- Write up the asset, capital and liability accounts in the books of M Crash to record the following transactions:(Solved)

Write up the asset, capital and liability accounts in the books of M Crash to record the following transactions:

2002

June 1 Started business with Sh.50,000 in the bank.

“ 2 Bought motor van paying by cheque Sh.12,000.

“ 5 Bought Fixtures Sh.4,000 on credit from Office Masters Ltd.

“ 8 Bought a van on credit from Motor Cars Ltd Sh.8,000.

“ 12 Took Sh.1,000 out of the bank and put it into the cash till.

“ 15 Bought Fixtures paying by cash Sh.600.

“ 19 Paid Motor Cars Ltd by cheque Sh.8000.

“ 21 A loan of Sh.10,000 cash is received from J Marcus.

“ 25 Paid Sh.8,000 of the cash in hand into the bank account.

“ 30 Bought more Fixtures paying by cheque Sh.3,000.

Date posted: February 28, 2019. Answers (1)

- H Jumps has the following assets and liabilities as on 30 November 2002:

Creditors Sh.39,500;

Equipment Sh.115,000;

Motor vehicle Sh.62,900;

Stock Sh.61,500;

Debtors Sh.57,700;

Cash at bank...(Solved)

H Jumps has the following assets and liabilities as on 30 November 2002:

Creditors Sh.39,500;

Equipment Sh.115,000;

Motor vehicle Sh.62,900;

Stock Sh.61,500;

Debtors Sh.57,700;

Cash at bank Sh.72,800 and Cash in hand Sh.400.

Compute the balance on the capital account as at 30 November 2002.

During the first week of December 2002, Jump:

a. Bought extra equipment on credit for Sh.13,800.

b. Bought extra stock by cheque Sh.5,700.

c. Paid creditors by cheque Sh.7,900.

d. Received from debtors Sh.8,400 by cheque and Sh.600 by cash.

e. Put in an extra Sh.2,500 cash as capital.

You are to record the above transactions in respective accounts.

Date posted: February 28, 2019. Answers (1)

- State and explain the effects of double entry(Solved)

State and explain the effects of double entry

Date posted: February 28, 2019. Answers (1)

- State the difference between Initial Capital and Final Capital of a Business(Solved)

State the difference between Initial Capital and Final Capital of a Business

Date posted: February 28, 2019. Answers (1)

- State and explain what can Cause Changes in Capital(Solved)

State and explain what can Cause Changes in Capital

Date posted: February 28, 2019. Answers (1)

- D Moody has the following assets and liabilities as on 31 April 2002:(Solved)

D Moody has the following assets and liabilities as on 31 April 2002:

Sh.

Creditors 15,800

Equipment 46,000

Motor Vehicle 25,160

Stock 24,600

Debtors 23,080

Cash at bank 29,120

Cash in hand 160

During the first week of May 2002 Moody:

a. Bought extra equipment on credit for Sh.5,520.

b. Bought extra stock by cheque Sh.2,280.

c. Paid creditors by cheque Sh.3,160.

d. Debtors paid Sh.3,360 by cheque and Sh.240 by cash.

e. Moody put in extra Sh.1,000 cash as capital

Required:

a. Determine the capital as at 1st May 2002.

b. Draw up a statement of financial position after the above transactions have been completed.

Date posted: February 28, 2019. Answers (1)

- State the two formats of writing statement of financial position and describe them.(Solved)

State the two formats of writing statement of financial position and describe them.

Date posted: February 28, 2019. Answers (1)

- What are the components of accounting equations?(Solved)

What are the components of accounting equations?

Date posted: February 28, 2019. Answers (1)

- Given that prudence is the main consideration, discuss under what circumstances, if any, revenue might be recognized at the following stages of a sale.(Solved)

Given that prudence is the main consideration, discuss under what circumstances, if any, revenue might be recognized at the following stages of a sale.

(a) Goods have been acquired by the business, which it confidently expects to resell very quickly.

(b) A customer places a firm order for goods.

(c) Goods are delivered to the customer.

(d) The customer is invoiced for goods.

(e) The customer pays for the goods.

(f) The customer’s cheque in payment for the goods has been cleared by the bank.

Date posted: February 28, 2019. Answers (1)

- When should sales revenue only be ‘realized’ and so ‘recognized’ in the trading, profit and loss account?(Solved)

When should sales revenue only be ‘realized’ and so ‘recognized’ in the trading, profit and loss account?

Date posted: February 28, 2019. Answers (1)

- The following information was extracted from the book of LIMA Ltd. For the year 2006(Solved)

The following information was extracted from the book of LIMA Ltd. For the year 2006

(i) Initial capital as at 1/01/2006 – Sh.200,000

(ii) Made a net loss of Sh. 50,000

(iii) The proprietor invested into the business from her personal saving Sh. 600,000

(iv) The proprietor withdraw in cash for her personal use Sh. 250,000

Required:

Using the final capital formula, determine the final capital as at 31/12/06

Date posted: February 27, 2019. Answers (1)

- Outline 4 circumstances under which the capital of a business may change(Solved)

Outline 4 circumstances under which the capital of a business may change

Date posted: February 27, 2019. Answers (1)

- Define the following terms as used in Business.

(i) Business transactions

(ii) Credit transaction

(iii) Initial capital

(iv) Final capital

(v) Drawings(Solved)

Define the following terms as used in Business.

(i) Business transactions

(ii) Credit transaction

(iii) Initial capital

(iv) Final capital

(v) Drawings

Date posted: February 27, 2019. Answers (1)

- The following transaction to Best Sales (K) Ltd for the month of March 2009.(Solved)

The following transaction to Best Sales (K) Ltd for the month of March 2009.

March 1: Started business with Sh. 800,000 in the bank.

March 2: Bought goods on credit from the following persons

Ndichu- Sh. 76,000

Omolo- Sh. 27,000

Tina- Sh. 56,000

March 5: Cash sales Sh. 87,000

March 6: Paid wages in cash Sh. 14,000

March 7: Sold goods on credits to

Emma-Sh.35, 000

Jane- Sh. 42,000

Juma- Sh. 72,000

March 9: Bought goods for cash Sh. 46,000

March 10: Bought goods on Credits from

Omolo- Sh. 57,000

Ndebu-Sh. 98,000

March 12: Paid wages in cash Sh.465, 000

March 13: Sold on credit to: Jane- Sh. 32,000

Juma- Sh. 23,000

March 15: Bought fix tires on credit from Beta Ltd Sh. 50,000

March 17: Paid Omolo by cheque Sh. 84,000

March 18: Returned goods to Ndebu Sh.20, 000

March 24: Jane returned some of goods sold to her Sh.11, 000

March 31: Bought a motor van paying by cheque Sh. 400,000

Required:

Record the above transaction in the ledger of Best Sales Ltd and balance off the account; hence forth, extract a trial balance as at 31 March 2009.

Date posted: February 27, 2019. Answers (1)

- Write a two-column cash book from the following detail and balance off as at the end of the month.(Solved)

Write a two-column cash book from the following detail and balance off as at the end of the month.

2009

Oct 1: Started business with capital in cash Sh. 1,000,000

Oct 2: Paid rent by cash Sh. 100,000

Oct 3: Loan from Mary- Sh. 500,000, paid by cheque.

Oct 4: Paid B. Peter by cheque Sh. 65,000

Oct 5: Cash sales made Sh. 98,000

Oct 7: Mitter, owe of debtor paid by cash Sh.62, 000

Oct 9: Paid Den (creditor) in cash 22,000

Oct 11: Cash sales paid direct into the bank Sh. 53,000

Oct 15: George (creditor) paid as by cheque Sh. 65,000

Oct 16: Repaid Mary by cheque Sh.100, 000

Oct 19: Took Sh.50, 000 out of the cash till and paid it into the bank accounts.

Oct 22: Paid motor expenses by cheque Sh. 12,000

Oct 26: Withdrew Sh. 100,000 cash from the bank for business use.

Oct 31: Paid wages in cash Sh. 97,000.

Date posted: February 27, 2019. Answers (1)

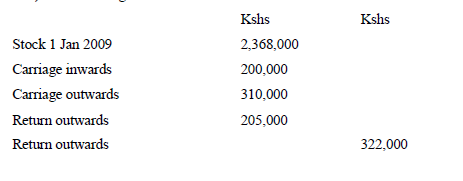

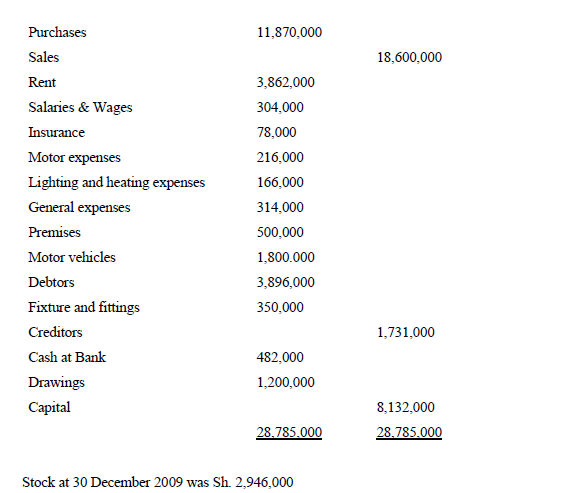

- The following is a trial balance of ABC Ltd.(Solved)

The following is a trial balance of ABC Ltd.

Required:

Draw up a statement of comprehensive income for the year ended 31st Dec. 2009 and statement of financial position as at 31/12/2009.

Date posted: February 27, 2019. Answers (1)

- Differentiate between:

1. An asset account and liability account

2. An expense account and revenue account

3. A trial balance and a balance sheet(Solved)

Differentiate between:

1. An asset account and liability account

2. An expense account and revenue account

3. A trial balance and a balance sheet

Date posted: February 27, 2019. Answers (1)

- Differentiate between Return inwards and return outwards(Solved)

Differentiate between Return inwards and return outwards

Date posted: February 27, 2019. Answers (1)

- Differentiate between A debit entry and credit entry(Solved)

Differentiate between A debit entry and credit entry

Date posted: February 27, 2019. Answers (1)