-

Describe an Income Statement.

(Solved)

Describe an Income Statement.

Date posted:

August 17, 2021

.

Answers (1)

-

A company depreciates its plant at the rate of 20% p.a. straight line method for each month of ownership.

On 1st January 1999 bought plant costing...

(Solved)

A company depreciates its plant at the rate of 20% p.a. straight line method for each month of ownership.

On 1st January 1999 bought plant costing Sh. 9,000. On 1st October 1999 also bought plant costing Sh. 6,000. On 1st July 2001 bought plant costing Sh. 5,500.

On 30th September 2002, the plant that had been bought for Sh. 9,000 on 1st January 1999 was sold for Sh. 2,750.

Required:

(a) Plant A/c

(b) Provision for depreciation A/c

(c) Disposal A/c

Date posted:

August 17, 2021

.

Answers (1)

-

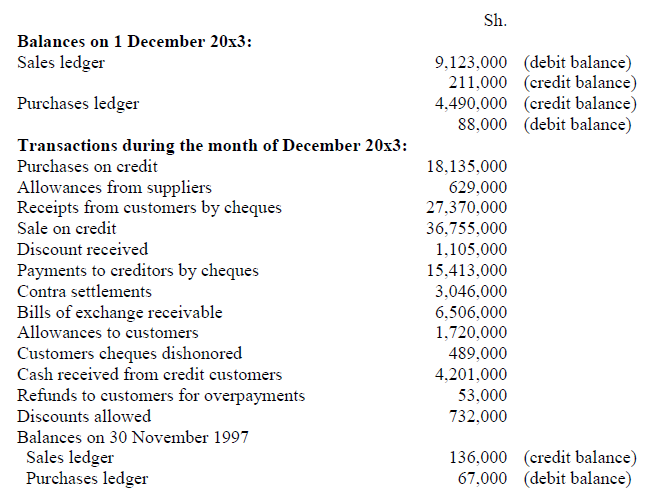

The following transactions relate to Jaime Ltd for the month of December 2013. Prepare sales ledger and purchases ledger control account for that month.

(Solved)

The following transactions relate to Jaime Ltd for the month of December 2013. Prepare sales ledger and purchases ledger control account for that month.

Date posted:

August 17, 2021

.

Answers (1)

-

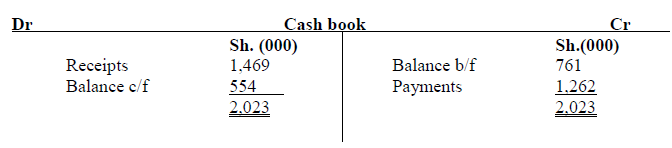

The following cash book relates to Jockey Ltd for the month of October, 20x3. The bank statement had a debit balance of Sh 1,353,000.

Required:

Prepare an...

(Solved)

The following cash book relates to Jockey Ltd for the month of October, 2013. The bank statement had a debit balance of Sh 1,353,000.

On investigation the following was discovered;

1. Bank charges of Sh. 136,000 in the bank statement have not been reflected in the cash book.

2. Cheques drawn amounting to Sh. 267,000 had not been presented to the bank for payment.

3. Cheques received totaling to Sh. 726,000 had been entered in the cash book but credited by the bank by 3rd November.

4. A cheque for Sh. 22,000 for expenses had been entered in the cash book as a receipt instead of a payment

5. A cheque received from John for Sh. 80,000 had been returned by the bank and marked “No Funds Available”. No adjustment has been made in the cash book

6. A standing order for business rates of Ksh 150,000 on 30th October had not been entered in the cash book.

7. Dividends of Sh. 62,000 were received and credited directly to the bank account with no entries in the cash book.

8. A cheque drawn for Sh. 66,000 for stationery had been incorrectly entered in the cash book as Sh. 60,000.

9. The balance brought forward in the cash book should have been Sh. 711,000 not Sh. 761,000.

Required:

Prepare an adjusted cash book and a bank reconciliation statement as at 31 October, 20x3 to reconcile the difference in the cash book and bank statement balance.

Date posted:

August 17, 2021

.

Answers (1)

-

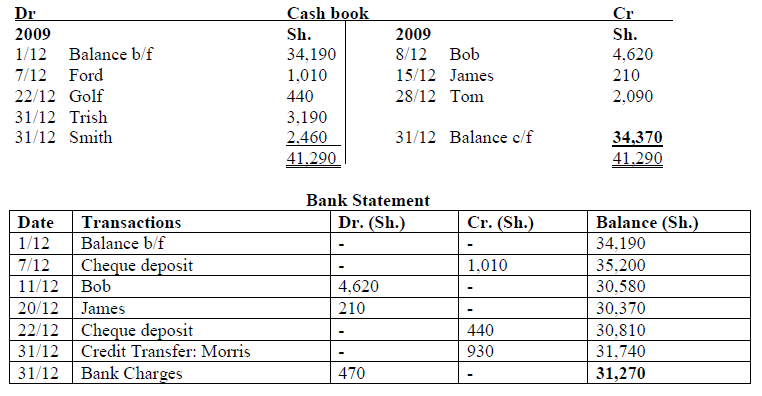

The following bank statement and cash book relates to Sunshine Enterprises. Prepare an updated cash book and a bank reconciliation statement to explain the difference...

(Solved)

The following bank statement and cash book relates to Sunshine Enterprises. Prepare an updated cash book and a bank reconciliation statement to explain the difference in their balance as on 31st December 2013.

Date posted:

August 17, 2021

.

Answers (1)

-

State and explain the items appearing in the bank statement and not reflected in the cashbook.

(Solved)

State and explain the items appearing in the bank statement and not reflected in the cashbook.

Date posted:

August 17, 2021

.

Answers (1)

-

Explain the items that appear in The Cashbook and do not reflect in the Bank Statement.

(Solved)

Explain the items that appear in The Cashbook and do not reflect in the Bank Statement.

Date posted:

August 17, 2021

.

Answers (1)

-

Tempo Ltd prepared a trial balance that failed to balance having a shortage on the credit side. A suspense account was opened for the difference....

(Solved)

Tempo Ltd prepared a trial balance that failed to balance having a shortage on the credit side. A suspense account was opened for the difference. Upon some thorough investigations the following errors were discovered.

a) Sales day book had been undercast by Sh 4,000.

b) Credit sales of Sh 12,200 to JJ Electronics had been debited in error to JJ Enterprise account.

c) Rent account had been undercast by Sh 18,000.

d) Discounts Allowed account had been overcast by Sh 2,000.

e) The sale of a computer at net book value had been credited in error to the Sales account Sh 4,600.

Required:

i. Journal entries to correct the discovered errors.

ii. A suspense account and determine the difference as per the trial balance.

Date posted:

August 17, 2021

.

Answers (1)

-

The trial balance for XYZ ltd at 31 December 2013 showed a difference of Sh. 8,000, being a shortage on the debit side. Show the...

(Solved)

The trial balance for XYZ ltd at 31 December 2013 showed a difference of Sh. 8,000, being a shortage on the debit side. Show the journal entries to correct the following errors and prepare a suspense account.

1. Extra capital of Sh. 5,000 paid into the bank had been credited to sales account.

2. Sales account had been overcast by Sh. 9000

3. Insurance expense was undercast by Sh. 4,000

4. Private rent of Sh. 1,900 had been debited in the rent account.

5. Cash of Sh. 5000 received from a debtor was entered in the cash book only.

6. A credit purchase of Sh. 5,900 was entered in the books as Sh. 9,500

Date posted:

August 17, 2021

.

Answers (1)

-

Describe the Petty Cash Book and the Imprest system of Accounting.

(Solved)

Describe the Petty Cash Book and the Imprest system of Accounting.

Date posted:

August 17, 2021

.

Answers (1)

-

Michael Kamau runs a general groceries shop in Nairobi. The following transactions relate to the shop for the month of September 2013.

Sept 1st : Cash...

(Solved)

Michael Kamau runs a general groceries shop in Nairobi. The following transactions relate to the shop for the month of September 2013.

Sept 1st : Cash in hand Sh. 31,400; Bank balance Sh. 50,800; Capital account Sh. 82,200

Sept 3rd: Bought goods in cash for Sh. 8,200

Sept 4th: Purchased goods on credit from Jambo ltd for Sh. 11,600 less 10% trade discount.

Sept 7th: Sold goods on credit to Simon at Sh. 17,800 less 20% trade discount.

Sept 10th: Withdrew cash from the bank amounting to Sh. 1,000 for private use.

Sept 12th: Sold goods on credit to Eric at Sh. 12,800.

Sept 14th: Paid Sh. 10,000 in cash to Jambo ltd in full settlement of their account.

Sept 15th: Received Sh. 8,000 in cash from Eric in part settlement of his account

Sept 17th: Goods worth Sh. 800 were returned by Eric.

Sept 21th: Purchased goods on credit at Sh. 17,400 from Shauri ltd.

Sept 24th: Paid Sh. 12,000 to Shauri ltd by cheque; discount given was Sh. 600.

Sept 25th: Purchased furniture on credit from Magic furniture for Sh. 16,000

Sept 26th: Transferred Sh. 4,400 from the cash till to the bank account.

Sept 27th: Eric was declared bankrupt and could only pay Sh.2,000 of the debt by cheque the rest being treated as a bad debt.

Sept 28th: Goods worth Sh. 1,200 were returned to Shauri ltd.

Sept 29th: Goods worth Sh. 800 were taken by Michael Kamau for his personal use.

Sept 29th: Paid Sh. 1000 by cheque for advertising.

Sept 29th: Paid wages to shop assistant in cash amounting to Sh. 3,600.

Sept 29th: Made cash sales of Sh. 43,600

Sept 29th: Banked Sh. 40,000

Sept 29th: Received cash of Sh. 11,800 from Simon in part payment of their account after allowing a discount of Sh. 200.

Required;

a) Record the above transactions in the appropriate ledger accounts including the three column cash book.

b) Extract a trial balance as at 30th September 2013.

Date posted:

August 17, 2021

.

Answers (1)

-

Describe a Return Outwards Journal.

(Solved)

Describe a Return Outwards Journal.

Date posted:

August 17, 2021

.

Answers (1)

-

Describe a Return Inwards Journal.

(Solved)

Describe a Return Inwards Journal.

Date posted:

August 17, 2021

.

Answers (1)