Analysis of cost behaviour is important to all organizations for effective management. This is because many organizations have a unique cost structure. For example, fixed costs account for 60 – 80% of all hospital costs. However, unlike many organizations of this type, labour costs largely comprise the hospital’s fixed costs.

Labour costs unlike depreciation require a cash outflow. This is characteristic of labour intensive organizations. Capital-intensive organizations, on the other hand, have low labour costs, e.g. computerized manufacturing organizations.

Some organizations e.g. hospitals allocate 10 –15% of their space for standby emergency events giving them built in idle capacity. This prevents them from enjoying advantages of higher profits that a capital-intensive organization realizes at higher volumes beyond the break-even volume. Thus the cost structure of healthcare institutions presents challenges to accountants because of their labour intensive and capital-intensive characteristics

Wilfykil answered the question on April 17, 2019 at 05:05

- What is the role of Cost Accounting in business management?(Solved)

What is the role of Cost Accounting in business management?

Date posted: April 17, 2019. Answers (1)

- What is the role of a cost accounting department in an organization?(Solved)

What is the role of a cost accounting department in an organization?

Date posted: April 17, 2019. Answers (1)

- The following information for the year ended December 31, 2005 is obtained from the books and records of a factory.(Solved)

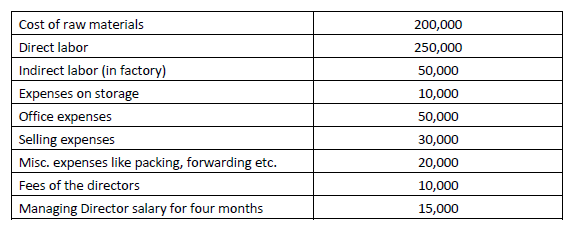

The following information for the year ended December 31, 2005 is obtained from the books and records of a factory.

Factory overhead is 80% of wages and administration overhead 25% of factory cost. The value of the jobs during 2005 was Kshs. 410,000

Prepare:

(i) Consolidated completed jobs account showing the profit made or loss incurred on the jobs.

(ii) Consolidated work – in – progress account.

Date posted: April 16, 2019. Answers (1)

- As newly appointed cost accounting, you find that the selling price of job No. 5 has been calculated on the following basis:(Solved)

As newly appointed cost accounting, you find that the selling price of job No. 5 has been calculated on the following basis:

You are required to:

Wage rate: A = Shs. 4 per hour, B = Shs. 6 per hour, C = Shs. 4 per hour.

(a) Draw up a job cost sheet

(b) Calculate and enter the revised costs using the previous year’s figures as a basis (c) Add to the total job cost 10% for profit and give the final selling price.

Date posted: April 16, 2019. Answers (1)

- The following information is available for job No. 202, which is being produced at the request of a customer.(Solved)

The following information is available for job No. 202, which is being produced at the request of a customer.

Required:

(i) (a) Calculate the total cost and selling price of job No.202

(ii) Assume that shortly after the job is completed the original customer goes bankrupt and the job is not delivered. The only other possible customer is prepared to pay Kshs. 9,000. Briefly indicate, with reasons whether you would accept the offer of Kshs. 9,000.

Date posted: April 16, 2019. Answers (1)

- The information given below has been taken from the cost records of a factory in respect of job no. 707.(Solved)

The information given below has been taken from the cost records of a factory in respect of job no. 707.

Fixed expenses estimated at Kshs. 20,000 for 10,000 working hours. Calculate the cost of the job No. 707 and the price for the job to give a profit of 25% on the selling price.

Date posted: April 16, 2019. Answers (1)

- Give the disadvantages of job order costing(Solved)

Give the disadvantages of job order costing

Date posted: April 16, 2019. Answers (1)

- Give the advantages of a job order costing system(Solved)

Give the advantages of a job order costing system

Date posted: April 16, 2019. Answers (1)

- What are the objectives of Job order costing?(Solved)

What are the objectives of Job order costing?

Date posted: April 16, 2019. Answers (1)

- Define the term Job costing(Solved)

Define the term Job costing

Date posted: April 16, 2019. Answers (1)

- What are the features of Job order costing?(Solved)

What are the features of Job order costing?

Date posted: April 16, 2019. Answers (1)

- The following figures are extracted from the Trial Balance of AB. Co. on 31st Sep, 2005.(Solved)

The following figures are extracted from the Trial Balance of AB. Co. on 31st Sep, 2005.

REQUIRED

Prepare

i) A statement of cost showing various elements of cost.

ii) A statement of profit.

Date posted: April 16, 2019. Answers (1)

- The following extract of costing information relates to commodity ‘A’ for the half year ending 31st Dec. 2005.(Solved)

The following extract of costing information relates to commodity ‘A’ for the half year ending 31st Dec. 2005.

Selling and distribution overheads are Sh. 1 per ton sold. 16000 tons of commodity were produced during the period:

Required:

You are to ascertain

(i) Cost of raw materials used

(ii) Cost of output for the period

(iii) Cost of sales

(iv) net profit for the period

(v) Net profit per ton of the commodity.

Date posted: April 16, 2019. Answers (1)

- Your company is exporting cotton to U.S.A. It has received an enquiry from AB Incorporation(Solved)

Your company is exporting cotton to U.S.A. It has received an enquiry from AB Incorporation. The export manager seeks the advice of the cost Accounting Department (of which you are the Head) to send a suitable quotation. From the following figures, relating to the last 4 months, you are to suggest a suitable price after preparing a cost sheet: Total Production (in meters) 200,000

Date posted: April 16, 2019. Answers (1)

- During the month of Dec 2008, 16000 units of standard product were manufactured, out of which 13500 units were sold at 8/- per unit. (Solved)

During the month of Dec 2008, 16000 units of standard product were manufactured, out of which 13500 units were sold at 8/- per unit. The value of raw material consumed was Sh. 60,000 and the direct wages paid Sh. 16,480. The factory expenses were allocated to production at machine hour’s rate which for this month was Sh. 5 per hour and 1200 machine hours were worked during the month. The office expenses are charged @ 20% on works cost and the selling expenses @ 25cts per unit.

Prepare a cost sheet showing

a) Cost per unit and

b) Profit for the month

Date posted: April 16, 2019. Answers (1)

- A.B.C Manufacturing Company provides the following information for the month of October 19 – 8(Solved)

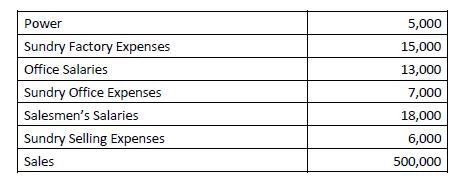

A.B.C Manufacturing Company provides the following information for the month of October 19 – 8

Required:

i. Prepare a production cost statement

ii. Prepare a profit statement

Date posted: April 16, 2019. Answers (1)

- What are the differences between Cost Account and Cost Sheet?(Solved)

What are the differences between Cost Account and Cost Sheet?

Date posted: April 16, 2019. Answers (1)

- Define Cost sheets and and its advantages(Solved)

Define Cost sheets and and its advantages

Date posted: April 16, 2019. Answers (1)

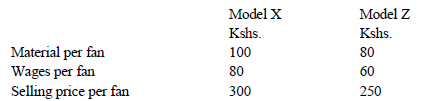

- A company manufacturing table fans, supplies to you the following data and asks you to prepare a statement showing profit per table fan.(Solved)

A company manufacturing table fans, supplies to you the following data and asks you to prepare a statement showing profit per table fan. Wages and materials are charged at cost, works overheads at 80% of wages, and office on cost at 20% of works costs. You are also required to prepare a statement reconciling the profit as shown by the cost accounts with the points shown by financial accounts for the year ended 31st March, 1980.

Two types of table fans are manufactured namely model X and model Z. there is no fan in the stock. Number of fans sold were X 1,500; Z 1,050 The description is as under:

Prepare the relevant statements, showing the actual profits for the year, if the works indirect expenses were Kshs. 82,000 and office on cost Kshs. 75,000

Date posted: April 16, 2019. Answers (1)

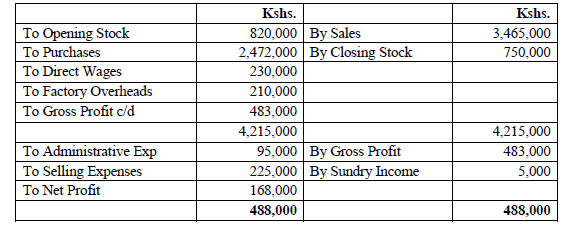

- During a particular year, the auditors certified the financial accounts showing a profit of Kshs. 168,000 whereas the same as per costing books was coming...(Solved)

During a particular year, the auditors certified the financial accounts showing a profit of Kshs. 168,000 whereas the same as per costing books was coming out to be Kshs. 240,000. Given the following information you are asked to prepare a reconciliation statement showing clearly the reasons for the gap

Trading and Profit and Loss A/C

The costing records show:

a) Book value of closing stock Kshs. 780,000

b) Factory overheads have been absorbed to the extent of Kshs. 189,000

c) Sundry income is not considered.

d) Administrative expenses are recovered at 3% of selling price.

e) Total absorption of direct wages Kshs. 246,000

f) Selling prices include 5% for selling expenses.

Date posted: April 16, 2019. Answers (1)