- A plank AD is lying against a log of circular cross-section of radius 1.4 cm as shown.

Given that AB is 6 cm, find the height...(Solved)

A plank AD is lying against a log of circular cross-section of radius 1.4 cm as shown.

Given that AB is 6 cm, find the height of C above the ground.

Date posted: September 24, 2019. Answers (1)

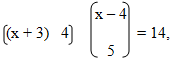

- If find the possible values of x which satisfy the matrix product.(Solved)

If  find the possible values of x which satisfy the matrix product.

find the possible values of x which satisfy the matrix product.

Date posted: September 24, 2019. Answers (1)

- Two brands of coffee Arabica and Robusta cost shs. 4700 and shs. 4200 per kilogram respectively, are mixed to produce a blend that costs shs....(Solved)

Two brands of coffee Arabica and Robusta cost shs. 4700 and shs. 4200 per kilogram respectively, are mixed to produce a blend that costs shs. 4600 per kilogram. Find the ratio of the mixture.

Date posted: September 24, 2019. Answers (1)

- Under a transformation represented by a matrix a triangle of area 10 cm2 is mapped on to a triangle whose area is 110 cm2....(Solved)

Under a transformation represented by a matrix  a triangle of area 10 cm2 is mapped on to a triangle whose area is 110 cm2. Find x.

a triangle of area 10 cm2 is mapped on to a triangle whose area is 110 cm2. Find x.

Date posted: September 24, 2019. Answers (1)

- Determine the amplitude, period and phase angle of the curve y = 5Sin(3x – 120)0(Solved)

Determine the amplitude, period and phase angle of the curve y = 5Sin(3x – 120)0

Date posted: September 24, 2019. Answers (1)

- The position vector OA = - 3a i + b j, OB = 6a i + 4b j and OC = 15a i + 7b...(Solved)

The position vector OA = - 3a i + b j, OB = 6a i + 4b j and OC = 15a i + 7b j, where a and b are scalars. Find in column form;

(i) AB

(ii) AC

Hence show that A,B and C are collinear.

Date posted: September 24, 2019. Answers (1)

- Determine the two possible values of a which (Solved)

Determine the two possible values of a which

Date posted: September 24, 2019. Answers (1)

- Given Log m = x and log n = y, find x and y if Log m2 n = 4 and Log mn3 = 7(Solved)

Given Log m = x and log n = y, find x and y if Log m2 n = 4 and Log mn3 = 7

Date posted: September 24, 2019. Answers (1)

- Solve the following equation for 00 = x = 3600

Sin4 x – Cos4x = 0(Solved)

Solve the following equation for 00 ≤ x ≤ 3600

Sin4 x – Cos4x = 0

Date posted: September 24, 2019. Answers (1)

- The figure below shows the graph of Log P against Log Q.

Given that P = aQn , find the value of a and n(Solved)

The figure below shows the graph of Log P against Log Q.

Given that P = aQn , find the value of a and n

Date posted: September 24, 2019. Answers (1)

- Simplify;(Solved)

Simplify;

Date posted: September 24, 2019. Answers (1)

- In the figure below O is the centre of the circle and ABCDEA is a regular polygon inscribed in a circle. Line GEF is a...(Solved)

In the figure below O is the centre of the circle and ABCDEA is a regular polygon inscribed in a circle. Line GEF is a tangent to the circle at point E

a.Find angle

i.AEG

ii. OEC

iii. DFE

iv. Obtuse angle AOC

b.If the sides of the pentagon are 6cm find the area of the circle giving your answer to one decimal place

Date posted: September 24, 2019. Answers (1)

- A particle is moving with an acceleration of (t – 4) m/s2 where t is time in seconds. When t is 2 seconds the velocity...(Solved)

A particle is moving with an acceleration of (t – 4) m/s2 where t is time in seconds. When t is 2 seconds the velocity is 4m/s and when t is 0 the displacement is 0m

a.Express velocity in terms of t

b.Find the displacement of the particle during the third second.

c.Calculate the interval of time when the velocity was not more than 4m/s

d.Calculate the minimum velocity.

Date posted: September 24, 2019. Answers (1)

- The table below shows the rate at which income tax was charged for all income earned in the year 2012

a.A tax of ksh1200 was deducted...(Solved)

The table below shows the rate at which income tax was charged for all income earned in the year 2012

a.A tax of ksh1200 was deducted from Mr. Rono’s monthly salary. He was entitled to a personal relief of ksh 1064 per month. Calculate his monthly

i.Gross tax in k£.

ii.Taxable income in ksh

b.He was entitled to a house allowance of ksh 3000 and medical allowances of ksh 2000 calculate his monthly basic salary in ksh.

c.Every month the following deductions were made from his salary electricity bill of sh 680, water bill of sh 460, co-operative shares of sh1250 and loan repayment of sh 2000 calculate his net salary in ksh.

Date posted: September 24, 2019. Answers (1)

- At the Kenya medical research institute a new drug is being tried. A sample of eighty sick rats is being used. Sixty of these rats...(Solved)

At the Kenya medical research institute a new drug is being tried. A sample of eighty sick rats is being used. Sixty of these rats are given drugs and the rest are not. A half of those given drugs are put on a high calorie diet while three quarters of those who are not given drugs were put on the same diet. For the ones who are treated and put on a high calorie diet the probability of dying is 0.1 and 0.2 if not put on a high calorie diet. For the ones who are not treated and put on a high calorie diet the probability of dying is 0.4 and 0.6 if not put on a high calorie diet.

a.Draw a tree diagram to represent the above information.

b.Calculate the probability that a rat picked at random

i.Is given drugs, put on a high calorie diet and will die

ii.Is given drugs and will die .

iii.Will die

iv.Is not given drugs and will not die

Date posted: September 24, 2019. Answers (1)

- The diagram below shows the frustum of a rectangular based pyramid. The base ABCD is a rectangle of side 24cm by 12cm.The top EFGH is...(Solved)

The diagram below shows the frustum of a rectangular based pyramid. The base ABCD is a rectangle of side 24cm by 12cm.The top EFGH is a rectangle of side 14cm by 7cm.Each of the slanting edges of the frustum is 13cm.

Determine the

a.altitude of the frustum

b.angle between the line AG and the base ABCD

c.Volume of the frustum

Date posted: September 24, 2019. Answers (1)

- In order to ensure optimal health a lab technician needs to feed the rabbits on a daily diet containing a minimum of 24grams of fat,...(Solved)

In order to ensure optimal health a lab technician needs to feed the rabbits on a daily diet containing a minimum of 24grams of fat, 36grams of carbohydrates and 4grams of protein. Rather than order rabbit food that is custom blended it is cheaper to order food X and food Y and blend them for an optimal use. One packet of food X contains 6grams of fat ,12 grams of carbohydrates ,2 grams of proteins and costs Sh 50.While one packet of food Y contains 12grams of fat,12 grams of carbohydrates,1 gram of proteins and it costs Sh 60

a)Form all the inequalities to represent the information above.

b)Graph the inequalities

c)Determine the number of packets of type X and Y feed that should be used for optimal health at minimum cost.

Date posted: September 24, 2019. Answers (1)

- The volume V of a cylinder varies jointly as the square of the radius R and the height H. If the radius is increased by...(Solved)

The volume V of a cylinder varies jointly as the square of the radius R and the height H. If the radius is increased by 10% and the height decreased by 20% find the percentage change in the volume.

Date posted: September 24, 2019. Answers (1)

- Solve the equation 9tan2theta + tan theta =10(Solved)

Solve the equation 9tan2theta + tan theta =10 for 00 = less than or = 3600

Date posted: September 24, 2019. Answers (1)

- The masses of two objects to the nearest 100g are 51kg, and 43kg find the percentage error in the difference of their masses.(Solved)

The masses of two objects to the nearest 100g are 51kg, and 43kg find the percentage error in the difference of their masses.

Date posted: September 24, 2019. Answers (1)