-

A company is considering two mutually exclusive projects requiring an initial cash outlay of Sh 10,000 each and with a useful life of 5 years....

(Solved)

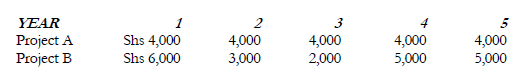

A company is considering two mutually exclusive projects requiring an initial cash outlay of Sh 10,000 each and with a useful life of 5 years. The company required rate of return is 10% and the appropriate corporate tax rate is 50%. The projects will be depreciated on a straight line basis. The before depreciation and taxes cash flows expected to be generated by the projects are as follows.

Required:

Calculate for each project

i. The payback period

ii. The average rate of return

iii. The net present value

iv. Profitability index

v. The internal rate of return

Which project should be accepted? Why?

Date posted:

April 13, 2021

.

Answers (1)

-

Two neighbouring countries have chosen to organize their electricity supply industries in different ways. In

country A, electricity supplies are provided by a nationalized industry. On...

(Solved)

Two neighbouring countries have chosen to organize their electricity supply industries in different ways. In

country A, electricity supplies are provided by a nationalized industry. On the other hand in country B

electricity supplies are provided by a number of private sector companies.

Required:

(a) Explain how the objectives of the nationalized industry in country A might differ from those of the private sector companies in country B.

(b) Briefly discuss whether investment planning and appraisal techniques are likely to differ in the nationalized industry and private sector companies.

Date posted:

April 13, 2021

.

Answers (1)

-

List and explain the 14 principles of management

(Solved)

List and explain the 14 principles of management

Date posted:

March 5, 2019

.

Answers (1)

-

Identify the various methods of issuing new ordinary shares to shareholders.

(Solved)

Identify the various methods of issuing new ordinary shares to shareholders.

Date posted:

February 12, 2019

.

Answers (1)

-

Why does ordinary share capital have a high cost relative to debt capital?

(Solved)

Why does ordinary share capital have a high cost relative to debt capital?

Date posted:

February 12, 2019

.

Answers (1)

-

What practical problems are faced by finance managers in capital budgeting decisions.

(Solved)

What practical problems are faced by finance managers in capital budgeting decisions.

Date posted:

February 12, 2019

.

Answers (1)

-

What are the features of a sound appraisal technique?

(Solved)

What are the features of a sound appraisal technique?

Date posted:

February 12, 2019

.

Answers (1)

-

What are the advantages of having a farmers' bank compared with an ordinary

commercial bank in the provision of services to farmers

(Solved)

What are the advantages of having a farmers' bank compared with an ordinary

commercial bank in the provision of services to farmers

Date posted:

February 12, 2019

.

Answers (1)

-

Why do different sources of finance have different costs?

(Solved)

Why do different sources of finance have different costs?

Date posted:

February 12, 2019

.

Answers (1)

-

The Kitale Maize Mills is contemplating the purchase of a new high-speed grinder to replace an

existing one. The existing grinder was purchased two years ago...

(Solved)

The Kitale Maize Mills is contemplating the purchase of a new high-speed grinder to replace an

existing one. The existing grinder was purchased two years ago at an installed cost of Sh.300,000.

The grinder was estimated to have an economic life of 5 years but a critical analysis of its

performance now shows it is usable for the next five years with no resale value.

The new grinder would cost Sh.525,000 and require Sh.25,000 in installation costs. It has a five

year usable life. The existing grinder can currently be sold for Sh.350,000 without incurring any

removal costs. To support the increased business resulting from purchase of the new grinder,

accounts receivable would increase by Sh.200,000, inventories by Sh.150,000 and trade creditors

by Sh.290,000. At the end of 5 years the new grinder would be sold to net Sh.145,000 after

removal costs and before taxes. The company provides for 40% taxes on ordinary income. The

estimated profit before depreciation and taxes over the five years for both machines are given as

follows:

The company uses straight line method of depreciation for both machines.

Required:

a) Calculate the initial investment associated with the replacement of the existing grinder

with the new one. Show your full workings.

b) Determine the incremental operating cash flows associated with the proposed grinder

replacement.

c) Calculate the terminal cash flow expected from the proposed grinder replacement.

Date posted:

February 12, 2019

.

Answers (1)

-

The valuation of ordinary shares is more complicated than the valuation of bonds and

preference shares. Explain the factors that complicate the valuation of ordinary shares.

(Solved)

The valuation of ordinary shares is more complicated than the valuation of bonds and

preference shares. Explain the factors that complicate the valuation of ordinary shares.

Date posted:

February 12, 2019

.

Answers (1)

-

Within a Financial Management context, discuss the problems that might exist in the

relationships (sometimes referred to as agency relationships) between:

1. Shareholders and managers, and

2. Shareholders...

(Solved)

Within a Financial Management context, discuss the problems that might exist in the

relationships (sometimes referred to as agency relationships) between:

1. Shareholders and managers, and

2. Shareholders and creditors.

Date posted:

February 12, 2019

.

Answers (1)

-

Distinguish between the following terms:

(i) Weighted average cost of capital and marginal cost of capital.

(ii) Finance lease and operating lease.

(Solved)

Distinguish between the following terms:

(i) Weighted average cost of capital and marginal cost of capital.

(ii) Finance lease and operating lease.

Date posted:

February 12, 2019

.

Answers (1)

-

The management of Biashara Ltd. is in the process of evaluating two

alternative machine models, Alpha and Beta for possible purchase in order to

increase the company's...

(Solved)

The management of Biashara Ltd. is in the process of evaluating two

alternative machine models, Alpha and Beta for possible purchase in order to

increase the company's production level.

The following additional information is available:

1. Alpha costs Shs. 3,800,000 and will have a useful life of four years.

2. Beta costs Shs. 8,000,000 and will have a useful life of six years.

3. Both machines have no salvage value after their useful lives.

4. An investment in working capital amounting to Shs. 825,000 will have to be made

at the beginning of the first year of the machine‟s life regardless of the

model purchased.

5. The estimated pre-tax cash inflows for each of the machines are shown below:

6. The cost of capital to the company is 12% and the corporation tax rate is 30%.

Required:

(i) Calculate the undiscounted pay back period for each machine model.

(ii) Calculate the net present value (NPV) for each machine model.

(iii) Using the net present values computed in

(ii) above, advise the management on

which model to purchase.

(iv) The management of the company has received an alternative offer to lease

Alpha at an annual lease charge of Shs. 1,200,000 for four years, payable at

the year end. All other details remain unchanged.

Will this offer affect your selection in part

(iii) above? Explain.

Date posted:

February 12, 2019

.

Answers (1)

-

Mwongozo Limited has approached you for advice on an equipment to be purchased

for use in a five year project.

The investment will involve an initial capital...

(Solved)

Mwongozo Limited has approached you for advice on an equipment to be purchased

for use in a five year project.

The investment will involve an initial capital outlay of Shs. 1.4 million and the expected

cash flows are given below:

The equipment is to be depreciated on a straight line basis over the duration of the

project with a nil residual value.

The cost of capital and the tax rate are 12% and 30% respectively.

Required:

The net present value (NPV) of the investment.

Date posted:

February 12, 2019

.

Answers (1)

-

List four factors that should be considered in establishing an effective credit policy.

(Solved)

List four factors that should be considered in establishing an effective credit policy.

Date posted:

February 11, 2019

.

Answers (1)

-

Identify and briefly explain the three main forms of agency relationship in a firm.

(Solved)

Identify and briefly explain the three main forms of agency relationship in a firm.

Date posted:

February 11, 2019

.

Answers (1)

-

Dawamu Ltd., which operates in the retail sector selling a single product, is considering

a change of credit policy which will result in an increase in...

(Solved)

Dawamu Ltd, which operates in the retail sector selling a single product, is considering

a change of credit policy which will result in an increase in the average collection period

of debts from one to two months. The relaxation of the credit policy is expected to

produce an increase in sales in each year, amounting to 25% of the current sales

volume. The following information is available.

1. Selling price per unit of product – Sh.1,000

2. Variable cost per unit of product – Sh.850

3. Current annual sales of product – Sh.240,000,000

4. Dawamu Ltd.'s required rate of return on investments is 20%.

5. It is expected that increase in sales would result in additional stock of

Sh.10,000,000 and additional creditors of Sh.2,000,000.

Required:

Advise Dawamu Ltd. on whether or not to extend the credit period offered to

customers, if

(i) All customers take the longer credit period of two months.

(ii) Existing customers do not change their payment habits and only the new

customers will take a full two months' credit.

Date posted:

February 11, 2019

.

Answers (1)

-

Briefly explain how the Miller-Orr cash management model operates.

(Solved)

Briefly explain how the Miller-Orr cash management model operates.

Date posted:

February 11, 2019

.

Answers (1)

-

Identify and briefly explain three conditions which have to be satisfied before the use of

the weighted average cost of capital (WACC) can be justified.

(Solved)

Identify and briefly explain three conditions which have to be satisfied before the use of

the weighted average cost of capital (WACC) can be justified.

Date posted:

February 11, 2019

.

Answers (1)