i) Value added tax VAT

VAT is elastic because a slight change in VAT rate will lead to significant change in revenue to the Government from vat able goods. However, for zero and exempt goods, VAT is inelastic

ii) Income tax

For Body Corporate it is inelastic since the corporate tax rate is constant for individuals it is slightly elastic since a slight change in graduated scale rates does not have significant impact on the revenue to the Government.

iii) Customs and excise duty

Customs duty is elastic since a change in customs duty rate will led to a change in volume of imports leading to a change in Revenue to a government. Excise duty is inelastic since consumers will re-organize their spending in case of change of change in excise duty rate.

Wilfykil answered the question on February 26, 2019 at 06:19

- Distinguish buoyancy from elasticity of a tax(Solved)

Distinguish buoyancy from elasticity of a tax

Date posted: February 26, 2019. Answers (1)

- You have been approached by Mr. Kenneth Kamau, seeking your assistance in the computation of his tax liability for the year ended 31 December 2001....(Solved)

You have been approached by Mr. Kenneth Kamau, seeking your assistance in the computation of his tax liability for the year ended 31 December 2001. He has provided you with the following information:

Mr. Kamau works for Chip.com Ltd. as the technical director. During the year ended 31 December 2001, he received the following emoluments:

Required:

i) Compute the taxable income for Mr. Kamau for the year ended 31 December 2001.

ii) Determine tax payable and specify when it is to be paid.

iii) Is Mr. Kamau to blame for the PAYE not deducted from his emoluments? Briefly explain.

iv) Assuming that the market rate of interest for January 2001 was 10% per annum. Compute the fringe benefit tax (FBT) payable on Mr. Kamau’s loan. When would the FBT be paid to the Commissioner of Income Tax?

v) Comment on the tax implications of Mrs. Kamau’s contributions to an Individual Retirement Benefit Scheme

Date posted: February 26, 2019. Answers (1)

- Mr. Abdi, a businessman, has provided the following information to the year ended 31 December 2002:(Solved)

Mr. Abdi, a businessman, has provided the following information to the year ended 31 December 2002:

Date posted: February 26, 2019. Answers (1)

- Mr. Alex employment was terminated on 31st Dec 2010 after serving for 20 years in a company and was paid a gratuity of Shs. 4...(Solved)

Mr. Alex employment was terminated on 31st Dec 2010 after serving for 20 years in a company and was paid a gratuity of Shs. 4 million, a 3 months’ notice pay of Kshs. 200,000 and shs 75, 000 for his 25 days leave not taken in the year 2010. The information relating to his income for the last 5 years was as follows:

Date posted: February 26, 2019. Answers (1)

- With reference to section 46 and 47 of the income tax Act (cap 470) explain how the incomes of the following persons are assessed for...(Solved)

With reference to section 46 and 47 of the income tax Act (cap 470) explain how the incomes of the following persons are assessed for tax.

i) Incapacitated persons

ii) Nonresident persons

Date posted: February 26, 2019. Answers (1)

- Outline two types of capital allowances granted to companies manufacturing bond.(Solved)

Outline two types of capital allowances granted to companies manufacturing bond.

Date posted: February 26, 2019. Answers (1)

- Write brief notes on Tax-free employment benefits(Solved)

Write brief notes on Tax-free employment benefits

Date posted: February 26, 2019. Answers (1)

- Define the term 'tax planning'(Solved)

Define the term 'tax planning'

Date posted: February 26, 2019. Answers (1)

- Write brief notes on Exempt interest income(Solved)

Write brief notes on Exempt interest income

Date posted: February 26, 2019. Answers (1)

- Write brief notes on Fringe benefit tax

(Solved)

Write brief notes on Fringe benefit tax

Date posted: February 26, 2019. Answers (1)

- Starlit company Ltd. has been operating in Kenya Since 1 January 2003. The company is a subsidiary of Mega Holdings Ltd. which is used on...(Solved)

Starlit company Ltd. has been operating in Kenya Since 1 January 2003. The company is a subsidiary of Mega Holdings Ltd. which is used on the United Kingdom.

The financial statements of Starlit Company Ltd. for the year ended 31 December 2005 are presented below.

Date posted: February 26, 2019. Answers (1)

- Related companies may understate their taxable profits by engaging in transfer pricing. With reference to Section 18 (3) of the Income Tax Act (Cap. 470),...(Solved)

Related companies may understate their taxable profits by engaging in transfer pricing. With reference to Section 18 (3) of the Income Tax Act (Cap. 470), briefly explain three transactions that may constitute transfer pricing."

Date posted: February 26, 2019. Answers (1)

- Explain the methods applied in adjusting transfer prices.(Solved)

Explain the methods applied in adjusting transfer prices.

Date posted: February 26, 2019. Answers (1)

- Explain the meaning of transfer pricing?(Solved)

Explain the meaning of transfer pricing?

Date posted: February 26, 2019. Answers (1)

- Kamere Ltd. commenced manufacturing operations on 1 January 2003. The management of the company has prepared the following financial statement for the year ended 31...(Solved)

Kamere Ltd. commenced manufacturing operations on 1 January 2003. The management of the company has prepared the following financial statement for the year ended 31 December 2005.

Balance sheet as at 31 December 2005

Additional information:

1. Non-current assets are stated net of depreciation including for year 2005. It is the policy of the company to charge depreciation at 20 % per annum on a straight line method.

2. The company has not claimed capital allowance since it commenced operations.

3. The company's reported taxable profits for the year ended 31 December 2003 and 2004 were sh.8,000,000 andsh.6,400,000 respectively

4. Factory building includes an extension to the factory constructed at a cost of sh. 1,600,000 which was put into use on I January

5. Machinery include generator and conveyor belts bought for sh. 1,400,000 and sh. 800,000 respectively.

6. Motor vehicles include a forklift purchased in 2003 at sh. 1,160,000.

7. A saloon car purchased in year 2004 at sh. 1,200,000 was disposed of during the year 2005 for sh. 600,000 no adjustment have been made to record this disposal.

8. The loan was received on 1 January 2005 and is subject to interest at the rate of 8% per annum

Required:

i) Capital allowances due to Kamere Ltd. for each of the three years ended 31 December 2003 , 2004, and 2005

ii) Adjusted taxable profit or loss for the company in each of the three years above.

Date posted: February 26, 2019. Answers (1)

- The Kenya Revenue Authority ("KRA") is geared towards a function-based organization rather than one structured along the types of taxes. This is evidenced by the...(Solved)

The Kenya Revenue Authority ("KRA") is geared towards a function-based organization rather than one structured along the types of taxes. This is evidenced by the integration of VAT, Income Tax and Excise departments into the Domestic Department. Asses the likely benefits and drawbacks to KRA arising from this integration

Date posted: February 26, 2019. Answers (1)

- Fruit farm Ltd. produces pineapple juice for sale in both local and export markets. The company owns plantations in Sagan which supply pineapples to the...(Solved)

Fruit farm Ltd. produces pineapple juice for sale in both local and export markets. The company owns plantations in Sagan which supply pineapples to the processing factory located in Thika.

The following is a summary of the company’s income statement for the year ended 31 December 2006.

Required:

i) Capital allowances due to Fruit farm Ltd. for the year ended 31 December 2006

ii) Adjusted taxable profit or loss for the year to 31 December 2006.

Date posted: February 26, 2019. Answers (1)

- The following information relates to ABC Ltd. for the year ended 31 December 2006.(Solved)

The following information relates to ABC Ltd. for the year ended 31 December 2006.

- Profit before tax sh. 4,000,000

- Import duty refunded by the authority sh. 400,000

- Dividend distributed by .ABC Ltd. sh. 8,800,000

- Dividend distributed by ABC Ltd. Sh. 3,000,000

- Corporation tax rate 30%.

Required:

Compensating tax payable by ABC Ltd. for the year ended 31 December 2006.

Date posted: February 26, 2019. Answers (1)

- The following information was extracted from the books of Faida Ltd. for the year ended 31 December 2006(Solved)

The following information was extracted from the books of Faida Ltd. for the year ended 31 December 2006

- Profit before tax sh. 400,000

- Import duty refunded by tax authority sh. 400,000

- Dividend distributed by Faida Ltd. sh. 8,800,000.

- Dividend received by Faida Ltd. sh 3,000,000

The rate of corporation tax is 30%

Required:

Compensating tax payable by Faida Ltd. for the year ended 31 December 2006

Date posted: February 26, 2019. Answers (1)

- Primark Ltd. manufactures a variety of goods for the local market. The company commenced operations on 2 January 2006. The following is an extract from...(Solved)

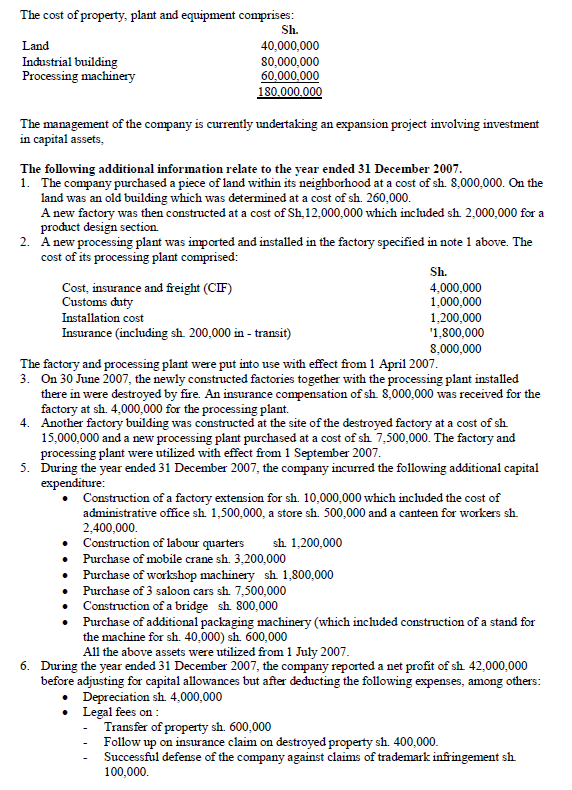

Primark Ltd. manufactures a variety of goods for the local market. The company commenced operations on 2 January 2006. The following is an extract from the company's balance sheet as at 31 December 2006

Required:

i) Capital allowances due to Primark Ltd. for the year ended 31 December 2007.

ii) Tax payable by the company (if any) for the year ended 31 December 2007.

Date posted: February 25, 2019. Answers (1)