Pata Transport Limited (PTL) was incorporated on 1 June 2006 and on the same day bought its first

lorry; KB099S for Sh. 9,000,000.

On 1 April 2007,...

(Solved)

Pata Transport Limited (PTL) was incorporated on 1 June 2006 and on the same day bought its first

lorry; KB099S for Sh. 9,000,000.

On 1 April 2007, the company bought its second lorry KB 120T FOR Sh 12,000,000.

On 1 June 2008, the company bought a third lorry KB 340X for Sh. 6,000,000.

On 1 October 2008, lorry KB 099S was involved in an accident and was written off. The

insurance compensation paid to PTL by the insurers was Sh. 2,600,000.

On 31 December 2009,lorry KB 340X broke down and was traded in with a new lorry registration KB

419Y valued at Sh. 8,000,000.PTL; paid cash amounting to Sh. 5,400,000 for the lorry.

On 1 Apri12010, a van KB 890B was purchased for Sh 4,800,000.

Depreciation on motor vehicles is to be provided at the rate of 10% per annum on a straight line basis.

The policy of the company is to provide depreciation on a pro rata basis.

On 1 January 2009, the company decided to change its depreciation rate from 10% to 15% per annum.

The change was effected on motor vehicles that were in use retrospectively; that is from the year of

purchase. An adjusting entry was to be made in the accounts for the year ended 31 December 2009.

All lorries were comprehensively insured.

Assume the year end for PTL IS 31 December.

Required:

i) Motor vehicles account for the five years ended 31 December 2006,2007,2008,2009 and 2010.

ii) Provision for depreciation account for the same years stated in (b) (i) above

iii) Disposal of motor vehicles account

Date posted:

May 16, 2019

.

Answers (1)

You have just been employed by Best Way Ltd as a trainee accountant. Your first exercise is to

check the transactions in the company’s cash book,...

(Solved)

You have just been employed by Best Way Ltd as a trainee accountant. Your first exercise is to

check the transactions in the company’s cash book, check entries in the bank statement, update

the cash book and make any amendments as necessary after which you will prepare a bank

reconciliation statement at the end of the month.

The company’s cash book and bank statement for the month of March 2013 are provided below;-

Required;

A bank reconciliation statement as at 31 March 2013

Date posted:

May 16, 2019

.

Answers (1)

Distinguish between ‘purchased goodwill’ and ‘non-purchased goodwill’

(Solved)

Distinguish between ‘purchased goodwill’ and ‘non-purchased goodwill’

Date posted:

May 16, 2019

.

Answers (1)

The following balances were extracted from the books of Furahia Enterprises for the month of

September 2013:

Sh.

Debit balance (1 September 2013): Sales ledger 14,280,000

Purchases ledger 1,920,000

Credit...

(Solved)

The following balances were extracted from the books of Furahia Enterprises for the month of

September 2013:

Sh.

Debit balance (1 September 2013): Sales ledger 14,280,000

Purchases ledger 1,920,000

Credit balance (1 September 2013): Sales ledger 1,680,000

Purchases ledger 6,720,000

Credit notes received from suppliers 1,860,000

Debt collection expenses 480,000

Interest charged on customers' overdue accounts 384,000

Customers dishonoured cheques 1,260,000

Bad debts written off 720,000

Receipts from customers 1,280,000

Interest charged by creditors on overdue accounts^ 588,000

Payment to creditors 7,680,000

Contra settlements 390,000

Credit notes issued to customers 270,000

Credit sales 17,340,000

Cash sales 3,240,000

Cash purchases 2,160,000

Credit purchases 7,440,000

Discounts, allowed 1,080,000

Discounts received 690,000

Balances as at 30 September 2013:

Sales ledger (credit) 1,110,000

Purchases ledger (debit) 1,050,000

Required;

i) Sales ledger control account for the month ended 30 September 2013.

ii) Purchases ledger control account for the month ended 30 September

Date posted:

May 16, 2019

.

Answers (1)

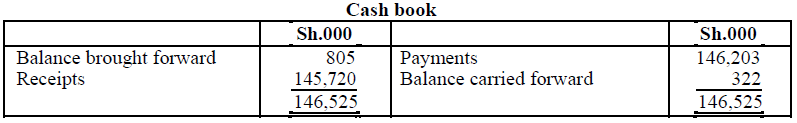

The following is a summary of the cash book of Azimio Ltd. for the year ended 31 May 2014:

Subsequent investigations reveal that:

1. A page of...

(Solved)

The following is a summary of the cash book of Azimio Ltd. for the year ended 31 May 2014:

Subsequent investigations reveal that:

1. A page of the receipt side of the cash book has been under cast by Sh.200, 000.

2. The following transactions appearing on the bank statement have not yet been entered in the cash

book:

- Dividend received on a trade investment Sh.1, 147,000.

- Hire purchase repayments for 12 months at Sh.55, 000 per month.

- Interest for the half year to 30 November 2014 on a loan of Sh.20, 000,000 at 11 percent per

annum.

3. Bank charges of Sh. 143,000 shown on the bank statement have not yet been entered in the cash

book.

4. A cheque received from a customer for Sh.180, 000 was returned by the bank unpaid and no entry

has been made in the cash book for this transaction.

5. The company owes Sh.430, 000 for electricity consumed in the month of May 2014.

6. A cheque for Sh.82, 000 has been debited to the company's account in error by the bank.

7. A cheque drawn for Sh.98, 000 has been entered in the cash book as Sh.89, 000 and another

one-drawn for Sh.230, 000 has been entered as a receipt.

8. A transposition error occurred in the opening balance of the cash book. The opening

balance should have been brought down as Sh.850, 000 instead of Sh.805, 000.

9. Cheques paid to suppliers totalling Sh.630, 000 have not yet been presented at the bank, while

deposits totaling Sh.580, 000 made on 31 May 2014 have not yet been credited to the company's

account.

10. The balance as per the bank statement is an overdraft of Sh.870, 000.

Required:

(i) Adjusted cash book balance.

(ii) Bank reconciliation statement as at 31 May 2014.

Date posted:

May 16, 2019

.

Answers (1)

Discuss five principles of the code of ethics that govern the professional conduct of accountants.

(Solved)

Discuss five principles of the code of ethics that govern the professional conduct of accountants.

Date posted:

May 15, 2019

.

Answers (1)