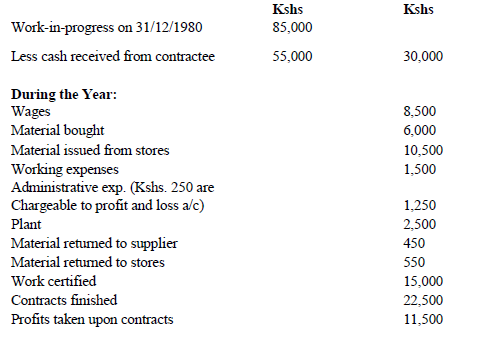

- The following figures are supplied to you by contractor for the year ending 31st December, 1981(Solved)

The following figures are supplied to you by contractor for the year ending 31st December, 1981

Advances from contractee - 40,000

Prepare contract ledger accounts and the total contractee’s account and show the work-in-progress as it would appear in the Balance Sheet

Date posted: April 16, 2019. Answers (1)

- A building contractor took a contract to build a building on 1st Jan 1980. The contract price was agreed at Kshs. 800,000. The contractor has...(Solved)

A building contractor took a contract to build a building on 1st Jan 1980. The contract price was agreed at Kshs. 800,000. The contractor has made the following expenditure during the year:

Materials - 50,000

Direct labor - 30,000

Plant - 80,000

Direct expenses - 20,000

From the following extra information prepare a Contract Account for the year. Also show the amount in work in progress, which will be shown in the balance sheet of the contractor.

Value plant 31/12/1980 - 60,000

Stock of material 31/12/1980 - 10,000

Material returned to store - 2,000

Work certified - 150,000

Cash received - 140,000

Cost of work uncertified - 8,000

Date posted: April 16, 2019. Answers (1)

- From the information given below relating to an unfinished contract ascertain: (Solved)

From the information given below relating to an unfinished contract ascertain:

a) Profit on work – certified

b) Cost of work in progress at the end of year.

The value of the plant at the end of I, II and III year was Rs. 11,200, Rs. 7,000 and Rs. 3,000 respectively. Prepare Contract account for these three years taking into account such profit as you think proper on incomplete contract

Date posted: April 16, 2019. Answers (1)

- Crystal Construction Limited engaged in contract works has the following Trial Balance on 31st December 1975(Solved)

Crystal Construction Limited engaged in contract works has the following Trial Balance on 31st December 1975

Contract No. 707 having a contract price of Rs. 240,000 was begun on 1st January, 1975 and contractee pays 80% of the work completed and certified. The cost of work done since certification is estimated to be Rs. 1,600. After the above Trial Balance was extracted on 31st December 1975, plant costing Rs. 3,200 was returned to the stores and materials at site on that date were valued at Rs. 3,000. Provision is to be made for sub standard costs amounting to Rs. 600 incurred in contract No. 707 and for depreciation of all Plant and Tools @ 12½% on cost.

Prepare Contract No. 707 Account showing the computation of profit, if any which credit may properly be taken in 1975 and prepare the Balance Sheet for the construction company on 31st December 1975.

Date posted: April 16, 2019. Answers (1)

- A company of contractors begun to trade on 1st January, 2008.(Solved)

A company of contractors begun to trade on 1st January, 2008. During 2008 the company was engaged on only one contract of which the contract the contract price was Kshs. 500,000. Of the plant and materials charged to contract: plant costing Kshs. 5,000 and material costing Kshs. 4,000 were lost in an accident. On 31st December, 2008, plant costing Kshs. 5,000 were returned to stores. Cost of work uncertified but finished Kshs. 2,000 and materials costing Kshs. 4,000 were in the hand at site. Charge 10% depreciation on plant and compile contract a/c and balance sheet from the following:-

Date posted: April 16, 2019. Answers (1)

- AB undertook a contract for Kshs. 1,500,000 on an arrangement that 80% of the value of the work done as certified by the engineer of...(Solved)

AB undertook a contract for Kshs. 1,500,000 on an arrangement that 80% of the value of the work done as certified by the engineer of the contractee should be paid immediately and that the remaining 20% be retained until the contract was completed.

In 2005, the amount expected was materials Kshs. 180,000, wages Kshs. 170,000, carriage Kshs.600, 000, cartage Kshs 1,000 sundry expenses Kshs. 3,000. The work was certified for Kshs.375, 000 and 80% of this was paid as agreed.

In 2006 the amount spent were: materials Kshs. 220,000, wages Kshs. 230,000, carriage Kshs. 23,000, cartage Kshs. 2000 sundry expenses Kshs. 4,000, ¾ of the contract was certified as done by 31st Dec. and 80% of this was received accordingly. The value of work uncertified was ascertained at Kshs. 20,000.

In 2007, the amount spent was: materials Kshs. 126,000, wages Kshs.170, 000, carriage Kshs. 6,000, sundry expenses Kshs.3, 000 and on 30th June, the whole contract was completed. Prepare contract account, contractees account and extract balance sheet (only asset side) as would appear each of this year in the books of the contractor assuming that the balance due to him was received on completion of the contract.

Date posted: April 16, 2019. Answers (1)

- Construction Ltd. is engaged on two contracts A and B during the year. The following particulars are obtained at the end of the year (Dec....(Solved)

Construction Ltd. is engaged on two contracts A and B during the year. The following particulars are obtained at the end of the year (Dec. 31)

During the period materials amounted to Kshs. 9,000 have been transferred from contract A to contract B.

You are required to show.

(a) Contract account

(b) Contractees accounts

(c) Extract from balance sheet as at Dec. 31.

Date posted: April 16, 2019. Answers (1)

- The following is the Trial Balance of Premier Construction Company engaged on the execution of Contract No. 747 for the year ended 31st December, 2010(Solved)

The following is the Trial Balance of Premier Construction Company engaged on the execution of Contract No. 747 for the year ended 31st December, 2010

The work on Contract No. 747 was commenced on 1st January 2010. Materials costing Kshs. 170,000 were sent to the site of the contract but those of Kshs. 6,000 were destroyed in an accident. Wages of Kshs. 180,000 were paid during the year. Plant costing Kshs. 50,000 was used on the contract all through the year. Plant with a cost of Kshs. 200,000 was used from 1st January to 30th September and was then returned to the stores. Materials of the cost of Kshs. 4,000 were at site on 31st December, 2010.

The contract was for Kshs. 600,000 and the contractee pays 75% of the work certified. Work certified was 80% of the total contract work at the end of 2010. Uncertified work was estimated at Kshs. 15,000 on 31st December, 2010.

Expenses are charged to the contract at 25% of wages. Plant is to be depreciated at 10% for the entire year. Prepare Contract no. 747 Account for the year 2010 and make out the Balance Sheet as on 31st December 2010 in the books of premier Construction Co.

Date posted: April 16, 2019. Answers (1)

- From the following information, prepare contract account. Show how these figures appear in the extracts balance sheet as at 31st December, 2005.(Solved)

From the following information, prepare contract account. Show how these figures appear in the extracts balance sheet as at 31st December, 2005.

Depreciation is to be charged on plant@ 10% which was installed on the opening date of the contract in each case.

Date posted: April 16, 2019. Answers (1)

- Contractors began to trade on 1st April, 2004.(Solved)

Contractors began to trade on 1st April, 2004.

The following was the expenditure on the contract for Kshs. 300,000. Materials issued to contract Kshs.

51,000, plant used for contract Kshs. 15,000, wages incurred Kshs. 81,000. Other expenses incurred Kshs.

5,000 cash received on account to 31st March, 2005, amounted to 128,000 being 80% of the work certified.

Of the plant and materials charged to the contract, plant which cost Kshs. 3,000 and materials which cost Kshs. 2,500 were lost. On 31st March, 2005 plant which cost Kshs. 2,000 was returned to store, the cost of work done but uncertified was Kshs. 1,000 and materials costing Kshs. 2,300 were in hand on site. Charge 15% depreciation on plant.

Prepare the contract account and the contractee’s account from the above particulars.

Date posted: April 16, 2019. Answers (1)

- The following particulars relate to a contract undertaken by a firm of engineers.(Solved)

The following particulars relate to a contract undertaken by a firm of engineers.

The contract price has been agreed at 250,000.

Cash received from the contractee was 180,000

You are required:

(a) To prepare contract showing profit, prepare contractee’s a/c

(b) Balance sheet extract

Date posted: April 16, 2019. Answers (1)

- Building contractors Ltd undertake contract on 31st October, 1989 when the actual account were prepared. The position of contract No. 101 which was commenced on...(Solved)

Building contractors Ltd undertake contract on 31st October, 1989 when the actual account were prepared. The position of contract No. 101 which was commenced on 1st January, 1989, was as under:

Prepare contract No. 101 account after taking credit for profit which you think reasonable.

Date posted: April 16, 2019. Answers (1)

- A certain product passes through two processes desired before it is transferred to finished stock. The following information is obtained for the month of March,...(Solved)

A certain product passes through two processes desired before it is transferred to finished stock. The following information is obtained for the month of March, 2006.

Stocks in process are valued at prime cost and finished stock has been valued at the price at which it was received from process II sales during the period were Kshs. 140,000.

Prepare and compute:-

(a) Process cost account showing profit element at each stage

(b) Actual realized profit

(c) Stock valuation for balance sheet purposes

Date posted: April 16, 2019. Answers (1)

- The cost records show the following costs of producing 200 units of a product in a process(Solved)

The cost records show the following costs of producing 200 units of a product in a process

The normal wastage is 10% of the units and this wastage can be sold in the market at Kshs. 15 per unit. The actual production was 190 units. Prepare process account and the abnormal effectiveness account.

Date posted: April 16, 2019. Answers (1)

- The cost record shows the following expenses of manufacturing 200 units of product X in a process:-(Solved)

The cost record shows the following expenses of manufacturing 200 units of product X in a process:-

The standard normal wastage in production is 10% and it can be sold in the market at Kshs. 15 per unit. The actual production is 150 units due to gross carelessness of workers. Show the treatment of wastage in the process account.

Date posted: April 15, 2019. Answers (1)

- State the applications of process costing(Solved)

State the applications of process costing

Date posted: April 15, 2019. Answers (1)

- A company makes a single product with a sale price of Kshs. 10 and a marginal cost of Kshs. 6. Fixed costs are Kshs. 60,000...(Solved)

A company makes a single product with a sale price of Kshs. 10 and a marginal cost of Kshs. 6. Fixed costs are Kshs. 60,000 p.a.

Calculate;

(a) Number of units to break even.

(b) Sales at break – even point.

(c) C/S Ratio

(d) What number of units will need to be sold to achieve a profit of Kshs. 20,000 p.a

(e) What level of sales will achieve a profit of Kshs. 20,000 p.a

(f) As (d) with a 40% tax rate

(g) Because of increasing costs the marginal costs is expected to rise to Kshs. 6.50 per unit and fixed costs to Kshs. 70,000 p.a . if the selling price cannot be increased what will be the number of units required to maintain a profit of Kshs. 20,000 p.a (ignore tax)

Date posted: April 15, 2019. Answers (1)

- A plant is operating at 60% capacity. The fixed costs are Kshs. 30,000, the variable costs are Kshs. 100,000 and the sales amount to Kshs....(Solved)

A plant is operating at 60% capacity. The fixed costs are Kshs. 30,000, the variable costs are Kshs. 100,000 and the sales amount to Kshs. 150,000. Calculate the Break – Even point and find out the % of capacity at which the plant should operate to earn a profit of Kshs. 40,000.

Date posted: April 15, 2019. Answers (1)

- Company has fixed expenses of Kshs. 90,000 with sales at Kshs. 300,000 and a profit of Kshs. 60,000. Calculate the Profit – Volume ratio. If...(Solved)

(a) Company has fixed expenses of Kshs. 90,000 with sales at Kshs. 300,000 and a profit of Kshs. 60,000. Calculate the Profit – Volume ratio. If in the next period, the company suffered a loss of Kshs. 30,000. Calculate the sales Volume.

(b) What is the margin of safety for a profit of Kshs. 60,000 in (a) above?

Date posted: April 15, 2019. Answers (1)

- The following information relates to production and sales of an article for January and February 2004.(Solved)

The following information relates to production and sales of an article for January and February 2004.

(i) Break – even sales volume

(ii) Profit or loss at Kshs. 46,000 sales

(iii) Sales to earn a profit of Kshs. 5,000.

Date posted: April 15, 2019. Answers (1)