1. Allocation it is a term used where the overhead cost item is be charged to a specific cost centre without the need for any estimation procedure e.g. the salary of a sales manager will be allocated to the selling overhead cost centre.

2. Apportionment occurs when the total value of an overhead item is shared between two or more cost centres. An appointment bases which reflects the benefits and extracted by a cost centre must be used e.g., rent payable may be apportioned on the bases of area of occupancy.

3. Reapportionment occurs when service department cost are charged to user department. e.g., the maintenance department overheads are totaled and then charged to user department which may include other services or non productive department.

4. A reciprocal service charge is a situation where service department provides services to each other as they continue to serve productive departments e.g., where maintenance department uses power and the power department requires maintenance work on its machinery.

5. Absorption is a term used for the method by which overhead costs are charged to cost units.

Wilfykil answered the question on August 5, 2019 at 14:40

- Discuss the topic Overhead Analysis(Solved)

Discuss the topic Overhead Analysis

Date posted: August 5, 2019. Answers (1)

- Which are the typical Causes of Labour Rate Variances?(Solved)

Which are the typical Causes of Labour Rate Variances?

Date posted: April 17, 2019. Answers (1)

- Which are the typical Causes of Material Variances?(Solved)

Which are the typical Causes of Material Variances?

Date posted: April 17, 2019. Answers (1)

- Why should one Perform Variance Analysis?(Solved)

Why should one Perform Variance Analysis?

Date posted: April 17, 2019. Answers (1)

- Define Variance Analysis(Solved)

Define Variance Analysis

Date posted: April 17, 2019. Answers (1)

- List and explain the methods Used to Allocate Joint Costs(Solved)

List and explain the methods Used to Allocate Joint Costs

Date posted: April 17, 2019. Answers (1)

- Which is the accounting Treatment of Spoilage Costs?(Solved)

Which is the accounting Treatment of Spoilage Costs?

Date posted: April 17, 2019. Answers (1)

- What are the features of contract accounting?(Solved)

What are the features of contract accounting?

Date posted: April 17, 2019. Answers (1)

- Give the factors considered on each overhead Absorption Method(Solved)

Give the factors considered on each overhead Absorption Method

Date posted: April 17, 2019. Answers (1)

- Simon worked 360 hours during the month of June 2012 and he was paid at the rate of Ksh 200 per hour. During the month...(Solved)

Simon worked 360 hours during the month of June 2012 and he was paid at the rate of Ksh 200 per hour. During the month he completed three jobs. The following additional information was provided.

Calculate the labour cost chargeable to these three jobs on the assumption that these jobs were completed only by Simon.

Date posted: April 17, 2019. Answers (1)

- From the following information, prepare a payroll for the month of May 2014.(Solved)

From the following information, prepare a payroll for the month of May 2014.

Additional Information

1. Normal working hours per month are 180. Overtime payable for extra hours at the rate of 50% above normal pay rate.

2. P.A.Y.E to be deducted at the rate of 20% of gross wage.

3. N.S.S.F to be deducted Ksh200 for each employee.

4. N.H.I.F to be deducted Ksh400 for each employee.

Date posted: April 17, 2019. Answers (1)

- The following information was extracted from the books of Danex Holdings regarding its stocks:(Solved)

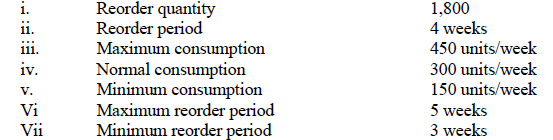

The following information was extracted from the books of Danex Holdings regarding its stocks:

Determine the following stock levels for Danex Holdings:

i. Re-order level

ii. Maximum stock level

iii. Minimum stock level

Date posted: April 17, 2019. Answers (1)

- What considerations should be given to Stock Level and its control?(Solved)

What considerations should be given to Stock Level and its control?

Date posted: April 17, 2019. Answers (1)

- Outline the factors Affecting Stock Levels(Solved)

Outline the factors Affecting Stock Levels

Date posted: April 17, 2019. Answers (1)

- A company has an annual demand for material “p” of 25,000 tons per annum. The cost price per ton is Ksh2, 000 and stock holding...(Solved)

A company has an annual demand for material “p” of 25,000 tons per annum. The cost price per ton is Ksh2, 000 and stock holding is 25% per annum of the stock value. Delivery cost per batch is Ksh400.

Calculate the Economic Order Quantity(E.O.Q)

Date posted: April 17, 2019. Answers (1)

- Outline the assumptions / limitation of Economic Order Quality(Solved)

Outline the assumptions / limitation of Economic Order Quality

Date posted: April 17, 2019. Answers (1)

- Give objectives of Stock Control.(Solved)

Give objectives of Stock Control.

Date posted: April 17, 2019. Answers (1)

- Explain Average Weighted Cost Average as a method of Valuing Material Issues(Solved)

Explain Average Weighted Cost Average as a method of Valuing Material Issues

Date posted: April 17, 2019. Answers (1)

- Explain Last In, First Out (LIFO) as a method of Valuing Material Issues(Solved)

Explain Last In, First Out (LIFO) as a method of Valuing Material Issues

Date posted: April 17, 2019. Answers (1)

- Explain First In First Out (FIFO) as a method of Valuing Material Issues(Solved)

Explain First In First Out (FIFO) as a method of Valuing Material Issues

Date posted: April 17, 2019. Answers (1)