- The debtors account for ABC Ltd was Ksh 500,000 by end of the year 2013. Bad debts amounting to Ksh 50,000 were written off from...(Solved)

The debtors account for ABC Ltd was Ksh 500,000 by end of the year 2013. Bad debts amounting to Ksh 50,000 were written off from this balance. The specific provision stood at Ksh 10,000 while the general provision was maintained at 5% on the debtors balance.

Required:

i. Debtors Account

ii. Bad debts Account

iii. Provision for bad debts Accounts

iv. Income statement Extract

v. Balance sheet Extract

Date posted: August 17, 2021. Answers (1)

- What is a Prepaid Income?(Solved)

What is a Prepaid Income?

Date posted: August 17, 2021. Answers (1)

- Describe Prepaid Expenses.(Solved)

Describe Prepaid Expenses.

Date posted: August 17, 2021. Answers (1)

- Define the term Accrued Income.(Solved)

Define the term Accrued Income.

Date posted: August 17, 2021. Answers (1)

- Define Accrued Expenses.(Solved)

Define Accrued Expenses.

Date posted: August 17, 2021. Answers (1)

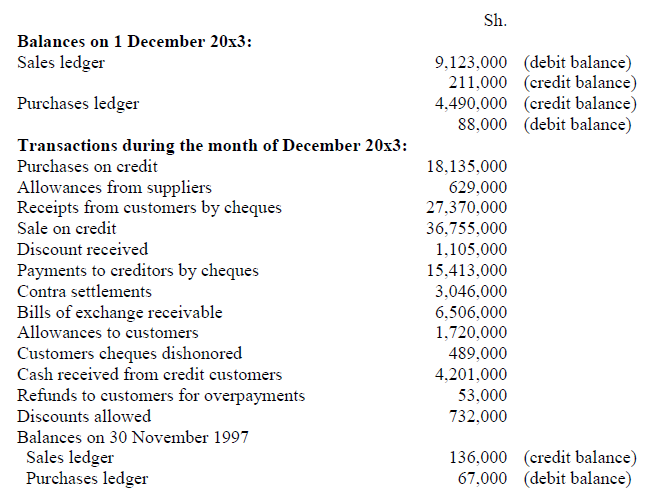

- The following transactions relate to Jaime Ltd for the month of December 2013. Prepare sales ledger and purchases ledger control account for that month.(Solved)

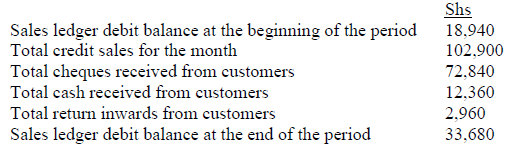

The following transactions relate to Jaime Ltd for the month of December 2013. Prepare sales ledger and purchases ledger control account for that month.

Date posted: August 17, 2021. Answers (1)

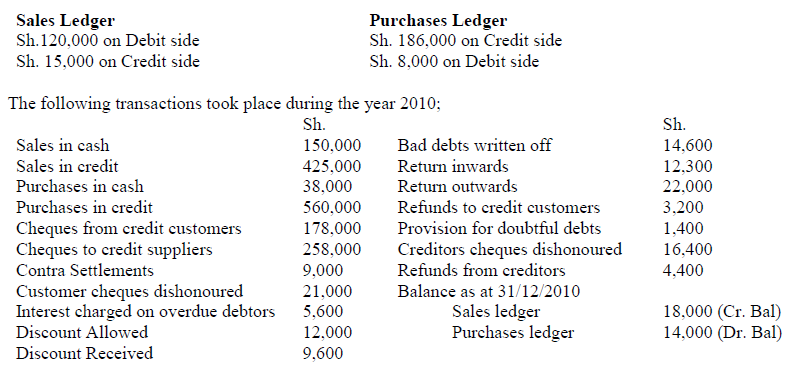

- The following information was obtained from Juja traders as at 31/12/2010. Balances as at 1st January 2010 are as follows;

Required: Prepare sales ledger and purchases...(Solved)

The following information was obtained from Juja traders as at 31/12/2010. Balances as at 1st January 2010 are as follows;

Required: Prepare sales ledger and purchases ledger control accounts.

Date posted: August 17, 2021. Answers (1)

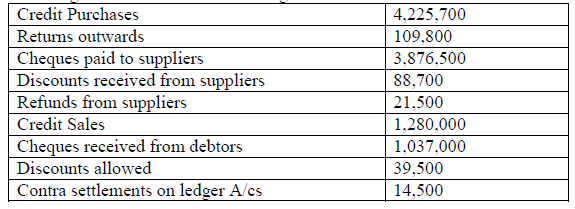

- The following information relates to Zeta Ltd for the month of June, 2013.

Balances as at 1st June,2013

Sales Ledger Sh. 642,000...(Solved)

The following information relates to Zeta Ltd for the month of June, 2013.

Balances as at 1st June,2013

Sales Ledger Sh. 642,000 on Debit side

Purchases Ledger Sh. 103,700 on Credit side

The following were the transactions during the month

Compute the information to Purchases and Sales ledger accounts.

Date posted: August 17, 2021. Answers (1)

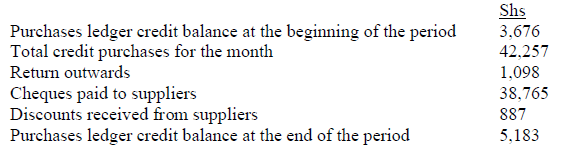

- Prepare a Purchases Ledger Control A/c from the following details for the month of June 2008.(Solved)

Prepare a Purchases Ledger Control A/c from the following details for the month of June 2008.

Date posted: August 17, 2021. Answers (1)

- State the items that decrease creditor’s balance.(Solved)

State the items that decrease creditor’s balance.

Date posted: August 17, 2021. Answers (1)

- State the items that increase creditor’s balance.(Solved)

State the items that increase creditor’s balance.

Date posted: August 17, 2021. Answers (1)

- Draw a Sales Ledger control A/c to record the following details relating to a business.(Solved)

Draw a Sales Ledger control A/c to record the following details relating to a business.

Date posted: August 17, 2021. Answers (1)

- State the items that decrease debtor’s balance.(Solved)

State the items that decrease debtor’s balance.

Date posted: August 17, 2021. Answers (1)

- State the items that increase debtor’s balance.(Solved)

State the items that increase debtor’s balance.

Date posted: August 17, 2021. Answers (1)

- What are Control Accounts?(Solved)

What are Control Accounts?

Date posted: August 17, 2021. Answers (1)

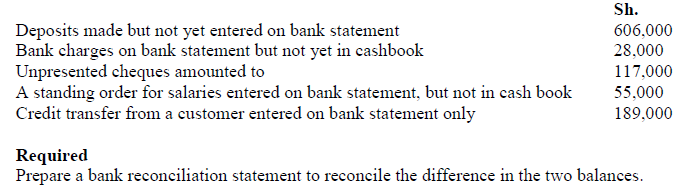

- The following cash book relates to Jockey Ltd for the month of October, 20x3. The bank statement had a debit balance of Sh 1,353,000.

Required:

Prepare an...(Solved)

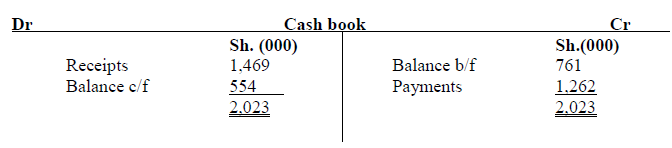

The following cash book relates to Jockey Ltd for the month of October, 2013. The bank statement had a debit balance of Sh 1,353,000.

On investigation the following was discovered;

1. Bank charges of Sh. 136,000 in the bank statement have not been reflected in the cash book.

2. Cheques drawn amounting to Sh. 267,000 had not been presented to the bank for payment.

3. Cheques received totaling to Sh. 726,000 had been entered in the cash book but credited by the bank by 3rd November.

4. A cheque for Sh. 22,000 for expenses had been entered in the cash book as a receipt instead of a payment

5. A cheque received from John for Sh. 80,000 had been returned by the bank and marked “No Funds Available”. No adjustment has been made in the cash book

6. A standing order for business rates of Ksh 150,000 on 30th October had not been entered in the cash book.

7. Dividends of Sh. 62,000 were received and credited directly to the bank account with no entries in the cash book.

8. A cheque drawn for Sh. 66,000 for stationery had been incorrectly entered in the cash book as Sh. 60,000.

9. The balance brought forward in the cash book should have been Sh. 711,000 not Sh. 761,000.

Required:

Prepare an adjusted cash book and a bank reconciliation statement as at 31 October, 20x3 to reconcile the difference in the cash book and bank statement balance.

Date posted: August 17, 2021. Answers (1)

- Haze Ltd had a Credit balance of Ksh 351,300 in the bank statement and a debit balance of Ksh 389,600. Upon investigation the following transactions...(Solved)

Haze Ltd had a Credit balance of Ksh 351,300 in the bank statement and a debit balance of Ksh 389,600. Upon investigation the following transactions were missing in the books of accounts.

Date posted: August 17, 2021. Answers (1)

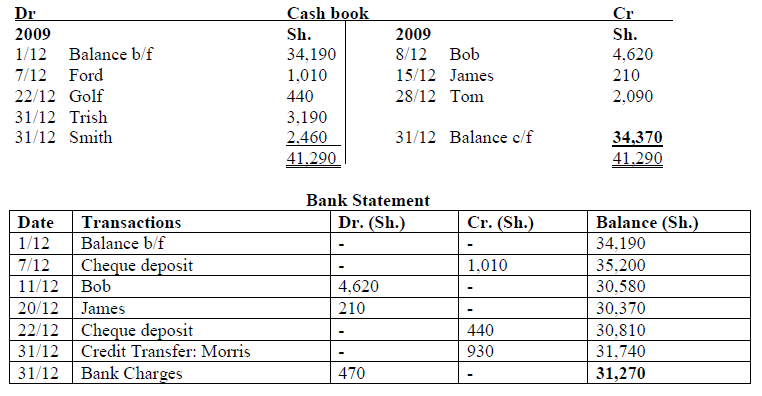

- The following bank statement and cash book relates to Sunshine Enterprises. Prepare an updated cash book and a bank reconciliation statement to explain the difference...(Solved)

The following bank statement and cash book relates to Sunshine Enterprises. Prepare an updated cash book and a bank reconciliation statement to explain the difference in their balance as on 31st December 2013.

Date posted: August 17, 2021. Answers (1)

- Outline the steps in preparing a bank reconciliation statement.(Solved)

Outline the steps in preparing a bank reconciliation statement.

Date posted: August 17, 2021. Answers (1)

- State and explain the items appearing in the bank statement and not reflected in the cashbook.(Solved)

State and explain the items appearing in the bank statement and not reflected in the cashbook.

Date posted: August 17, 2021. Answers (1)