Advantages/functions/case for development financial institutions

1. They provide venture capital

2. They provide facilities for large lending

3. They provide technical expertise and support emerging projects transferable

from other sectors of development economies.

4. They are risk capital providers in areas which are not attractive to commercial

banks and other major lenders due to risk involved.

5. They carry out feasibility study to evaluate viability of projects.

Case against specialized institutions and development banks

1. They are being phased out by globalization and liberalization where needy

sectors can easily get expertise from outside.

2. Commercial banks have now matured up to provide capital for all sectors.

3. They were only useful during periods of foreign exchange restriction.

4. Their performance has been wanting and they have largely failed to achieve the

goal/purpose they were intended for.

5. Hey increase government spending.

Kavungya answered the question on December 15, 2021 at 07:29

- Define development financial institutions and justify their existence in the economy concerns.(Solved)

Define development financial institutions and justify their existence in the economy concerns.

Date posted: December 15, 2021. Answers (1)

- The Pesa Company Unlimited is using a machine whose original cost was Sh.720,000. The machine is two years old, and it has a current market...(Solved)

The Pesa Company Unlimited is using a machine whose original cost was Sh.720,000. The machine is two years old, and it has a current market value of Sh.160,000. The asset is fully being depreciated over a twelve-years period. At the end of the twelve-years the asset will have a zero salvage value. Depreciation is on a straight line basis.

The Management is contemplating the purchase of a new machine to replace the old one. The new machine costs Sh.750,000 and has an estimated salvage value of Sh.100,000. The new machine will have a greater technological capacity, and therefore annual sales are expected to increase from Sh.10,000,000 to Sh.10,100,000. Operating efficiencies with the new machine will produce an expected saving of Sh.100,000 a year. Depreciation would be on a straight line basis over a ten-year life. The cost of capital is 12%, and a 40% tax rate is applicable. In addition, if the new machine is purchased, inventories will increase by sh.150,000 and payables by Sh.50,000

during the life of the project.

Required:

(a) Should the new machine be purchased? (Use Net Present Value (NPV) approach).

(b) What factors in addition to the quantitative ones above are likely to require consideration in a practical situation?

Date posted: December 15, 2021. Answers (1)

- RITE Ltd. maintains an average monthly balance of Sh.320,000 in accounts receivable throughout the year. The company is in need of additional working capital and...(Solved)

RITE Ltd. maintains an average monthly balance of Sh.320,000 in accounts receivable throughout the year. The company is in need of additional working capital and is considering two alternative methods of raising it.

METHOD 1 Factoring accounts receivable

METHOD 2 A commercial bank loan secured by accounts receivable.

The company's bankers have agreed to lend the firm 80% of its average accounts receivable at an interest of 30% per annum. The amount will be made available in a series of 30 day advances. The advances would be discounted and a 6% compensating balance will be required.

The factor is willing to establish a factoring arrangement on a continuing basis. It charges 2% for servicing the accounts and 15% per annum on any advances taken. Both charges are made on discount basis. In addition, the factor requires a 5% reserve to cover returned items. RITE Ltd. sells its merchandise on terms of net 30.

Required:

(a) Calculate the amount of advances RITE Ltd. can expect to have under each alternative.

(b) Calculate the effective rate of interest for each financing alternative.

(c) Which alternative would you recommend and why?

Date posted: December 15, 2021. Answers (1)

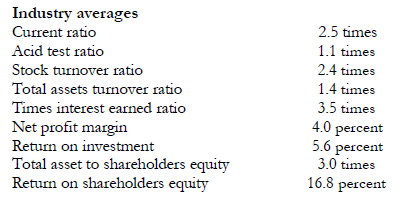

- The following are the financial statements of Richardo Ltd. for the year ended 31 March 1995:

Required

(a) Calculate the ratios shown above for Richardo Ltd. and...(Solved)

The following are the financial statements of Richardo Ltd. for the year ended 31 March 1995:

Required

(a) Calculate the ratios shown above for Richardo Ltd. and present them in columnar form

along the industry averages.

(b) Comment upon the following about Richardo Ltd. in relation to the industry averages:

(i) Liquidity position

(ii) Financial risk

(iii) Overall performance

Date posted: December 15, 2021. Answers (1)

- Gopher Ltd has issued 300,000 ordinary shares of £1 each, which are at present selling for £4 per share. The company plans to issue rights...(Solved)

Gopher Ltd has issued 300,000 ordinary shares of £1 each, which are at present selling for £4 per share. The company plans to issue rights to purchase one new equity share at a price of £3.20 per share for every 3 shares held. A shareholder who owns 900 shares thinks that he will suffer a loss in his personal wealth because the new shares are being offered at a price lower than market value. On the assumption that the actual market value of shares will be equal to the theoretical ex-rights price, what would be the effect on the shareholder's wealth if:

(a) He sells all the rights;

(b) He exercises one half of the rights and sells the other half;

(c) He does nothing at all?

Date posted: December 15, 2021. Answers (1)

- What is rights issue and what are the advantages?(Solved)

What is rights issue and what are the advantages?

Date posted: December 15, 2021. Answers (1)

- How can a firm overcome capital rationing problems?(Solved)

How can a firm overcome capital rationing problems?

Date posted: December 15, 2021. Answers (1)

- Distinguish between 'Hard' and 'soft' capital rationing clearly indicating the causes of each.(Solved)

Distinguish between 'Hard' and 'soft' capital rationing clearly indicating the causes of each.

Date posted: December 15, 2021. Answers (1)

- Explain how tax treatment of capital expenditure can affect investment decision.(Solved)

Explain how tax treatment of capital expenditure can affect investment decision.

Date posted: December 15, 2021. Answers (1)

- The Independent Film Company plc is a film company which purchases distribution rights on films from small independent producers, and sells the films on to...(Solved)

The Independent Film Company plc is a film company which purchases distribution rights on films from small independent producers, and sells the films on to cinema chains for national and international screening. In recent years the company has found it difficult to source sufficient films to maintain profitability. In response to the problem, the Independent Film Company has decided to invest in commissioning and producing films in its own right. In order to gain the expertise for this venture, the Independent Film Company is considering purchasing an existing

filmmaking concern, at a cost of Sh.400,000. The main difficult that is anticipated for the business is the increasing uncertainty as to the potential success/failure rate of independently produced films. Many cinema chains are adopting a policy of only buying films from large international film companies, as they believe that the market for independent films is very limited and specialist in nature. The Independent Film Company is prepared for the fact that they are likely to have more films that fail than that succeed, but believe that the proposed film

production business will nonetheless be profitable.

Using data collection from the existing distribution business and discussions with industry

experts, they have produced cost and revenue forecasts for the five years of operation of the

proposed investment. The company aims to complete the production of three films per year.

The after tax cost of capital for the company is estimated to be 14%.

Year 1 sales for the new business are uncertain, but expected to be in the range of Sh.4-10

million. Probability estimates for different forecast values are as follows:

Sales are expected to grow at an annual rate of 5%.

Anticipated costs related to the new business are as follows:

Additional Information

(i) No capital allowances are available.

(ii) Tax is payable one year in arrears, at a rate of 33% and full use can be made of tax

refunds as they fall due.

(iii) Staff wages (technical and non-production staff) and actors‟ salaries, are

expected to rise by 10% per annum.

(iv) Studio hire costs will be subject to an increase of 30% in Year 3.

(v) Screenplay costs per film are expected to rise by 15% per annum due to a shortage of

skilled writers.

(vi) The new business will occupy office accommodation which has to date been let out for

an annual rent of Sh.20,000. Demand for such accommodation is buoyant and the

company anticipates in finding future tenants at the same annual rent.

(vii) A market research survey into the potential for the film production business cost Sh.25,000.

Required:

Using DCF analysis, calculate the expected Net Present Value of the proposed investment.

(Workings should be rounded to the nearest Sh.‟000‟)

Date posted: December 15, 2021. Answers (1)

- A working capital policy of any business is critical to its viability as a going concern. The board of directors would ignore the information of...(Solved)

A working capital policy of any business is critical to its viability as a going concern. The board of directors would ignore the information of such a policy to its great disadvantage.

The finance director of Watu Limited is formulating the company's capital policy for next year.

Sales have been protected at Sh.240 million next year. Three alternative policies are under

consideration as follows:

1. Maintain current asset level at 40 per cent of projected sales.

2. Maintain current asset level at 50 per cent of projected sales.

3. Maintain current asset level at 60 percent of projected sales.

Required:

(a) Discuss the expected impact of policies (1) and (3).

(b) The fixed assets of Watu Limited are Sh.100 million and the company wishes to

maintain a 60 percent debt ratio. The cost of capital for Watu Limited is currently 12

percent on both short-term and long-term debt. This is the rate which the firm also

applies on its permanent capital structure. The company earns 15 percent on sales.

What is the expected return on equity under each of the three policies above?

(c) Are earnings and level of sales independent of current asset policy in real life? Explain.

(d) What is meant by “maturity matching”, in finance?

Date posted: December 15, 2021. Answers (1)

- Can market forces be able to eliminate insider trading? Explain.(Solved)

Can market forces be able to eliminate insider trading? Explain.

Date posted: December 15, 2021. Answers (1)

- One of the objectives of the Capital Markets Authority is “the protection of investor interests;” [Capital Markets Authority Act, Cap.485A, Section 11, (1) (c)].

Several statements...(Solved)

One of the objectives of the Capital Markets Authority is “the protection of investor interests;” [Capital Markets Authority Act, Cap.485A, Section 11, (1) (c)].

Several statements have appeared in the papers to suggest that some instances of share price manipulation have been observed in Kenya.

Required:

Specify those measures which the Capital Markets Authority has taken and publicized in order to protect the investor.

Date posted: December 15, 2021. Answers (1)

- Explain the term 'Invoice discounting' and the merits and demerits of its use as a way of improving cash flow.(Solved)

Explain the term 'Invoice discounting' and the merits and demerits of its use as a way of improving cash flow.

Date posted: December 15, 2021. Answers (1)

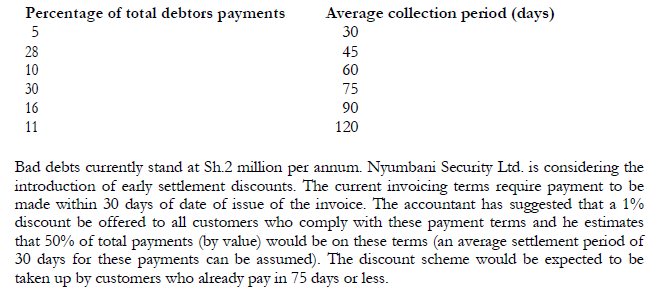

- Nyumbani Security Ltd. is a wholesaler of household security fittings. Over the last 12 months the company has encountered increasing problems with late payment by...(Solved)

Nyumbani Security Ltd. is a wholesaler of household security fittings. Over the last 12 months the company has encountered increasing problems with late payment by debtors. The last 12 months of credit sales of Sh.67.5 million show an increase of 10% over the previous year's sales, but the company's overdraft on which it is charged 20% per annum has also increased by Sh.1.8 million over the previous year.

The company wishes to reduce its working capital requirements by reducing the debtor collection period.

Nyumbani Security Ltd.'s accountant has extracted average debtors profile which is shown below:

As an alternative way of reducing the debtors figure, Nyumbani Security Ltd. would use a debt collection service which has quoted a price of 1% of sales receipts. It is estimated that using the service will have the effect of reducing debtor days by 20 and eliminating 50% of bad debts.

Required:

Calculate the change in working capital requirements and bad debts which would result from:

(i) The introduction of the early settlement discounts.

(ii) The use of the debt collection service.

(iii) Recommend which policy should be adopted by Nyumbani Security Ltd.

Date posted: December 15, 2021. Answers (1)

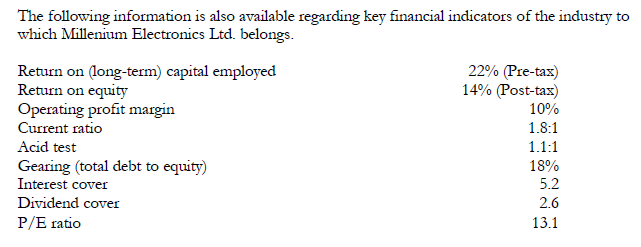

- Millenium Electronics Ltd. is a company which produces a wide range of electronic goods. It has recorded a strong and consistent growth during the last...(Solved)

Millenium Electronics Ltd. is a company which produces a wide range of electronic goods. It has recorded a strong and consistent growth during the last 10 years. The management of the company is now contemplating obtaining a stock market listing.

The company's financial statements for the last financial year are summarized below:

Required:

(a) Briefly explain why companies like Millenium Electronics Ltd. seek stock market listing.

(b) Discuss the performance and financial health of Millenium Electronics Ltd. in relation

to that of the industry as a whole.

(c) In what ways would you advise Millenium Electronics Ltd. to change its financial policy

following flotation?

Date posted: December 15, 2021. Answers (1)

- Many enterprises begin as sole proprietorships and then as they grow ad become successful, the need arises for them to convert to companies and eventually...(Solved)

Many enterprises begin as sole proprietorships and then as they grow ad become successful, the need arises for them to convert to companies and eventually go public.

Required:

(a) List and explain the advantages a company derives from going public.

(b) Highlight the factors that a firm should consider when inviting an initial public offering (IPO).

Date posted: December 15, 2021. Answers (1)

- Vitabu Ltd. is a merchandising firm. The following information relates to the capital structure of the company:

1. The current capital structure of the company which...(Solved)

Vitabu Ltd. is a merchandising firm. The following information relates to the capital structure of the company:

1. The current capital structure of the company which is considered optimal, comprises: Ordinary share capital – 50%, preference share capital – 10% and debt – 40%.

2. The firm can raise an unlimited amount of debt by selling Sh.1,000 par value, 10 year 10% debentures on which annual interest payments will be made. To sell the issue it will have to grant an average discount of 3% on the par value and meet flotation costs of Sh.20 per debenture.

3. The firm can sell 11% preference shares at the par value of Sh.100. However, the issue and selling costs are expected to amount to Sh.4 per share. An unlimited amount of preference share capital can be raised under these terms.

4. The firm's ordinary shares are currently selling at Sh.80 per share. The company expects to pay an ordinary dividend of Sh.6 per share in the coming year.

Ordinary dividends have been growing at an annual rate of 6% and this growth rate is expected to be maintained into the foreseeable future. The firm can sell unlimited amounts of new ordinary shares but this will require an under pricing of Sh.4 per share in addition to flotation costs of Sh.3 per share.

5. The firm expects to have Sh.225,000 of retained earnings available in the coming year. If the retained earnings are exhausted, new ordinary shares will have to be issued as the form of equity financing.

The company is in the 30% corporation tax bracket.

Required:

(a) The cost of each component of financing.

(b) The level of total financing at which a break in the marginal cost of capital (M.C.C)

curve occurs.

(b) The weighted average cost of capital (W.A.C.C):

(i) Before exhausting retained earnings.

(ii) After exhausting retained earnings.

Date posted: December 15, 2021. Answers (1)

- Munyu Ltd. currently has a centralized billing system. All payments are made by customers to a central billing location. It requires an average of eight...(Solved)

Munyu Ltd. currently has a centralized billing system. All payments are made by customers to a central billing location. It requires an average of eight days for customers mailed payments to reach the central location. An additional three days are required to process payments before a deposit can be made into the bank account. The firm has a daily average collection of sh.10,000,000. Recently the bank has investigated the possibility of initiating a lockbox system. It is estimated that if the system is introduced customers mail payments will reach the receipt location five days sooner than is the case now. Furthermore, the processing time of the payments could be reduced to one day.

Required:

(i) The reduction in cash balances in transit to the bank brought about by the lockbox system.

(ii) The opportunity cost of the present system assuming a 5 per cent per annum return on deposits at the bank.

(iii) In light of your answer to part (ii) above, should the lockbox system be introduced, if it will cost Shs. 4,000,000?

Date posted: December 15, 2021. Answers (1)

- Write notes on the following cash management models:

(i) The Baumol model.

(ii) The Miller – Orr model.(Solved)

Write notes on the following cash management models:

(i) The Baumol model.

(ii) The Miller – Orr model.

Date posted: December 15, 2021. Answers (1)