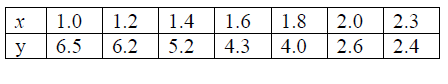

- The table shows corresponding values of x and y for a certain curve;

Using 3 strips and mid-ordinate rule estimate the area between the curve, x-axis,

the...(Solved)

The table shows corresponding values of x and y for a certain curve;

Using 3 strips and mid-ordinate rule estimate the area between the curve, x-axis,

the lines x =1 and x =2.2

Date posted: June 19, 2019. Answers (1)

- ABCD is a parallelogram with vertices A (1,1) and C(8,10). AB has the equation

4x -5y = -1 and BC has the equation 5x – 2y...(Solved)

ABCD is a parallelogram with vertices A (1,1) and C(8,10). AB has the equation

4x -5y = -1 and BC has the equation 5x – 2y = 20. Determine by calculation;

(a) the co-ordinates of the point M where the diagonals meet

(b) The co-ordinates of the vertices B and D

(c) the length of AB correct to 4 significant figures

Date posted: June 19, 2019. Answers (1)

- OABC is a trapezium such that the coordinates of O, A , B and C are (0, 0), (2, -1), (4, 3)

and (0, y)

(a) Find...(Solved)

OABC is a trapezium such that the coordinates of O, A , B and C are (0, 0), (2, -1), (4, 3)

and (0, y)

(a) Find the value of y

(b) M is the mid-point of AB and N is the mid-point of OM. Find in column form

(i) the vector AN

(ii) the vector NC

(iii) Vector AC

(c) Hence show that A, N and C are collinear

Date posted: June 19, 2019. Answers (1)

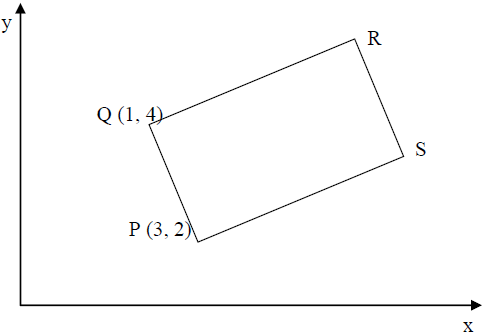

- In the figure below (not drawn to scale), PQRS is a rectangle and P and Q are the points

(3, 2) and (1,4) respectively

Given that the...(Solved)

In the figure below (not drawn to scale), PQRS is a rectangle and P and Q are the points

(3, 2) and (1,4) respectively

Given that the equation of the line PQ is y =3x -7, find:

(a) The equation of line QR

(b) The coordinates of point R

(c) The coordinates of point S

Date posted: June 19, 2019. Answers (1)

- T is the mid-point of line XY where X is point (1,4) and Y is the point (-5, 10). Find the

equation of a line, L2...(Solved)

T is the mid-point of line XY where X is point (1,4) and Y is the point (-5, 10). Find the

equation of a line, L2 which is perpendicular to line XY and goes through point T

Date posted: June 19, 2019. Answers (1)

- Find the equation of a line which passes through the point (2, 3) and is perpendicular to

y – 3x+ 1 = 0, giving your answer...(Solved)

Find the equation of a line which passes through the point (2, 3) and is perpendicular to

y – 3x+ 1 = 0, giving your answer in the form y = mx + c

Date posted: June 19, 2019. Answers (1)

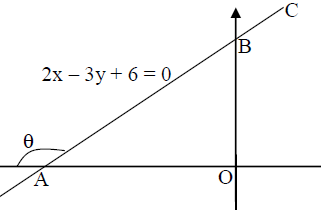

- Find the angle ? in degrees from the figure below(Solved)

Find the angle θ in degrees from the figure below

Date posted: June 19, 2019. Answers (1)

- In certain day the bank rates for changing dollars to shillings are given below.

Buying selling

Dollar 78.43 ...(Solved)

In certain day the bank rates for changing dollars to shillings are given below.

Buying selling

Dollar 78.43 79.25

An American tourist changed US dollar 1500 to shillings, but then had to return to U. S. A

immediately and changed all the shillings back to dollars using the same rates. How much

did he lose?

Date posted: June 19, 2019. Answers (1)

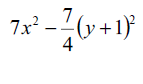

- Factorise the expression(Solved)

Factorise the expression

Date posted: June 19, 2019. Answers (1)

- When shop keeper sells articles at sh. 240.50 each he makes a profit of 25% on the cost

price. During a sale he reduces the price...(Solved)

When shop keeper sells articles at sh. 240.50 each he makes a profit of 25% on the cost

price. During a sale he reduces the price of each article by sh. 22.90. Calculate the

percentage profit on an article sold at the sale price.

Date posted: June 19, 2019. Answers (1)

- The cost of a camera outside Kenya is US$1000. James intends to buy one camera through an agent

who deals in Japanese Yen. The agent charges...(Solved)

The cost of a camera outside Kenya is US1000.JamesintendstobuyonecamerathroughanagentwhodealsinJapaneseYen.Theagentchargeshimacommissionof5 = 105.00 Yen.

1 US$ = Kshs.63.00

Date posted: June 19, 2019. Answers (1)

- Muthoni went to a shop and bought 50 packets of milk and 25 packets of salt all for Kshs.200.00. She

sold the milk at a profit...(Solved)

Muthoni went to a shop and bought 50 packets of milk and 25 packets of salt all for Kshs.200.00. She

sold the milk at a profit of 28% and the salt at a profit of 24% thereby making a net profit of

Kshs.53.50. Find the cost price of a packet of milk and a packet of salt.

Date posted: June 19, 2019. Answers (1)

- Kimani bought a car at kshs. 120,000. Its value depreciated by 8% per year for the first 2 years

and by 12% per year for the...(Solved)

Kimani bought a car at kshs. 120,000. Its value depreciated by 8% per year for the first 2 years

and by 12% per year for the subsequent years.

(a) Determine the value of the car after 6 years.

(b) After 6 years, the car was sold through an agent at 25% more than its value. If the sales

price was to be taken as its value after depreciation, calculate the average monthly rate of

depreciation for the six years.

Date posted: June 19, 2019. Answers (1)

- A Kenya bank buys and sells foreign currencies as shown below.

...(Solved)

A Kenya bank buys and sells foreign currencies as shown below.

Buying (Ksh) Selling Ksh

1 Euro 84.15 84.26

100 Japanese Yen 65.37 65.45

A Japanese traveling from France in Kenya with 5000 Euros. He converted all the 5000 Euros to

Kenya shillings at the bank. While in Kenya, he spent a total of Ksh. 289850 and then converted the

remaining Kenya shillings to Japanese Yens at the bank. Calculate the amount in Japanese Yen that he

received.

Date posted: June 19, 2019. Answers (1)

- Mr. Sitienei sold a house to Mr. Lagat at a profit of 10%. Mr. Lagat then sold it to Mr. Rotich at a

profit of 5%....(Solved)

Mr. Sitienei sold a house to Mr. Lagat at a profit of 10%. Mr. Lagat then sold it to Mr. Rotich at a

profit of 5%. Mr. Rotich paid Ksh 110,000 more than Mr. Lagat for the house. Find how much Mr.

Rotich paid for the house.

Date posted: June 19, 2019. Answers (1)

- Juanita sold goods worth Ksh 95,000 and earned a total commission of Ksh 4,500. If the commission

on the first Ksh. 50,000 was half of the...(Solved)

Juanita sold goods worth Ksh 95,000 and earned a total commission of Ksh 4,500. If the commission

on the first Ksh. 50,000 was half of the total commission, what were the two rates of commission?

Date posted: June 19, 2019. Answers (1)

- A Kenyan tourist left Germany for Kenya through Switzerland. While in Switzerland he bought a watch

worth 52 Deutsche marks. Find the value of the watch...(Solved)

A Kenyan tourist left Germany for Kenya through Switzerland. While in Switzerland he bought a watch

worth 52 Deutsche marks. Find the value of the watch in:-

(a) Swiss Francs

(b) Kenya shillings

Use the exchange rates below

1 Swiss Franc = 1.28 Deutsche marks

1 Swiss Franc = 45.21 Kenya shillings

Date posted: June 19, 2019. Answers (1)

- A man imported a vehicle at Shs. 600,000 and sold it at Sh. 1,080,0000. Find his percentage profit if he

spent sh. 60,000 for clearing the...(Solved)

A man imported a vehicle at Shs. 600,000 and sold it at Sh. 1,080,0000. Find his percentage profit if he

spent sh. 60,000 for clearing the vehicle from the port and a further sh. 40,000 for shipping.

Date posted: June 19, 2019. Answers (1)

- Chepkurui imports rice from the United States at an initial cost of 500US Dollars per tonne. He then

pays 20% of this amount as shipping costs...(Solved)

Chepkurui imports rice from the United States at an initial cost of 500US Dollars per tonne. He then

pays 20% of this amount as shipping costs and 10% of the same amount as custom duty. When the

rice reaches Mombasa he has to pay 5% of the initial cost to transport it to Nairobi.

(a) Given that on the day of this transaction the exchange rate was 1US Dollar = Ksh 76.60,

calculate the total cost of importing one tonne of rice up to Nairobi in Kenya Shillings

(b) Chepkurui intends to make a profit of 20%. Giving your answer to the nearsest ten cents,

calculate the price at which he must sell the rice per kilogram

(c) If on the day that he completes the sale of this import he changes the total collection back to

US Dollars at the rate of 1US Dollar = Ksh 78.20, calculate the actual profit that Chepkurui

realized correct to three decimal places

Date posted: June 19, 2019. Answers (1)

- A drapper bought some shirts and some trousers from a wholesaler Y at Sh.200 per

shirt and Sh.600 per trouser, spending a total of Sh.22, 000....(Solved)

A drapper bought some shirts and some trousers from a wholesaler Y at Sh.200 per

shirt and Sh.600 per trouser, spending a total of Sh.22, 000. If he had bought the same

items from wholesaler X, he would have paid 25% more for a shirt and 15% less for a

trouser and he would have spent Sh.700 more.

a) Write a simultaneous equation to represent the above information.

b) Determine the number of each item he bought

c) He sold all the items as a profit of 50% per shirt and 30% per trouser. Find the

total profit he made if he bought from wholesaler X.

d) Calculate to the nearest whole number, the percentage profit he made if he bought

from wholesale Y

Date posted: June 19, 2019. Answers (1)