Discounts are allowances given by a trader or manufacturer to another trader or customer to enable or encourage them pay promptly or buy in bulk or earn profits. Discounts can be classified into either:

i. Trade Discount

ii. Quantity Discount

iii. Cash Discount

- Discount Allowed

- Discount received

- Trade Discount

Trade discount is allowance given by a trader to another trader to enable them earn a profit on goods that have low profit margin or have fixed prices.

- Quantity Discount

Quantity discount is allowance given by a trader to encourage bulk purchasing from the customers.

Accounting treatment for Trade and Quantity discounts;

These discounts are shown as a deduction from invoice price and only NET AMOUNT paid or received is treated in the books of accounts.

- Cash Discount

Cash discount is allowance given to encourage buyers or customers to pay promptly within the stipulated period.

Cash discount is further sub-divided into;

(i) DISCOUNT ALLOWED

Discounts allowed are allowances made by a business firm on the amounts receivable from customers so as to encourage prompt payment. The amount for discount allowed is deducted from the sales invoice. This allowance given to debtors and is treated as an EXPENSE.

Accounting treatment for Discount Allowed

When incurred Debit : Discount allowed Account

Credit : Debtors Account/ Accounts Receivable

At year end Debit : Income Statement/ Profit and loss Account

Credit : Discount allowed Account

(ii) DISCOUNT RECEIVED

Discounts received are allowances given by the creditors or suppliers to a business firm to encourage payment of amount due within the agreed time. The amount for discount received is deducted from the invoice price.

This allowance is given by creditors and is treated as INCOME.

Accounting treatment for Discount Received

When earned Debit : Creditors Account/ Account Payable

Credit : Discount received Account

At year end Debit : Discount received Account

Credit : Income Statement/ Profit and loss Account

Kavungya answered the question on August 17, 2021 at 08:45

- Explain the types of cash books.(Solved)

Explain the types of cash books.

Date posted: August 17, 2021. Answers (1)

- Explain a Cash Book.(Solved)

Explain a Cash Book.

Date posted: August 17, 2021. Answers (1)

- Using a diagram, illustrate the Classification of Accounts.(Solved)

Using a diagram, illustrate the Classification of Accounts.

Date posted: August 17, 2021. Answers (1)

- Prepare journal entries to record the following transactions that took place in the month of February, 2013:

01/02/2013: Bought office fittings on credit from Heritage Ltd...(Solved)

Prepare journal entries to record the following transactions that took place in the month of February, 2013:

01/02/2013: Bought office fittings on credit from Heritage Ltd for Ksh 77,000.

05/02/2013: Goods costing Ksh 34,000 were taken out of the business without paying for them.

08/02/2013: Ksh 6,800 of the goods taken by us on 5th February is returned back into the business stock by us and no money is taken in exchange for the return.

13/02/2013: Johnson owes us Ksh 26,400 and he is unable to pay his debt so we agree to take some of his computers worth the same amount to cancel his debt.

17/02/2013: Paid Heritage Ltd Ksh 50,000 by cheque in partial settlement of the amount due.

25/02/2013: A debt owing to us by Hicks of Ksh 13,450 is written off as a bad debt.

28/02/2013: Bought equipment on credit from ART Ltd for Ksh 31,500.

Date posted: August 17, 2021. Answers (1)

- Record the following entries in a journal for the year 2011.

- On May 1st bought a vehicle on credit from Kenya motors for Kshs 96,000.

-...(Solved)

Record the following entries in a journal for the year 2011.

- On May 1st bought a vehicle on credit from Kenya motors for Kshs 96,000.

- On May 3rd a debt of Kshs 6,000 owing from John was written off as a bad debt.

- On May 8th credit purchase of furniture for 12,500 was returned to the supplier BB ltd as it was unsuitable and full allowance will be given.

- On May 12th a Ken a debtor who owed us Kshs 4,000 was declared bankrupt and we received Kshs 1050 in full settlement of the debt.

- On May 14th we take goods costing Kshs 3,500 out of the business stock without paying for them.

- On May 28th we discovered that Kshs 1,500 of the insurance paid, belonged to private use.

- On May 30th bought machinery for Kshs 25,000 on credit from Electronics ltd.

Date posted: August 17, 2021. Answers (1)

- Describe a General Journal.(Solved)

Describe a General Journal.

Date posted: August 17, 2021. Answers (1)

- The following transactions relate to Jasho Enterprises. Enter the transactions in the relevant books of original entry and show the postings made in the general...(Solved)

The following transactions relate to Jasho Enterprises. Enter the transactions in the relevant books of original entry and show the postings made in the general ledger.

2013

1/10/2013 Credit purchases from: Martin Sh. 38,000; Mark Sh. 5,000; Mike Sh. 1,060.

3/10/2013 Credit sales to: Rick Sh. 5,100; Raps Sh. 2,460; Rachael Sh. 3,560.

5/10/2013 Credit purchases from: Matthew Sh. 2,000; Mabel Sh.1,800 ; Marshal Sh. 4,100; Michael Sh.660.

8/10/2013 Credit sales to: Stephen Sh. 3,070; Stella Sh. 2,500; Samuel Sh. 1,850.

12/10/2013 Returns outwards to: Mark Sh. 300; Mike Sh. 160.

14/10/2013 Returns inwards from: Raps Sh. 180; Rachael Sh. 220.

20/10/2013 Credit sales to: Raps Sh. 1,880; Shakes Sh. 3,100; Slim Sh. 4,200.

24/10/2013 Credit purchases from: Peter Sh. 5,500; Patrick Sh. 9,000.

31/10/2013 Returns inwards from: Raps Sh. 270; Rick Sh. 300.

31/10/2013 Returns outwards to: Mabel Sh. 130; Michael Sh. 110.

Date posted: August 17, 2021. Answers (1)

- Describe a Return Outwards Journal.(Solved)

Describe a Return Outwards Journal.

Date posted: August 17, 2021. Answers (1)

- Describe a Return Inwards Journal.(Solved)

Describe a Return Inwards Journal.

Date posted: August 17, 2021. Answers (1)

- Describe a Purchases Journal.(Solved)

Describe a Purchases Journal.

Date posted: August 17, 2021. Answers (1)

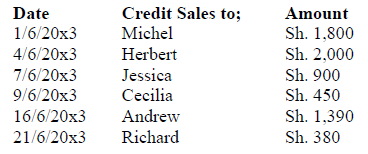

- You are to enter up the sales journal from the following details. Post the items to the relevant accounts in the sales ledger and then...(Solved)

You are to enter up the sales journal from the following details. Post the items to the relevant accounts in the sales ledger and then show the transfer to the sales account in the general ledger.

Date posted: August 17, 2021. Answers (1)

- Describe a Sales Journal.(Solved)

Describe a Sales Journal.

Date posted: August 17, 2021. Answers (1)

- Define the term Journalizing.(Solved)

Define the term Journalizing.

Date posted: August 17, 2021. Answers (1)

- Explain a Credit note.(Solved)

Explain a Credit note.

Date posted: August 17, 2021. Answers (1)

- Explain a Purchase Invoice.(Solved)

Explain a Purchase Invoice.

Date posted: August 17, 2021. Answers (1)

- What is a Sales Invoice?(Solved)

What is a Sales Invoice?

Date posted: August 17, 2021. Answers (1)

- State the steps which the accounting cycle comprises of.(Solved)

State the steps which the accounting cycle comprises of.

Date posted: August 17, 2021. Answers (1)

- The following transactions relate to Kencom Enterprises. You are required to complete the double entry in the relevant accounts for the month of May, 2013.(Solved)

The following transactions relate to Kencom Enterprises. You are required to complete the double entry in the relevant accounts for the month of May, 2013.

01/05/2013: Started business by depositing Ksh 200,000 in the bank.

02/05/2013: Purchased goods worth Ksh 17,500 on credit from MM Wholesalers.

03/05/2013: Bought Equipment for Ksh 15,000 paying by cheque.

05/05/2013: Sold goods for cash worth Ksh 27,500.

06/05/2013: Bought goods on credit worth Ksh 11,400 from Pp Shah.

10/05/2013: Paid rent by cash Ksh 1,500.

12/05/2013: Bought stationery for Ksh 2,700, paying in cash.

18/05/2013: Goods returned to MM Wholesalers were amounting to Ksh 2,300.

21/05/2013: Received rent by cheque for Ksh 500.

23/05/2013: Sold goods on credit to Unity for Ksh 7,700.

24/05/2013: Bought a motor vehicle paying by cheque Ksh 30,000.

30/05/2013: Paid the wages by cash amounting to Ksh 11,700.

31/05/2013: The owner made cash drawings for personal use worth Ksh 4,400.

Date posted: August 17, 2021. Answers (1)

- Explain the accounts that record any decrease in stock.(Solved)

Explain the accounts that record any decrease in stock.

Date posted: August 17, 2021. Answers (1)

- State and explain two accounts that record any increase in stock.(Solved)

State and explain two accounts that record any increase in stock.

Date posted: August 17, 2021. Answers (1)