1) Normal Spoilage Costs: These costs are assigned to the good output using two approaches:

(i) Omission Approach: Under this approach, the normally spoilt units are not included in the calculation of equivalent units. This means that the cost of the normally spoilt units will automatically be distributed to the good output. By excluding the normal spoilage in the computation to the good output, a lower figure will be derived. The weaknesses of this method are;

(a) The cost of normal spoilage is spread equally into the finished goods and the ending W.I.P regardless of whether the ending W.I.P. has passed the inspection stage or not.

(b) It does not allow the manager to see the costs of spoilage because these costs are not computed.

(ii) Recognition and Re-Assignment Approach In this approach, the normal spoilage is included in the equivalent units computation; further, the normally spoilt units will be assigned costs just like any other unit. The spoilage costs will then be reallocated to these good units that have passed the inspection point. The steps to follow under this method are:

(a) Compute equivalent units including normal spoilage.

(b) Assign costs to all units including normal spoilage.

(c) Reassign normal spoilage costs to good output.

2) Abnormal Spoilage Costs

These costs do not add any production benefit to the company and are treated as accounting losses. The costs are written off directly as losses for the period in which they occur.

Wilfykil answered the question on April 17, 2019 at 08:22

- What are the features of contract accounting?(Solved)

What are the features of contract accounting?

Date posted: April 17, 2019. Answers (1)

- Give the factors considered on each overhead Absorption Method(Solved)

Give the factors considered on each overhead Absorption Method

Date posted: April 17, 2019. Answers (1)

- Simon worked 360 hours during the month of June 2012 and he was paid at the rate of Ksh 200 per hour. During the month...(Solved)

Simon worked 360 hours during the month of June 2012 and he was paid at the rate of Ksh 200 per hour. During the month he completed three jobs. The following additional information was provided.

Calculate the labour cost chargeable to these three jobs on the assumption that these jobs were completed only by Simon.

Date posted: April 17, 2019. Answers (1)

- From the following information, prepare a payroll for the month of May 2014.(Solved)

From the following information, prepare a payroll for the month of May 2014.

Additional Information

1. Normal working hours per month are 180. Overtime payable for extra hours at the rate of 50% above normal pay rate.

2. P.A.Y.E to be deducted at the rate of 20% of gross wage.

3. N.S.S.F to be deducted Ksh200 for each employee.

4. N.H.I.F to be deducted Ksh400 for each employee.

Date posted: April 17, 2019. Answers (1)

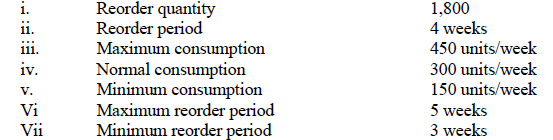

- The following information was extracted from the books of Danex Holdings regarding its stocks:(Solved)

The following information was extracted from the books of Danex Holdings regarding its stocks:

Determine the following stock levels for Danex Holdings:

i. Re-order level

ii. Maximum stock level

iii. Minimum stock level

Date posted: April 17, 2019. Answers (1)

- What considerations should be given to Stock Level and its control?(Solved)

What considerations should be given to Stock Level and its control?

Date posted: April 17, 2019. Answers (1)

- Outline the factors Affecting Stock Levels(Solved)

Outline the factors Affecting Stock Levels

Date posted: April 17, 2019. Answers (1)

- A company has an annual demand for material “p” of 25,000 tons per annum. The cost price per ton is Ksh2, 000 and stock holding...(Solved)

A company has an annual demand for material “p” of 25,000 tons per annum. The cost price per ton is Ksh2, 000 and stock holding is 25% per annum of the stock value. Delivery cost per batch is Ksh400.

Calculate the Economic Order Quantity(E.O.Q)

Date posted: April 17, 2019. Answers (1)

- Outline the assumptions / limitation of Economic Order Quality(Solved)

Outline the assumptions / limitation of Economic Order Quality

Date posted: April 17, 2019. Answers (1)

- Give objectives of Stock Control.(Solved)

Give objectives of Stock Control.

Date posted: April 17, 2019. Answers (1)

- Explain Average Weighted Cost Average as a method of Valuing Material Issues(Solved)

Explain Average Weighted Cost Average as a method of Valuing Material Issues

Date posted: April 17, 2019. Answers (1)

- Explain Last In, First Out (LIFO) as a method of Valuing Material Issues(Solved)

Explain Last In, First Out (LIFO) as a method of Valuing Material Issues

Date posted: April 17, 2019. Answers (1)

- Explain First In First Out (FIFO) as a method of Valuing Material Issues(Solved)

Explain First In First Out (FIFO) as a method of Valuing Material Issues

Date posted: April 17, 2019. Answers (1)

- Define the term Perpetual inventory(Solved)

Define the term Perpetual inventory

Date posted: April 17, 2019. Answers (1)

- Explain Just-in-time (JIT) systems(Solved)

Explain Just-in-time (JIT) systems

Date posted: April 17, 2019. Answers (1)

- Discuss on the systems of Stock Taking(Solved)

Discuss on the systems of Stock Taking

Date posted: April 17, 2019. Answers (1)

- Define material Coding and its' purposes(Solved)

Define material Coding and its' purposes

Date posted: April 17, 2019. Answers (1)

- Name and explain types of Stores(Solved)

Name and explain types of Stores

Date posted: April 17, 2019. Answers (1)

- List the features of Effective and Good Store keeping(Solved)

List the features of Effective and Good Store keeping

Date posted: April 17, 2019. Answers (1)

- Discuss Purchasing procedure as an aspect of material control(Solved)

Discuss Purchasing procedure as an aspect of material control

Date posted: April 17, 2019. Answers (1)