Ltd. for the year ended 31 December 2006

- Profit before tax sh. 400,000

- Import duty refunded by tax authority sh. 400,000

- Dividend distributed by Faida Ltd. sh. 8,800,000.

- Dividend received by Faida Ltd. sh 3,000,000

The rate of corporation tax is 30%

Required:

Compensating tax payable by Faida Ltd. for the year ended 31 December 2006

Date posted: February 26, 2019. Answers (1)

- Primark Ltd. manufactures a variety of goods for the local market. The company commenced operations on 2 January 2006. The following is an extract from...(Solved)

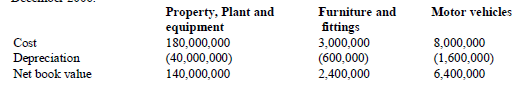

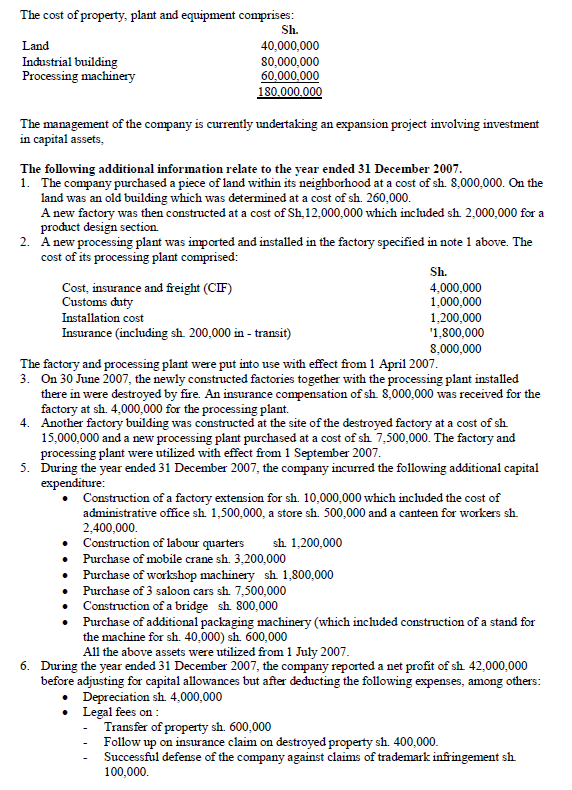

Primark Ltd. manufactures a variety of goods for the local market. The company commenced operations on 2 January 2006. The following is an extract from the company's balance sheet as at 31 December 2006

Required:

i) Capital allowances due to Primark Ltd. for the year ended 31 December 2007.

ii) Tax payable by the company (if any) for the year ended 31 December 2007.

Date posted: February 25, 2019. Answers (1)

- Ann Mwajuma runs a small business in Kisii town. The revenue authority has asked her to submit a self assessment return for the year ended...(Solved)

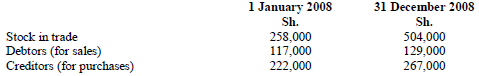

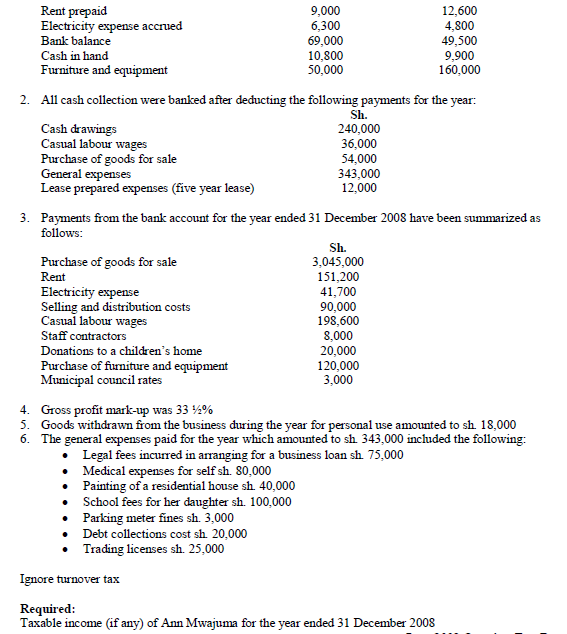

Ann Mwajuma runs a small business in Kisii town. The revenue authority has asked her to submit a self assessment return for the year ended 31 December 2008

However, Ann Mwajuma did not maintain complete accounting records for the year ended 31 December 2008. She has therefore requested you to assist her and has provided you with the following information:

1. Opening and closing balances of assets and liabilities were as follows for the year ended 31 December 2008:

Date posted: February 25, 2019. Answers (1)

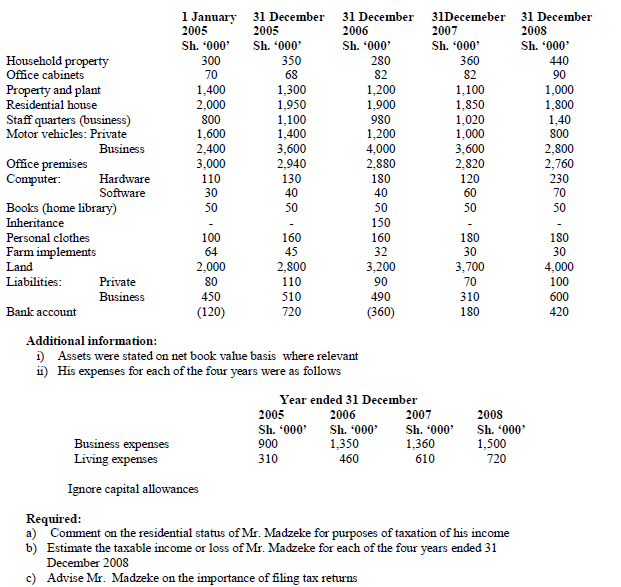

- Mr. Felix Madzeke is a citizen of Malawi but has been residing and conducting business in your country since 2005. However, he was not aware...(Solved)

Mr. Felix Madzeke is a citizen of Malawi but has been residing and conducting business in your country since 2005. However, he was not aware of the requirements to maintain proper records and submitting regular assessment to the revenue authority.

An inspection conducted by the revenue authority on his business and personal transactions over past four years revealed the following:

Assets and liabilities (business and personal) as at:

Date posted: February 25, 2019. Answers (1)

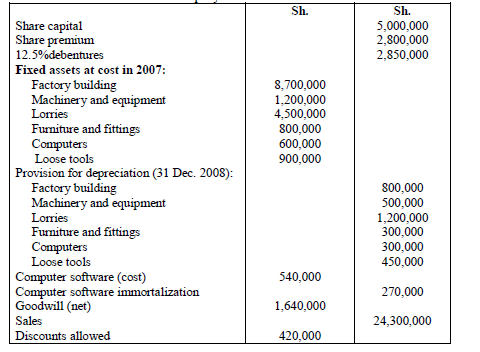

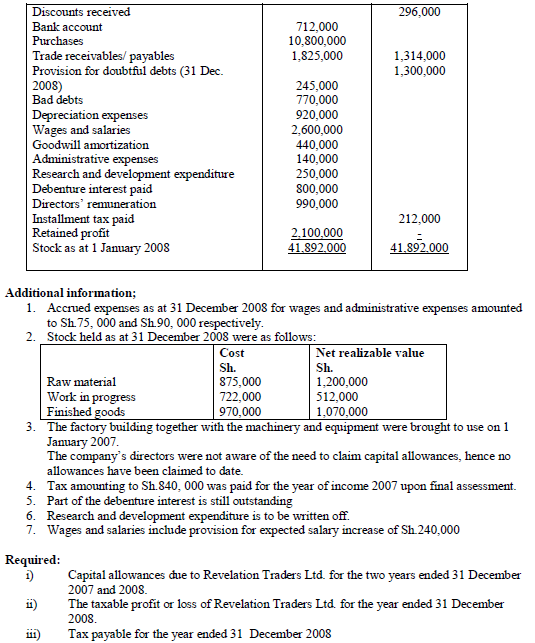

- Revelation Traders Ltd. started its operations on 1 January 2007. The following trial balance was extracted from the books of the company as at 31...(Solved)

Revelation Traders Ltd. started its operations on 1 January 2007. The following trial balance was extracted from the books of the company as at 31 December 2008:

Date posted: February 25, 2019. Answers (1)

- Briefly explain the procedure to be followed when an error on past returns is discovered either by the tax payer or commissioner for Domestic Taxes.(Solved)

Briefly explain the procedure to be followed when an error on past returns is discovered either by the tax payer or commissioner for Domestic Taxes.

Date posted: February 25, 2019. Answers (1)

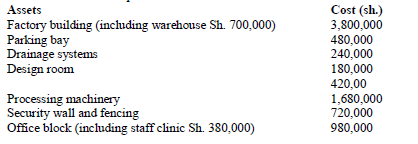

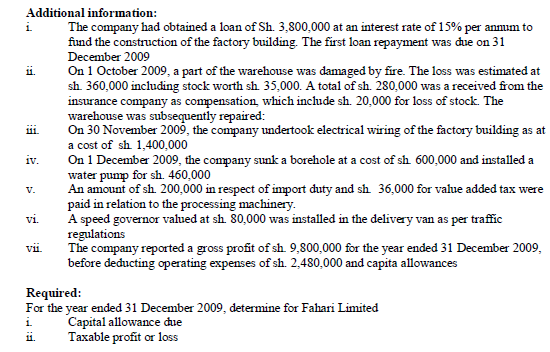

- Fahari Limited, a company making various leather products, commenced operation on 1 January 2009. The following information relate to the assets that the company purchased...(Solved)

Fahari Limited, a company making various leather products, commenced operation on 1 January 2009. The following information relate to the assets that the company purchased or constructed before commencement of operations

Date posted: February 25, 2019. Answers (1)

- What should individuals and corporates put in mind to mitigate their tax exposure or avoid being taxed unfairly?(Solved)

What should individuals and corporates put in mind to mitigate their tax exposure or avoid being taxed unfairly?

Date posted: February 25, 2019. Answers (1)

- How can corporates avoid taxes?(Solved)

How can corporates avoid taxes?

Date posted: February 25, 2019. Answers (1)

- What techniques or ways can individuals take advantage of to avoid taxes?(Solved)

What techniques or ways can individuals take advantage of to avoid taxes?

Date posted: February 25, 2019. Answers (1)

- Tax refunds and tax credits are increasingly being used by governments in the information and modernization taxation policies(Solved)

Tax refunds and tax credits are increasingly being used by governments in the information and modernization taxation policies.

Required:

i) Citing examples distinguish between a tax refund” and a “tax credit”

ii) Evaluate the fundamental role of tax refunds and tax credits in a government’s developments agenda

Date posted: February 25, 2019. Answers (1)

- In the year ended 31 December 2011. Malipo Ltd. earned a profit before tax of Sh. 400 million from its main operation.(Solved)

In the year ended 31 December 2011. Malipo Ltd. earned a profit before tax of Sh. 400 million from its main operation.

In addition, the company earned an investment income of Sh. k60 million. Dividend paid to members for the year amounted to Sh. 98 million.

The corporation tax rate is 30%

Required:

Shortfall tax, inclusive of penalties (if any) payable by the company for the year ended 31 December 2011.

Date posted: February 25, 2019. Answers (1)

- Justify the imposition of shortfall tax on companies(Solved)

Justify the imposition of shortfall tax on companies

Date posted: February 25, 2019. Answers (1)

- A number of countries, particularly in the developing world, have rest fact urea their revenue authorities to provide for large taxpayer units (LTUs).(Solved)

A number of countries, particularly in the developing world, have rest fact urea their revenue authorities to provide for large taxpayer units (LTUs).

Required;

i) Explain three reasons that have motivated the formation of LTUs.

ii) As a tax consultant in a country that intends to form an LTU, describe three key functional areas of an LTU.

Date posted: February 25, 2019. Answers (1)

- Discuss three reasons that related parties may give to justify the continued use of transfer pricing systems.(Solved)

Discuss three reasons that related parties may give to justify the continued use of transfer pricing systems.

Date posted: February 25, 2019. Answers (1)

- Describe ways in which related parties could be transfer pricing systems to avoid tax(Solved)

Describe ways in which related parties could be transfer pricing systems to avoid tax

Date posted: February 25, 2019. Answers (1)

- Briefly explain how firms or individuals could mitigate tax exposure through.

i) Stock dividends

ii) Share repurchases programmes.

iii) Registered venture capital entities.(Solved)

Briefly explain how firms or individuals could mitigate tax exposure through.

i) Stock dividends

ii) Share repurchases programmes.

iii) Registered venture capital entities.

Date posted: February 25, 2019. Answers (1)

- Discuss four tax incentives that could "have contributed to the growth of financial markets in your country.(Solved)

Discuss four tax incentives that could "have contributed to the growth of financial markets in your country.

Date posted: February 25, 2019. Answers (1)