(i) Historical cost

Assets are recognised at the actual, or cash equivalent or fair value expended to acquire them at

the time of their acquisition. Liabilities are recorded at the actual amount received in exchange for

the obligation or the amount expected for settlement of liability.

(ii) Net realisable value

Assets are recorded at the amount of cash or cash equivalent by reference to the amount that could be

received if it is disposed in an orderly manner. Liabilities are carried at their settlement value in the

normal course of business.

(iii) Present value

Assets are recorded at the present discounted value of the future net cash inflows the item is expected

to generate in the normal course of business. Liabilities are recorded at present discounted value of

the expected outflow necessary to settle them.

Kavungya answered the question on May 16, 2019 at 06:25

- Distinguish between ‘purchased goodwill’ and ‘non-purchased goodwill’(Solved)

Distinguish between ‘purchased goodwill’ and ‘non-purchased goodwill’

Date posted: May 16, 2019. Answers (1)

- The following balances were extracted from the books of Furahia Enterprises for the month of

September 2013:

Sh.

Debit balance (1 September 2013): Sales ledger 14,280,000

Purchases ledger 1,920,000

Credit...(Solved)

The following balances were extracted from the books of Furahia Enterprises for the month of

September 2013:

Sh.

Debit balance (1 September 2013): Sales ledger 14,280,000

Purchases ledger 1,920,000

Credit balance (1 September 2013): Sales ledger 1,680,000

Purchases ledger 6,720,000

Credit notes received from suppliers 1,860,000

Debt collection expenses 480,000

Interest charged on customers' overdue accounts 384,000

Customers dishonoured cheques 1,260,000

Bad debts written off 720,000

Receipts from customers 1,280,000

Interest charged by creditors on overdue accounts^ 588,000

Payment to creditors 7,680,000

Contra settlements 390,000

Credit notes issued to customers 270,000

Credit sales 17,340,000

Cash sales 3,240,000

Cash purchases 2,160,000

Credit purchases 7,440,000

Discounts, allowed 1,080,000

Discounts received 690,000

Balances as at 30 September 2013:

Sales ledger (credit) 1,110,000

Purchases ledger (debit) 1,050,000

Required;

i) Sales ledger control account for the month ended 30 September 2013.

ii) Purchases ledger control account for the month ended 30 September

Date posted: May 16, 2019. Answers (1)

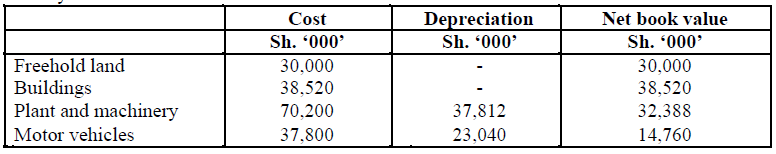

- The property, plant and equipment balances of Matatizo Ltd. comprised the following as at 1

January 2013:

The company uses the straight line method of depreciation on...(Solved)

The property, plant and equipment balances of Matatizo Ltd. comprised the following as at 1

January 2013:

The company uses the straight line method of depreciation on assets as follows:

• 10% per annum for plant and machinery.

• 20% per annum for motor vehicles.

Additional information:

1. It is the company's policy to make a depreciation charge proportionate to the period of usage of the

asset.

2. An item of machinery bought on 1 July 2009 for Sh.10,080.000 was sold on 1 April 2013

at Sh.6,000,000.

3. From the year ended 31 December 2013, the management of the company decided to charge

depreciation on buildings at a rate of 2.5% per annum. The buildings were all completed on 1 July

2009.

4. On 1 January 2013, a vehicle purchased on 1 May 2010 for Sh.12,600,000 was traded in at a value

of Sh.7,320,000 in part exchange for a new vehicle costing Sh.18,000,000.

5. Included in machinery is an old machine which originally cost Sh.13, 500,000 and which was

already fully depreciated and not expected to yield any material amount on either use or resale.

6. On 30 June 2013, a machine costing Sh.13, 500,000 was purchased from a vendor who had used it

for three years. The vendor had bought the machine at Sh.18,000,000. Another machine costing

Sh.10,500,000 was purchased on 1 August 2013.

Required:

A schedule showing the movement of property, plant and equipment for the year ended 31 December

2013.

Date posted: May 16, 2019. Answers (1)

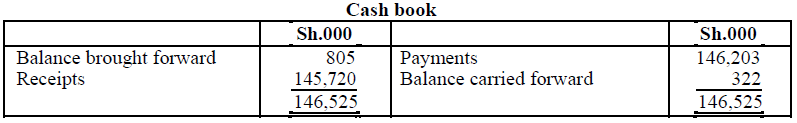

- The following is a summary of the cash book of Azimio Ltd. for the year ended 31 May 2014:

Subsequent investigations reveal that:

1. A page of...(Solved)

The following is a summary of the cash book of Azimio Ltd. for the year ended 31 May 2014:

Subsequent investigations reveal that:

1. A page of the receipt side of the cash book has been under cast by Sh.200, 000.

2. The following transactions appearing on the bank statement have not yet been entered in the cash

book:

- Dividend received on a trade investment Sh.1, 147,000.

- Hire purchase repayments for 12 months at Sh.55, 000 per month.

- Interest for the half year to 30 November 2014 on a loan of Sh.20, 000,000 at 11 percent per

annum.

3. Bank charges of Sh. 143,000 shown on the bank statement have not yet been entered in the cash

book.

4. A cheque received from a customer for Sh.180, 000 was returned by the bank unpaid and no entry

has been made in the cash book for this transaction.

5. The company owes Sh.430, 000 for electricity consumed in the month of May 2014.

6. A cheque for Sh.82, 000 has been debited to the company's account in error by the bank.

7. A cheque drawn for Sh.98, 000 has been entered in the cash book as Sh.89, 000 and another

one-drawn for Sh.230, 000 has been entered as a receipt.

8. A transposition error occurred in the opening balance of the cash book. The opening

balance should have been brought down as Sh.850, 000 instead of Sh.805, 000.

9. Cheques paid to suppliers totalling Sh.630, 000 have not yet been presented at the bank, while

deposits totaling Sh.580, 000 made on 31 May 2014 have not yet been credited to the company's

account.

10. The balance as per the bank statement is an overdraft of Sh.870, 000.

Required:

(i) Adjusted cash book balance.

(ii) Bank reconciliation statement as at 31 May 2014.

Date posted: May 16, 2019. Answers (1)

- Define a sequence control structure.(Solved)

Define a sequence control structure.

Date posted: May 15, 2019. Answers (1)

- Citing an example in each case, briefly explain four types of bookkeeping errors which are

not disclosed by a trial balance(Solved)

Citing an example in each case, briefly explain four types of bookkeeping errors which are

not disclosed by a trial balance

Date posted: May 15, 2019. Answers (1)

- Highlight six types of errors that could be reflected in a trial balance.(Solved)

Highlight six types of errors that could be reflected in a trial balance.

Date posted: May 15, 2019. Answers (1)

- Explain five challenges facing organizations that use computerized accounting software(Solved)

Explain five challenges facing organizations that use computerized accounting software

Date posted: May 15, 2019. Answers (1)

- Highlight six applications of accounting software packages.(Solved)

Highlight six applications of accounting software packages.

Date posted: May 15, 2019. Answers (1)

- Highlight four accounting tasks performed by accounting software packages(Solved)

Highlight four accounting tasks performed by accounting software packages

Date posted: May 15, 2019. Answers (1)

- Identify five benefits of customized accounting software.(Solved)

Identify five benefits of customized accounting software.

Date posted: May 15, 2019. Answers (1)

- Explain four qualities of useful accounting information with reference to the International Account(Solved)

Explain four qualities of useful accounting information with reference to the International Account

Date posted: May 15, 2019. Answers (1)

- Explain the following accounting assumptions

i) Accrual

ii) Going concern(Solved)

Explain the following accounting assumptions

i) Accrual

ii) Going concern

Date posted: May 15, 2019. Answers (1)

- Explain the following accounting concepts.

i) Consistency

ii) Materiality

(Solved)

Explain the following accounting concepts.

i) Consistency

ii) Materiality

Date posted: May 15, 2019. Answers (1)

- Discuss five users of accounting information clearly indicating their information needs(Solved)

Discuss five users of accounting information clearly indicating their information needs

Date posted: May 15, 2019. Answers (1)

- Discuss five principles of the code of ethics that govern the professional conduct of accountants.(Solved)

Discuss five principles of the code of ethics that govern the professional conduct of accountants.

Date posted: May 15, 2019. Answers (1)

- Explain how the prudence concept might be applied to:

(i) The valuation of inventory.

(ii) The valuation of receivables.

(iii) The valuation of shares held as investments quoted...(Solved)

Explain how the prudence concept might be applied to:

(i) The valuation of inventory.

(ii) The valuation of receivables.

(iii) The valuation of shares held as investments quoted on the securities exchange.

(iv) The valuation of land and buildings.

Date posted: May 15, 2019. Answers (1)