- Balance brought d own cash 10,000 (Dr)

- Bank 15,000 (Cr)

- Cash sales amounting to 18,500/sold goods for sh. 18,500 in cash.

- Banked 12,000 from the cash till

Paid jebet in cash sh. 6000

Kavungya answered the question on April 3, 2019 at 12:38

- The following transaction took place in the business of Highlands Retail in the month

of June 2008

1.6.2008-commenced business with Kshs. 120,000 in cash

4.6.2008-transferred kshs66, 000 from...(Solved)

The following transaction took place in the business of Highlands Retail in the month

of June 2008

1.6.2008-commenced business with Kshs. 120,000 in cash

4.6.2008-transferred kshs66, 000 from business till to the bank

13.6.2008-brought his private furniture worth kshs. 15,000 into the business for business use

28.6.2008-borrowed a loan in cash kshs.40, 000

Required: Post the transactions into the relevant ledger account

Date posted: April 3, 2019. Answers (1)

- Record the following transactions in the relevant ledger accounts for the month of June, 2009

June 1: invested shs.100,000 cash in a retail business

June 2: Obtained...(Solved)

Record the following transactions in the relevant ledger accounts for the month of June, 2009

June 1: invested shs.100,000 cash in a retail business

June 2: Obtained a co-operative loan of Shs.20,000 cash

June 3: bought furniture Shs. 70,000, paying Shs.40,000 cheque and the balance in cash

Date posted: April 3, 2019. Answers (1)

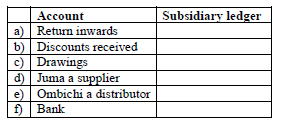

- Given below is a list of subsidiary ledgers:

-General ledger

-Nominal ledger

-Purchases ledger

-Sales ledger

-Cash book

Indicate in which ledger the following accounts should be recorded(Solved)

Given below is a list of subsidiary ledgers:

-General ledger

-Nominal ledger

-Purchases ledger

-Sales ledger

-Cash book

Indicate in which ledger the following accounts should be recorded

Date posted: April 3, 2019. Answers (1)

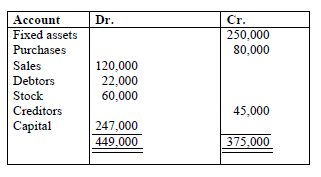

- The following trial balance was prepared by an incompetent book keeper thus failed to

balance. Balance it.(Solved)

The following trial balance was prepared by an incompetent book keeper thus failed to

balance. Balance it.

Date posted: April 3, 2019. Answers (1)

- The following information relates to Kebirigo Traders as at 31st December, 2009

...(Solved)

The following information relates to Kebirigo Traders as at 31st December, 2009

Kshs.

Buildings 100,000

Debtors 54,000

Capital 136,000

Sales 85,000

Purchases 48,000

Stock 1 Jan.2009 25,400

Creditors 35,700

General expenses 31,800

Bank overdraft 2,500

Prepare a trial balance as at 31st December, 2009

Date posted: April 3, 2019. Answers (1)

- The following balances were extracted from the books of Nyatike Traders Limited as at

31st January 2010 Kshs.

Discount...(Solved)

The following balances were extracted from the books of Nyatike Traders Limited as at

31st January 2010 Kshs.

Discount allowed 5,000

Buildings 250,000

Return outwards 6,000

Purchases 74,000

Creditors 20,000

Drawings 16,000

Capital 319,000

Required: Prepare Nyatike Traders Ltd trial balance as at that date

Date posted: April 3, 2019. Answers (1)

- Identify the situation in which the following types of ledgers are appropriate:

i) Creditors ledger

ii) Private ledgers

iii) Normal ledger(Solved)

Identify the situation in which the following types of ledgers are appropriate:

i) Creditors ledger

ii) Private ledgers

iii) Normal ledger

Date posted: April 3, 2019. Answers (1)

- Prepare Betty’s trial balance from the following information

Items ksh

Purchases ...(Solved)

Prepare Betty’s trial balance from the following information

Items ksh

Purchases 130,000

Capital 150,000

Sales 165,000

Debtors 45,000

Creditors 40,000

Motor vehicles 120,000

Stock 50,000

Cash at bank 10,000

Date posted: April 3, 2019. Answers (1)

- The following information relates to Ogello traders as at 31st Dec 2009:-

Capital (1-1-2009) kshs.100,000

Loss during the year ...(Solved)

The following information relates to Ogello traders as at 31st Dec 2009:-

Capital (1-1-2009) kshs.100,000

Loss during the year kshs.40,000

Investment kshs 35,000

If the trader took goods worth kshs. 15,000 during the year for private use, calculate the capital of

the business as at 31-12-2009

Date posted: April 3, 2019. Answers (1)

- Queen Traders had the following information extracted from her books of accounts as at

31st Dec 2009:-

...(Solved)

Queen Traders had the following information extracted from her books of accounts as at

31st Dec 2009:-

Shs

Capital (1/1/009) 3,400,000

Additional capital 610,780

Drawings for the year 25,220

Capital (31/12/009) 4,900,000

Determine the profit for the year.

Date posted: April 3, 2019. Answers (1)

- The following was obtained from the books of Wambui Mary for the ended 31st December,2007

Drawings ...(Solved)

The following was obtained from the books of Wambui Mary for the ended 31st December,2007

Drawings 82000

Profit 170000

Additional investment 58000

Capital 1.1.2007 240000

Calculate the of Mary Wambui as at 31st Dec,2007

Date posted: April 3, 2019. Answers (1)

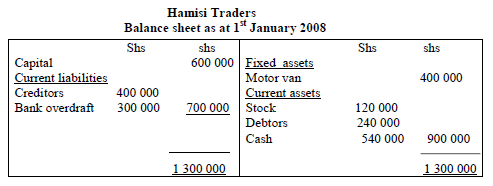

- The following balance sheet relates to Hamisi traders as at 1st January 2008.

Additional information:-

- On 2nd January 2008, Hamisi traders bought stock for cash at...(Solved)

The following balance sheet relates to Hamisi traders as at 1st January 2008.

Additional information:-

- On 2nd January 2008, Hamisi traders bought stock for cash at Shs 36 000

- On 10th January 2008, a debtor paid shs 26 000 to Hamisi traders

- On 13th January 2008, Hamisi used his personal cash to buy equipment for shs 47 000 for

the business

Prepare Hamisi traders balance sheet as at 31st January 2008.

Date posted: April 3, 2019. Answers (1)

- Okelo invested Kshs.120,000 into a business. At the end of the year, his capital was Kshs.160000

and his monthly drawing was Kshs.2000. Determine the net profit...(Solved)

Okelo invested Kshs.120,000 into a business. At the end of the year, his capital was Kshs.160000

and his monthly drawing was Kshs.2000. Determine the net profit for the year

Date posted: April 3, 2019. Answers (1)

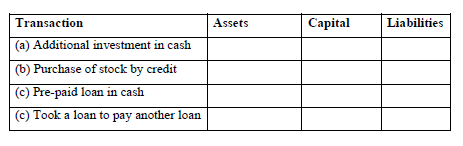

- Show how the following transactions may affect the items of balance sheet, stating whether it is

an increase , decrease or no effect(Solved)

Show how the following transactions may affect the items of balance sheet, stating whether it is

an increase , decrease or no effect

Date posted: April 3, 2019. Answers (1)

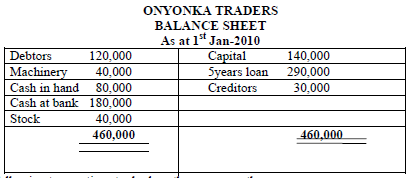

- The following balances relates to Onyonka traders as at 1st Jan. 2010

The following transactions took place the same month:-

Jan 2nd debtors paid in cash shs.20,000.

Jan....(Solved)

The following balances relates to Onyonka traders as at 1st Jan. 2010

The following transactions took place the same month:-

Jan 2nd debtors paid in cash shs.20,000.

Jan. 31st sold stock worth shs.20,000 for Shs.25,000 by cheque

Prepare a balance sheet as 31st Jan. 2010

Date posted: April 3, 2019. Answers (1)

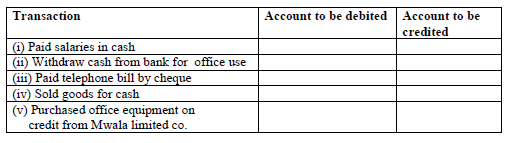

- Given below are transactions relating to Mwala traders. For each of the transactions, indicate

in the column below the account to be debited and the account...(Solved)

Given below are transactions relating to Mwala traders. For each of the transactions, indicate

in the column below the account to be debited and the account to be credited

Date posted: April 3, 2019. Answers (1)

- Indicate the balance sheet items which would be affected by the following transactions

(a) Purchase of a lawn mower by cheque

(b) Sale of goods on credit...(Solved)

Indicate the balance sheet items which would be affected by the following transactions

(a) Purchase of a lawn mower by cheque

(b) Sale of goods on credit to Mwangi

(c) A debtor pays by cash

(d) The owner converted his personal car into a business asset

Date posted: April 3, 2019. Answers (1)

- The proprietor of the sunrise dealer had ksh.13,730/= as capital as at 1st January 2010.

The following transactions took place.

i) Sold goods worth ksh 3000/= for...(Solved)

The proprietor of the sunrise dealer had ksh.13,730/= as capital as at 1st January 2010.

The following transactions took place.

i) Sold goods worth ksh 3000/= for ksh.9000/=

ii) Deposited ksh.50, 000/= from his personal savings

If his capital as at 31st January 2010 was kshs.62, 230/=, determine the value of drawings

for the month of January 2010.

Date posted: April 3, 2019. Answers (1)

- The accounting period of Ochomo Traders ended on 30th June, 2008. The assets, liabilities and

capital were as follows on their date :

Capital ...(Solved)

The accounting period of Ochomo Traders ended on 30th June, 2008. The assets, liabilities and

capital were as follows on their date :

Capital 51000

Cash in hand 4000

Stock 10000

Furniture 7000

Creditors 5000

Long term loan 20000

Premises 50000

Debtors 2000

Bicycle 3000

Required: Prepare Ochomo traders balance sheet as at 30th June,2008

Date posted: April 3, 2019. Answers (1)

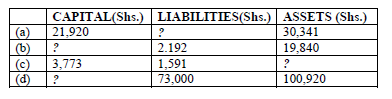

- Use the balance sheet equation to fill the missing figures in the table below(Solved)

Use the balance sheet equation to fill the missing figures in the table below

Date posted: April 3, 2019. Answers (1)