(a) taxable income = Kshs. 25000 + Kshs.10480

= Kshs. 35480

b) tax charged:

1st 4350 = 4350 x 2/20 = 683.25

2nd 4555 = 4555 x 3/20 – 683.25

3rd 4555 = 4555 x 4/20 – 911

4th 4555 = 4555 x 5/20 - 1138.75

Rem. 17465 = 17645 x 6/20 – 5239

Total tax – 8407.5

800.00

7607.50

(c) 40/100 x 35480 – 14.192 = 49672

New income = 35480 + 14192 = 49672

Remainder = 49672 – 18015 = 31657

Tax charged = 31657 x 6/20 =12665.1

Total tax = 12665.1

% increase in income ax = 4257.6 x 100

7607.5 = 55.97%

Kavungya answered the question on June 19, 2019 at 09:55

-

A certain amount of money was invested at compound interest of 10% compounded

every two years for ten years. Given that the investor invested a total...

(Solved)

A certain amount of money was invested at compound interest of 10% compounded

every two years for ten years. Given that the investor invested a total of 500,000/= at the

end of the ten years, find the amount of money invested to the nearest shillings

Date posted:

June 19, 2019

.

Answers (1)

-

The cash price of a T.V set is Ksh. 26,000. Linda bought the set on hire purchase terms by

paying a deposit of Ksh. 6,000 and...

(Solved)

The cash price of a T.V set is Ksh. 26,000. Linda bought the set on hire purchase terms by

paying a deposit of Ksh. 6,000 and the balance by 24 equal monthly installments of

Khs. 1,045.30. Find the compound rate of interest per year.

Date posted:

June 19, 2019

.

Answers (1)

-

What would Kshs.15000 amount to after 3years at 16% per annum compounded quarterly?

(Solved)

What would Kshs.15000 amount to after 3years at 16% per annum compounded quarterly?

Date posted:

June 19, 2019

.

Answers (1)

-

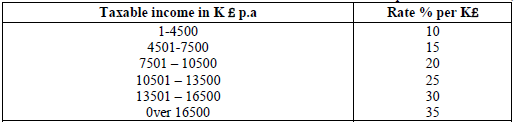

Income rates for income earned were charged as follows:

Income in Kshs. p.m Rate in Kshs. per sh.20

1- 8400 ...

(Solved)

Income rates for income earned were charged as follows:

Income in Kshs. p.m Rate in Kshs. per sh.20

1- 8400 2

8401- 18,000 3

18,001- 30,000 4

30,000 - 36,000 5

36,001 - 48,000 6

48,001 and above 7

A civil servant earns a monthly salary of Ksh.19,200. His house allowance is Ksh12,000 per

month. Other allowces per month are transport Ksh.1300 and medical allowance Ksh.2300.

He is entitled to a family relief of Kshs. 1240 per month.

Determine:

a) (i) His taxable income per month.

(ii) Net tax. b) In addition, the following deductions were made

NHIF shs. 230

Service charge Kshs. 100

Loan repayment Kshs. 4000

Co-operative shares of Kshs. 1200.

Calculate his net salary per month.

Date posted:

June 19, 2019

.

Answers (1)

-

Use the taxation rates in the table below to answer the questions that follow;-

The manager of a certain company is entitled to a monthly personal...

(Solved)

Use the taxation rates in the table below to answer the questions that follow;-

The manager of a certain company is entitled to a monthly personal relief of shs.3000

and her tax (PAYE) is kshs.9000 per month she is also deducted NHIF shs.350 per month,

WCPS shs.800 per month and cooperative shares shs.1200 per month, calculate

(a) The managers total deductions per month

(b) Total tax per month

(c) The manager’s annual gross salary

(d) The manager’s monthly basic salary if her monthly allowance and medical allowances

are 10000 and 2000 shillings

Date posted:

June 19, 2019

.

Answers (1)

-

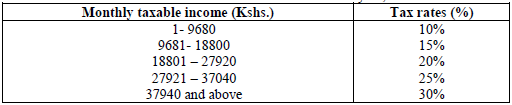

The table below shows the income tax for a certain year;

In that year, Odero paid a net tax of Kshs.5,512 per month. His total monthly...

(Solved)

The table below shows the income tax for a certain year;

In that year, Odero paid a net tax of Kshs.5,512 per month. His total monthly taxable allowances

amounted to Kshs.15,220 and he was entitled to a monthly personal relief of kshs.1,162.

Every month the following deductions were made;

N.H.I.F Kshs.320

Union dues Kshs.200

Co-operative shares Kshs.7,500

(a) Calculate Odero’s monthly basic salary in Kshs

(b) Calculate his monthly salary

Date posted:

June 19, 2019

.

Answers (1)

-

(a) A car is worth shs.800,000 when new. During the first year it depreciates by 20%

of its value and in the second it deprecates by...

(Solved)

(a) A car is worth shs.800,000 when new. During the first year it depreciates by 20%

of its value and in the second it deprecates by 5% of its value at the start of the year.

During the third, fourth and fifth year, depreciation rate is 10%. How much less will

it cost at the end of the fifth year?

(b) Find by how much the compound interest will exceed simple interest on shs.3,000

for two years at 15% per year

Date posted:

June 19, 2019

.

Answers (1)

-

The table below shows the income tax rates:

Income per month (K£) Rate in Kshs per £

1 - 325 ...

(Solved)

The table below shows the income tax rates:

Income per month (K£) Rate in Kshs per £

1 - 325 2

326 – 975 3

976 - 1300 5

1301 – 1625 6

Over 1625 7.50

Mr. Misoi is a public servant who lives in a government house and pays a nominal rent of Kshs.1,220 per month. He earns a basic salary of Kshs. 24,800 and a house allowance of Kshs.12,000 per month. He is entitled to a monthly relief of kshs.1620.

(a) Calculate his monthly;

(i) Taxable income in K£

(ii) Tax payable without relief

(iii) Tax after relief

(b) Apart from the income tax. The following monthly deductions are made from his earnings

-HELB loan repayment Kshs.2400

- Health insurance fund Kshs.1200

- 2% of Basic salary union fee

Calculate:- (i) the total monthly deduction made on Mr. Misoi’s income

(ii) Mr. Misoi’s net income per month

Date posted:

June 19, 2019

.

Answers (1)

-

Joseph bought a camera on hire purchase (H.P) term by paying a deposit of shs.7200

and cleared the balance in 24 equal monthly installments each of...

(Solved)

Joseph bought a camera on hire purchase (H.P) term by paying a deposit of shs.7200

and cleared the balance in 24 equal monthly installments each of 1250.

(a) find the hire purchase price of the camera

(b) the hire purchase price of the camera is 24% higher than the cash price. Find the

cash price of the camera

(c) Kangara took a loan from a financial institution and bought the camera with cash.

He repaid the loan at 18% p.a compound interest at the end of the two years. Find

the total interest paid by Kangara.

Date posted:

June 19, 2019

.

Answers (1)

-

The table below shows the rate at which income tax is charged for all taxable income.

...

(Solved)

The table below shows the rate at which income tax is charged for all taxable income.

INCOME RATE IN EXCH TWENTY SHILLINGS

On the first shs.116 160 10%

On the next shs.109 440 15%

On the next shs.109 440 20%

On the next shs.109 440 25%

On all income over shs.444 480 30%

Mr. Nyongesa earns a basic salary of sh.54, 450 per month. He is housed by the company and therefore 15% of his monthly salary is added to the basic salary as a taxable income. He is also given taxable medical and transport allowances of shs.4,000 and shs.2,000 per month respectively. He is entitled to a family relief of sh.1, 100 per month.

(a) Calculate Nyongesa’s annual taxable income

(b) Calculate his monthly P.A.Y.E after the relief

(c) If 20% of his basic salary goes towards deductions, determine his monthly income.

Date posted:

June 19, 2019

.

Answers (1)

-

ABCD is a parallelogram with vertices A (1,1) and C(8,10). AB has the equation

4x -5y = -1 and BC has the equation 5x – 2y...

(Solved)

ABCD is a parallelogram with vertices A (1,1) and C(8,10). AB has the equation

4x -5y = -1 and BC has the equation 5x – 2y = 20. Determine by calculation;

(a) the co-ordinates of the point M where the diagonals meet

(b) The co-ordinates of the vertices B and D

(c) the length of AB correct to 4 significant figures

Date posted:

June 19, 2019

.

Answers (1)

-

OABC is a trapezium such that the coordinates of O, A , B and C are (0, 0), (2, -1), (4, 3)

and (0, y)

(a) Find...

(Solved)

OABC is a trapezium such that the coordinates of O, A , B and C are (0, 0), (2, -1), (4, 3)

and (0, y)

(a) Find the value of y

(b) M is the mid-point of AB and N is the mid-point of OM. Find in column form

(i) the vector AN

(ii) the vector NC

(iii) Vector AC

(c) Hence show that A, N and C are collinear

Date posted:

June 19, 2019

.

Answers (1)

-

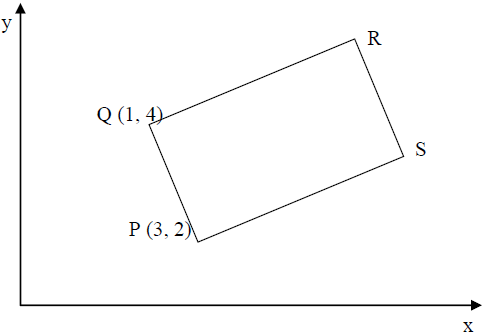

In the figure below (not drawn to scale), PQRS is a rectangle and P and Q are the points

(3, 2) and (1,4) respectively

Given that the...

(Solved)

In the figure below (not drawn to scale), PQRS is a rectangle and P and Q are the points

(3, 2) and (1,4) respectively

Given that the equation of the line PQ is y =3x -7, find:

(a) The equation of line QR

(b) The coordinates of point R

(c) The coordinates of point S

Date posted:

June 19, 2019

.

Answers (1)

-

When shop keeper sells articles at sh. 240.50 each he makes a profit of 25% on the cost

price. During a sale he reduces the price...

(Solved)

When shop keeper sells articles at sh. 240.50 each he makes a profit of 25% on the cost

price. During a sale he reduces the price of each article by sh. 22.90. Calculate the

percentage profit on an article sold at the sale price.

Date posted:

June 19, 2019

.

Answers (1)

-

Muthoni went to a shop and bought 50 packets of milk and 25 packets of salt all for Kshs.200.00. She

sold the milk at a profit...

(Solved)

Muthoni went to a shop and bought 50 packets of milk and 25 packets of salt all for Kshs.200.00. She

sold the milk at a profit of 28% and the salt at a profit of 24% thereby making a net profit of

Kshs.53.50. Find the cost price of a packet of milk and a packet of salt.

Date posted:

June 19, 2019

.

Answers (1)

-

Juanita sold goods worth Ksh 95,000 and earned a total commission of Ksh 4,500. If the commission

on the first Ksh. 50,000 was half of the...

(Solved)

Juanita sold goods worth Ksh 95,000 and earned a total commission of Ksh 4,500. If the commission

on the first Ksh. 50,000 was half of the total commission, what were the two rates of commission?

Date posted:

June 19, 2019

.

Answers (1)

-

A man imported a vehicle at Shs. 600,000 and sold it at Sh. 1,080,0000. Find his percentage profit if he

spent sh. 60,000 for clearing the...

(Solved)

A man imported a vehicle at Shs. 600,000 and sold it at Sh. 1,080,0000. Find his percentage profit if he

spent sh. 60,000 for clearing the vehicle from the port and a further sh. 40,000 for shipping.

Date posted:

June 19, 2019

.

Answers (1)

-

A drapper bought some shirts and some trousers from a wholesaler Y at Sh.200 per

shirt and Sh.600 per trouser, spending a total of Sh.22, 000....

(Solved)

A drapper bought some shirts and some trousers from a wholesaler Y at Sh.200 per

shirt and Sh.600 per trouser, spending a total of Sh.22, 000. If he had bought the same

items from wholesaler X, he would have paid 25% more for a shirt and 15% less for a

trouser and he would have spent Sh.700 more.

a) Write a simultaneous equation to represent the above information.

b) Determine the number of each item he bought

c) He sold all the items as a profit of 50% per shirt and 30% per trouser. Find the

total profit he made if he bought from wholesaler X.

d) Calculate to the nearest whole number, the percentage profit he made if he bought

from wholesale Y

Date posted:

June 19, 2019

.

Answers (1)

-

A farmer made a loss of 28% by selling a goat for Sh.1440. What percentage profit

would he have made if he had sold the goat...

(Solved)

A farmer made a loss of 28% by selling a goat for Sh.1440. What percentage profit

would he have made if he had sold the goat for Sh.2100?

Date posted:

June 19, 2019

.

Answers (1)

-

A trader sold an article at sh.4800 after allowing his customer a 12% discount on the marked price of

the article. In so doing he made...

(Solved)

A trader sold an article at sh.4800 after allowing his customer a 12% discount on the marked price of

the article. In so doing he made a profit of 45% .

a) Calculate

(i) the marked price of the article.

(ii) the price at which the trader had bought the article

b) If the trader had sold the same article without giving a discount. Calculate the percentage profit he

would have made.

c) To clear his stock, the trader decided to sell the remaining articles at a loss of 12.5% (Calculate the price at which he sold each article.

Date posted:

June 19, 2019

.

Answers (1)