-

A fritter bought 144 pineapples atsh100 for every six pineapples. She sold them of at sh72 for every three and rest at sh60 for every...

(Solved)

A fritter bought 144 pineapples atsh100 for every six pineapples. She sold them of at sh72 for every three and rest at sh60 for every two.if she made 65% profit. Calculate the number of pineapples sold at sh72 for every three.

Date posted:

August 18, 2019

.

Answers (1)

-

Find the value of x in the following equation

25x-1 + 52x = 130

(Solved)

Find the value of x in the following equation

25x-1 + 52x = 130

Date posted:

August 16, 2019

.

Answers (1)

-

Solve the inequality -3x + 2

(Solved)

Solve the inequality -3x + 2

Date posted:

August 16, 2019

.

Answers (1)

-

The gradient of a line L through points A (2x, 4) and B (-1, X) is 1/7.Find the equation of a line perpendicular to L...

(Solved)

The gradient of a line L through points A (2x, 4) and B (-1, X) is 1/7.Find the equation of a line perpendicular to L through B

Date posted:

August 16, 2019

.

Answers (1)

-

A particle travels in a straight line through a fixed point O such that its displacement S metres, from O is given by S =...

(Solved)

A particle travels in a straight line through a fixed point O such that its displacement S metres, from O is given by S = 3t3 – 27t2 + 72t + 4 where t is the time in seconds after passing O.

Calculate;

a) The displacement of the particle at t = 3.

b) The value of t for which the particle is momentarily at rest.

c) The acceleration when t = 4.

d) At what time is its minimum velocity?

Date posted:

August 16, 2019

.

Answers (1)

-

A garden measures 10m long and 8m wide. A path of uniform width is made all round the garden. The total area of the garden...

(Solved)

A garden measures 10m long and 8m wide. A path of uniform width is made all round the garden. The total area of the garden and the path is 168m2.

a) Find the width of the path.

b) The path is to be covered with square concrete slabs. Each corner of the path is covered with a slab whose side is equal to the width of the path.The rest of the path is covered with slabs of side 50cm. The cost of making each corner slab is Shs.600 while the cost of making each smaller slab is shs.50.

Calculate;

i) The number of the smaller slabs used.

ii) The total cost of the slabs used to cover the whole path.

Date posted:

August 16, 2019

.

Answers (1)

-

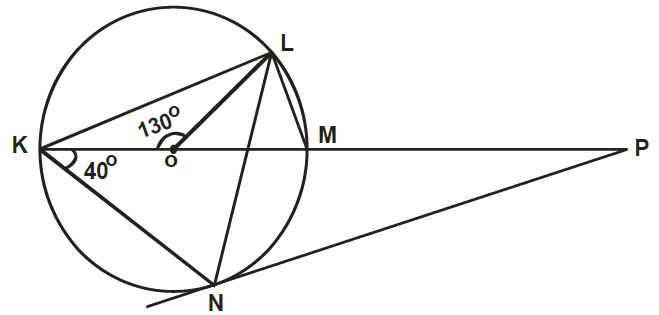

In the figure below K, L, M and N are points on the circumference of a circle centre O. The points K,O, M and P...

(Solved)

In the figure below K, L, M and N are points on the circumference of a circle centre O. The points K, O, M and P are on a straight line. PN is a tangent to the circle at N. Angle KOL = 1300 and Angle MKN = 400.

Find the values of the following angles stating the reasons in each case.

a)MLN

b)OLN

c)LNP

d)MPN

e)LMP

Date posted:

August 16, 2019

.

Answers (1)

-

A businessman buys beans directly from farmers in 90kg bags at Kshs.2,000 per bag and spends Kshs.100 per bag on transport and other overhead costs....

(Solved)

A businessman buys beans directly from farmers in 90kg bags at Kshs.2,000 per bag and spends Kshs.100 per bag on transport and other overhead costs. He sells the beans in tins at Kshs.60 making a profit of Kshs.500 per bag.

a) How many tins are there in a bag?

b) In a given season, he sold 1,000 bags. How much did he get?

c) The farmer has two options of selling his beans.

i) To the food processing company at Kshs.2,000 per bag and sells 50 bags.

ii) To retailers at Kshs.60 per tin and sells 30 bags.

Which option would earn her more profit and by how much.

Date posted:

August 16, 2019

.

Answers (1)

-

Four towns R, T, K and G are such that T is 84km directly to the North of R, and K is on a bearing...

(Solved)

Four towns R, T, K and G are such that T is 84km directly to the North of R, and K is on a bearing of 2950 from R at a distance of 60km. G is on a bearing of 3400 from K and a distance of 30km.

a) Using a scale of 1cm represents 10km, make an accurate scale drawing to show the relative positions of the towns.

b) Using the diagram above find;

i) The distance and bearing of T from G.

ii) The distance and bearing of K from T.

Date posted:

August 16, 2019

.

Answers (1)

-

The angles of elevation of the top of a tree form a point x on horizontal ground is 24.50. Rhoda moves 5 metres from x...

(Solved)

The angles of elevation of the top of a tree form a point x on horizontal ground is 24.50. Rhoda moves 5 metres from x towards the base of the tree and observes that the angle of elevation of the tree is now 33.20. Calculate the height of the tree to one decimal place.

Date posted:

August 16, 2019

.

Answers (1)

-

Given that OA = 3i – 2j + k and OB = 4i + j – 3k. Find the distance between points A and B.

(Solved)

Given that OA = 3i – 2j + k and OB = 4i + j – 3k. Find the distance between points A and B.

Date posted:

August 16, 2019

.

Answers (1)

-

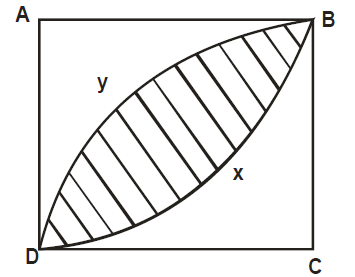

In the figure shown below ABCD is a square of side 4cm. BXD and BYD are arcs of circle centres A and C respectively.Calculate the...

(Solved)

In the figure shown below ABCD is a square of side 4cm. BXD and BYD are arcs of circle centres A and C respectively.

Calculate the area of the shaded part.

Date posted:

August 16, 2019

.

Answers (1)

-

Nairobi and Mtito Andei are 240km apart. A bus left Nairobi at 9:00am and travelled towards Mtito Andei at 80km/hr. 45 minutes later, a car...

(Solved)

Nairobi and Mtito Andei are 240km apart. A bus left Nairobi at 9:00am and travelled towards Mtito Andei at 80km/hr. 45 minutes later, a car left Mtito Andei for Nairobi at a speed of 100Km/hr.Calculate the distance covered by the bus before meeting the car.

Date posted:

August 16, 2019

.

Answers (1)

-

P (5, -4) and Q (-1, -2) are points on a straight line. Find the equation of the perpendicular bisector of PQ giving your answer...

(Solved)

P (5, -4) and Q (-1, -2) are points on a straight line. Find the equation of the perpendicular bisector of PQ giving your answer in the form y = mx + c.

Date posted:

August 16, 2019

.

Answers (1)

-

A particle moves on a straight line. The velocity after to seconds is given by v = 3t2 – 6t – 8. The distance of...

(Solved)

A particle moves on a straight line. The velocity after to seconds is given by v = 3t2 – 6t – 8. The distance of the particle from the origin after one second is 10 metres. Calculate the distance of the particle from the origin after 2 seconds.

Date posted:

August 16, 2019

.

Answers (1)

-

Factorize completely 3x2 – 2xy-y2.

(Solved)

Factorize completely 3x2 – 2xy-y2.

Date posted:

August 16, 2019

.

Answers (1)

-

The angle of elevation of the top of a tower from a point x on the horizontal is 28.5.From another point y, 8 meters near...

(Solved)

The angle of elevation of the top of a tower from a point x on the horizontal is 28.5.From another point y, 8 meters near to the base of the tower, the angle of elevation of the top of the tower is 37.20. Calculate, to one decimal place, the height of the tower.

Date posted:

August 16, 2019

.

Answers (1)

-

Security light poles have been erected along both sides of a street in Ndhiwa town. The poles are 50m apart a long the...

(Solved)

Security light poles have been erected along both sides of a street in Ndhiwa town. The poles are 50m apart a long the left hand side of the road while they are 80m a part a long the right hand side. At one end of the road the poles are directly opposite each other. How many poles will be erected by the time the poles are directly opposite each other at the end of the road?

Date posted:

August 16, 2019

.

Answers (1)

-

One interior angle of a certain polygon is 840. If each of the other angles is 1470, how many sides does this polygon have?

(Solved)

One interior angle of a certain polygon is 840. If each of the other angles is 1470, how many sides does this polygon have?

Date posted:

August 16, 2019

.

Answers (1)

-

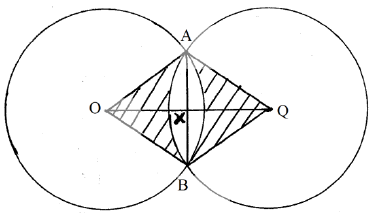

Two equal circles with centres O and Q and radius 8cm intersect at point A and B as shown below

Given that the distance between O...

(Solved)

Two equal circles with centres O and Q and radius 8cm intersect at point A and B as shown below

Given that the distance between O and Q is 12cm and that line AB meets OQ at X, find

(a) the length of chord AB

(b) the area of the shaded region

(c) the reflex angle AOB

Date posted:

August 16, 2019

.

Answers (1)