- Company A and B are in the same risk class and are identical in every respect except that Company A is

geared while B is not....(Solved)

Company A and B are in the same risk class and are identical in every respect except that Company A is

geared while B is not. Company A has Sh 6 million in 5% bonds outstanding. Both companies earn 10%

before interest and taxes on their Sh 10 million total assets. Assume perfect capital markets, rational

investors, a tax rate of 60% and a capitalization rate of 10% for an all equity company.

Required:

(a) Compute the value of firms A and B using the net income (NI) approach and Net operating income

(NOI) approach.

(b) Using the NOI approach, calculate the after tax weighted average cost of capital for firms A and B.

Which of these firms has the optimal capital structure according to NOI approach? Why?

(c) According to the NOI approach, the values of firms A and B computed in (a) are not in equilibrium.

Assuming that you own 10% of A's shares, show the process which will give you the same amount of

income but at less cost. At what point would this process stop?

Date posted: April 14, 2021. Answers (1)

- State and explain three theories explaining the term structure of interest rates.(Solved)

State and explain three theories explaining the term structure of interest rates.

Date posted: April 14, 2021. Answers (1)

- Assume XYZ ltd is considering a project which costs sh.100 000 to be financed by 50% equity with a cost

of 21.6% and 50% debt with...(Solved)

Assume XYZ ltd is considering a project which costs sh.100 000 to be financed by 50% equity with a cost

of 21.6% and 50% debt with a pre-tax cost of 12%.

The financing method would maintain the company’s overall cost of capital to remain unchanged. The

project is estimated to generate cash flows of sh.36 000 p.a. before interest charges and corporate tax at

33%.

Required:

Evaluate the project using:

NPV method

APV method

Date posted: April 14, 2021. Answers (1)

- Assume that the finance manager of ABC Ltd expects to generate sales of £50 000 in the current financial

year. Analysis of the firms operating cost...(Solved)

Assume that the finance manager of ABC Ltd expects to generate sales of £50 000 in the current financial

year. Analysis of the firms operating cost structure reveals that variable operating cost is 40% of sales and fixed operating cost at £250 000.

The manager wishes to explore the effect of changes in sales and has developed 2 scenarios.

Sales revenue is 10% less than expected

Sales revenue is 10% greater than expected

Required:

Compute EBIT for each of the scenarios and the degree of operating gearing.

Date posted: April 14, 2021. Answers (1)

- financial year and pays interest of 10% as long-term loan of £200 000. The company has 100 000

ordinary shares and the tax rate is 20%....(Solved)

financial year and pays interest of 10% as long-term loan of £200 000. The company has 100 000

ordinary shares and the tax rate is 20%. The finance manager is currently examining 2 scenarios.

A case where EBIT is 25% less than expected.

A case where EBIT is 25% more than expected.

Required.

Compute the EPS under the 3 cases and the degree of financial gearing for both scenario 1 and 2.

Date posted: April 14, 2021. Answers (1)

- State the assumptions of net operating income approach.(Solved)

State the assumptions of net operating income approach.

Date posted: April 14, 2021. Answers (1)

- The problem with selling off profitable publicly owned undertakings is that in the long term government,

and therefore the taxpayer, loses out by forfeiting the future...(Solved)

The problem with selling off profitable publicly owned undertakings is that in the long term government,

and therefore the taxpayer, loses out by forfeiting the future stream of profits.

Required:

Discuss briefly the validity of the above statement.

Date posted: April 14, 2021. Answers (1)

- Discuss and give examples of how governments assist companies in their financing requirements.(Solved)

Discuss and give examples of how governments assist companies in their financing requirements.

Date posted: April 14, 2021. Answers (1)

- Outline how a major refurbishment of publicly funded hospital facilities might affect the Public Sector

Borrowing Requirement.

(Solved)

Outline how a major refurbishment of publicly funded hospital facilities might affect the Public Sector

Borrowing Requirement.

Date posted: April 14, 2021. Answers (1)

- In a mixed economy, two of the objectives of a government could be;

(a) To minimize its borrowing requirements; and

(b) To reduce the taxation of incomes.

Required

(a)...(Solved)

In a mixed economy, two of the objectives of a government could be;

(a) To minimize its borrowing requirements; and

(b) To reduce the taxation of incomes.

Required

(a) Identify the general economic effects of these policies on private sector businesses.

(b) Discuss what particular effects might result from attempts to achieve these objectives by each of:

(i) Reductions in public expenditure;

(ii) Increases in charges made for the products or services of nationalized industries;

(iii) Selling nationalized assets.

Date posted: April 14, 2021. Answers (1)

- Outline the basic steps in capital improvement program.(Solved)

Outline the basic steps in capital improvement program.

Date posted: April 14, 2021. Answers (1)

- Explain the categories of long-term bonds.(Solved)

Explain the categories of long-term bonds.

Date posted: April 14, 2021. Answers (1)

- State and explain the short-term instruments used to generate cash to meet expected spending needs.(Solved)

State and explain the short-term instruments used to generate cash to meet expected spending needs.

Date posted: April 14, 2021. Answers (1)

- Outline the reasons why financial management in government departments is different from financial management in an industrial or commercial company.(Solved)

Outline the reasons why financial management in government departments is different from financial management in an industrial or commercial company.

Date posted: April 14, 2021. Answers (1)

- X Ltd intends to take-over Y Ltd by offering two of its share for every five shares in Y Company Ltd.

Relevant financial data is as...(Solved)

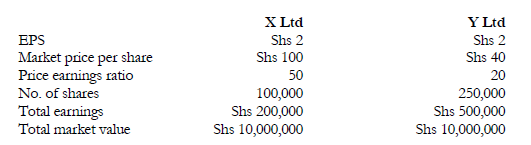

X Ltd intends to take-over Y Ltd by offering two of its share for every five shares in Y Company Ltd.

Relevant financial data is as follows:

Required.

a. Compute the combined EPS & MPS

b. Has wealth been created for shareholders?

Date posted: April 14, 2021. Answers (1)

- The following data are pertinent for companies A and B.

a. If the two companies were to merge and the exchange ratio were one share of...(Solved)

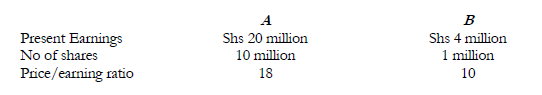

The following data are pertinent for companies A and B.

a. If the two companies were to merge and the exchange ratio were one share of Company A for each share of Company B, what would be the initial impact on earnings per share of the two companies? what is the market value exchange ratio? Is the merger likely to take place?

b. If the exchange ratio were two shares of Company A for each share of Company B what would happen with respect to the above?

c. If the exchange ratio were 1.5 shares of Company A for each share of Company B, what would happen?

d. What exchange ratio would you recommend?

Date posted: April 14, 2021. Answers (1)

- Outline the roles of investment bankers in mergers.(Solved)

Outline the roles of investment bankers in mergers.

Date posted: April 14, 2021. Answers (1)

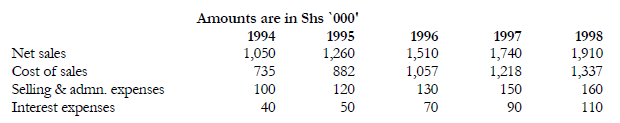

- XYZ Ltd. is considered acquiring ABC Ltd. The following information relates to ABC Ltd. for the next five years. The projected financial data are for...(Solved)

XYZ Ltd. is considered acquiring ABC Ltd. The following information relates to ABC Ltd. for the next five years. The projected financial data are for the post-merger period. The corporate tax rate is 40% for both companies.

Other information

a. After the fifth year the cashflows available to XYZ from ABC is expected to grow by 10% per

annum in perpetuity.

b. ABC will retain Shs 40,000 for internal expansion every year.

c. The cost of capital can be assumed to be 18%.

REQUIRED:

i. Estimate the annual cash flows.

ii. Determine the maximum amount XYZ would be willing to acquire ABC at.

Date posted: April 14, 2021. Answers (1)

- Company A is considering the acquisition by shares of Company B. The following information is also available.

Company B has agreed to an offer of Shs...(Solved)

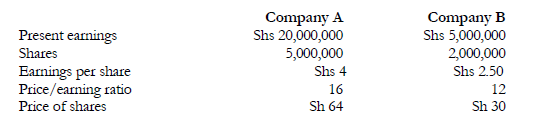

Company A is considering the acquisition by shares of Company B. The following information is also available.

Company B has agreed to an offer of Shs 35 a share to be paid in Company A shares.

Consider the effect of the acquisition to the earnings per share.

Date posted: April 14, 2021. Answers (1)

- Outline the reasons behind failed business mergers.(Solved)

Outline the reasons behind failed business mergers.

Date posted: April 14, 2021. Answers (1)