a. Balance sheet: This indicates the financial position of a firm at a given point, in time. It shows the assets/resources of the firm and the respective liabilities that were incurred to finance these assets.

b. Income Statement: This indicates the financial performance of a firm during a given financial year. This performance is indicated by profitability of the firm.

Titany answered the question on December 14, 2021 at 06:25

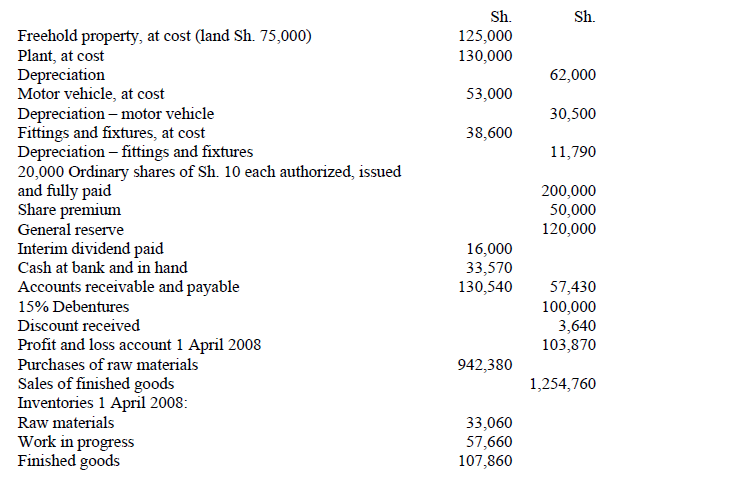

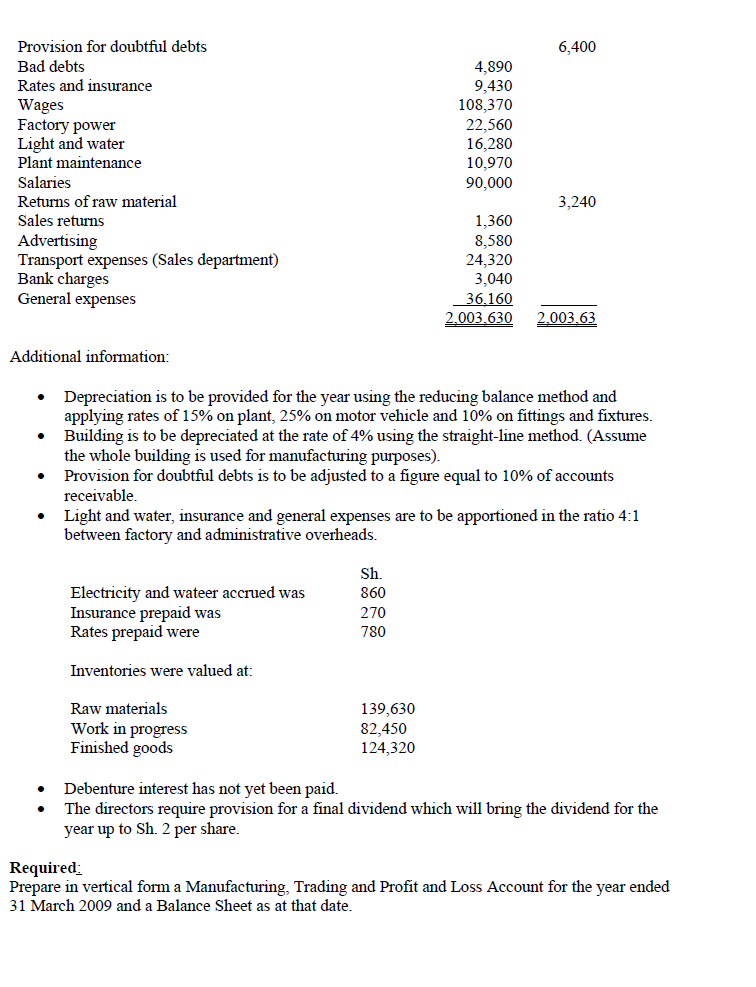

- Mwanga and Sons Ltd is a small manufacturing firm owned by members of the family. The

following trial balance was extracted from the books of the...(Solved)

Mwanga and Sons Ltd is a small manufacturing firm owned by members of the family. The

following trial balance was extracted from the books of the company as at 31 March 2009:

Date posted: December 10, 2021. Answers (1)

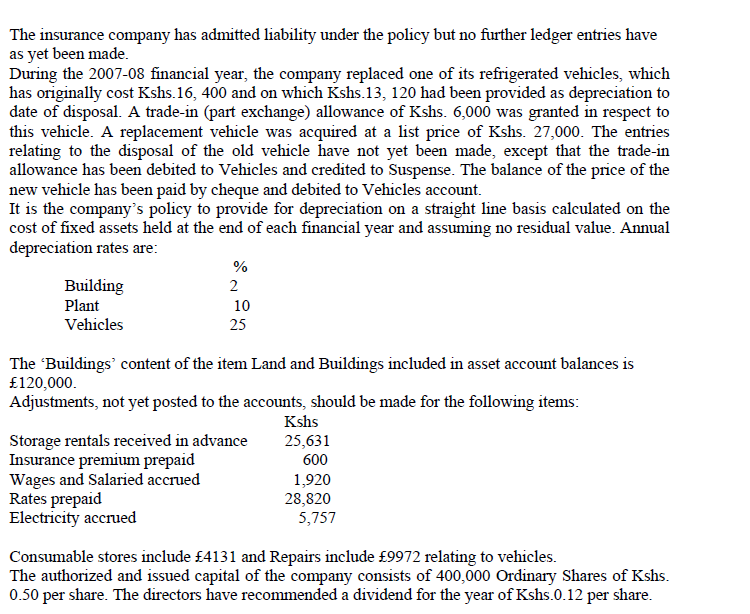

- Owik-Freez p.l.c. is a company which provides refrigerated storage facilities to local farmers.

Services offered include the collection of produce, the use of rapid freezing equipment,...(Solved)

Owik-Freez p.l.c. is a company which provides refrigerated storage facilities to local farmers.

Services offered include the collection of produce, the use of rapid freezing equipment, storage of the frozen produce and transport from frozen storage in refrigerated vehicles to any point within the country. Orders for these services are secured by the company’s sales staff.

The company’s revenue consists of charges for transport and freezing, and of storage rentals.

Customers may hire storage space either on a long-term contract basis at advantageous charges

(payable in advance) or on a casual basis (invoiced monthly).

A considerable amount of electricity from the public supply is used by the company in the

freezing and storage operations. In the event of a sudden failure in this supply, the company is able to generate its own emergency supplies from standby generators kept for this purpose. An insurance policy has been taken out to protect the company against the claims which would arise should any of the frozen produce deteriorate as the result of power or equipment failure.

At the end of the company’s financial year ended 30 September 2008, the assistant accountant

extracted the following balances from the ledgers.

Required:

-Prepare, for internal circulation purposes, a Profit and Loss account for Qwik-Freez p.l.c.for the year ended 30 September 2008 and a Balance Sheet at that date. All workings must be shown.

-Open the Suspense account and post the entries needed to eliminate the opening credit balance.

Date posted: December 10, 2021. Answers (1)

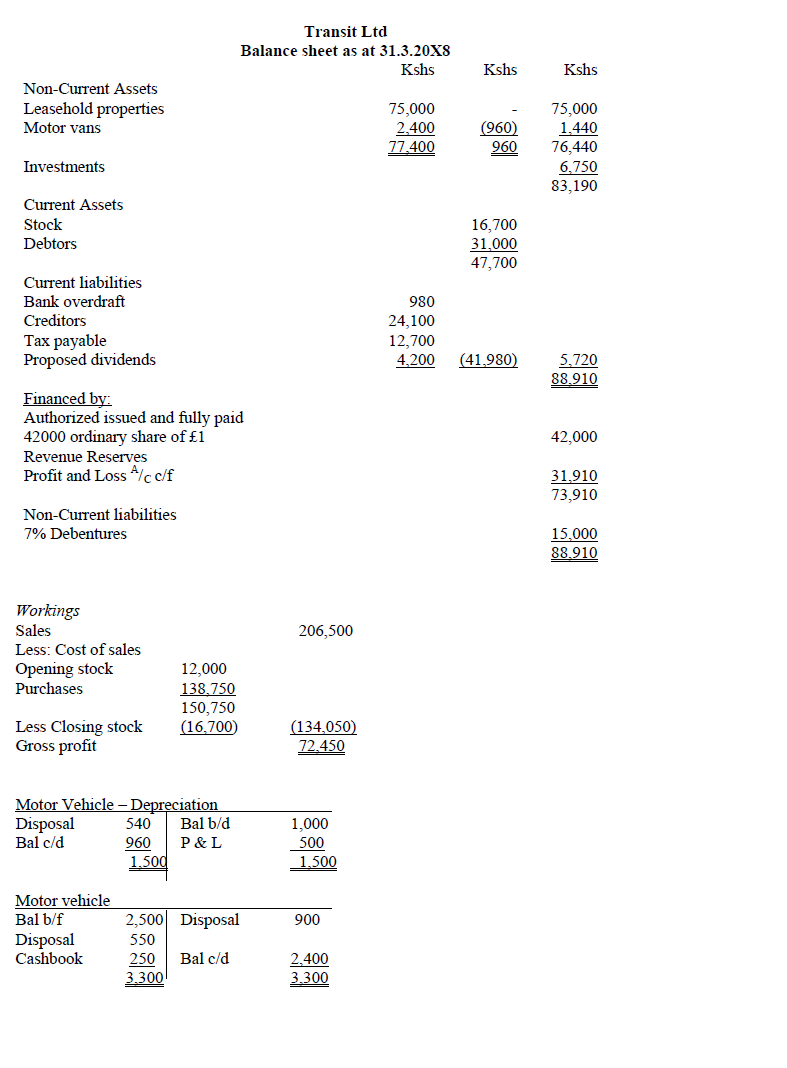

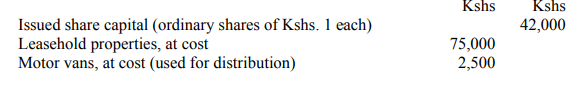

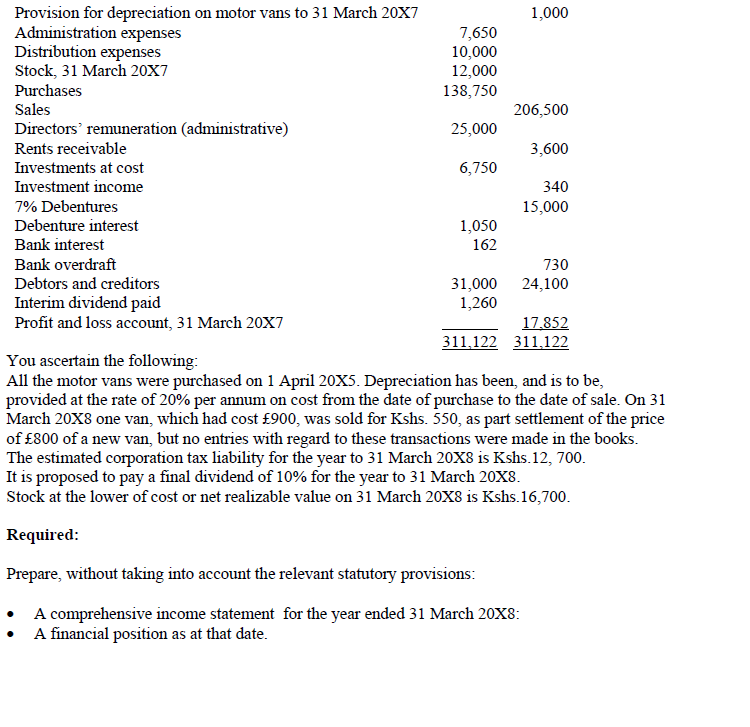

- The following is the trial balance of Transit Ltd at 31 March 20X8. (Solved)

The following is the trial balance of Transit Ltd at 31 March 20X8.

Date posted: December 10, 2021. Answers (1)

- Discuss the expenses that are unique to a company's profit and loss account and and not found a sole trader account(Solved)

Discuss the expenses that are unique to a company's profit and loss account and and not found a sole trader account

Date posted: December 10, 2021. Answers (1)

- Differentiate between unlimited partnerships and limited companies(Solved)

Differentiate between unlimited partnerships and limited companies

Date posted: December 10, 2021. Answers (1)

- Define paid-up share capital(Solved)

Define paid-up share capital

Date posted: December 10, 2021. Answers (1)

- Define uncalled share capital(Solved)

Define uncalled share capital

Date posted: December 10, 2021. Answers (1)

- Define called up share capital(Solved)

Define called up share capital

Date posted: December 10, 2021. Answers (1)

- Define issued share capital(Solved)

Define issued share capital

Date posted: December 10, 2021. Answers (1)

- Define authorized share capital(Solved)

Define authorized share capital

Date posted: December 10, 2021. Answers (1)

- A limited has an authorized share capital of 200,000 shares of Kshs1 each out of which only

150,000 shares have been issued, Although the firm requested...(Solved)

A limited has an authorized share capital of 200,000 shares of Kshs1 each out of which only

150,000 shares have been issued, Although the firm requested the shareholders to pay 80cents per

share, the shareholders were able to pay 50cents per share.

Required:

Determine the:

i) Authorized share capital

ii) Issued share capital

iii) Called up share capital

iv) Uncalled up share capital

v) Paid up share capital

Date posted: December 10, 2021. Answers (1)

- Discuss two types of share capital(Solved)

Discuss two types of share capital

Date posted: December 10, 2021. Answers (1)

- Kyamba, Onyango and Wakil were partners in a manufacturing and retail business and shared

profits and losses in the ratio 2:2:1 respectively

Given below is the balance...(Solved)

Kyamba, Onyango and Wakil were partners in a manufacturing and retail business and shared

profits and losses in the ratio 2:2:1 respectively

Given below is the balance sheet of the partnership as at 31 March 2009.

Date posted: December 10, 2021. Answers (1)

- Discuss some of the benefits paid to a partner who retires from a partnership(Solved)

Discuss some of the benefits paid to a partner who retires from a partnership

Date posted: December 10, 2021. Answers (1)

- The following was the partnership trial balance as at 30 April 2009

(Solved)

The following was the partnership trial balance as at 30 April 2009:

5. On 30 April, the stock was valued at Sh.1, 275,000.

6. Salaries included the following partners’ drawings:

Rotich Sh.150, 000, Sinei Sh.120, 000 and Tonui Sh. 62,500

7. A difference in the books of Sh.48,000 had been written off at 30 April 2009 to general

expenses, which was later found to be due to the following clerical errors:

- Sales returns of Sh. 32,000 had been debited to sales returns but had not been posted to

the account of the customer concerned;

-The purchases journal had been undercast by Sh.80,000

8. Doubtful debts (for which full provision was required) amounted to Sh.30, 000 and Sh.40,

000 as at 31 October 2008 and 30 April 2009respectively.

9. On 30 April 2008 rates and rent paid in advance amounted to Sh.50, 000 and a provision of

Sh.15, 000 for electricity consumed was required.

Required:

a) Trading and profit and loss account for the year ended 30 April 2009.

b) Partners’ current accounts for the year ended 30 April 2009

c) Balance sheet as at 30 April 20019

Date posted: December 10, 2021. Answers (1)

- Alan, Bob and Charles are in partnership sharing profits and losses in the ratio 3:2:1 respectively(Solved)

Alan, Bob and Charles are in partnership sharing profits and losses in the ratio 3:2:1 respectively

Date posted: December 10, 2021. Answers (1)

- A, B, and C are trading as partners sharing profits and losses in the ratio of 2:2:1. They have the following assets and liabilities at...(Solved)

A, B, and C are trading as partners sharing profits and losses in the ratio of 2:2:1. They have the following assets and liabilities at the book values and they wish to restate these values at market values and agreed values.

Date posted: December 10, 2021. Answers (1)

- A and B have been trading as partners sharing profits and losses equally. They decided to change

profit sharing ration to 3:2. The capital balances are:

A:...(Solved)

A and B have been trading as partners sharing profits and losses equally. They decided to change

profit sharing ration to 3:2. The capital balances are:

A: - Sh.1, 000,000

B: - Sh.1, 500,000

Goodwill has been agreed at Sh.500, 000.

Required: The partner’s capital balances assuming that:

1) Goodwill is to be retained in the accounts

2) Goodwill is to be written off form the accounts.

Date posted: December 10, 2021. Answers (1)

- Factors that contribute to goodwill(Solved)

Factors that contribute to goodwill

Date posted: December 10, 2021. Answers (1)

- Define the term goodwill(Solved)

Define the term goodwill

Date posted: December 10, 2021. Answers (1)