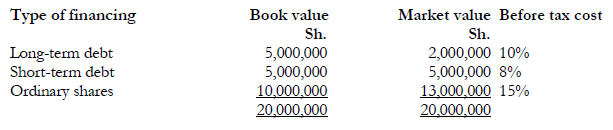

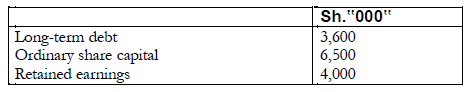

- Mchunguzi Limited has compiled the following information on its financing costs:

Mchunguzi Ltd. is in the 30 per cent tax bracket and has a target debt-equity...(Solved)

Mchunguzi Limited has compiled the following information on its financing costs:

Mchunguzi Ltd. is in the 30 per cent tax bracket and has a target debt-equity ratio of 100 percent. The company managers would like to keep the market values of short-term and long-term debt equal.

Required:

(a) The Weighted Average Cost of Capital (WACC) using:

(i) Book-value weights.

(ii) Market-value weights.

(iii) Target-weights.

(b) Explain the differences between the three WACC calculated in (a) above. What are the correct weights to use in the WACC calculation?

Date posted: December 15, 2021. Answers (1)

- List three advantages to the management of a company for knowing who their shareholders are.(Solved)

List three advantages to the management of a company for knowing who their shareholders are.

Date posted: December 15, 2021. Answers (1)

- Describe four non-financial objectives that a company might pursue that have the effect of limiting the achievement of the financial objectives.(Solved)

Describe four non-financial objectives that a company might pursue that have the effect of limiting the achievement of the financial objectives.

Date posted: December 15, 2021. Answers (1)

- The theory of company finance is based on the assumption that the objective of management is to maximize the market value of a company. To...(Solved)

The theory of company finance is based on the assumption that the objective of management is to maximize the market value of a company. To be able to do this, we need to be able to put values on a company and its shares.

Required:

Briefly explain three methods that can be used to value a company.

Date posted: December 15, 2021. Answers (1)

- You are trying to evaluate the economics of purchasing a van for your rental business. You expect the van to provide an annual after tax...(Solved)

You are trying to evaluate the economics of purchasing a van for your rental business. You expect the van to provide an annual after tax cash benefit of Sh.240,000 and that you can sell it for Sh.160,000 after six years. All the funds for purchasing the van will come from your savings which are currently earning 14% return after taxes.

Required:

(i) Calculate the maximum price you would be willing to pay to acquire the van.

(ii) Assume that you are of good credit standing and if you choose you could

borrow the money to purchase the van instead of using your savings. You have

two alternative sources from which to borrow.

Alternative A:

From a finance company. The finance company requires you to make six

annual installments of Sh.244,787.15 each covering both interest and principal.

Alternative B:

From an insurance company. The insurance company requires you to make a

lump sum payment of Shs. 1,880,971.90 covering both interest and principal at

the end of six years.

Which alternative would you opt for?

Date posted: December 14, 2021. Answers (1)

- Sunny Ltd is evaluating whether to replace an old printing machine with a new one. The following information relate to the two machines:

Required:

Using the net...(Solved)

Sunny Ltd is evaluating whether to replace an old printing machine with a new one. The following information relate to the two machines:

Required:

Using the net present value (NPV) method, analyze the replacement decision and state

whether or not the old machine should be replaced.

Date posted: December 14, 2021. Answers (1)

- Mecal Modern Company is a manufacturer of a popular range of items. The “industry” characteristics, on the average, are as shown below:

- Average collection period...(Solved)

Mecal Modern Company is a manufacturer of a popular range of items. The “industry” characteristics, on the average, are as shown below:

- Average collection period is 60 days and the inventory turnover is 5 times (on net sales)

- Credit sales are 50% of net sales

- Current ratio is 2:1. Of the current assets, 25% is cash.

- Debt is 30% of total assets

- Rate of return on total assets average 6.6667% and the average turnover on total assets is 2 times.

Mecal's current assets are shown as Sh.16,000,000 and the reported net profits (after tax) were

Sh.1,200,000. Retained profits were Sh.2,500,000 inclusive of current year.

Required:

Prepare a proforma balance sheet for Mecal Company showing as much detail as possible.

(Clearly state any assumptions made).

Date posted: December 14, 2021. Answers (1)

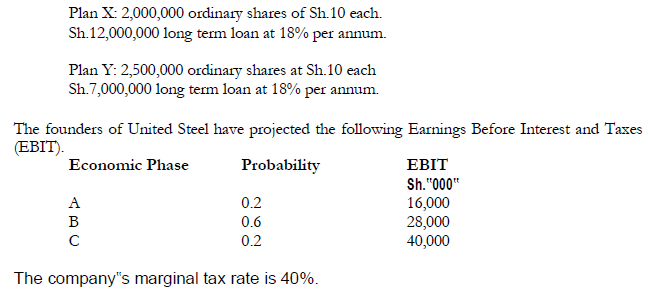

- United Steel has just been reorganized to produce industrial machinery. The company is in the process of establishing a financial policy and the following two...(Solved)

United Steel has just been reorganized to produce industrial machinery. The company is in the process of establishing a financial policy and the following two alternative plans have been suggested.

(a)Calculate the expected Earnings Per Share (EPS) for each financial plan.

(b) Which financial plan should be accepted? Why?

(c) Calculate the level of EBIT where the EPS are equal for the two plans.

Date posted: December 14, 2021. Answers (1)

- BCB Company is a manufacturer of bricks and concrete blocks. The company is considering replacing part of the current manual labour force by purchasing a...(Solved)

BCB Company is a manufacturer of bricks and concrete blocks. The company is considering replacing part of the current manual labour force by purchasing a small tractor with a forklift for use in loading bricks and concrete blocks. The purchase price would be Sh.570,000. The tractor will have an economic life of 5 years but would

require a Sh.20,000 overhaul at the end of 3 years. After 5 years the tractor could be sold for Sh.110,000.

The company estimates it will cost Sh.250,000 per year to operate the tractor. It will, however, save Sh.130,000 annually on labour cost. Because of increase in handling efficiency, losses caused by breakages will be cut by Sh.220,000 per year. Sales will also go up by Sh.450,000. The new sales level is expected to be maintained throughout the tractor's life. Assume the company's gross margin ratio is 40%, corporate tax rate 30%, and cost of capital 16%. Also assume straight-line method of depreciation.

Required:

Determine the NPV of the project and state whether the tractor should be purchased.

Date posted: December 14, 2021. Answers (1)

- Describe the characteristics of long term capital investment decisions.(Solved)

Describe the characteristics of long term capital investment decisions.

Date posted: December 14, 2021. Answers (1)

- Mr. Hesabu Kazi is considering giving up his paid employment and going into business on his own

account. He is considering buying a quarry pit with...(Solved)

Mr. Hesabu Kazi is considering giving up his paid employment and going into business on his own

account. He is considering buying a quarry pit with a “life” of about 35 years. To purchase this

business, he would have to pay £2,375,000 now. Mr. Kazi wishes to retire in 20 years‟ time.

He predicts that the net cash operating receipts from this business will be £625,000 per annum

for the first 15 years and £500,000 per annum for the last 5 years. He thinks that the business

could be sold at the end of the 20 year period for £750,000. Additionally, he estimates that

certain capital replacements and improvements would be necessary and this should amount to

£50,000 per annum for the first 5 years; £75,000 per annum for the next 5 years, £100,000 per

annum for the next 7 years and nothing for the last three years. This expenditure would be

incurred at the start.

Mr. Kazi has excluded any compensation to himself from the above data. If he should purchase

the business, however, he would have to leave his present job in which he earns £250,000 a year.

To finance the purchase of this business, he would have to realize his present savings which are

invested to yield a return of 10 per cent before tax, and have a comparable risk factor.

Required:

(a) Advise Mr. Kazi as to whether or not it is advisable to purchase the business in the light

of the information given.

Ignore Income Tax.

(b) Is there any additional information which you would have liked to have available to you

before giving advise to Mr. Kazi?

Date posted: December 14, 2021. Answers (1)

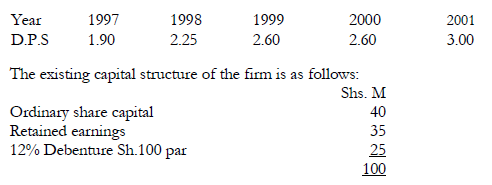

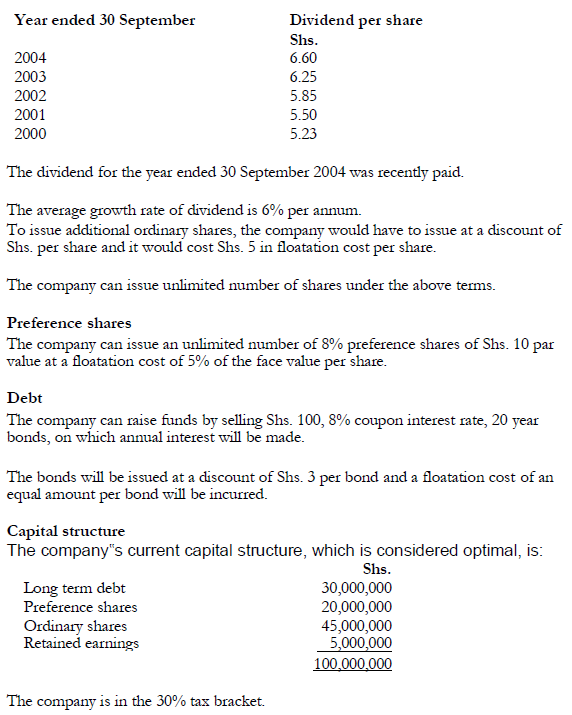

- XYZ Ltd is intending to raise capital to finance a new project. The current M.P.S is Sh.43 cum div of year 2001 declared but not...(Solved)

XYZ Ltd is intending to raise capital to finance a new project. The current M.P.S is Sh.43 cum div of year 2001 declared but not yet paid. For the part 5 years, the company has paid the following stream of dividends.

The debentures are currently selling at Sh.95 ex-interest. The corporate tax rate is 30%.

Required:

(a) Distinguish between cum-div and ex-div M.P.S.

(b) Compute the ex-div M.P.S

(c) Compute the overall cost of capital. Use dividend growth model to determine the cost

of equity.

(d) The company wants to raise additional Sh.20 million as

follows: 50% from retained earnings

30% from issue of debentures at the current market value

20% from issue of new ordinary shares with 10% floatation costs

(i) Compute the number of ordinary shares to issue to raise the amount required.

(ii) Compute the marginal cost of capital.

Date posted: December 14, 2021. Answers (1)

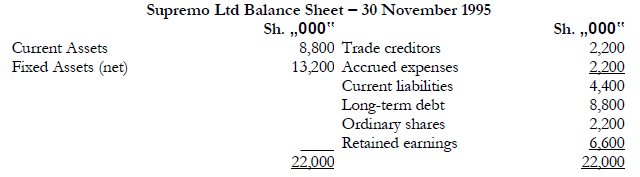

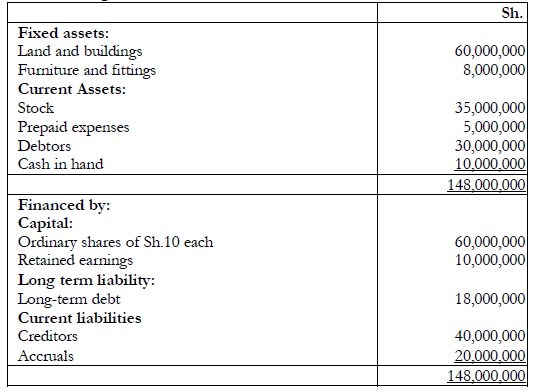

- The most recent balance sheet for Supremo Ltd is presented here below:

The company is about to embark on an advertising campaign which is expected to...(Solved)

The most recent balance sheet for Supremo Ltd is presented here below:

The company is about to embark on an advertising campaign which is expected to raise sales

from their present level of Sh.27.5 million to Sh.38.5 million by the end of next financial year.

The firm is presently operating at full capacity and will have to increase its investment in both

current and fixed assets to support the projected level of sales. It is estimated that both

categories of assets will rise in direct proportion to the projected increase in sales.

For the year just ended, the firm's net profits were 6% of the year's sales but are

expected to rise to 7% of projected sales. To help support its anticipated growth in assets

needs next year the firm has suspended plans to pay cash dividends to its shareholders. In years

past, a dividend of Sh.6.60 per share has been paid annually.

Supremo's trade creditors and accrued expenses are expected to vary directly with

sales. In addition, notes payable will be used to supply the added funds to finance next years

operations that are not forthcoming from other sources.

Required:

a) i)Estimate the amount of additional funds to be raised through notes payable.

ii) What one fundamental assumption have you made in making your estimate?

b) Prepare pro-forma balance sheet of Supremo Ltd. on 30 November 1996.

c) i)Calculate and compare Supremo Ltd.'s current and debt ratios before and after

growth in sales.

ii) What was the effect of the expanded sales on these two dimensions of

Supremo's financial condition?

Date posted: December 14, 2021. Answers (1)

- The following information relates to Mafuta Safi Limited:

Required:

The length of the operating cash cycle(Solved)

The following information relates to Mafuta Safi Limited:

Required:

The length of the operating cash cycle

Date posted: December 14, 2021. Answers (1)

- The Finance Manager of Mapato Limited has compiled the following information regarding the company's capital structure.

Ordinary shares

The company's equity shares are currently selling at Shs....(Solved)

The Finance Manager of Mapato Limited has compiled the following information regarding the company's capital structure.

Ordinary shares

The company's equity shares are currently selling at Shs. 100 per share. Over the past five years, the company's dividend pay-outs which have been approximately 60% of the earnings per share were as follows:

Required:

(i) The specific cost of each source of financing.

(ii) The level of total financing at which a break even point will occur in the

company's weighted marginal cost of capital.

Date posted: December 14, 2021. Answers (1)

- Distinguish between the following terms:

(i) Cum-dividend and ex-dividend.

(ii) Cum-all and ex-all.(Solved)

Distinguish between the following terms:

(i) Cum-dividend and ex-dividend.

(ii) Cum-all and ex-all.

Date posted: December 14, 2021. Answers (1)

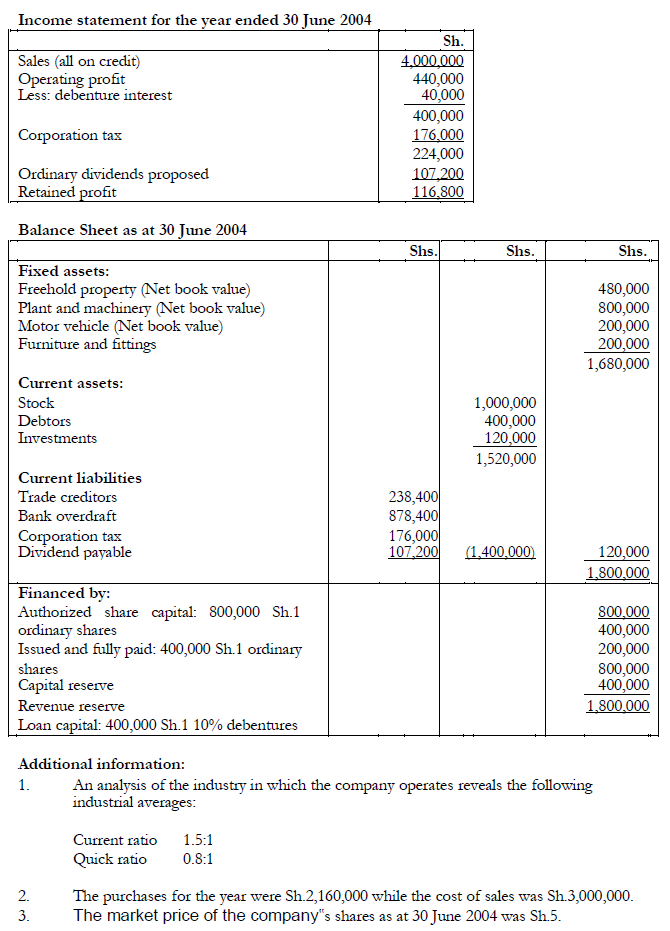

- Ushindi Limited presented the following financial statements on 30 June 2004.

Required:

(a) Compute the following ratios for Ushindi Limited:(Solved)

Ushindi Limited presented the following financial statements on 30 June 2004.

Required:

(a) Compute the following ratios for Ushindi Limited:

(i) Return on capital employed

(ii) Turnover of capital

(iii) Operating expenses ratio.

(iv) Accounts receivable turnover in days

(v) Dividend yield.

(vi) Price earnings ratio

(vii) Market value to book value ratio

(viii) Current ratio

(b) Compare the company's liquidity performance with that of the industry.

Date posted: December 14, 2021. Answers (1)

- The following is the summarized balance sheet of Kaka Kuona Ltd. as at 30 November 2003:(Solved)

The following is the summarized balance sheet of Kaka Kuona Ltd. as at 30 November 2003:

Additional information:

1. In the past, Kaha Kuona Ltd.'s earnings per share (EPS) averaged Sh.6 and the

dividend payout rate was 50% or Sh.3 per share. For the year ended 30 November 2003,

the EPS declined to Sh.2.50. Because it was felt that this decline was temporary, the annum

dividend of Sh.3 per share was maintained for the financial year ended 30 November

2003, as well as for the first six months of the financial year ending 30 November 2004.

2. Recent projections, however, have caused management to revise downwards the

expected EPS. For the financial year ending 30 November 2004, the forecast of EPS as

been reduced to Sh.2 per share and for the financial year ending 30 November 2005,

adjusted to Sh.2.20.

3. Kaka Kuona Ltd.'s ordinary shares are currently selling in the market at Sh.15 per share.

Management of Kaka Kuona Ltd. is considering whether or not to retain the cash dividend of

Sh.3 per share for the next two financial years.

Required:

(a) Calculations to help determine whether it will be feasible to maintain dividends at Sh.3

per share for the next two financial years.

(b) Determine whether the company should replace the cash dividend with a bonus issue of

one share for every four ordinary shares.

(c) Explain the course of action that the management of Kaka Kuona Ltd. should take in

the light of the declining projections in dividend payouts.

Date posted: December 14, 2021. Answers (1)

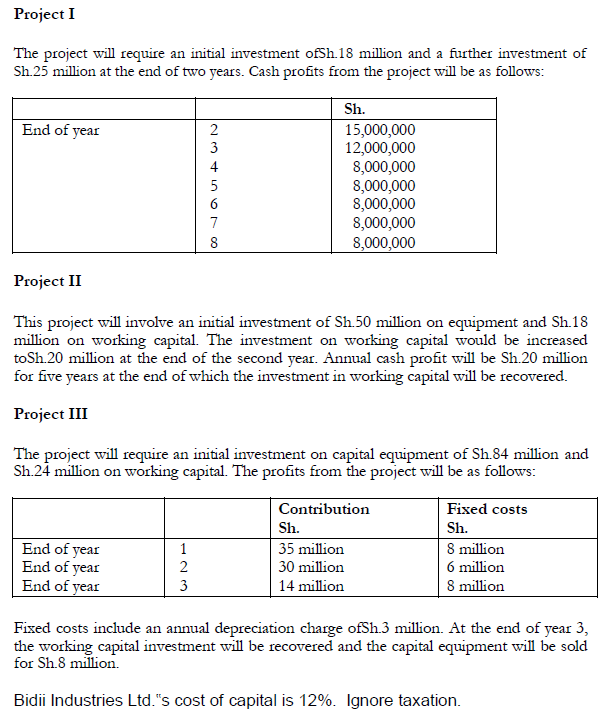

- The finance manager of Bidii Industries Ltd., which manufactures edible oils, has identified the following three projects for potential investment:(Solved)

The finance manager of Bidii Industries Ltd., which manufactures edible oils, has identified the following three projects for potential investment:

Required:

(i) Evaluate each project using the net present value (NPV) method.

(ii) Which of the three projects should Bidii Industries Ltd. accept?

Date posted: December 14, 2021. Answers (1)

- Biashara Ltd. has the following capital structure:

The finance manager of Biashara Ltd. has a proposal for a project requiring Sh.45

million. He has proposed the following...(Solved)

Biashara Ltd. has the following capital structure:

The finance manager of Biashara Ltd. has a proposal for a project requiring Sh.45

million. He has proposed the following method of raising the funds:

- Utilize all the existing retained earnings

- Issue ordinary shares at the current market price.

- Issue 100,000 10% preference shares at the current market price of Sh.100 per

share which is the same as the par value.

- Issue 10% debentures at the current market price of Sh.1,000 per debenture.

Additional information:

1. Currently, Biashara Ltd. pays a dividend of Sh.5 per share which is expected to

grow at the rate of 6% due to increased returns from the intended project.

Biashara Ltd.'s price/earnings (P/E) ratio and earnings per share

(EPS) are 5 and Sh.8 respectively.

2. The ordinary shares would be issued at a floatation cost of 10% based in the

market price.

3. The debenture par value is Sh.1,000 per debenture.

4. The corporate tax rate is 30%.

Required:

Biashara Ltd.'s weighted average cost of capital (WACC).

Date posted: December 14, 2021. Answers (1)