- (a)Sketch the graph of y = x2 + 5

(b) Using the mid-ordinate rule, with six strips, estimate the area enclosed by the curve, x-axis, y...(Solved)

(a).Sketch the graph of y = x2 + 5

(b) Using the mid-ordinate rule, with six strips, estimate the area enclosed by the curve, x-axis, y – axis and the line x = 3.

(c) Find the exact area by integration

(d) Calculate the percentage error made when the two methods above are used

Date posted: August 26, 2019. Answers (1)

- A firm has a fleet of vans and trucks. Each van can carry 9 crates and 3 cartons. Each truck can carry 4 crates and 10...(Solved)

A firm has a fleet of vans and trucks. Each van can carry 9 crates and 3 cartons. Each truck can carry 4 crates and 10 cartons. The firm has to deliver not more than 36 crates and at least 30 cartons.

(a) If x vans and y trucks are available to make the delivery. Write down inequalities to represent the

above information.

(b) Use the grid provided, to represent the inequalities in (a) above

(c) Given that the cost of using a truck is four times that of using a van, determine the number of vehicles that may give minimum cost

Date posted: August 26, 2019. Answers (1)

- A bus left Kitale at 10.45 a.m and travelled towards Nairobi at an average speed of 60 km/h. A Nissan left Kitale on the same...(Solved)

A bus left Kitale at 10.45 a.m and travelled towards Nairobi at an average speed of 60 km/h. A Nissan left Kitale on the same day at 1.15 p.m and travelled along the same road at an average speed of 100 km/h. The distance between Kitale and Nairobi is 500 km.

a) Determine the time of the day when the Nissan overtook the bus.

b) Both vehicles continued towards Nairobi at their original speed. Find how long the Nissan had to wait in Nairobi before the bus arrived.

Date posted: August 26, 2019. Answers (1)

- Plot the triangle:

a) whose co-ordinates are A(1, 2) B(5, 4) and C(2, 6)

b) On the same axes

i) Draw the image A1B1C1 of ABC under...(Solved)

Plot the triangle:

a) whose co-ordinates are A(1, 2) B(5, 4) and C(2, 6)

b) On the same axes

i) Draw the image A1B1C1 of ABC under a rotation of 90o clockwise about origin.

ii) Draw the image A11B11C11 of A1B1C1 under a reflection in the line y = -x. State the

coordinates of A11B11C11.

c) A111B111C111 is the image of A11B11C11 under the reflection in the line x = 0. Draw the image

A111B111C111 and state its coordinates.

d) Describe a single transformation that maps A111B111C111 onto ABC.

Date posted: August 26, 2019. Answers (1)

- A red and black dice are rolled and the events X, Y and Z are defined as follows.

X = The red die shows a 4

Y...(Solved)

A red and black dice are rolled and the events X, Y and Z are defined as follows.

X = The red die shows a 4

Y – The sum of the scores of the two dice is 6

Z – The black die shows a 3

(a) Find the probability of event X

(b) The probability of events X and Z

(c) Which event is mutually exclusive to X

(d) Which event is independent of X

(e) The probability of event Y

Date posted: August 26, 2019. Answers (1)

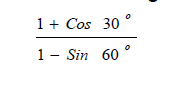

- Without using mathematical tables or calculators express in surd form and simplify(Solved)

Without using mathematical tables or calculators express in surd form and simplify

Date posted: August 26, 2019. Answers (1)

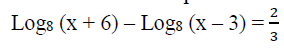

- Solve for x in the equation.(Solved)

Solve for x in the equation.

Date posted: August 26, 2019. Answers (1)

- Vector OP = 6i + j and OQ = -2i + 5j. A point N divides PQ internally in the ratio 3:1. Find PN in...(Solved)

Vector OP = 6i + j and OQ = -2i + 5j. A point N divides PQ internally in the ratio 3:1. Find PN in terms

of i and j.

Date posted: August 26, 2019. Answers (1)

- A small cone of height 8 cm is cut off from a bigger cone to leave a frustum of height 16 cm. If the volume...(Solved)

A small cone of height 8 cm is cut off from a bigger cone to leave a frustum of height 16 cm. If the volume of the smaller cone is 160 cm3, find the volume of the frustum.

Date posted: August 26, 2019. Answers (1)

- The equation of a circle is given as 3x2 + 3y2– 12x + 18y + 8 = 0. Find the centre and radius of this...(Solved)

The equation of a circle is given as 3x2 + 3y2– 12x + 18y + 8 = 0. Find the centre and radius of this circle.

Date posted: August 26, 2019. Answers (1)

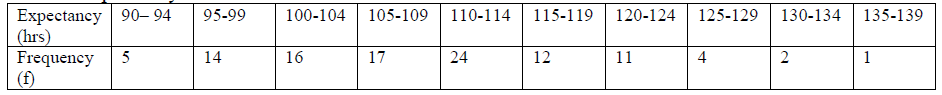

- The life expectancy in hours of 106 bulbs are shown in the table below.Calculate the quantile deviation of the life expectancy(Solved)

The life expectancy in hours of 106 bulbs are shown in the table below.

Calculate the quantile deviation of the life expectancy

Date posted: August 26, 2019. Answers (1)

- A salesman earns a basic salary of sh. 9,000 per month. In addition he is also paid a commission of 5% for sales above sh....(Solved)

A salesman earns a basic salary of sh. 9,000 per month. In addition he is also paid a commission of 5% for sales above sh. 15,000. In a certain month he sold goods worth sh. 120,000 at a discount of 2½%. Calculate his total earnings that month.

Date posted: August 26, 2019. Answers (1)

- Find the inverse of the matrix

Hence or otherwise solve the simultaneous equations

3x + 2y = 4

5x + 4y = 9(Solved)

Find the inverse of the matrix

Hence or otherwise solve the simultaneous equations

3x + 2y = 4

5x + 4y = 9

Date posted: August 26, 2019. Answers (1)

- Expand (1 – 2x)6 in ascending powers of x up to the term in x3(Solved)

Expand (1 – 2x)6 in ascending powers of x up to the term in x3

Date posted: August 26, 2019. Answers (1)

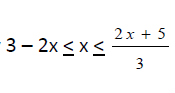

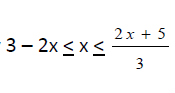

- Solve the inequality

and show the solution on the number line.(Solved)

and show the solution on the number line.(Solved)

Solve the inequality  and show the solution on the number line.

and show the solution on the number line.

Date posted: August 26, 2019. Answers (1)

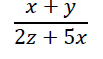

- Given that X:Y = 1:2 and Z:Y = 2:3, Find the value of(Solved)

Given that X:Y = 1:2 and Z:Y = 2:3, Find the value of

Date posted: August 26, 2019. Answers (1)

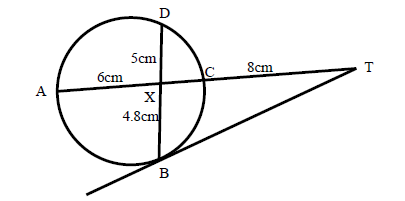

- In the diagram below, BT is a tangent to the circle at B. AXCT and BXD are straight lines. AX = 6cm, CT = 8cm,...(Solved)

In the diagram below, BT is a tangent to the circle at B. AXCT and BXD are straight lines. AX = 6cm, CT = 8cm, BX = 4.8cm and XD = 5cm.

Find the length of BT.

Date posted: August 26, 2019. Answers (1)

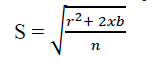

- Make b the subject of the formula a =

(Solved)

(Solved)

Make b the subject of the formula a =

Date posted: August 26, 2019. Answers (1)

- Make r the subject of the formula.(Solved)

Make r the subject of the formula.

Date posted: August 26, 2019. Answers (1)

- A car is driven a distance of 30 km measured to the nearest Km in 20 min measured to the nearest min. Between what limit...(Solved)

A car is driven a distance of 30 km measured to the nearest Km in 20 min measured to the nearest min. Between what limit will the average speed be?

Date posted: August 26, 2019. Answers (1)