General obligation bond (GO) indicates that the security standing behind the bond is the total

credibility and unrestricted resource of the government unit or other not-for-profit agency. The bond is

said to be issued with the full faith and credit of source of funds. In a governmental unit, the general tax revenue provides the ultimate source of funds.

Revenue bonds are obligations issued to finance a revenue-generating project or enterprise. Both the

principal and interest of revenue bonds are required to be paid exclusively from the generated earnings.

The massive growth in revenue bonds has come about as a way of reducing dependence on general

obligation bonds. It has had the effect of shifting the burden away from taxpayers to users, avoiding

referendums and imposed debt ceilings. Typical uses of the revenue bond include financing of sewer and

water systems, airports, toll roads, hospitals, parking facilities, and industrial developments.

Industrial bonds are issued by governments to construct facilities for a private corporation that makes

lease payments to the government to service those bonds. Such bonds may be general obligation bonds,

combination bonds, or revenue bonds. The state legislature enacts enabling legislation to permit local

governments, typically municipalities, to finance the acquisition or construction of industrial facilities. The major purpose of these bonds is to encourage local economic development efforts. Originally industrial bonds were used almost entirely to attract, expand, or retain industrial facilities in a community. The uses of industrial bonds have expanded in recent years to include financing of span facilities/stadiums,

hospitals, transportation, pollution control, and industrial parks.

Kavungya answered the question on April 14, 2021 at 18:47

- State and explain the short-term instruments used to generate cash to meet expected spending needs.(Solved)

State and explain the short-term instruments used to generate cash to meet expected spending needs.

Date posted: April 14, 2021. Answers (1)

- Outline the reasons why financial management in government departments is different from financial management in an industrial or commercial company.(Solved)

Outline the reasons why financial management in government departments is different from financial management in an industrial or commercial company.

Date posted: April 14, 2021. Answers (1)

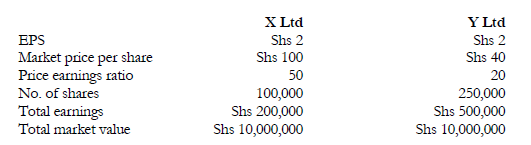

- X Ltd intends to take-over Y Ltd by offering two of its share for every five shares in Y Company Ltd.

Relevant financial data is as...(Solved)

X Ltd intends to take-over Y Ltd by offering two of its share for every five shares in Y Company Ltd.

Relevant financial data is as follows:

Required.

a. Compute the combined EPS & MPS

b. Has wealth been created for shareholders?

Date posted: April 14, 2021. Answers (1)

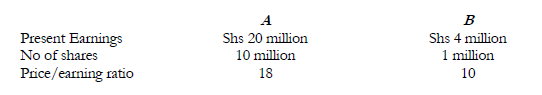

- The following data are pertinent for companies A and B.

a. If the two companies were to merge and the exchange ratio were one share of...(Solved)

The following data are pertinent for companies A and B.

a. If the two companies were to merge and the exchange ratio were one share of Company A for each share of Company B, what would be the initial impact on earnings per share of the two companies? what is the market value exchange ratio? Is the merger likely to take place?

b. If the exchange ratio were two shares of Company A for each share of Company B what would happen with respect to the above?

c. If the exchange ratio were 1.5 shares of Company A for each share of Company B, what would happen?

d. What exchange ratio would you recommend?

Date posted: April 14, 2021. Answers (1)

- Outline the roles of investment bankers in mergers.(Solved)

Outline the roles of investment bankers in mergers.

Date posted: April 14, 2021. Answers (1)

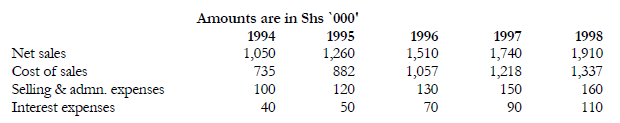

- XYZ Ltd. is considered acquiring ABC Ltd. The following information relates to ABC Ltd. for the next five years. The projected financial data are for...(Solved)

XYZ Ltd. is considered acquiring ABC Ltd. The following information relates to ABC Ltd. for the next five years. The projected financial data are for the post-merger period. The corporate tax rate is 40% for both companies.

Other information

a. After the fifth year the cashflows available to XYZ from ABC is expected to grow by 10% per

annum in perpetuity.

b. ABC will retain Shs 40,000 for internal expansion every year.

c. The cost of capital can be assumed to be 18%.

REQUIRED:

i. Estimate the annual cash flows.

ii. Determine the maximum amount XYZ would be willing to acquire ABC at.

Date posted: April 14, 2021. Answers (1)

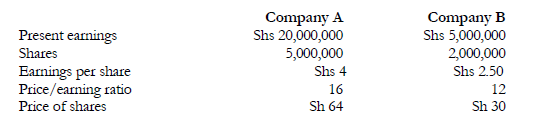

- Company A is considering the acquisition by shares of Company B. The following information is also available.

Company B has agreed to an offer of Shs...(Solved)

Company A is considering the acquisition by shares of Company B. The following information is also available.

Company B has agreed to an offer of Shs 35 a share to be paid in Company A shares.

Consider the effect of the acquisition to the earnings per share.

Date posted: April 14, 2021. Answers (1)

- Outline the reasons behind failed business mergers.(Solved)

Outline the reasons behind failed business mergers.

Date posted: April 14, 2021. Answers (1)

- Describe the overall merger and acquisition process.(Solved)

Describe the overall merger and acquisition process.

Date posted: April 14, 2021. Answers (1)

- State and explain the reasons of business mergers.(Solved)

State and explain the reasons of business mergers.

Date posted: April 14, 2021. Answers (1)

- State and explain the types of mergers.(Solved)

State and explain the types of mergers.

Date posted: April 14, 2021. Answers (1)

- XYZ ltd. is considering three possible capital projects for next year. Each project has a 1 year life, and

project returns depend on next years state...(Solved)

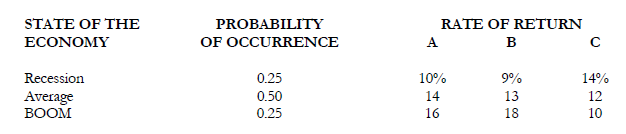

XYZ ltd. is considering three possible capital projects for next year. Each project has a 1 year life, and

project returns depend on next years state of the economy. The estimated rates of return are shown below.

a. Find each project expected rate of return, variance, standard deviation and coefficient of

variation.

b. Compute the correlation coefficient between

i. A and B

ii. A and C

iii. B and C

c. Compute the expected return on a portfolio if the firm invests equal wealth on each asset.

d. Compute the standard deviation of the portfolio.

Date posted: April 13, 2021. Answers (1)

- The risk free rate is 10% and the expected return on the market portfolio is 15%. The expected returns for 4

securities are listed below together...(Solved)

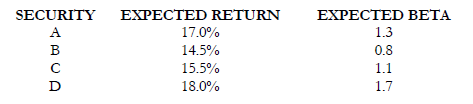

The risk free rate is 10% and the expected return on the market portfolio is 15%. The expected returns for 4

securities are listed below together with their expected betas.

a. On the basis of these expectations, which securities are overvalued? Which are undervalued?

b. If the risk-free rate were to rise to 12% and the expected return on the market portfolio rose to 16%,

which securities would be overvalued? which would be under-valued? (Assume the expected returns

and the betas remain the same).

Date posted: April 13, 2021. Answers (1)

- Securities D, E and F have the following characteristics with respect to expected return, standard deviation

and correlation coefficients.

Compute the expected rate of return and standard...(Solved)

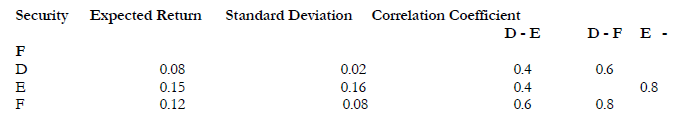

Securities D, E and F have the following characteristics with respect to expected return, standard deviation

and correlation coefficients.

Compute the expected rate of return and standard deviation of a portfolio comprised of equal investment in

each security.

Date posted: April 13, 2021. Answers (1)

- Security returns depend on only three risk factors-inflation, industrial production and the aggregate degree of

risk aversion. The risk free rate is 8%, the required rate...(Solved)

Security returns depend on only three risk factors-inflation, industrial production and the aggregate degree of

risk aversion. The risk free rate is 8%, the required rate of return on a portfolio with unit sensitivity to

inflation and zero-sensitivity to other factors is 13.0%, the required rate of return on a portfolio with unit

sensitivity to industrial production and zero sensitivity to inflation and other factors is 10% and the required

return on a portfolio with unit sensitivity to the degree of risk aversion and zero sensitivity to other factors is

6%. Security i has betas of 0.9 with the inflation portfolio, 1.2 with the industrial production and-0.7 with

risk bearing portfolio—(risk aversion)

Assume also that required rate of return on the market is 15% and stock i has CAPM beta of 1.1

Required:

Compute security i's required rate of return using

a. CAPM

b. APT

Date posted: April 13, 2021. Answers (1)

- Assume that the risk free rate of return is 8%, the market expected rate of return is 12%. The standard deviation of the market return...(Solved)

Assume that the risk free rate of return is 8%, the market expected rate of return is 12%. The standard deviation of the market return is 2% while the covariance of return for security A and the market is 2%.

What is the required rate of return on Security A?

Date posted: April 13, 2021. Answers (1)

- What are efficient portfolios?(Solved)

What are efficient portfolios?

Date posted: April 13, 2021. Answers (1)

- Four assets have the following distribution of returns.a. Compute the expected return and standard deviation of each asset.b. Compute the covariance of asseti. A and...(Solved)

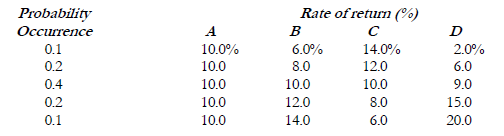

Four assets have the following distribution of returns.

Required.

a. Compute the expected return and standard deviation of each asset.

b. Compute the covariance of asset

i. A and B

ii. B and C

iii. B and D

c. Compute the correlation coefficient of the combination of assets in b above.

Date posted: April 13, 2021. Answers (1)

- Consider two investments A & B each having the following characteristics:

Compute the portfolio standard deviation if the correlation coefficient between the assets is

a. 1

b. 0

c....(Solved)

Consider two investments A & B each having the following characteristics:

Investment Expected Return (%) Proportion

A 20 2/3

B 40 1/3

REQUIRED:

Compute the portfolio standard deviation if the correlation coefficient between the assets is

a. 1

b. 0

c. -1

Date posted: April 13, 2021. Answers (1)

- Consider two investments, A and B each having the following investment characteristics;

Compute the expected return of a portfolio of the two assets.(Solved)

Consider two investments, A and B each having the following investment characteristics;

Investment Expected Return (%) Proportion

A 10 2/3

B 20 1/3

Required.

Compute the expected return of a portfolio of the two assets.

Date posted: April 13, 2021. Answers (1)