- Millenium Electronics Ltd. is a company which produces a wide range of electronic goods. It has recorded a strong and consistent growth during the last...(Solved)

Millenium Electronics Ltd. is a company which produces a wide range of electronic goods. It has recorded a strong and consistent growth during the last 10 years. The management of the company is now contemplating obtaining a stock market listing.

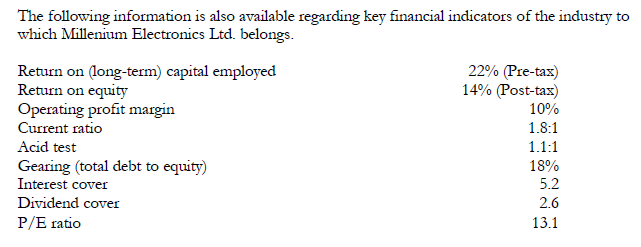

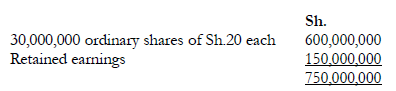

The company's financial statements for the last financial year are summarized below:

Required:

(a) Briefly explain why companies like Millenium Electronics Ltd. seek stock market listing.

(b) Discuss the performance and financial health of Millenium Electronics Ltd. in relation

to that of the industry as a whole.

(c) In what ways would you advise Millenium Electronics Ltd. to change its financial policy

following flotation?

Date posted: December 15, 2021. Answers (1)

- Many enterprises begin as sole proprietorships and then as they grow ad become successful, the need arises for them to convert to companies and eventually...(Solved)

Many enterprises begin as sole proprietorships and then as they grow ad become successful, the need arises for them to convert to companies and eventually go public.

Required:

(a) List and explain the advantages a company derives from going public.

(b) Highlight the factors that a firm should consider when inviting an initial public offering (IPO).

Date posted: December 15, 2021. Answers (1)

- Vitabu Ltd. is a merchandising firm. The following information relates to the capital structure of the company:

1. The current capital structure of the company which...(Solved)

Vitabu Ltd. is a merchandising firm. The following information relates to the capital structure of the company:

1. The current capital structure of the company which is considered optimal, comprises: Ordinary share capital – 50%, preference share capital – 10% and debt – 40%.

2. The firm can raise an unlimited amount of debt by selling Sh.1,000 par value, 10 year 10% debentures on which annual interest payments will be made. To sell the issue it will have to grant an average discount of 3% on the par value and meet flotation costs of Sh.20 per debenture.

3. The firm can sell 11% preference shares at the par value of Sh.100. However, the issue and selling costs are expected to amount to Sh.4 per share. An unlimited amount of preference share capital can be raised under these terms.

4. The firm's ordinary shares are currently selling at Sh.80 per share. The company expects to pay an ordinary dividend of Sh.6 per share in the coming year.

Ordinary dividends have been growing at an annual rate of 6% and this growth rate is expected to be maintained into the foreseeable future. The firm can sell unlimited amounts of new ordinary shares but this will require an under pricing of Sh.4 per share in addition to flotation costs of Sh.3 per share.

5. The firm expects to have Sh.225,000 of retained earnings available in the coming year. If the retained earnings are exhausted, new ordinary shares will have to be issued as the form of equity financing.

The company is in the 30% corporation tax bracket.

Required:

(a) The cost of each component of financing.

(b) The level of total financing at which a break in the marginal cost of capital (M.C.C)

curve occurs.

(b) The weighted average cost of capital (W.A.C.C):

(i) Before exhausting retained earnings.

(ii) After exhausting retained earnings.

Date posted: December 15, 2021. Answers (1)

- Munyu Ltd. currently has a centralized billing system. All payments are made by customers to a central billing location. It requires an average of eight...(Solved)

Munyu Ltd. currently has a centralized billing system. All payments are made by customers to a central billing location. It requires an average of eight days for customers mailed payments to reach the central location. An additional three days are required to process payments before a deposit can be made into the bank account. The firm has a daily average collection of sh.10,000,000. Recently the bank has investigated the possibility of initiating a lockbox system. It is estimated that if the system is introduced customers mail payments will reach the receipt location five days sooner than is the case now. Furthermore, the processing time of the payments could be reduced to one day.

Required:

(i) The reduction in cash balances in transit to the bank brought about by the lockbox system.

(ii) The opportunity cost of the present system assuming a 5 per cent per annum return on deposits at the bank.

(iii) In light of your answer to part (ii) above, should the lockbox system be introduced, if it will cost Shs. 4,000,000?

Date posted: December 15, 2021. Answers (1)

- Write notes on the following cash management models:

(i) The Baumol model.

(ii) The Miller – Orr model.(Solved)

Write notes on the following cash management models:

(i) The Baumol model.

(ii) The Miller – Orr model.

Date posted: December 15, 2021. Answers (1)

- State and explain the methods of obtaining a listing on the stock exchange.(Solved)

State and explain the methods of obtaining a listing on the stock exchange.

Date posted: December 15, 2021. Answers (1)

- Is the stock exchange more of a primary market or a secondary market? Explain.(Solved)

Is the stock exchange more of a primary market or a secondary market? Explain.

Date posted: December 15, 2021. Answers (1)

- What is a primary market?(Solved)

What is a primary market?

Date posted: December 15, 2021. Answers (1)

- Insectkill Ltd. is considering whether to establish a new subsidiary in Uganda. The cost of the fixed assets would be Sh.10,000,000 in total, with Sh.7,500,000...(Solved)

Insectkill Ltd. is considering whether to establish a new subsidiary in Uganda. The cost of the fixed assets would be Sh.10,000,000 in total, with Sh.7,500,000 payable at once and the remainder payable after one year. A further investment of Sh.3,000,000 in working capital would be required immediately.

The management of Insectkill Ltd. expect all their investments to be financially justifiable within a four year planning horizon. The net disposal value of fixed assets after four years is expected to be zero.

The operation would incur fixed costs amounting to Sh.5,200,000 a year in the first year, including depreciation of Sh.2,000,000. These costs, excluding depreciation are expected to increase by 5% each year because of inflation. The operation would involve the manufacture and sale of a standard unit, with a unit selling price of Sh.12 and variable cost of sh.6 in the first year and expected annual increase because of inflation of 4% and 7% respectively. Annual sales are expected to be 1,250,000 units.

The company's cost of capital is 14%.

Required:

(a) Fixed costs for the four years.

(b) Total contribution for each of the four years.

(c) (i) Net Present Value of the project

(ii) Is the project viable?

Date posted: December 15, 2021. Answers (1)

- Mary Atieno owns a chain of seven clothes shops in Kisumu town. Takings at each shop are remitted once a week on Thursday afternoon to...(Solved)

Mary Atieno owns a chain of seven clothes shops in Kisumu town. Takings at each shop are remitted once a week on Thursday afternoon to the head office and are then banked at the start of business on Friday morning. As business is expanding, Mary Atieno has hired a finance assistant to help her. The finance assistant gave the following advice: “Turnover at the seven shops totaled Shs. 1,950,000 last year at a constant daily rate but you were paying bank overdraft charges at a rate of 11% per annum. You could have reduced your overdraft costs by banking the shop takings each day except Saturdays. Saturdays takings could have been banked on Mondays.

Required:

Using numbered paragraphs, comment on the significance of this advice, stating your assumptions.

(“Note” The shops are closed on Sundays).

Date posted: December 15, 2021. Answers (1)

- Name and briefly explain five ways in which cash flow problems may arise.(Solved)

Name and briefly explain five ways in which cash flow problems may arise.

Date posted: December 15, 2021. Answers (1)

- (a) Nakuru Bottlers Ltd. is a mineral water company based in Nakuru town. The company is listed on the Stock Exchange. Due to the huge...(Solved)

(a) Nakuru Bottlers Ltd. is a mineral water company based in Nakuru town. The company is listed on the Stock Exchange. Due to the huge demand for its products, the company is in the process of expanding its bottling facilities. The board of directors is undecided as to whether to have a rights issue or a placing on the stock exchange.

Required:

(i) Explain the meaning of a rights issue and list its advantages.

(ii) Explain the meaning of a stock placing and list its advantages.

(b) Nakuru Bottlers Ltd. can achieve a profit after tax of 20% on the capital employed. At present, its capital structure is as follows:

Required:

(i) Calculate the number of shares that must be issued if the rights issue price is Sh.25, Sh.23.40, Sh.21.50, Sh.26 and Sh.27.10.

(ii) Calculate the dilution in earning per share in each case.

Date posted: December 15, 2021. Answers (1)

- Hafix Ltd. is a manufacturing company. Its projected turnover for the year 2002 is Sh.150,000,000. At present the costs as percentages of sales are as...(Solved)

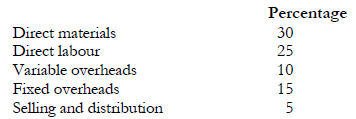

Hafix Ltd. is a manufacturing company. Its projected turnover for the year 2002 is Sh.150,000,000. At present the costs as percentages of sales are as follows:

On average:

1. Debtors will take 2½ months before payment

2. Raw materials will be in stock for three months.

3. Work-in-progress will represent two months worth of half produced goods.

4. Finished goods will represent one month's production.

5. Credit will be taken as follows:

(i) Direct materials 2 months

(ii) Direct labour 1 week

(iii) Variable overheads 1 month

(iv) Fixed overheads 1 month

(v) Selling and distribution ½ month

Work-in-progress and finished goods will be valued at material, labour and variable expense cost.

Required:

Working capital requirements of Haffix Ltd. assuming the labour force will be paid for 50 working weeks in the year 2002.

Date posted: December 15, 2021. Answers (1)

- Mchunguzi Limited has compiled the following information on its financing costs:

Mchunguzi Ltd. is in the 30 per cent tax bracket and has a target debt-equity...(Solved)

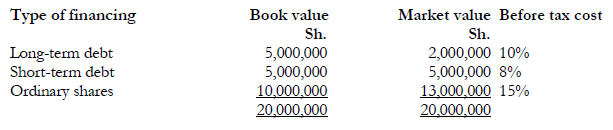

Mchunguzi Limited has compiled the following information on its financing costs:

Mchunguzi Ltd. is in the 30 per cent tax bracket and has a target debt-equity ratio of 100 percent. The company managers would like to keep the market values of short-term and long-term debt equal.

Required:

(a) The Weighted Average Cost of Capital (WACC) using:

(i) Book-value weights.

(ii) Market-value weights.

(iii) Target-weights.

(b) Explain the differences between the three WACC calculated in (a) above. What are the correct weights to use in the WACC calculation?

Date posted: December 15, 2021. Answers (1)

- List three advantages to the management of a company for knowing who their shareholders are.(Solved)

List three advantages to the management of a company for knowing who their shareholders are.

Date posted: December 15, 2021. Answers (1)

- Describe four non-financial objectives that a company might pursue that have the effect of limiting the achievement of the financial objectives.(Solved)

Describe four non-financial objectives that a company might pursue that have the effect of limiting the achievement of the financial objectives.

Date posted: December 15, 2021. Answers (1)

- The theory of company finance is based on the assumption that the objective of management is to maximize the market value of a company. To...(Solved)

The theory of company finance is based on the assumption that the objective of management is to maximize the market value of a company. To be able to do this, we need to be able to put values on a company and its shares.

Required:

Briefly explain three methods that can be used to value a company.

Date posted: December 15, 2021. Answers (1)

- You are trying to evaluate the economics of purchasing a van for your rental business. You expect the van to provide an annual after tax...(Solved)

You are trying to evaluate the economics of purchasing a van for your rental business. You expect the van to provide an annual after tax cash benefit of Sh.240,000 and that you can sell it for Sh.160,000 after six years. All the funds for purchasing the van will come from your savings which are currently earning 14% return after taxes.

Required:

(i) Calculate the maximum price you would be willing to pay to acquire the van.

(ii) Assume that you are of good credit standing and if you choose you could

borrow the money to purchase the van instead of using your savings. You have

two alternative sources from which to borrow.

Alternative A:

From a finance company. The finance company requires you to make six

annual installments of Sh.244,787.15 each covering both interest and principal.

Alternative B:

From an insurance company. The insurance company requires you to make a

lump sum payment of Shs. 1,880,971.90 covering both interest and principal at

the end of six years.

Which alternative would you opt for?

Date posted: December 14, 2021. Answers (1)

- Sunny Ltd is evaluating whether to replace an old printing machine with a new one. The following information relate to the two machines:

Required:

Using the net...(Solved)

Sunny Ltd is evaluating whether to replace an old printing machine with a new one. The following information relate to the two machines:

Required:

Using the net present value (NPV) method, analyze the replacement decision and state

whether or not the old machine should be replaced.

Date posted: December 14, 2021. Answers (1)

- Mecal Modern Company is a manufacturer of a popular range of items. The “industry” characteristics, on the average, are as shown below:

- Average collection period...(Solved)

Mecal Modern Company is a manufacturer of a popular range of items. The “industry” characteristics, on the average, are as shown below:

- Average collection period is 60 days and the inventory turnover is 5 times (on net sales)

- Credit sales are 50% of net sales

- Current ratio is 2:1. Of the current assets, 25% is cash.

- Debt is 30% of total assets

- Rate of return on total assets average 6.6667% and the average turnover on total assets is 2 times.

Mecal's current assets are shown as Sh.16,000,000 and the reported net profits (after tax) were

Sh.1,200,000. Retained profits were Sh.2,500,000 inclusive of current year.

Required:

Prepare a proforma balance sheet for Mecal Company showing as much detail as possible.

(Clearly state any assumptions made).

Date posted: December 14, 2021. Answers (1)