- What are the Causes of Depreciation(Solved)

What are the Causes of Depreciation

Date posted: February 28, 2019. Answers (1)

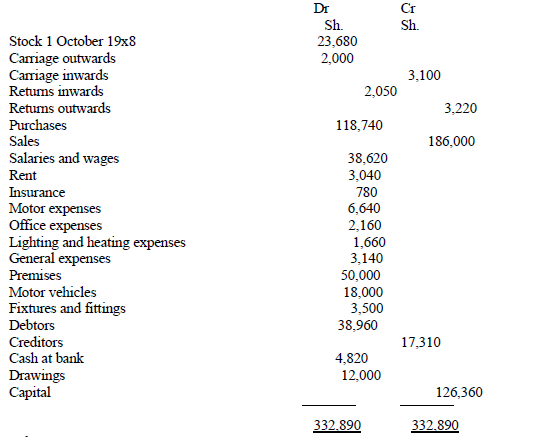

- From the following trial balance of P Boones draw up statement of comprehensive income for the year ended 30 September 2002, and a statement of...(Solved)

From the following trial balance of P Boones draw up statement of comprehensive income for the year ended 30 September 2002, and a statement of financial position as at that date.

Date posted: February 28, 2019. Answers (1)

- The following details for the year ended 31 March 2003 are available. Draw up the trading account of R Sings for that year.(Solved)

The following details for the year ended 31 March 2003 are available. Draw up the trading account of R Sings for that year.

Sh.

Stocks: 1 April 2002 16,523

Returns inwards 1,372

Returns outwards 2,896

Purchases 53,397

Carriage inwards 1,122

Sales 94,600

Stocks: 31 March 2003 14323

Date posted: February 28, 2019. Answers (1)

- A bookkeeper extracted a trial balance on 31 December 2002 that failed to agree by Sh.3, 300, a shortage on the credit side of the...(Solved)

A bookkeeper extracted a trial balance on 31 December 2002 that failed to agree by Sh.3, 300, a shortage on the credit side of the trial balance. A suspense account was opened for the difference.

In January 2003 the following errors made in 2003 were found:

(i) Sales daybook had been undercast by Sh.1, 000.

(ii) Sales of Sh.2, 500 to J Church had been debited in error to J Chane account.

(iii) Rent account had been undercast by Sh.700.

(iv) Discounts received account had been under cast by Sh.3, 000.

(v) The sale of a motor vehicle at book value had been credited in error to Sales account Sh.3, 600.

You are required to:

a) Show the journal entries necessary to correct the errors.

b) Draw up the suspense account after the errors described have been corrected.

Date posted: February 28, 2019. Answers (1)

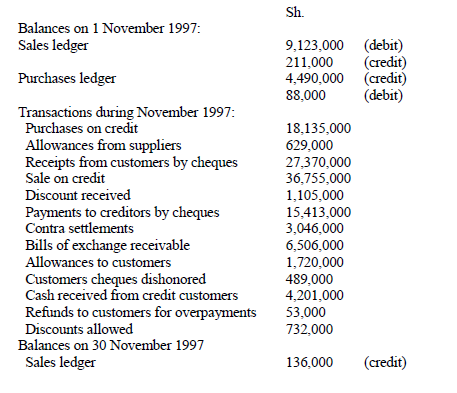

- The balances and transactions affecting the control accounts of Kopesha Ltd. for the month of November 1997 are listed below:-(Solved)

The balances and transactions affecting the control accounts of Kopesha Ltd. for the month of November 1997 are listed below:-

Date posted: February 28, 2019. Answers (1)

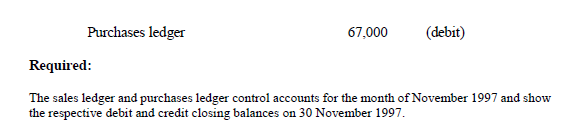

- A cashier in a firm starts with Sh.2,000 in the month of March (that is the cash float). I n the following week, the following...(Solved)

A cashier in a firm starts with Sh.2,000 in the month of March (that is the cash float). I n the following week, the following payments are made:

Required:

Prepare a detailed petty cash book showing the balance to be carried forward to the next period and the relevant expense accounts, as they would appear on the General Ledger.

Date posted: February 28, 2019. Answers (1)

- Define the The Imprest system(Solved)

Define the The Imprest system

Date posted: February 28, 2019. Answers (1)

- Define the following source documents:

(Solved)

Define the following source documents:

(i) Sales Invoice

(ii) Purchases Invoice

(iii) Credit note

(iv) Debit note

(vi) Receipts

(vii) Other correspondence

Date posted: February 28, 2019. Answers (1)

- Write up the following transactions in the books of S Pink:

(Solved)

Write up the following transactions in the books of S Pink:

2003

March 1 Started business with cash Sh.1,000.

“ 2 Bought goods on credit from A Cliks Sh.296.

“ 3 Paid rent by cash Sh.28.

“ 4 Paid Sh.1,000 of the cash of the firm into a bank account.

“ 5 Sold goods on credit to J Simpson Sh.54.

“ 7 Bought stationery Sh.15 paying by cheque.

“ 11 Cash sales Sh.49.

“ 14 Goods returned by us to A Cliks Sh.17.

“ 17 Sold goods on credit to P Lutz Sh.29.

“ 20 Paid for repairs to the building by cash Sh.18.

“ 22 J Simpson returned goods to us Sh.14.

“ 27 Paid A Cliks by cheque Sh.279.

“ 28 Cash purchases Sh.125.

“ 29 Bought a motor vehicle paying by cheque Sh.395.

“ 30 Paid motor expenses in cash Sh.15.

“ 31 Bought fixtures Sh.120 on credit from R west.

Date posted: February 28, 2019. Answers (1)

- Explain how to Account for Drawings, Discounts Allowed and Discounts Received.(Solved)

Explain how to Account for Drawings, Discounts Allowed and Discounts Received.

Date posted: February 28, 2019. Answers (1)

- Explain how double entry will be done in these accounts: Sales, Purchases, Incomes and Expenses.(Solved)

Explain how double entry will be done in these accounts: Sales, Purchases, Incomes and Expenses.

Date posted: February 28, 2019. Answers (1)

- Write up the asset, capital and liability accounts in the books of M Crash to record the following transactions:(Solved)

Write up the asset, capital and liability accounts in the books of M Crash to record the following transactions:

2002

June 1 Started business with Sh.50,000 in the bank.

“ 2 Bought motor van paying by cheque Sh.12,000.

“ 5 Bought Fixtures Sh.4,000 on credit from Office Masters Ltd.

“ 8 Bought a van on credit from Motor Cars Ltd Sh.8,000.

“ 12 Took Sh.1,000 out of the bank and put it into the cash till.

“ 15 Bought Fixtures paying by cash Sh.600.

“ 19 Paid Motor Cars Ltd by cheque Sh.8000.

“ 21 A loan of Sh.10,000 cash is received from J Marcus.

“ 25 Paid Sh.8,000 of the cash in hand into the bank account.

“ 30 Bought more Fixtures paying by cheque Sh.3,000.

Date posted: February 28, 2019. Answers (1)

- H Jumps has the following assets and liabilities as on 30 November 2002:

Creditors Sh.39,500;

Equipment Sh.115,000;

Motor vehicle Sh.62,900;

Stock Sh.61,500;

Debtors Sh.57,700;

Cash at bank...(Solved)

H Jumps has the following assets and liabilities as on 30 November 2002:

Creditors Sh.39,500;

Equipment Sh.115,000;

Motor vehicle Sh.62,900;

Stock Sh.61,500;

Debtors Sh.57,700;

Cash at bank Sh.72,800 and Cash in hand Sh.400.

Compute the balance on the capital account as at 30 November 2002.

During the first week of December 2002, Jump:

a. Bought extra equipment on credit for Sh.13,800.

b. Bought extra stock by cheque Sh.5,700.

c. Paid creditors by cheque Sh.7,900.

d. Received from debtors Sh.8,400 by cheque and Sh.600 by cash.

e. Put in an extra Sh.2,500 cash as capital.

You are to record the above transactions in respective accounts.

Date posted: February 28, 2019. Answers (1)

- State and explain the effects of double entry(Solved)

State and explain the effects of double entry

Date posted: February 28, 2019. Answers (1)

- State the difference between Initial Capital and Final Capital of a Business(Solved)

State the difference between Initial Capital and Final Capital of a Business

Date posted: February 28, 2019. Answers (1)

- State and explain what can Cause Changes in Capital(Solved)

State and explain what can Cause Changes in Capital

Date posted: February 28, 2019. Answers (1)

- D Moody has the following assets and liabilities as on 31 April 2002:(Solved)

D Moody has the following assets and liabilities as on 31 April 2002:

Sh.

Creditors 15,800

Equipment 46,000

Motor Vehicle 25,160

Stock 24,600

Debtors 23,080

Cash at bank 29,120

Cash in hand 160

During the first week of May 2002 Moody:

a. Bought extra equipment on credit for Sh.5,520.

b. Bought extra stock by cheque Sh.2,280.

c. Paid creditors by cheque Sh.3,160.

d. Debtors paid Sh.3,360 by cheque and Sh.240 by cash.

e. Moody put in extra Sh.1,000 cash as capital

Required:

a. Determine the capital as at 1st May 2002.

b. Draw up a statement of financial position after the above transactions have been completed.

Date posted: February 28, 2019. Answers (1)

- State the two formats of writing statement of financial position and describe them.(Solved)

State the two formats of writing statement of financial position and describe them.

Date posted: February 28, 2019. Answers (1)

- What are the components of accounting equations?(Solved)

What are the components of accounting equations?

Date posted: February 28, 2019. Answers (1)

- Given that prudence is the main consideration, discuss under what circumstances, if any, revenue might be recognized at the following stages of a sale.(Solved)

Given that prudence is the main consideration, discuss under what circumstances, if any, revenue might be recognized at the following stages of a sale.

(a) Goods have been acquired by the business, which it confidently expects to resell very quickly.

(b) A customer places a firm order for goods.

(c) Goods are delivered to the customer.

(d) The customer is invoiced for goods.

(e) The customer pays for the goods.

(f) The customer’s cheque in payment for the goods has been cleared by the bank.

Date posted: February 28, 2019. Answers (1)