In marginal costing the cost of a product is its variable cost i.e. direct material direct labour, direct

expenses and the variable part of overheads.

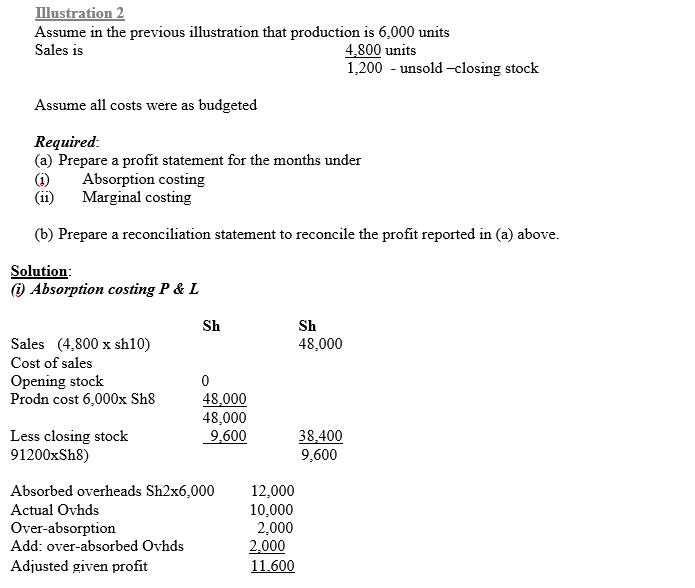

In absorption costing, all costs are absorbed into production and thus operating statements do not

distinguish between fixed and variable costs.

Or

-In absorption costing fixed manufacturing overheads are absorbed into cost units and for this

reason stocks are valued at full costs (direct material, direct labour, valuable overheads and fixed overheads). Overheads are therefore charged in the P& L A/C of the period in which the stocks are sold.

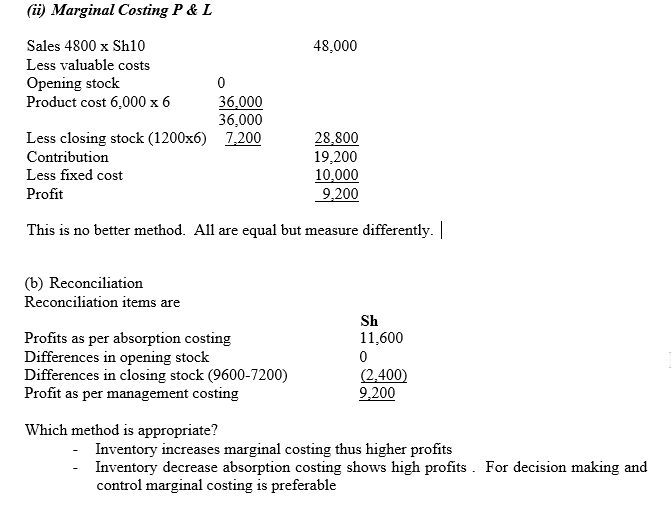

- In marginal costing however overheads are not absorbed into cost units and therefore stocks are valued at marginal or variable costs (direct material, direct labour and variable overheads only). For this reason fixed manufacturing overheads are treated as periodic costs and are changed to the P & L A/c of the period in which they are incurred.

marto answered the question on

February 26, 2019 at 08:54