1. The decision tree can become more and more complicated as more alternatives are included.

2. It cannot be used for dependent variables.

Kavungya answered the question on April 13, 2021 at 10:00

- State the merits of decision tree.(Solved)

State the merits of decision tree.

Date posted: April 13, 2021. Answers (1)

- A project has the following cash flows

The projects initial cash outlay is Sh 100,000 with a cost of capital of 12%.

Required:

Determine:

(a) The projects expected monetary...(Solved)

A project has the following cash flows

The projects initial cash outlay is Sh 100,000 with a cost of capital of 12%.

Required:

Determine:

(a) The projects expected monetary value (EMV)

(b) The projects NPV

Date posted: April 13, 2021. Answers (1)

- Outline the factors affecting the projects net present value.(Solved)

Outline the factors affecting the projects net present value.

Date posted: April 13, 2021. Answers (1)

- State the advantages of sensitivity analysis.(Solved)

State the advantages of sensitivity analysis.

Date posted: April 13, 2021. Answers (1)

- State the disadvantages of sensitivity analysis.(Solved)

State the disadvantages of sensitivity analysis.

Date posted: April 13, 2021. Answers (1)

- Outline the steps followed in use of sensitivity analysis.(Solved)

Outline the steps followed in use of sensitivity analysis.

Date posted: April 13, 2021. Answers (1)

- What is sensitivity analysis?(Solved)

What is sensitivity analysis?

Date posted: April 13, 2021. Answers (1)

- State the demerits of certainty equivalent approach.(Solved)

State the demerits of certainty equivalent approach.

Date posted: April 13, 2021. Answers (1)

- State the merits of certainty equivalent approach.(Solved)

State the merits of certainty equivalent approach.

Date posted: April 13, 2021. Answers (1)

- Assume a project costs Sh 30,000 and yields the following uncertain cashflows:

Compute the NPV of the project(Solved)

Assume a project costs Sh 30,000 and yields the following uncertain cash flows:

Year Cash flow

1 12,000

2 14,000

3 10,000

4 6,000

Assume also that the certainty equivalent coefficients have been estimated as follows:

α0 = 1.00

α1 = 0.90

α2 = 0.70

α3 = 0.50

α4 = 0.30

The risk-free discount rate is given as 10%

Required

Compute the NPV of the project

Date posted: April 13, 2021. Answers (1)

- Outline the methods that can be used to incorporate risk into capital budgeting decisions.(Solved)

Outline the methods that can be used to incorporate risk into capital budgeting decisions.

Date posted: April 13, 2021. Answers (1)

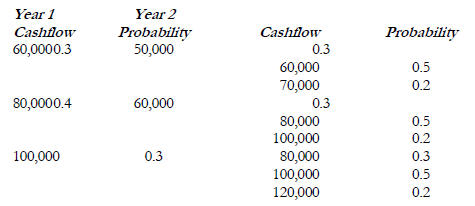

- Study the table below and compute the expected cash flow.(Solved)

Study the table below and compute the expected cash flow.

Date posted: April 13, 2021. Answers (1)

- Outline the possible attitudes towards Risk.(Solved)

Outline the possible attitudes towards Risk.

Date posted: April 13, 2021. Answers (1)

- Define the term risk associated with a project.(Solved)

Define the term risk associated with a project.

Date posted: April 13, 2021. Answers (1)

- Project A has the following cashflows over its useful life of 3 years. The market value (Abandonment

value) has also been given.(Solved)

Project A has the following cashflows over its useful life of 3 years. The market value (Abandonment value) has also been given.

Year Cash Abandonment

flow value

Sh`000' Sh`000'

0 (4,800) 4,800

1 2,000 3,000

2 1,875 1,900

3 1,750 0

Required:

Determine when to abandon the project assuming a discount rate of 10%.

Date posted: April 13, 2021. Answers (1)

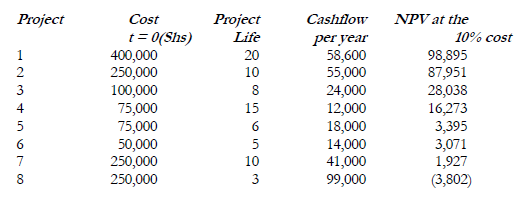

- Management is faced with eight projects to invest in. The capital expenditures during the year has been rationed to Sh 500,000 and the projects have...(Solved)

Management is faced with eight projects to invest in. The capital expenditures during the year has been rationed to Sh 500,000 and the projects have equal risk and therefore should be discounted at the firm's cost of capital of 10%.

Required:

Determine the optimal investment sets.

Date posted: April 13, 2021. Answers (1)

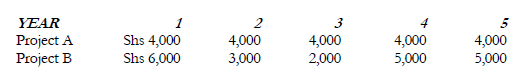

- A company is considering two mutually exclusive projects requiring an initial cash outlay of Sh 10,000 each and with a useful life of 5 years....(Solved)

A company is considering two mutually exclusive projects requiring an initial cash outlay of Sh 10,000 each and with a useful life of 5 years. The company required rate of return is 10% and the appropriate corporate tax rate is 50%. The projects will be depreciated on a straight line basis. The before depreciation and taxes cash flows expected to be generated by the projects are as follows.

Required:

Calculate for each project

i. The payback period

ii. The average rate of return

iii. The net present value

iv. Profitability index

v. The internal rate of return

Which project should be accepted? Why?

Date posted: April 13, 2021. Answers (1)

- State and explain the two groups of investment appraisal techniques.(Solved)

State and explain the two groups of investment appraisal techniques.

Date posted: April 13, 2021. Answers (1)

- What are capital budgeting decisions?(Solved)

What are capital budgeting decisions?

Date posted: April 13, 2021. Answers (1)

- Two neighbouring countries have chosen to organize their electricity supply industries in different ways. In

country A, electricity supplies are provided by a nationalized industry. On...(Solved)

Two neighbouring countries have chosen to organize their electricity supply industries in different ways. In

country A, electricity supplies are provided by a nationalized industry. On the other hand in country B

electricity supplies are provided by a number of private sector companies.

Required:

(a) Explain how the objectives of the nationalized industry in country A might differ from those of the private sector companies in country B.

(b) Briefly discuss whether investment planning and appraisal techniques are likely to differ in the nationalized industry and private sector companies.

Date posted: April 13, 2021. Answers (1)