- When using a route which is not used by matatus since taxi can go any route.

- When transporting valuable goods which require special handling.

- When the traveler wants to save time as taxis fills up quickly.

- When there is need for privacy as matatus are used by the general public.

- When a comfortable means is required since the passenger decides on the number of passengers to be carried.

- When there is an emergency e.g. sickness, at night.

- Where one wants to create a good impression since taxi is more prestigious.

- Where a traveler wants to use a taxi for a long period as taxi can be hired for a long period of time.

sharon kalunda answered the question on September 2, 2019 at 14:04

- Mrs. Baraka, a trader had the following cash transactions starting 1st January 2016.(Solved)

Mrs. Baraka, a trader had the following cash transactions starting 1st January 2016.

Jan 1 Balance b/d cash 5,000 bank 15,000

2 Bought goods for sale and paid by cheque 4,000

9 Paid insurance 150 cash

12 Received 250 cash from Mr. Kibet

14 Deposited 1,000 in the bank

16 Received by cheque 2,000 from Mchana

20 With drew 7,500 from bank for office use.

23 Paid wages 900 by cheque.

26 Received payment of 7,500 cheque from Joy Enterprises after allowing discount of shs. 100

28 Paid electricity 3,000 cash

30 Paid water 1,500 in cash

31 Settled Korir Traders account of sh. 2,250 and received a 10% discount.

Enter the above transactions in a three-column cashbook.

Date posted: September 2, 2019. Answers (1)

- The following information relates to Nyangores Traders as at 31st December 2000.Prepare Nyangores Traders Balance Sheet as at December 2000.(Solved)

The following information relates to Nyangores Traders as at 31st December 2000.

Prepare Nyangores Traders Balance Sheet as at December 2000.

Date posted: September 2, 2019. Answers (1)

- Read the following transactions and state the accounts to be debited or credited.

(i) Started business with sh. 50,000 in cash.

(ii) Sold goods worth sh....(Solved)

Read the following transactions and state the accounts to be debited or credited.

(i) Started business with sh. 50,000 in cash.

(ii) Sold goods worth sh. 30,000 receiving a cheque.

(iii) A debtor, Onyango returned goods to the business worth sh. 5,000.

(iv) Withdrew sh. 20,000 from the bank for business use.

Date posted: September 2, 2019. Answers (1)

- Henry‘s business had a mark-up of 25%. Calculate his margin.(Solved)

Henry‘s business had a mark-up of 25%. Calculate his margin.

Date posted: September 2, 2019. Answers (1)

- Mention four factors that may have caused the Demand curve to shift to the right.(Solved)

Mention four factors that may have caused the Demand curve to shift to the right.

Date posted: September 2, 2019. Answers (1)

- State four differences between subsistence production and large-scale production.(Solved)

State four differences between subsistence production and large-scale production.

Date posted: September 2, 2019. Answers (1)

- The following trial balance was extracted from the ledgers of Baraka Traders for the year ended 31st December 2015.(Solved)

The following trial balance was extracted from the ledgers of Baraka Traders for the year ended 31st December 2015.

On 31st December 2015, the business had closing stock valued at Shs. 60,000.

Required:

(i) The Trading, Profit and Loss Account for the year ended 31st December 2015.

(ii) A Balance Sheet as at that date.

Date posted: September 2, 2019. Answers (1)

- Record the following transactions in Akili Traders‘ Three-Column Cashbook and balance it off on 31st January 2015.Jan 1 Balance b/d Cash Kshs. 200,000 Dr.Bank –...(Solved)

Record the following transactions in Akili Traders‘ Three-Column Cashbook and balance it off on 31st January 2015.

Jan 1 Balance b/d Cash Kshs. 200,000 Dr.

Bank – Kshs. 15,000Cr

Jan 2 Cash sales Kshs. 145,000

Jan 6 Paid for motor expenses Kshs. 2,000

Jan 7 Paid salaries in cash Kshs. 50,000

Jan 9 Bought stationeries in cash Kshs. 1,000

Jan 14 Settled Kalyet‘s account of Kshs. 60,000 by cheque less 3% cash discount.

Jan 18 Received a cheque of 84,600 from Koech after deducting 10% cash discount.

Jan 21 Cash sales paid direct into the bank 340,000

Jan 23 Kaigat settled his account of 2,600 by cheque after deducting 5% cash discount.

Jan 24 Received cheque from the following debtors after deducting 10% discount in each case;

Chuma Kshs, 3,000, Buko 28,000 and Matapei 9,000

Jan 25 Paid consultancy salaries in cash Shs. 2,000

Jan 29 Credit purchase of Shs. 10,000

Jan 31 Banked all except 4,200

Date posted: September 2, 2019. Answers (1)

- Mark with a tick to indicate in the appropriate column the financial statement in which each of the items in the table below would appear.(Solved)

Mark with a tick to indicate in the appropriate column the financial statement in which each of the items in the table below would appear.

Date posted: September 2, 2019. Answers (1)

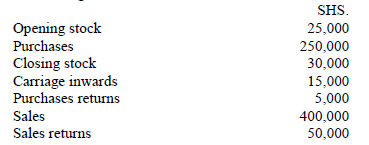

- The following was obtained from the Books of Keino Traders.

Calculate:-

(i) Cost of goods sold.

(ii) Net sales

(iii) Gross profit(Solved)

The following was obtained from the Books of Keino Traders.

Calculate:-

(i) Cost of goods sold.

(ii) Net sales

(iii) Gross profit

Date posted: September 2, 2019. Answers (1)

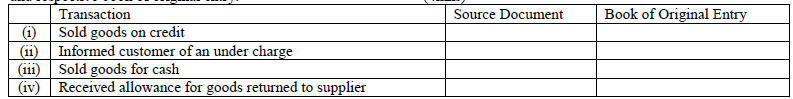

- Chetambe retail shop carried out the transactions given in the table below. For each transaction, state the source of document and respective book of original...(Solved)

Chetambe retail shop carried out the transactions given in the table below. For each transaction, state the source of document and respective book of original entry.

Date posted: September 2, 2019. Answers (1)

- An entrepreneur may spot a gap in the market which may be converted into a business idea. Name four such gaps.(Solved)

An entrepreneur may spot a gap in the market which may be converted into a business idea. Name four such gaps.

Date posted: September 2, 2019. Answers (1)

- National income from expenditure approach is calculated as follows:

NI = C + I + G + (X-M)

State the meaning of the following:

(i) C

(ii) I:

(iii)...(Solved)

National income from expenditure approach is calculated as follows:

NI = C + I + G + (X-M)

State the meaning of the following:

(i) C

(ii) I:

(iii) G

(iv) X-M:

Date posted: September 2, 2019. Answers (1)

- Sherry traders had the following assets and liabilities as at 1st January 2004.

For the year ended 31st December 2004,

(i) Additional capital was Shs. 24,000

(ii) Drawings...(Solved)

Sherry traders had the following assets and liabilities as at 1st January 2004.

For the year ended 31st December 2004,

(i) Additional capital was Shs. 24,000

(ii) Drawings were Shs. 20,000

(iii) Net profit was Shs. 34,000

Determine the capital as at 31st December 2004.

Date posted: September 2, 2019. Answers (1)

- The following balances were obtained from the Books of Mtema Traders as at 31st July 2010.(Solved)

The following balances were obtained from the Books of Mtema Traders as at 31st July 2010.Prepare a trial balance as at 31st July 2010.

Date posted: September 2, 2019. Answers (1)

- Outline four challenges that a distributor of fresh milk is likely to face in his / her operations.(Solved)

Outline four challenges that a distributor of fresh milk is likely to face in his / her operations.

Date posted: September 2, 2019. Answers (1)

- Highlight four ways in which HIV/AIDS prevalence has negatively affected business activities.(Solved)

Highlight four ways in which HIV/AIDS prevalence has negatively affected business activities.

Date posted: September 2, 2019. Answers (1)

- State four auxiliary services to business.(Solved)

State four auxiliary services to business.

Date posted: September 2, 2019. Answers (1)

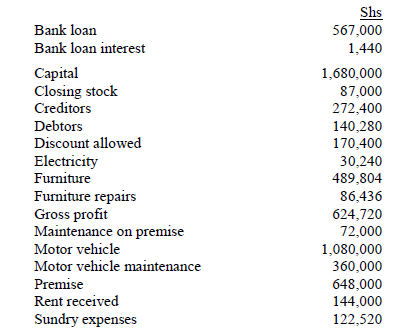

- The following information was extracted from the books of Umeme Traders as at 31st December 2009.

Prepare:

(i) Profit and loss account for the year ended 31st...(Solved)

The following information was extracted from the books of Umeme Traders as at 31st December 2009.

Prepare:

(i) Profit and loss account for the year ended 31st December 2009.

(ii) Balance sheet as at 31st December 2009.

Date posted: September 2, 2019. Answers (1)

- On 1st June 2015, Ndovu Traders had cash in hand of sh.25,000 and sh.56,200 at bank.

During the month, the following transactions took place:

2015

June 2 Cash...(Solved)

On 1st June 2015, Ndovu Traders had cash in hand of sh.25,000 and sh.56,200 at bank.

During the month, the following transactions took place:

2015

June 2 Cash sales, sh.42,000.

June 5 Received a cheque of sh.70,500 from Kiptala Traders after deducting a 6% cash discount.

June 8 Paid salaries, sh24,000 cash.

June 9 Yegon settled his account of sh.45,000 in cash and was allowed sh.l,800 cash discount.

June 12 Cash sales sh46,500.

June 18 Paid Tuitoek's debt of sh.l00,000 by cheque after deducting 5% cash discount.

June 24 Withdrew sh.26,000 from the bank for office use.

June 30 Banked all the cash except sh.25,000.

Prepare a 3-column cashbook and balance it off on 30th June, 2015.

Date posted: September 2, 2019. Answers (1)