- The following information relates to Makini Traders for the year ending 31st December 2015.

...(Solved)

The following information relates to Makini Traders for the year ending 31st December 2015.

Shs.

Margin........................................... 15%

Sales ............................................640,000

Purchases........................................ 480,000

Stock on 1/1/2015................................ 130,000

Closing stock ......................................?

Required

Trading Account of Makini Traders for the year ending 31st December 2015.

Date posted: September 4, 2019. Answers (1)

- The following information relates to Kamongo Traders for the year ending 31st Dec. 2010.

...(Solved)

The following information relates to Kamongo Traders for the year ending 31st Dec. 2010.

Shs.

Additional investment................................. 900,000

Drawings ..............................................300,000

Closing capital..................................... 7,000,000

Profit.............................................. 3,200,000

Required: Kamongo‘s initial capital.

Date posted: September 4, 2019. Answers (1)

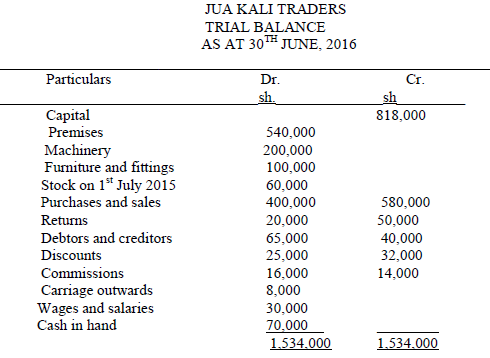

- The following trial balance was extracted from the books of Jua Kali Trader as at 30th June 2016.

Stock as at 30th June 2016 was sh.70,000

(i)...(Solved)

The following trial balance was extracted from the books of Jua Kali Trader as at 30th June 2016

Stock as at 30th June 2016 was sh.70,000

(i) Prepare Jua Kali Traders trading, profit and loss account for the period ended 30th June 2016.

(ii) A balance sheet as at that date.

Date posted: September 4, 2019. Answers (1)

- On 1st January 2015, Ngunjiri had shs.15,000 in hand and bank overdraft of sh.25,000.

During the month the following transactions took place:

January 2: Cash sales directly...(Solved)

On 1st January 2015, Ngunjiri had shs.15,000 in hand and bank overdraft of sh.25,000.

During the month the following transactions took place:

January 2: Cash sales directly banked sh40,360

January 4; Bought stock of goods in cash sh.2,400

January 6: Received a cheque of sh.97,800 from Karanja after allowing him a cash discount of Sh. 2,200.

January 9: Paid Mung‘athia, a creditor sh.65,800 by cheque after deducting 6& cash discount.

January 14; Paid salaries sh.8,000 in cash.

January 17: Mwatela, a debtor settle his account of sh.75,000 by cheque less 10% cash discount.

January 24; Withdraw sh.30,000 from bank for office use.

January 28: Bought stationery in cash sh.10,000.

January 31; Withdraw sh.7,000 from bank for private use.

Required

Prepare the three column cash book duly balanced.

Date posted: September 4, 2019. Answers (1)

- Explain five reasons why a firm would prefer trade credit to a bank loan.(Solved)

Explain five reasons why a firm would prefer trade credit to a bank loan.

Date posted: September 4, 2019. Answers (1)

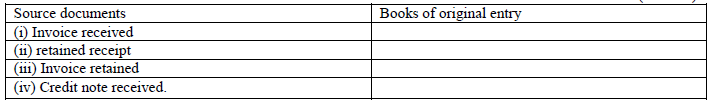

- The table below shows source document state the book of original entry in which the information from these source documents would be recorded.(Solved)

The table below shows source document state the book of original entry in which the information from these source documents would be recorded.

Date posted: September 4, 2019. Answers (1)

- Funny Traders, had the following assets and liabilities as at 1st January, 2015 ...(Solved)

Funny Traders, had the following assets and liabilities as at 1st January, 2015

Sh

Furniture + equipment........................... 350,000

Debtors .........................................45,000

Cash............................................ 7,000

Creditor......................................... 48,000

For the year ended 31st December, 2015 there was:

(i) Additional capital introduced amounting to sh34,000.

(ii) Drawings made during the year amounting to sh20,000.

(iii) Net profit amounting to sh34,000.

Determine the capital of the business as at 31st December, 2015.

Date posted: September 4, 2019. Answers (1)

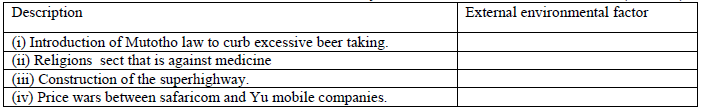

- Indicate the form of external environmental factor described by the statement below.(Solved)

Indicate the form of external environmental factor described by the statement below.

Date posted: September 4, 2019. Answers (1)

- The following balances were extracted from the books of Sitaki Mambo traders as at 31st December, 2015

...(Solved)

The following balances were extracted from the books of Sitaki Mambo traders as at 31st December, 2015

Sh.

Cash at bank................................... 12,500

Cash in hand ....................................7,500

Wages due .......................................3,500

Creditors .......................................11,500

Loan from bank ...................................60,000

Motor vehicles ...................................100,000

Equipment + Machinery .............................50,000

Stock ............................................25,000

Debtors ...........................................30,000

Prepare a balance sheet for Sitaki Mambo traders as at 31st December 2015

Date posted: September 4, 2019. Answers (1)

- Using the following transactions, state the name of the account to be debited and the account to be credited.

Transaction ........................................A/c debited.......................... A/c Credited

(i) Made...(Solved)

Using the following transactions, state the name of the account to be debited and the account to be credited.

Transaction ........................................A/c debited.......................... A/c Credited

(i) Made cash sales of sh 2,000

(ii) Purchased machine by cheque

(iii) paid a creditor sh3,000 cash

(iv) withdraw sh10,000 for business Use.

Date posted: September 4, 2019. Answers (1)

- Hellen the new manager, outshine Company limited, is considering turning the office layout from being an open office layout to a landscape layout. Outline four...(Solved)

Hellen the new manager, outshine Company limited, is considering turning the office layout from being an open office layout to a landscape layout. Outline four changes she can adopt.

Date posted: September 4, 2019. Answers (1)

- The following information relates to Malindi Traders for the year ended

31st December 2015.

...(Solved)

The following information relates to Malindi Traders for the year ended

31st December 2015.

Shs

Total current assets ......................587,500

Total Fixed assets ........................720,000

Total current liabilities ..................32,500

Total long term liabilities................. 357,500

Net Profit ..................................50,000

Capital...................................... 625,000

Sales....................................... 1,000,000

Opening stock................................. 50,000

Closing stock .................................25,000

Margin....................................... 20%

Calculate:

(i) Working capital

(ii) Current ratio

(iii) Mark-up percentage

(iv) Rate of stock turnover

(v) Return on capital

Date posted: September 4, 2019. Answers (1)

- State FOUR Ways in which advertising agencies assist in sales promotion.(Solved)

State FOUR Ways in which advertising agencies assist in sales promotion.

Date posted: September 4, 2019. Answers (1)

- Kisii Traders had the following balances as at 31st December 2014.

...(Solved)

Kisii Traders had the following balances as at 31st December 2014.

Shs

Bank Loan 3 years........................... 472,500

Buildings ....................................540,000

Creditors ....................................227,000

Debtors .......................................116,900

Furniture ......................................408,170

Gross profit ...................................520,600

Motor vehicle ...................................900,000

Discount allowed ................................142,000

Lighting........................................ 25,200

Interest on loan ................................1,200

Closing stock ...................................72,500

Rent Received ..................................120,000

Repairs on buildings .............................60,000

Repairs on furniture .............................72,030

Repairs on motor vehicle .........................300,000

General expenses ..................................102,100

Capital ..........................................1,400,000

Prepare:

(i) Profit and loss account for the year ended 31st December 2014.

(ii) Balance sheet as at 31/12/2014.

Date posted: September 4, 2019. Answers (1)

- State FOUR economic effects of taxation to a country's economy.(Solved)

State FOUR economic effects of taxation to a country's economy.

Date posted: September 4, 2019. Answers (1)

- In each of the following cases, state the type of inflation described.

a) The unrest in Libya has resulted to an increase in the price of...(Solved)

In each of the following cases, state the type of inflation described.

a) The unrest in Libya has resulted to an increase in the price of oil.

b) The price of bread has gone up to Shs.60 due to Increase in the price of Wheat.

c) A lot of Money in circulation has led to the general increase of price.

d) A rise in price due to uneven growth in Some sectors of the economy.

Date posted: September 4, 2019. Answers (1)

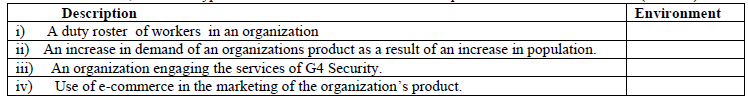

- The following are types of internal and external environments (Solved)

The following are types of internal and external environments. Technological, Business structure, Demographic and physical.In the table below , write the type of environment that suits the description.

Date posted: September 4, 2019. Answers (1)

- Record the following transactions in a two column cash bookand balance it off as at January 12th2008 January 1 Started business with capital sh. 10,000...(Solved)

Record the following transactions in a two column cash bookand balance it off as at January 12th2008

January 1 Started business with capital sh. 10,000 cash and sh. 25,000 bank overdraft

January 2 bought stock in cash sh. 6,000

January 3 cash sales sh. 2,500

January 7 bought stock worth sh. 5,000 on credit

January 12 withdrew cash from bank for office use sh. 4,000

Date posted: September 4, 2019. Answers (1)

- Atemo is the head of the marketing team at ABC Company that has recorded tremendous increase in volume of sales over the last four years....(Solved)

Atemo is the head of the marketing team at ABC Company that has recorded tremendous increase in volume of sales over the last four years. Highlight four attributes that she possess.

Date posted: September 4, 2019. Answers (1)

- The following balances were extracted from the books of Asena Enterprises on 30th June, 2006. ...(Solved)

The following balances were extracted from the books of Asena Enterprises on 30th June, 2006.

Shs.

Gross profit........................... 120,000

Rent Income ............................100,000

Dividends received..................... 200,000

Salaries................................ 300,000

Carriage outwards........................ 10,300

Discount allowed .........................21,000

Prepare Asena's Enterprises profit and loss account for the year ended 30th June,2006.

Date posted: September 4, 2019. Answers (1)