The rate of interest is the rate used to convert amounts offered at different times to

equivalent amount at the present. It is the charge required by lenders for the use of their funds.

It can also be referred to as the investors required rate of return and can be given by the

following formula

R = Risk free rate + Risk premium

Where R is the investors required rate of return. To the company it is the opportunity cost of

capital.

Kavungya answered the question on April 13, 2021 at 10:16

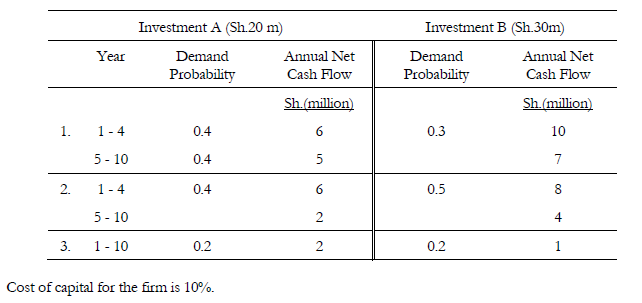

- The Zeda Company Ltd. is considering a substantial investment in a new production process. From a

variety of sources, the total cost of the project has...(Solved)

The Zeda Company Ltd. is considering a substantial investment in a new production process. From a

variety of sources, the total cost of the project has been estimated at Sh.20 million. However, if the

investment were to be increased to Sh.30 million, the productive capacity of the plant could be substantially

increased. Due to the nature of the process, it would be exorbitantly expensive to increase capacity once the

equipment is installed.

Once of the problems facing the company is that there is a considerable degree of uncertainty regarding

demand for the product. After some research which has been conducted jointly by the marketing and

finance departments, some data has been produced. These are shown below:

REQUIRED:

(a) Prepare a statement which clearly indicates the financial implications of each of the two alternative

investment scenarios.

(b) Comment on other matters which the management should take into account before reaching

the final decision.

PVIFA: 10% 5 years = 3.79

PVIFA: 10% 10 years = 6.14

PVIFA: 10% 10 years = 0.62

Date posted: April 13, 2021. Answers (1)

- State the disadvantages of utility approach.(Solved)

State the disadvantages of utility approach.

Date posted: April 13, 2021. Answers (1)

- State the advantages of utility approach.(Solved)

State the advantages of utility approach.

Date posted: April 13, 2021. Answers (1)

- State the demerits of decision tree.(Solved)

State the demerits of decision tree.

Date posted: April 13, 2021. Answers (1)

- State the merits of decision tree.(Solved)

State the merits of decision tree.

Date posted: April 13, 2021. Answers (1)

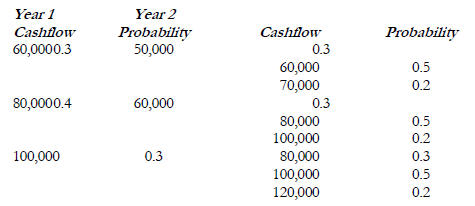

- A project has the following cash flows

The projects initial cash outlay is Sh 100,000 with a cost of capital of 12%.

Required:

Determine:

(a) The projects expected monetary...(Solved)

A project has the following cash flows

The projects initial cash outlay is Sh 100,000 with a cost of capital of 12%.

Required:

Determine:

(a) The projects expected monetary value (EMV)

(b) The projects NPV

Date posted: April 13, 2021. Answers (1)

- Outline the factors affecting the projects net present value.(Solved)

Outline the factors affecting the projects net present value.

Date posted: April 13, 2021. Answers (1)

- State the advantages of sensitivity analysis.(Solved)

State the advantages of sensitivity analysis.

Date posted: April 13, 2021. Answers (1)

- State the disadvantages of sensitivity analysis.(Solved)

State the disadvantages of sensitivity analysis.

Date posted: April 13, 2021. Answers (1)

- Outline the steps followed in use of sensitivity analysis.(Solved)

Outline the steps followed in use of sensitivity analysis.

Date posted: April 13, 2021. Answers (1)

- What is sensitivity analysis?(Solved)

What is sensitivity analysis?

Date posted: April 13, 2021. Answers (1)

- State the demerits of certainty equivalent approach.(Solved)

State the demerits of certainty equivalent approach.

Date posted: April 13, 2021. Answers (1)

- State the merits of certainty equivalent approach.(Solved)

State the merits of certainty equivalent approach.

Date posted: April 13, 2021. Answers (1)

- Assume a project costs Sh 30,000 and yields the following uncertain cashflows:

Compute the NPV of the project(Solved)

Assume a project costs Sh 30,000 and yields the following uncertain cash flows:

Year Cash flow

1 12,000

2 14,000

3 10,000

4 6,000

Assume also that the certainty equivalent coefficients have been estimated as follows:

α0 = 1.00

α1 = 0.90

α2 = 0.70

α3 = 0.50

α4 = 0.30

The risk-free discount rate is given as 10%

Required

Compute the NPV of the project

Date posted: April 13, 2021. Answers (1)

- Outline the methods that can be used to incorporate risk into capital budgeting decisions.(Solved)

Outline the methods that can be used to incorporate risk into capital budgeting decisions.

Date posted: April 13, 2021. Answers (1)

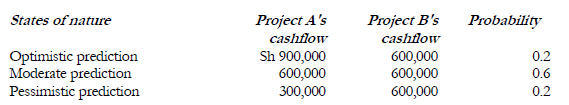

- Study the table below and compute the expected cash flow.(Solved)

Study the table below and compute the expected cash flow.

Date posted: April 13, 2021. Answers (1)

- Outline the possible attitudes towards Risk.(Solved)

Outline the possible attitudes towards Risk.

Date posted: April 13, 2021. Answers (1)

- Define the term risk associated with a project.(Solved)

Define the term risk associated with a project.

Date posted: April 13, 2021. Answers (1)

- Project A has the following cashflows over its useful life of 3 years. The market value (Abandonment

value) has also been given.(Solved)

Project A has the following cashflows over its useful life of 3 years. The market value (Abandonment value) has also been given.

Year Cash Abandonment

flow value

Sh`000' Sh`000'

0 (4,800) 4,800

1 2,000 3,000

2 1,875 1,900

3 1,750 0

Required:

Determine when to abandon the project assuming a discount rate of 10%.

Date posted: April 13, 2021. Answers (1)

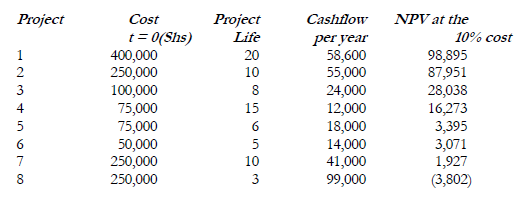

- Management is faced with eight projects to invest in. The capital expenditures during the year has been rationed to Sh 500,000 and the projects have...(Solved)

Management is faced with eight projects to invest in. The capital expenditures during the year has been rationed to Sh 500,000 and the projects have equal risk and therefore should be discounted at the firm's cost of capital of 10%.

Required:

Determine the optimal investment sets.

Date posted: April 13, 2021. Answers (1)