- HZ Construction Company acquired a contact for the construction of a dual carriage way from Nairobi at cost of 200 million.(Solved)

HZ Construction Company acquired a contact for the construction of a dual carriage way from Nairobi at cost of 200 million. The data relating to the contract for year ended 31st December 2009 was as follows:

The company had received from the client payment amounting to 126 million.

Required:

(i) Contract account

(ii) Contractee account

(iii) Balance sheets extract showing work in progress.

Date posted: August 6, 2019. Answers (1)

- Give and explain cases where job costing is applied(Solved)

Give and explain cases where job costing is applied

Date posted: August 6, 2019. Answers (1)

- A company manufactures products L and M using the same equipment and similar processes. An extract of the production data for these products in one...(Solved)

A company manufactures products L and M using the same equipment and similar processes. An extract of the production data for these products in one period is as follows.

Required:

Calculate the production overhead to be absorbed by one of each other product using the following costing methods.

(a) A traditional costing approach using direct labour hour rate to absorb overheat.

(b) An activity based costing approach using suitable cost drivers to trace overheads to products.

Date posted: August 6, 2019. Answers (1)

- Gome Engineering Ltd. Employees job order cost system. The company use predetermined overheads rates in rime manufacturing overheads to jobs.(Solved)

Gome Engineering Ltd. Employees job order cost system. The company use predetermined overheads rates in rime manufacturing overheads to jobs. The following additional information is presented by the company‟s cost accountant.

1. The company has two departments P and R. The predetermined overhead rates is based on machine hours for Dept P and direct labour cost for Dept R. As at 31st January 2003 the cost accountant made the following estimates for the year.

2. The companies cost records show the following information on job YJ 648.

Required:

a) Complete the predetermined overhead rates that should be used during the year in Dept P and R.

b) Compute the total overhead cost applied in job EFJ 648.

c) Calculate the cost of job FJ 648 and the cost per unit if the job containers 120 units.

d) As at 31st Dec 2003 the company records revealed the following information in relation to each department.

Calculate the amount of under / over applied overheads in each department and for the company as a whole.

Date posted: August 6, 2019. Answers (1)

- Discuss the Overhead Absorption(Solved)

Discuss the Overhead Absorption

Date posted: August 6, 2019. Answers (1)

- Explain the purposes of overhead cost analysis(Solved)

Explain the purposes of overhead cost analysis

Date posted: August 5, 2019. Answers (1)

- Define the following terms:(Solved)

Define the following terms:

1. Allocation

2. Apportionment

3. Reapportionment

4. A reciprocal service charge

5. Absorption

Date posted: August 5, 2019. Answers (1)

- Discuss the topic Overhead Analysis(Solved)

Discuss the topic Overhead Analysis

Date posted: August 5, 2019. Answers (1)

- Which are the typical Causes of Labour Rate Variances?(Solved)

Which are the typical Causes of Labour Rate Variances?

Date posted: April 17, 2019. Answers (1)

- Which are the typical Causes of Material Variances?(Solved)

Which are the typical Causes of Material Variances?

Date posted: April 17, 2019. Answers (1)

- Why should one Perform Variance Analysis?(Solved)

Why should one Perform Variance Analysis?

Date posted: April 17, 2019. Answers (1)

- Define Variance Analysis(Solved)

Define Variance Analysis

Date posted: April 17, 2019. Answers (1)

- List and explain the methods Used to Allocate Joint Costs(Solved)

List and explain the methods Used to Allocate Joint Costs

Date posted: April 17, 2019. Answers (1)

- Which is the accounting Treatment of Spoilage Costs?(Solved)

Which is the accounting Treatment of Spoilage Costs?

Date posted: April 17, 2019. Answers (1)

- What are the features of contract accounting?(Solved)

What are the features of contract accounting?

Date posted: April 17, 2019. Answers (1)

- Give the factors considered on each overhead Absorption Method(Solved)

Give the factors considered on each overhead Absorption Method

Date posted: April 17, 2019. Answers (1)

- Simon worked 360 hours during the month of June 2012 and he was paid at the rate of Ksh 200 per hour. During the month...(Solved)

Simon worked 360 hours during the month of June 2012 and he was paid at the rate of Ksh 200 per hour. During the month he completed three jobs. The following additional information was provided.

Calculate the labour cost chargeable to these three jobs on the assumption that these jobs were completed only by Simon.

Date posted: April 17, 2019. Answers (1)

- From the following information, prepare a payroll for the month of May 2014.(Solved)

From the following information, prepare a payroll for the month of May 2014.

Additional Information

1. Normal working hours per month are 180. Overtime payable for extra hours at the rate of 50% above normal pay rate.

2. P.A.Y.E to be deducted at the rate of 20% of gross wage.

3. N.S.S.F to be deducted Ksh200 for each employee.

4. N.H.I.F to be deducted Ksh400 for each employee.

Date posted: April 17, 2019. Answers (1)

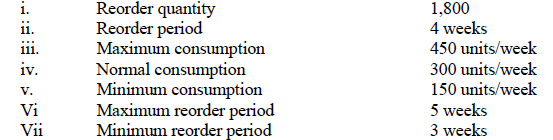

- The following information was extracted from the books of Danex Holdings regarding its stocks:(Solved)

The following information was extracted from the books of Danex Holdings regarding its stocks:

Determine the following stock levels for Danex Holdings:

i. Re-order level

ii. Maximum stock level

iii. Minimum stock level

Date posted: April 17, 2019. Answers (1)

- What considerations should be given to Stock Level and its control?(Solved)

What considerations should be given to Stock Level and its control?

Date posted: April 17, 2019. Answers (1)