-

A rectangle ABCD is such that AB=6cm, and BC=5cm. A variable point P moves inside the rectangle such that AP = PB and AP >2.5cm....

(Solved)

A rectangle ABCD is such that AB=6cm, and BC=5cm. A variable point P moves inside the rectangle such that AP ≤ PB and AP >2.5cm. Show the region where P lies

Date posted:

September 20, 2019

.

Answers (1)

-

(a) Expand and simplify the binomial expression (2x-y)5

(b) Use the first four terms of the expansion above to approximate the value of (3.8)5

(Solved)

(a) Expand and simplify the binomial expression (2x-y)5

(b) Use the first four terms of the expansion above to approximate the value of (3.8)5

Date posted:

September 20, 2019

.

Answers (1)

-

An arithmetic progression of 41 terms in such that the sum of the first five terms is 560 and sum of the last five terms...

(Solved)

An arithmetic progression of 41 terms in such that the sum of the first five terms is 560 and sum of the last five terms is -250. Find the first term

Date posted:

September 20, 2019

.

Answers (1)

-

Miss Jaber bought a motor cycle at Shs.160,000. The depreciation rate was 6% per annum determined semi annually. How long will it take the motor...

(Solved)

Miss Jaber bought a motor cycle at Shs.160,000. The depreciation rate was 6% per annum determined semi annually. How long will it take the motor cycle to be valued at a quarter of its original cost.

Date posted:

September 20, 2019

.

Answers (1)

-

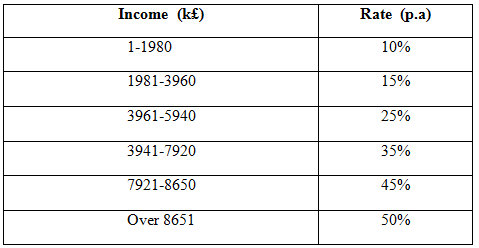

The table below gives the income tax rates.a)Calculate income tax of Wanga’s taxable income of kshs.50,400 per monthallowing a family relief of kshs. 520 per...

(Solved)

The table below gives the income tax rates.

a)Calculate income tax of Wanga’s taxable income of kshs.50,400 per month allowing a family relief of kshs. 520 per month.

b)Calculate the total tax as a percentage of taxable income

Date posted:

September 20, 2019

.

Answers (1)

-

Write the expression of (2 – 1/5 x)6 up to the term in x4. Hence use the expansion to find the value of (1.96)6 correct...

(Solved)

Write the expression of (2 – 1/5 x)6 up to the term in x4. Hence use the expansion to find the value of (1.96)6 correct to 3 decimal places.

Date posted:

September 20, 2019

.

Answers (1)

-

The position vectors of points A and B are a = 2i + j – 8k and b = 3i +2j – 2k respectively....

(Solved)

The position vectors of points A and B are a = 2i + j – 8k and b = 3i +2j – 2k respectively. Find the magnitude of AB.

Date posted:

September 20, 2019

.

Answers (1)

-

A quantity P varies partly as t and partly as the square of t.When t = 20, p = 45 , and when t =...

(Solved)

A quantity P varies partly as t and partly as the square of t.When t = 20, p = 45 , and when t = 24 , p = 60.

a)Express p in terms of t.

b)Find p when t = 32.

Date posted:

September 20, 2019

.

Answers (1)

-

Express the recurring decimal below as a fraction; 4.372 leaving your answer in the form of a/b where a and ...

(Solved)

Express the recurring decimal below as a fraction; 4.372 leaving your answer in the form of a/b where a and b are integers.

Date posted:

September 20, 2019

.

Answers (1)

-

Use logarithms only to evaluate,

Correct to four significant figures.

(Solved)

Use logarithms only to evaluate,

Correct to four significant figures.

Date posted:

September 20, 2019

.

Answers (1)

-

(a) Complete the table below for the function:

(b) Use the mid-ordinate rule with six ordinates to estimate the area enclosed by the curve...

(Solved)

(a) Complete the table below for the function:

(b) Use the mid-ordinate rule with six ordinates to estimate the area enclosed by the curve of the functions y = x2 – 3x + 5, x – axis and the lines x = 2 and x = 8.

(c) Find the exact area of the region described in (b) above.

(d) If the mid-ordinates rule is used to estimate the area under the curve between x = 2 and x = 8, what will be the percentage error in the estimation?

Date posted:

September 20, 2019

.

Answers (1)

-

A farmer has at least 50 acres of land on which he plans to plant potatoes and cabbages.

Each acre of potatoes requires 6 men...

(Solved)

A farmer has at least 50 acres of land on which he plans to plant potatoes and cabbages.

Each acre of potatoes requires 6 men and each acre of cabbages requires 2 men. The farmer has 240 men available and he must plant at least 10 acres of potatoes. The profit on potatoes is Ksh. 1000 per acre and on cabbages is Ksh. 1200 per acre. If he plants x acres of potatoes and y acres of cabbages:

(a)Write down three inequalities in x and y to describe this information.

(b)Represent these inequalities graphically.

Date posted:

September 20, 2019

.

Answers (1)

-

In the diagram M is the midpoint of XZ. OX = p + 2q. Oz = 7p – 2q and ZY = 3Kq + Mp...

(Solved)

In the diagram M is the midpoint of XZ. OX = p + 2q. Oz = 7p – 2q and ZY = 3Kq + Mp where

k, and m are constants.

(a)Express the following in terms of p and q.

(i) XZ

(ii) XM

(iii) OM

(b)Express OY in terms of p, q, k and m.

(c)If y lies on OM produced with OY:OM = 3:2. Find the values of k and m.

Date posted:

September 20, 2019

.

Answers (1)

-

A blender mixes two brands of Juice A and B to obtain 70mls of the mixture worth Ksh. 165 per litre. If brand...

(Solved)

A blender mixes two brands of Juice A and B to obtain 70mls of the mixture worth Ksh. 165 per litre. If brand A is valued at Ksh. 168 per 1 litre bottle and brand B at Ksh. 153 per 1 litre bottle, calculate the ratio in which the bands A and B are mixed.

Date posted:

September 20, 2019

.

Answers (1)

-

A circle whose equation is (x – 1)2 + (y – k)2 = 10 passes through point (2,5). Find the coordinates of the two...

(Solved)

A circle whose equation is (x – 1)2 + (y – k)2 = 10 passes through point (2,5). Find the coordinates of the two possible centres of the circle.

Date posted:

September 20, 2019

.

Answers (1)

-

Use logarithm table to evaluate:

(Solved)

Use logarithm table to evaluate:

Date posted:

September 20, 2019

.

Answers (1)

-

The curve y =3x2- 6x + 6 passes through the point s ( 2,3)(a)Determine the gradient function of the curve.(b) Find the co-ordinates of...

(Solved)

The curve y=3x2- 6x + 6 passes through the point s ( 2,3)

(a)Determine the gradient function of the curve.

(b) Find the co-ordinates of the turning point of the curve.

(c) Determine whether the point is a minima or a maxima.

(d) Find the equation of the

(i) Tangent to the curve at S.

(ii) Normal to the curve at S.

Date posted:

September 20, 2019

.

Answers (1)

-

The relationship between two variables S and T is given by the equation S = KTn where K and n are constants.

(a) Write down the...

(Solved)

The relationship between two variables S and T is given by the equation S = KTn where K and n are constants.

(a) Write down the linear equation relating to S and T

(b) Hence complete the table above for the linear equation relating to S and T.

(c) Draw a suitable straight line graph to represent the data.

(d) use your graph to determine the values of K and n.

(e) find the value of S when T = 3.5

Date posted:

September 20, 2019

.

Answers (1)

-

Three quantities P,Q,and R are such that P varies jointly with Q and the square of R . if P = 900 when...

(Solved)

Three quantities P,Q,and R are such that P varies jointly with Q and the square of R . if P = 900 when

Q = 20 and R = 3

Find (i) an equation connecting P, Q and R

(ii) the value of R when Q = 10 and P = 800

Date posted:

September 20, 2019

.

Answers (1)

-

A supermarket is stocked with plates which come from two suppliers A and B. They are bought in the ratio of 3:5 respectively, 10% of...

(Solved)

A supermarket is stocked with plates which come from two suppliers A and B. They are bought in the ratio of 3:5 respectively, 10% of plates from A are defective and 6% of the plates from B are defective.

(a) A plate is chosen by a buyer at random. Find the probability that;

(i) it is from A

(ii) it is from B and it is defective.

(iii) it is defective

(b) Two plates are chosen at random. Find the probability that:

(i) both are defective

(ii) at least one is not defective.

Date posted:

September 20, 2019

.

Answers (1)