Poor strategic fit - The two companies have strategies and objectives that are too different and they conflict

with one another.

Cultural and Social Differences - It has been said that most problems can be traced to "people problems." If

the two companies have wide differences in cultures, then synergy values can be very elusive.

Incomplete and Inadequate Due Diligence - Due diligence is the "watchdog" within the M & A Process. If

you fail to let the watchdog do his job, you are in for some serious problems within the M & A Process.

Poorly Managed Integration - The integration of two companies requires a very high level of quality

management. In the words of one CEO, "give me some people who know the drill." Integration is often poorly

managed with little planning and design. As a result, implementation fails.

Paying too Much - In today's merger frenzy world, it is not unusual for the acquiring company to pay a

premium for the Target Company. Premiums are paid based on expectations of synergies. However, if synergies

are not realized, then the premium paid to acquire the target is never recouped.

Overly Optimistic - If the acquiring company is too optimistic in its projections about the Target Company,

then bad decisions will be made within the M & A Process. An overly optimistic forecast or conclusion about a

critical issue can lead to a failed merger.

Kavungya answered the question on April 14, 2021 at 12:25

- Describe the overall merger and acquisition process.(Solved)

Describe the overall merger and acquisition process.

Date posted: April 14, 2021. Answers (1)

- State and explain the reasons of business mergers.(Solved)

State and explain the reasons of business mergers.

Date posted: April 14, 2021. Answers (1)

- State and explain the types of mergers.(Solved)

State and explain the types of mergers.

Date posted: April 14, 2021. Answers (1)

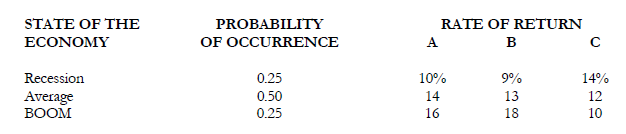

- XYZ ltd. is considering three possible capital projects for next year. Each project has a 1 year life, and

project returns depend on next years state...(Solved)

XYZ ltd. is considering three possible capital projects for next year. Each project has a 1 year life, and

project returns depend on next years state of the economy. The estimated rates of return are shown below.

a. Find each project expected rate of return, variance, standard deviation and coefficient of

variation.

b. Compute the correlation coefficient between

i. A and B

ii. A and C

iii. B and C

c. Compute the expected return on a portfolio if the firm invests equal wealth on each asset.

d. Compute the standard deviation of the portfolio.

Date posted: April 13, 2021. Answers (1)

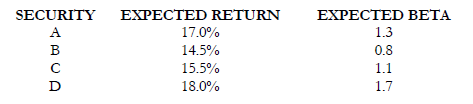

- The risk free rate is 10% and the expected return on the market portfolio is 15%. The expected returns for 4

securities are listed below together...(Solved)

The risk free rate is 10% and the expected return on the market portfolio is 15%. The expected returns for 4

securities are listed below together with their expected betas.

a. On the basis of these expectations, which securities are overvalued? Which are undervalued?

b. If the risk-free rate were to rise to 12% and the expected return on the market portfolio rose to 16%,

which securities would be overvalued? which would be under-valued? (Assume the expected returns

and the betas remain the same).

Date posted: April 13, 2021. Answers (1)

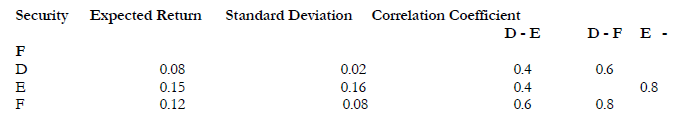

- Securities D, E and F have the following characteristics with respect to expected return, standard deviation

and correlation coefficients.

Compute the expected rate of return and standard...(Solved)

Securities D, E and F have the following characteristics with respect to expected return, standard deviation

and correlation coefficients.

Compute the expected rate of return and standard deviation of a portfolio comprised of equal investment in

each security.

Date posted: April 13, 2021. Answers (1)

- Security returns depend on only three risk factors-inflation, industrial production and the aggregate degree of

risk aversion. The risk free rate is 8%, the required rate...(Solved)

Security returns depend on only three risk factors-inflation, industrial production and the aggregate degree of

risk aversion. The risk free rate is 8%, the required rate of return on a portfolio with unit sensitivity to

inflation and zero-sensitivity to other factors is 13.0%, the required rate of return on a portfolio with unit

sensitivity to industrial production and zero sensitivity to inflation and other factors is 10% and the required

return on a portfolio with unit sensitivity to the degree of risk aversion and zero sensitivity to other factors is

6%. Security i has betas of 0.9 with the inflation portfolio, 1.2 with the industrial production and-0.7 with

risk bearing portfolio—(risk aversion)

Assume also that required rate of return on the market is 15% and stock i has CAPM beta of 1.1

Required:

Compute security i's required rate of return using

a. CAPM

b. APT

Date posted: April 13, 2021. Answers (1)

- Assume that the risk free rate of return is 8%, the market expected rate of return is 12%. The standard deviation of the market return...(Solved)

Assume that the risk free rate of return is 8%, the market expected rate of return is 12%. The standard deviation of the market return is 2% while the covariance of return for security A and the market is 2%.

What is the required rate of return on Security A?

Date posted: April 13, 2021. Answers (1)

- What are efficient portfolios?(Solved)

What are efficient portfolios?

Date posted: April 13, 2021. Answers (1)

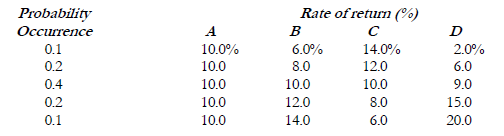

- Four assets have the following distribution of returns.a. Compute the expected return and standard deviation of each asset.b. Compute the covariance of asseti. A and...(Solved)

Four assets have the following distribution of returns.

Required.

a. Compute the expected return and standard deviation of each asset.

b. Compute the covariance of asset

i. A and B

ii. B and C

iii. B and D

c. Compute the correlation coefficient of the combination of assets in b above.

Date posted: April 13, 2021. Answers (1)

- Consider two investments A & B each having the following characteristics:

Compute the portfolio standard deviation if the correlation coefficient between the assets is

a. 1

b. 0

c....(Solved)

Consider two investments A & B each having the following characteristics:

Investment Expected Return (%) Proportion

A 20 2/3

B 40 1/3

REQUIRED:

Compute the portfolio standard deviation if the correlation coefficient between the assets is

a. 1

b. 0

c. -1

Date posted: April 13, 2021. Answers (1)

- Consider two investments, A and B each having the following investment characteristics;

Compute the expected return of a portfolio of the two assets.(Solved)

Consider two investments, A and B each having the following investment characteristics;

Investment Expected Return (%) Proportion

A 10 2/3

B 20 1/3

Required.

Compute the expected return of a portfolio of the two assets.

Date posted: April 13, 2021. Answers (1)

- Define the term portfolio.(Solved)

Define the term portfolio.

Date posted: April 13, 2021. Answers (1)

- A piece of equipment requiring the investment of 2.2 million is being considered by Charo Foods Ltd. The equipment has a ten-year useful life and...(Solved)

A piece of equipment requiring the investment of 2.2 million is being considered by Charo Foods Ltd. The equipment has a ten-year useful life and an expected salvage value of Sh 200,000. The company uses the straight-line method of depreciation for analyzing investment decisions and faces a tax rate of 40%. For simplicity assume that the depreciation method is acceptable for tax purposes.

A pessimistic forecast projects cash earnings before depreciation and taxes at Sh 400,000 per year compared with an optimistic estimate of Sh 500,000 per year. The probability associated with the pessimistic estimate is 0.4 and 0.6 for the optimistic forecast. The company has a policy of using a hurdle rate of 10% for replacement investments, 12% (its cost of capital) for revenue expansion investments into existing product lines and 15% projects involving new areas or new product lines.

REQUIRED:

(a) Compute the expected annual cash flows associated with the proposed equipment investments.

(b) Would you recommend acceptance of this project if it involved expansion of sales for an existing product?

(c) Would it be acceptable if it was for the replacement of equipment with a book value of Sh 200,000 at the end of the tenth year but which could be sold at that time for only Sh 40,000?

(d) Discounted cash flow methods were developed for idealized settings of complete and perfect capital, factor and commodity markets. Explain what complications arise when an attempt is made to apply these methods in real life markets that are neither complete nor perfect.

Date posted: April 13, 2021. Answers (1)

- The Mentala Plastics Company has been dumping in the local council waste collection

centre some 30,000 Kg. of unusable chemicals each year. In addition to being...(Solved)

The Mentala Plastics Company has been dumping in the local council waste collection

centre some 30,000 Kg. of unusable chemicals each year. In addition to being an

eyesore, the residents of a nearby estate have started complaining of bad odour

emanating from the dump and suspect that the company is to blame.

The company has received information that these chemicals can be recycled at relatively little

cost. The equipment to do it is however rather expensive and, in addition, the chemicals

recovered are of a relatively poor quality. Investigations have shown that these chemicals can

be sold to another firm at an average price of Sh.35 per Kg. The direct cost of recycling has

been calculated at Sh.15 per Kg. but this is before depreciation and taxes.

The equipment for this process has an expected life of 10 years and a current cost of Sh.2 million. At the

end of the ten years, it will be virtually worthless.

For financial analysis, the company uses the straight line method of depreciation and an average tax rate of

40%. It has a required rate of return of 15%.

REQUIRED:

i. Compute the project's net present value (N.P.V).

ii. Compute the payback period and the accounting rate of return.

iii. Compute the internal rate of return (IRR).

iv. Should this project be undertaken? Explain.

Are there any other important matters that the company should consider in evaluating this project?

Date posted: April 13, 2021. Answers (1)

- Explain the concept of "rate of interest" in the context of financial decisions.(Solved)

Explain the concept of "rate of interest" in the context of financial decisions.

Date posted: April 13, 2021. Answers (1)

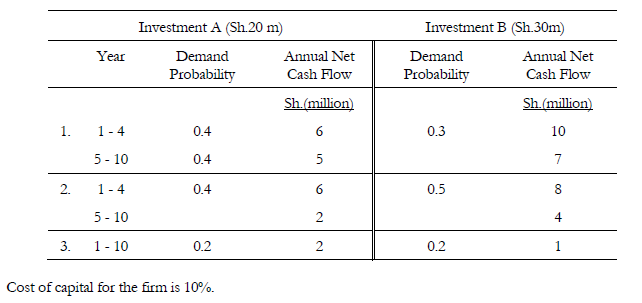

- The Zeda Company Ltd. is considering a substantial investment in a new production process. From a

variety of sources, the total cost of the project has...(Solved)

The Zeda Company Ltd. is considering a substantial investment in a new production process. From a

variety of sources, the total cost of the project has been estimated at Sh.20 million. However, if the

investment were to be increased to Sh.30 million, the productive capacity of the plant could be substantially

increased. Due to the nature of the process, it would be exorbitantly expensive to increase capacity once the

equipment is installed.

Once of the problems facing the company is that there is a considerable degree of uncertainty regarding

demand for the product. After some research which has been conducted jointly by the marketing and

finance departments, some data has been produced. These are shown below:

REQUIRED:

(a) Prepare a statement which clearly indicates the financial implications of each of the two alternative

investment scenarios.

(b) Comment on other matters which the management should take into account before reaching

the final decision.

PVIFA: 10% 5 years = 3.79

PVIFA: 10% 10 years = 6.14

PVIFA: 10% 10 years = 0.62

Date posted: April 13, 2021. Answers (1)

- State the disadvantages of utility approach.(Solved)

State the disadvantages of utility approach.

Date posted: April 13, 2021. Answers (1)

- State the advantages of utility approach.(Solved)

State the advantages of utility approach.

Date posted: April 13, 2021. Answers (1)

- State the demerits of decision tree.(Solved)

State the demerits of decision tree.

Date posted: April 13, 2021. Answers (1)