1. Direct expenses.

In addition to direct materials and direct labour, a high proportion of indirect expenses are incurred. This includes hire charges of plant & machinery, site office expenses, site power usage etc.

Most of the expenses are direct. Direct materials charged to a specific contract may be classified as

1. materials issued from the store and

2. Materials purchased for a contract from the local market.

These materials are charged to the respective contract.

In case of excessive materials, they are returned to the store and credited to the contract account. The materials on site at the end of the accounting period are valued at cost and carried forward to the next period. Direct wages both paid and accrued are debited to the contract account.

2. Overheads.

Expenses like telephone, electricity, repairs, water etc are allocated to the respective contract account. All other overheads incurred for the company as whole are apportioned on a suitable basis to all contracts. The proper share of these overheads is charged to a specific contract.

3. Contract plant

The amount of plant used in a contract work is a key feature.

This includes :cranes, trucks, mixers, lorries etc. if plant is on lease basis, then the leasing charges are directly charged to the contract, on the other hand, if plant is purchased then this plant is charged to that contract for which it was purchased.

At the end of the year or on completion of the contract, the contract account is credited with the value of plant at that time. Thus the depreciation of plant is charged to the respective contract. If the plant is moved frequently from one contract to another contract, then each contract is charged the depreciation of the plant at a specific rate.

4. Subcontracts:

If the contractor assigns some work to sub-contractors e.g. electrical or plumbing work, the amount paid to subcontractors is charged to the respective contract.

5. The contract price

This is the price agreed upon by the contractor and the contractee after the tendering process.

6. Architect’s certificate.

The architect inspects the work done periodically and certifies the amount of work completed. The contractor can claim the amount of work of work certified from the contractee. The architect is appointed by the contractee.

7. Retention

A specific percentage of work certified is withheld by the contractee or client. This amount withheld is known as retention money. The amount is paid to the contractor on the completion of the contract.

The main purpose of this retention money is to ensure that the contract has been completed according to the satisfaction of the client and all defects in the work have been rectified by the contractor. If the contractor does not remove such defects, then the retention money is not released by the contractee. The retention money is shown as debtors in the books of the contractor.

8. Profits on uncompleted contracts.

When a contract extends over a number of years, it may be necessary to take profit each year in order to avoid wide fluctuations in annual profits.

Wilfykil answered the question on April 17, 2019 at 08:17

- Give the factors considered on each overhead Absorption Method(Solved)

Give the factors considered on each overhead Absorption Method

Date posted: April 17, 2019. Answers (1)

- Simon worked 360 hours during the month of June 2012 and he was paid at the rate of Ksh 200 per hour. During the month...(Solved)

Simon worked 360 hours during the month of June 2012 and he was paid at the rate of Ksh 200 per hour. During the month he completed three jobs. The following additional information was provided.

Calculate the labour cost chargeable to these three jobs on the assumption that these jobs were completed only by Simon.

Date posted: April 17, 2019. Answers (1)

- From the following information, prepare a payroll for the month of May 2014.(Solved)

From the following information, prepare a payroll for the month of May 2014.

Additional Information

1. Normal working hours per month are 180. Overtime payable for extra hours at the rate of 50% above normal pay rate.

2. P.A.Y.E to be deducted at the rate of 20% of gross wage.

3. N.S.S.F to be deducted Ksh200 for each employee.

4. N.H.I.F to be deducted Ksh400 for each employee.

Date posted: April 17, 2019. Answers (1)

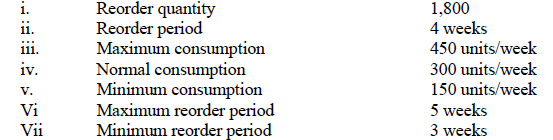

- The following information was extracted from the books of Danex Holdings regarding its stocks:(Solved)

The following information was extracted from the books of Danex Holdings regarding its stocks:

Determine the following stock levels for Danex Holdings:

i. Re-order level

ii. Maximum stock level

iii. Minimum stock level

Date posted: April 17, 2019. Answers (1)

- What considerations should be given to Stock Level and its control?(Solved)

What considerations should be given to Stock Level and its control?

Date posted: April 17, 2019. Answers (1)

- Outline the factors Affecting Stock Levels(Solved)

Outline the factors Affecting Stock Levels

Date posted: April 17, 2019. Answers (1)

- A company has an annual demand for material “p” of 25,000 tons per annum. The cost price per ton is Ksh2, 000 and stock holding...(Solved)

A company has an annual demand for material “p” of 25,000 tons per annum. The cost price per ton is Ksh2, 000 and stock holding is 25% per annum of the stock value. Delivery cost per batch is Ksh400.

Calculate the Economic Order Quantity(E.O.Q)

Date posted: April 17, 2019. Answers (1)

- Outline the assumptions / limitation of Economic Order Quality(Solved)

Outline the assumptions / limitation of Economic Order Quality

Date posted: April 17, 2019. Answers (1)

- Give objectives of Stock Control.(Solved)

Give objectives of Stock Control.

Date posted: April 17, 2019. Answers (1)

- Explain Average Weighted Cost Average as a method of Valuing Material Issues(Solved)

Explain Average Weighted Cost Average as a method of Valuing Material Issues

Date posted: April 17, 2019. Answers (1)

- Explain Last In, First Out (LIFO) as a method of Valuing Material Issues(Solved)

Explain Last In, First Out (LIFO) as a method of Valuing Material Issues

Date posted: April 17, 2019. Answers (1)

- Explain First In First Out (FIFO) as a method of Valuing Material Issues(Solved)

Explain First In First Out (FIFO) as a method of Valuing Material Issues

Date posted: April 17, 2019. Answers (1)

- Define the term Perpetual inventory(Solved)

Define the term Perpetual inventory

Date posted: April 17, 2019. Answers (1)

- Explain Just-in-time (JIT) systems(Solved)

Explain Just-in-time (JIT) systems

Date posted: April 17, 2019. Answers (1)

- Discuss on the systems of Stock Taking(Solved)

Discuss on the systems of Stock Taking

Date posted: April 17, 2019. Answers (1)

- Define material Coding and its' purposes(Solved)

Define material Coding and its' purposes

Date posted: April 17, 2019. Answers (1)

- Name and explain types of Stores(Solved)

Name and explain types of Stores

Date posted: April 17, 2019. Answers (1)

- List the features of Effective and Good Store keeping(Solved)

List the features of Effective and Good Store keeping

Date posted: April 17, 2019. Answers (1)

- Discuss Purchasing procedure as an aspect of material control(Solved)

Discuss Purchasing procedure as an aspect of material control

Date posted: April 17, 2019. Answers (1)

- What does material Control mean in cost accounting?(Solved)

What does material Control mean in cost accounting?

Date posted: April 17, 2019. Answers (1)