- When there is need to save on cost

- Where the parties are both literate

- When there is need to have immediate feedback

- If both the sender and recipient have phones

- Where there is need for evidence

- Where there is need to store information for future reference

- Incase the message is to be given to several people

- If the sender wants to be brief and straight to the point

sharon kalunda answered the question on September 5, 2019 at 13:15

- The following transactions took place in the month of January 2015 for Karuku Retailers.

Jan 12th Sales to Juma worth shs.200,000 invoice no. 231

Jan 20th Sales...(Solved)

The following transactions took place in the month of January 2015 for Karuku Retailers.

Jan 12th Sales to Juma worth shs.200,000 invoice no. 231

Jan 20th Sales to Kiama worth sh.150,000

Jan 26th Sales to Mercy worth sh.125,000

Required : A sales journal for Karuku.

Date posted: September 5, 2019. Answers (1)

- The following statements refer to different office layouts. Identify the type of office layout explained in the following statements.

a) All staff members operate from...(Solved)

The following statements refer to different office layouts. Identify the type of office layout explained in the following statements.

a) All staff members operate from the same room

b) Senior managers are assigned separate rooms from where they coordinate activities.

c) High class office designed to enhancing the image of the organisation.

Date posted: September 5, 2019. Answers (1)

- Identify the type of goods described by the following statements given in the table.(Solved)

Identify the type of goods described by the following statements given in the table.

Date posted: September 5, 2019. Answers (1)

- The following information was extracted from the books of Ambwere Trader for the year ended 31st Dec 2015.

Cost of sales ......................................1,200,000

Stock as at 1.1.2015...(Solved)

The following information was extracted from the books of Ambwere Trader for the year ended 31st Dec 2015.

Cost of sales ......................................1,200,000

Stock as at 1.1.2015 ..............................160,000

Stock as at 31.12. 2015 .............................240,000

Calculate the rate of stock turn over

Date posted: September 5, 2019. Answers (1)

- The following balances were extracted from the books of Mungoma Traders as at 31st Dec 2015.

Prepare a balance sheet for Mungoma Traders as at 31st...(Solved)

The following balances were extracted from the books of Mungoma Traders as at 31st Dec 2015.

Motor Vehicles.................................... 80,000

Plant and Machinery............................... 70,000

Loan from bank ....................................60,000

Stock .............................................25,000

Debtors ...........................................30,000

Creditors .........................................15,000

Cash at Bank .......................................20,000

Prepare a balance sheet for Mungoma Traders as at 31st Dec.2015.

Date posted: September 5, 2019. Answers (1)

- For each case of the following cases, name the motive for holding Money(Solved)

For each case of the following cases, name the motive for holding Money

Date posted: September 5, 2019. Answers (1)

- State the document to be applied in each of the following statements.(Solved)

State the document to be applied in each of the following statements.

Date posted: September 5, 2019. Answers (1)

- For each of the following transaction, indicate in the spaces provided the account to be debited the account to be credited and the ledger in...(Solved)

For each of the following transaction, indicate in the spaces provided the account to be debited the account to be credited and the ledger in which it is maintained.

Date posted: September 5, 2019. Answers (1)

- Record the following transactions in the cash book of Kamau Traders for the Month of May 2016 and balance it .

2016

Jan 1 : Cash in...(Solved)

Record the following transactions in the cash book of Kamau Traders for the Month of May 2016 and balance it .

2016

Jan 1 : Cash in hand shs 10,000. Cash at Bank shs 20,000.

Jan 10 : Paid Lucy shs 8,800 and Toms shs 11,000 after deduction 12% cash discount in Each case.

Jan 30 : Banked all the cash leaving ksh 1,200 in the cash book.

Date posted: September 5, 2019. Answers (1)

- State four features of consumer goods and services(Solved)

State four features of consumer goods and services

Date posted: September 5, 2019. Answers (1)

- The following information relates to Mungoma Traders for the year ended 31st Dec 2015(Solved)

The following information relates to Mungoma Traders for the year ended 31st Dec 2015

Gross profit............................... 140,000

Salaries ...................................20,000

Electricity charges..........................8,000

Discount Allowed............................ 6,000

Discount Received............................ 26,000

Prepare a profit and Loss Account for Mungoma Traders for the year ended 31st Dec 2015.

Date posted: September 5, 2019. Answers (1)

- The following balances were extracted from the books of Ongware traders as at 31st December 2015.

Calculate :

i) Current ratio

ii) Cost of goods sold

iii) Mark up

iv)...(Solved)

The following balances were extracted from the books of Ongware traders as at 31st December 2015

Sales during the year amounted to Ksh.2,000,000

Stock on 1st Jan. 2015 was shs.100,000

Stock on 31st Dec. 2015 was shs.200,000

Creditors shs.250,000

Bank overdraft shs.400,000

Cash in hand shs.150,000

Gross profit margin was 20%

Calculate :

i) Current ratio

ii) Cost of goods sold

iii) Mark up

iv) Rate of stock turnover

Date posted: September 5, 2019. Answers (1)

- Prepare a duly balanced three column cash book from the following information extracted from the books of Omwami traders.

Jan 1st Balance b/d cash sh.4,000, Bank...(Solved)

Prepare a duly balanced three column cash book from the following information extracted from the books of Omwami traders.

Jan 1st Balance b/d cash sh.4,000, Bank Sh.27,000

Jan. 4th Settled Olweny creditors account of shs.8000 by cheque having deducted 6% cash discount

Jan 8th Received shs.6,000 cash from Mutoma traders

Jan 16th Deposited shs.4,500 to bank account

Jan 24th Withdrew shs.9200 from bank for private use

Jan 29th Received shs.19950 from Kahawa by cheque after allowing 5% discount

Jan 31st Banked all the cash leaving shs.1500 in the office

Date posted: September 5, 2019. Answers (1)

- The following balance were extracted from the books of Nyachenge discount centre for the year ended 31st December 2010.Prepare a balance sheet as at 31st...(Solved)

The following balance were extracted from the books of Nyachenge discount centre for the year ended 31st December 2010

Cash ...........................................................20,520

Bank ...........................................................160,230

Premises .......................................................800,000

Debtors .........................................................40,000

Creditors....................................................... 40,000

2 year loan..................................................... 62,000

Stock ............................................................2500

Prepare a balance sheet as at 31st December 2010.

Date posted: September 5, 2019. Answers (1)

- Omwega traders had the following balances on 30th June 2009.

Prepare a trial balance for Omwega traders as at 30th June 2009.(Solved)

Omwega traders had the following balances on 30th June 2009.

Sales ................................................420,000

Motorvan .............................................300,000

Purchases.............................................240,000

Equipments ...........................................120,000

Debtors ...............................................80,000

Creditors............................................. 40,000

Expenses .............................................160,000

Capital ..............................................440,000

Prepare a trial balance for Omwega traders as at 30th June 2009.

Date posted: September 5, 2019. Answers (1)

- The following information relates to Undugu traders for the year ended 31st December 2015

Average stock .............................................50,000

Rate of stock turnover................................... 3 times

Mark up.................................................. 20%

From the above...(Solved)

The following information relates to Undugu traders for the year ended 31st December 2015

Average stock .............................................50,000

Rate of stock turnover................................... 3 times

Mark up.................................................. 20%

From the above information determine :

i) Cost of goods sold

ii) The gross profit

Date posted: September 5, 2019. Answers (1)

- The following information was extracted from the books of Zamzam traders as at 31st December 2015 ...(Solved)

The following information was extracted from the books of Zamzam traders as at 31st December 2015

...........................................Ksh

Purchases............................... 70,000

Sales ..................................170,000

Stock (1 Jan 2015)..................... 20,000

Capital............................... 240,000

Bank overdraft ........................145,000

Cash .................................3,000

Discount allowed..................... 5,000

Discount received ....................7,000

Return outwards ......................5,000

Return inwards .......................4,000

carriage on purchase .................2,000

Rent and rates ......................30,000

Commission received ..................2,200

Machinery ...........................40,000

Motor vehicles ......................70,000

Debtors ............................20,000

Creditors ..........................30,000

Drawings ...........................70,000

Wages and salaries ..................200,000

Additional information:

i) Stock on 31st Dec. 2015 was 15,000

ii) Wages and salaries accrued at 31st Dec. 2015 Kshs 10,000

iii) Prepaid rates shs 6,000

iv) Provide depreciation as follows;

Machinery shs 4,000

Motor vehicle 10% on cost

v) Drawings of stock 2,000/=

Required:

Prepare Zamzam traders trading, profit and loss account for year ended 31st Dec 2015.

Date posted: September 5, 2019. Answers (1)

- Journalise the following transactions through a general journal.

Jan 1 Sold an old typewriter on credit to Githumu academy worth shs 53,000

Jan 6...(Solved)

Journalise the following transactions through a general journal.

Jan 1 Sold an old typewriter on credit to Githumu academy worth shs 53,000

Jan 6 Bought an old sofa set on credit from Murata Sacco, for shs 8,000

Jan 10 Proprietor converted his personal saloon car for business use worth Kshs 150,000

Jan 12 Paid wages shs 6,000 cash.

Date posted: September 5, 2019. Answers (1)

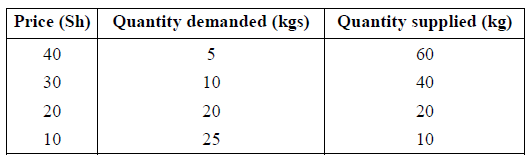

- The table below shows the demand and supply schedules for product A in a week.Using the information given in the table above, draw the demand...(Solved)

The table below shows the demand and supply schedules for product A in a week.

Using the information given in the table above, draw the demand and supply curves showing the market equilibrium for the product.

Date posted: September 5, 2019. Answers (1)

- The following information relates to Gakarara traders for the year 2015. ...(Solved)

The following information relates to Gakarara traders for the year 2015.

.......................................................shs

Net sales ...........................................320,000

Margin............................................... 25%

Expenses .............................................35,000

Rate of Stock Turnover................................ 6 times

From the information above,calculate

i) Gross profit

ii) Cost of goods sold

iii) Net profit

Date posted: September 5, 2019. Answers (1)