- A business firm started trading on 1st January in year 2013. On 1st April, it bought a new motor vehicle costing Ksh 400,000 and later...(Solved)

A business firm started trading on 1st January in year 2013. On 1st April, it bought a new motor vehicle costing Ksh 400,000 and later on 1st July it bought another motor vehicle costing Ksh 550,000. The financial year for the business ends on 31st December and it has a policy of depreciating motor vehicles at 20% p.a. using straight line basis.

Required:

i. Motor vehicle account as at 31st December 2013

ii. Provision for depreciation account as at 31st December 2013

iii. Income statement extract for year ending 31st December 2013

iv. Cash/ bank account extract

Date posted: August 17, 2021. Answers (1)

- A machine is expected to produce 10,000 electrical gadgets in its useful life. It has a cost of Sh. 6,000 and has an expected salvage...(Solved)

A machine is expected to produce 10,000 electrical gadgets in its useful life. It has a cost of Sh. 6,000 and has an expected salvage value of Sh. 1,000. If in the first year a total of 1,500 gadgets are produced, what is the depreciation for the year?

Date posted: August 17, 2021. Answers (1)

- Describe the Unit of Output Method of calculating depreciation.(Solved)

Describe the Unit of Output Method of calculating depreciation.

Date posted: August 17, 2021. Answers (1)

- Describe the Depletion Unit Method of calculating depreciation.(Solved)

Describe the Depletion Unit Method of calculating depreciation.

Date posted: August 17, 2021. Answers (1)

- Describe the Machine Hour Method of calculating depreciation.(Solved)

Describe the Machine Hour Method of calculating depreciation.

Date posted: August 17, 2021. Answers (1)

- Describe the Sum of Years Digits Method of calculating depreciation.(Solved)

Describe the Sum of Years Digits Method of calculating depreciation.

Date posted: August 17, 2021. Answers (1)

- Describe the Revaluation Method of calculating depreciation.(Solved)

Describe the Revaluation Method of calculating depreciation.

Date posted: August 17, 2021. Answers (1)

- A company purchased a machine at a cost of Sh. 450,000. The estimated life of this machine is 5 years. Using the sum of years...(Solved)

A company purchased a machine at a cost of Sh. 450,000. The estimated life of this machine is 5 years. Using the sum of years digits determine its depreciation.

Date posted: August 17, 2021. Answers (1)

- Calculate the reducing balance depreciation charged at 20% for the first 3 years on a machine bought for Sh. 10,000.(Solved)

Calculate the reducing balance depreciation charged at 20% for the first 3 years on a machine bought for Sh. 10,000.

Date posted: August 17, 2021. Answers (1)

- Define the Reducing Balance Method of calculating depreciation.(Solved)

Define the Reducing Balance Method of calculating depreciation.

Date posted: August 17, 2021. Answers (1)

- Describe the Straight Line Method of calculating depreciation.(Solved)

Describe the Straight Line Method of calculating depreciation.

Date posted: August 17, 2021. Answers (1)

- A Machine was bought for Sh. 220,000 and it was estimated to be in operation for 4 years with a residue value of Sh. 20,000....(Solved)

A Machine was bought for Sh. 220,000 and it was estimated to be in operation for 4 years with a residue value of Sh. 20,000. Calculate the depreciation expense for each year.

Date posted: August 17, 2021. Answers (1)

- A business firm that had previously written of bad debts amounting to Ksh 34,000 now recovers the same amount that was paid by cheque. In...(Solved)

A business firm that had previously written of bad debts amounting to Ksh 34,000 now recovers the same amount that was paid by cheque. In the same financial year the debtor account amount to Ksh 270,000 and out of this the firm will write off bad debts amounting Ksh 20,000.

Required:

i. Debtors Account

ii. Bad debts (written off) Account

iii. Bad debts recovered Account

iv. Bank Account

Date posted: August 17, 2021. Answers (1)

- XYZ Ltd started trading on 1 January 2013. The following are some of the bad debts that were written off during two years that XYZ...(Solved)

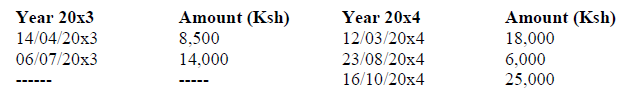

XYZ Ltd started trading on 1 January 2013. The following are some of the bad debts that were written off during two years that XYZ Ltd has been trading.

On 31 December 20x3 debtors balance was Ksh 4,050,000. Provision for bad debts was maintained at 3%.

On 31 December 20x4 debtors balance increased to Ksh 4,730,000. Provision for bad debts was maintained at 5%.

Required:

i. Debtors Account for the two years

ii. Bad debts Account for the two years

iii. Provision for bad debts Accounts for the two years

iv. Income statement Extract for the two years

v. Balance sheet Extract for the two years

Date posted: August 17, 2021. Answers (1)

- The debtors account for ABC Ltd was Ksh 500,000 by end of the year 2013. Bad debts amounting to Ksh 50,000 were written off from...(Solved)

The debtors account for ABC Ltd was Ksh 500,000 by end of the year 2013. Bad debts amounting to Ksh 50,000 were written off from this balance. The specific provision stood at Ksh 10,000 while the general provision was maintained at 5% on the debtors balance.

Required:

i. Debtors Account

ii. Bad debts Account

iii. Provision for bad debts Accounts

iv. Income statement Extract

v. Balance sheet Extract

Date posted: August 17, 2021. Answers (1)

- What is a Prepaid Income?(Solved)

What is a Prepaid Income?

Date posted: August 17, 2021. Answers (1)

- Describe Prepaid Expenses.(Solved)

Describe Prepaid Expenses.

Date posted: August 17, 2021. Answers (1)

- Define the term Accrued Income.(Solved)

Define the term Accrued Income.

Date posted: August 17, 2021. Answers (1)

- Define Accrued Expenses.(Solved)

Define Accrued Expenses.

Date posted: August 17, 2021. Answers (1)

- The following transactions relate to Jaime Ltd for the month of December 2013. Prepare sales ledger and purchases ledger control account for that month.(Solved)

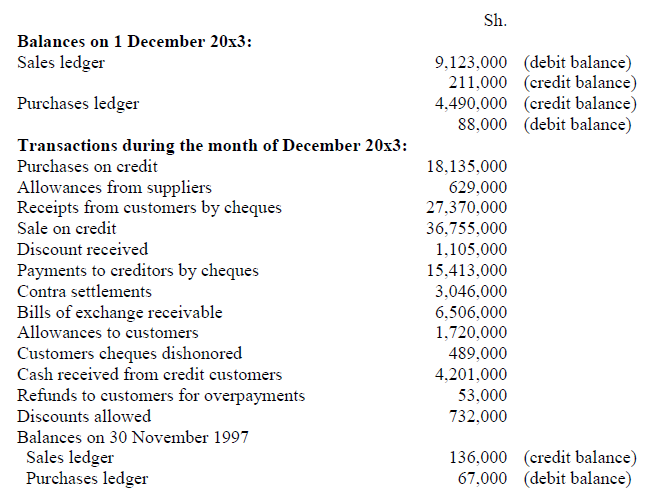

The following transactions relate to Jaime Ltd for the month of December 2013. Prepare sales ledger and purchases ledger control account for that month.

Date posted: August 17, 2021. Answers (1)