- Jane is a sales executive earning a salary of Ksh. 20,000 and a commission of 8% for the sales in excess of Ksh 100,000. If...(Solved)

Jane is a sales executive earning a salary of Ksh. 20,000 and a commission of 8% for the sales in excess of Ksh 100,000. If in January 2010 she earned a total of Ksh.48, 000 in salaries and commissions.

a) Determine the amount of sales she made in that month

b) If the total sales in the month of February and March increased by 18% and then dropped by 25% respectively. Calculate

(i) Jane’s commission in the month of February

(ii) Her total earning in the month of March

Date posted: June 19, 2019. Answers (1)

- A rectangular room has length 12.0 metres and width 8.0 metres. Find the maximum

percentage error in estimating the perimeter of the room.(Solved)

A rectangular room has length 12.0 metres and width 8.0 metres. Find the maximum

percentage error in estimating the perimeter of the room.

Date posted: June 19, 2019. Answers (1)

- In this question mathematical tables or calculator should not used. The base and perpendicular

height of a triangle measured to the nearest centimeters are 12cm and...(Solved)

In this question mathematical tables or calculator should not used. The base and perpendicular

height of a triangle measured to the nearest centimeters are 12cm and 8cm respectively;

Find ;

(a) the absolute error in calculating the are of the triangle

b) the percentage error in the area, giving the answer to 1 decimal place

Date posted: June 19, 2019. Answers (1)

- A rectangular plate has a perimeter of 28cm. determine the dimensions of the plate that

give the maximum area(Solved)

A rectangular plate has a perimeter of 28cm. determine the dimensions of the plate that

give the maximum area

Date posted: June 19, 2019. Answers (1)

- A wire of length 5.2m is cut into two pieces without wastage. One of the pieces is

3.08m long. What is the shortest possible length of...(Solved)

A wire of length 5.2m is cut into two pieces without wastage. One of the pieces is

3.08m long. What is the shortest possible length of the second piece?

Date posted: June 19, 2019. Answers (1)

- The dimensions of a rectangle are 10cm and 15cm. If there is an error of 5% in each of the

Measurements. Find the percentage error in...(Solved)

The dimensions of a rectangle are 10cm and 15cm. If there is an error of 5% in each of the

Measurements. Find the percentage error in the area of the rectangle.

Date posted: June 19, 2019. Answers (1)

- Find the products of 17.3 and 13.8. Find also the percentage error in getting the product.(Solved)

Find the products of 17.3 and 13.8. Find also the percentage error in getting the product.

Date posted: June 19, 2019. Answers (1)

- The mass of a metal is given as 14kg to the nearest l0g. Find the percentage error in this

measurement.(Solved)

The mass of a metal is given as 14kg to the nearest l0g. Find the percentage error in this

measurement.

Date posted: June 19, 2019. Answers (1)

- The length and breadth o a rectangular room are 15cm and 12 cm respectively. If each of these measurements is liable to 1.5% error, calculate...(Solved)

The length and breadth o a rectangular room are 15cm and 12 cm respectively. If each of these measurements is liable to 1.5% error, calculate the absolute error in the perimeter of the room

Date posted: June 19, 2019. Answers (1)

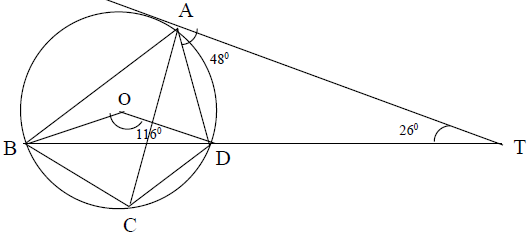

- In the figure below, TA is a tangent to the circle ABCD with centre O. TAD = 480 and

BOD = 1160

Giving reasons calculate:

a) ACD

b)...(Solved)

In the figure below, TA is a tangent to the circle ABCD with centre O. TAD = 480 and

BOD = 1160

Giving reasons calculate:

a) ACD

b) ABO

c) ADO

d) ACB

e) ATB

Date posted: June 18, 2019. Answers (1)

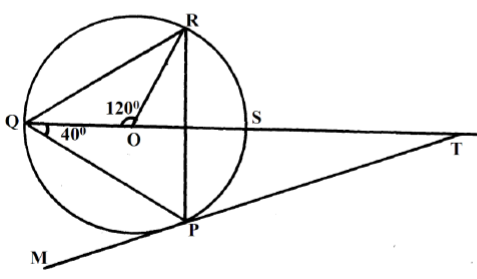

- In the figure below PQR and S are points on the circumference of a circle centre O. The point TSO

and Q lie on a straight...(Solved)

In the figure below PQR and S are points on the circumference of a circle centre O. The point TSO

and Q lie on a straight line MPT is a tangent to the circle at P.

Find the values of the following angles stating reasons in each case.

(a) SRP

(b) ORP

(c) RPT

(d) STP

(e) QPM

Date posted: June 18, 2019. Answers (1)

- The angles of elevation from two points A and B to the top of a storey building are 480 and 570 respectively. If AB =...(Solved)

The angles of elevation from two points A and B to the top of a storey building are 480 and 570 respectively. If AB = 50m and the point A and B are opposite each other; Calculate;

a) the distance of point A to the building

b) the height of the building

Date posted: June 18, 2019. Answers (1)

- The angle of depression of a point A on the ground from the top of a post is 180 and that of another point B...(Solved)

The angle of depression of a point A on the ground from the top of a post is 180 and that of another point B on the same line as A nearer to the foot of the post is 250. If A and B are 70m apart,

(a) Draw a sketch to represent positions of A and B.

(b) Using your sketch calculate

(i) The height of the post from the ground level (Ans 1 d.p)

(ii) The distance of point A from the foot of the post.

Date posted: June 18, 2019. Answers (1)

- A regular polygon has its exterior angle 180, and one of its sides 16cm. Calculate its area.

(to 2 d.p)(Solved)

A regular polygon has its exterior angle 180, and one of its sides 16cm. Calculate its area.

(to 2 d.p)

Date posted: June 18, 2019. Answers (1)

- From a point 20m away on a level ground the angle of elevation to the lower window line is 270 and the angle of elevation...(Solved)

From a point 20m away on a level ground the angle of elevation to the lower window line is 270 and the angle of elevation to the top line of the window is 320. Calculate the height of the window.

Date posted: June 18, 2019. Answers (1)

- The sides of a parallelogram are 4cm by 5cm and its area is 12cm2. Calculate its angles.(Solved)

The sides of a parallelogram are 4cm by 5cm and its area is 12cm2. Calculate its angles.

Date posted: June 18, 2019. Answers (1)

- The exterior angle of a regular polygon is an eighth of the interior angle. How many sides does the regular polygon have?(Solved)

The exterior angle of a regular polygon is an eighth of the interior angle. How many sides does the regular polygon have?

Date posted: June 18, 2019. Answers (1)

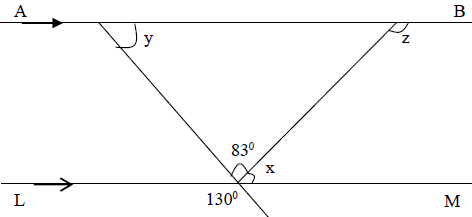

- In the figure below, lines AB and LM are parallel.

Find the values of the angles marked x, y and z(Solved)

In the figure below, lines AB and LM are parallel.

Find the values of the angles marked x, y and z

Date posted: June 18, 2019. Answers (1)

- The exterior angle of a regular polygon is equal to one-third of the interior angle.

Calculate the number of sides of the polygon and give its...(Solved)

The exterior angle of a regular polygon is equal to one-third of the interior angle.

Calculate the number of sides of the polygon and give its name.

Date posted: June 18, 2019. Answers (1)

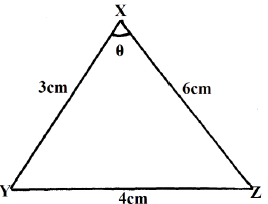

- In the triangle XYZ below, find the angle ZXY.(Solved)

In the triangle XYZ below, find the angle ZXY.

Date posted: June 18, 2019. Answers (1)