- Record the following entries in a journal for the year 2011.

- On May 1st bought a vehicle on credit from Kenya motors for Kshs 96,000.

-...(Solved)

Record the following entries in a journal for the year 2011.

- On May 1st bought a vehicle on credit from Kenya motors for Kshs 96,000.

- On May 3rd a debt of Kshs 6,000 owing from John was written off as a bad debt.

- On May 8th credit purchase of furniture for 12,500 was returned to the supplier BB ltd as it was unsuitable and full allowance will be given.

- On May 12th a Ken a debtor who owed us Kshs 4,000 was declared bankrupt and we received Kshs 1050 in full settlement of the debt.

- On May 14th we take goods costing Kshs 3,500 out of the business stock without paying for them.

- On May 28th we discovered that Kshs 1,500 of the insurance paid, belonged to private use.

- On May 30th bought machinery for Kshs 25,000 on credit from Electronics ltd.

Date posted: August 17, 2021. Answers (1)

- Describe a General Journal.(Solved)

Describe a General Journal.

Date posted: August 17, 2021. Answers (1)

- The following transactions relate to Jasho Enterprises. Enter the transactions in the relevant books of original entry and show the postings made in the general...(Solved)

The following transactions relate to Jasho Enterprises. Enter the transactions in the relevant books of original entry and show the postings made in the general ledger.

2013

1/10/2013 Credit purchases from: Martin Sh. 38,000; Mark Sh. 5,000; Mike Sh. 1,060.

3/10/2013 Credit sales to: Rick Sh. 5,100; Raps Sh. 2,460; Rachael Sh. 3,560.

5/10/2013 Credit purchases from: Matthew Sh. 2,000; Mabel Sh.1,800 ; Marshal Sh. 4,100; Michael Sh.660.

8/10/2013 Credit sales to: Stephen Sh. 3,070; Stella Sh. 2,500; Samuel Sh. 1,850.

12/10/2013 Returns outwards to: Mark Sh. 300; Mike Sh. 160.

14/10/2013 Returns inwards from: Raps Sh. 180; Rachael Sh. 220.

20/10/2013 Credit sales to: Raps Sh. 1,880; Shakes Sh. 3,100; Slim Sh. 4,200.

24/10/2013 Credit purchases from: Peter Sh. 5,500; Patrick Sh. 9,000.

31/10/2013 Returns inwards from: Raps Sh. 270; Rick Sh. 300.

31/10/2013 Returns outwards to: Mabel Sh. 130; Michael Sh. 110.

Date posted: August 17, 2021. Answers (1)

- Describe a Return Outwards Journal.(Solved)

Describe a Return Outwards Journal.

Date posted: August 17, 2021. Answers (1)

- Describe a Return Inwards Journal.(Solved)

Describe a Return Inwards Journal.

Date posted: August 17, 2021. Answers (1)

- Describe a Purchases Journal.(Solved)

Describe a Purchases Journal.

Date posted: August 17, 2021. Answers (1)

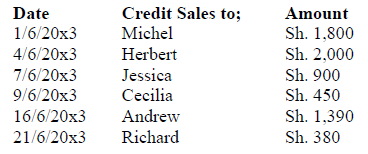

- You are to enter up the sales journal from the following details. Post the items to the relevant accounts in the sales ledger and then...(Solved)

You are to enter up the sales journal from the following details. Post the items to the relevant accounts in the sales ledger and then show the transfer to the sales account in the general ledger.

Date posted: August 17, 2021. Answers (1)

- Describe a Sales Journal.(Solved)

Describe a Sales Journal.

Date posted: August 17, 2021. Answers (1)

- Define the term Journalizing.(Solved)

Define the term Journalizing.

Date posted: August 17, 2021. Answers (1)

- Explain a Credit note.(Solved)

Explain a Credit note.

Date posted: August 17, 2021. Answers (1)

- Explain a Purchase Invoice.(Solved)

Explain a Purchase Invoice.

Date posted: August 17, 2021. Answers (1)

- What is a Sales Invoice?(Solved)

What is a Sales Invoice?

Date posted: August 17, 2021. Answers (1)

- State the steps which the accounting cycle comprises of.(Solved)

State the steps which the accounting cycle comprises of.

Date posted: August 17, 2021. Answers (1)

- The following transactions relate to Kencom Enterprises. You are required to complete the double entry in the relevant accounts for the month of May, 2013.(Solved)

The following transactions relate to Kencom Enterprises. You are required to complete the double entry in the relevant accounts for the month of May, 2013.

01/05/2013: Started business by depositing Ksh 200,000 in the bank.

02/05/2013: Purchased goods worth Ksh 17,500 on credit from MM Wholesalers.

03/05/2013: Bought Equipment for Ksh 15,000 paying by cheque.

05/05/2013: Sold goods for cash worth Ksh 27,500.

06/05/2013: Bought goods on credit worth Ksh 11,400 from Pp Shah.

10/05/2013: Paid rent by cash Ksh 1,500.

12/05/2013: Bought stationery for Ksh 2,700, paying in cash.

18/05/2013: Goods returned to MM Wholesalers were amounting to Ksh 2,300.

21/05/2013: Received rent by cheque for Ksh 500.

23/05/2013: Sold goods on credit to Unity for Ksh 7,700.

24/05/2013: Bought a motor vehicle paying by cheque Ksh 30,000.

30/05/2013: Paid the wages by cash amounting to Ksh 11,700.

31/05/2013: The owner made cash drawings for personal use worth Ksh 4,400.

Date posted: August 17, 2021. Answers (1)

- Explain the accounts that record any decrease in stock.(Solved)

Explain the accounts that record any decrease in stock.

Date posted: August 17, 2021. Answers (1)

- State and explain two accounts that record any increase in stock.(Solved)

State and explain two accounts that record any increase in stock.

Date posted: August 17, 2021. Answers (1)

- Explain the Accounting for Expenses.(Solved)

Explain the Accounting for Expenses.

Date posted: August 17, 2021. Answers (1)

- Explain the Accounting for Income.(Solved)

Explain the Accounting for Income.

Date posted: August 17, 2021. Answers (1)

- Explain the Accounting for Purchases.(Solved)

Explain the Accounting for Purchases.

Date posted: August 17, 2021. Answers (1)

- Explain the Accounting for Sales.(Solved)

Explain the Accounting for Sales.

Date posted: August 17, 2021. Answers (1)