The range of stakeholders may include: shareholders, directors/managers, lenders,

employees, suppliers and customers. These groups are likely to share in the wealth and

risk generated by a company in different ways and thus conflicts of interest are likely to

exist. Conflicts also exist not just between groups but within stakeholder groups. This

might be because sub groups exist e.g. preference shareholders and equity shareholders.

Alternatively it might be that individuals have different preferences (e.g to risk and

return, short term and long term returns) within a group. Good corporate governance is

partly about the resolution of such conflicts. Stakeholder financial and other objectives

may be identified as follows:

Shareholders

Shareholders are normally assumed to be interested in wealth maximization. This,

however, involves consideration of potential return and risk. Where a company is listed

this can be viewed in terms of the share price returns and other market-based ratios

using share price (e.g price earnings ratio, dividend yield, earnings yield).

Where a company is not listed, financial objectives need to be set in terms of accounting

and other related financial measures. These may include: return of capital employed,

earnings per share, gearing, growth, profit margin, asset utilization, market share. Many

other measures also exist which may collectively capture the objectives of return and risk.

Shareholders may have other objectives for the company and these can be identified in

terms of the interests of other stakeholder groups. Thus, shareholders, as a group, might

be interested in profit maximization; they may also be interested in the welfare of their

employees, or the environmental impact of the company's operations.

Directors and managers

While directors and managers are in essence attempting to promote and balance the

interests of shareholders and other stakeholders it has been argued that they also

promote their own interests as a separate stakeholder group.

This arises from the divorce between ownership and control where the behaviour of

managers cannot be fully observed giving them the capacity to take decisions which are

consistent with their own reward structures and risk preferences. Directors may thus be

interested in their own remuneration package. In a non-financial sense, they may be

interested in building empires, exercising greater control, or positioning themselves for

their next promotion. Non-financial objectives are sometimes difficulty to separate

from their financial impact.

Lenders

Lenders are concerned to receive payment of interest and ultimate repayment of capital.

They do not share in the upside of very successful organizational strategies as the

shareholders do. They are thus likely to be more risk averse than shareholders, with an

emphasis on financial objectives that promote liquidity and solvency with low risk (e.g

gearing, interest cover, security, cash flow).

Employees

The primary interest of employees is their salary/wage and security of employment. To

an extent there is a direct conflict between employees and shareholders as wages are a

cost to the company and a revenue to employees.

Performance related pay based upon financial or other quantitative objectives may,

however, go some way toward drawing the divergent interest together.

Suppliers and customers

Suppliers and customers are external stakeholders with their own set of objectives

(profit for the supplier and, possibly, customer satisfaction with the good or service

from the customer) that, within a portfolio of businesses, are only partly dependent

upon the company in question. Nevertheless it is important to consider and measure the

relationship in term of financial objectives relating to quality, lead times, volume of

business and a range of other variables in considering any organizational strategy.

Kavungya answered the question on December 15, 2021 at 07:52

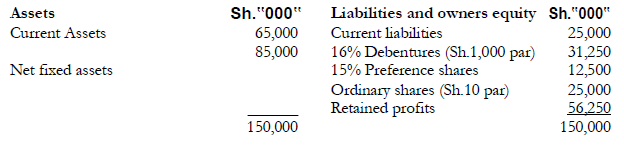

- The Salima company is in the fast foods industry. The following is the company's balance sheet for the year ended 31 March 1995:

Additional information:

1. The...(Solved)

The Salima company is in the fast foods industry. The following is the company's balance sheet for the year ended 31 March 1995:

Additional information:

1. The debenture issue was floated 10 years ago and will be due in the year 2005. A similar

debenture issue would today be floated at Sh.950 net.

2. Last December the company declared an interim dividend of Sh.2.50 and has now declared

a final dividend of Sh.3.00 per share. The company has a policy of 10% dividend growth

rate which it hopes to maintain into the foreseeable future. Currently the company's

shares are trading at Sh.75 per share in the local stock exchange.

3. A recent study of similar companies in the fast foods industry disclose their average beta as 1.1.

4. There has not been any significant change in the price of preference shares since they

were floated in mid 1990.

5. Treasury Bills are currently paying 12% interest per annum and the company is in the

40% marginal tax rate.

6. The inflation rate for the current year has been estimated to average 8%.

Required:

(a) Determine the real rate of return.

(b) What is the minimum rate of return investors in the fast foods industry may expect to

earn on their investment? Show your workings.

(c) Calculate Salina's overall cost of capital.

(d) Discuss the limitations of using a firm's overall cost of capital as an investment discount rate.

Date posted: December 15, 2021. Answers (1)

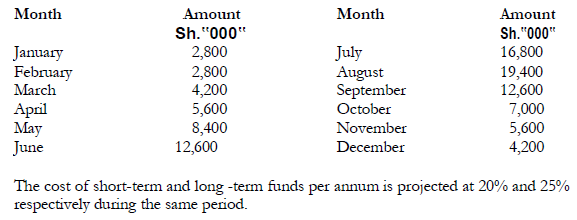

- Westwood Ltd. has projected its working capital for the next 12 months as follows:

Required:

(a) Prepare a schedule showing the amount of permanent and seasonal funds...(Solved)

Westwood Ltd. has projected its working capital for the next 12 months as follows:

Required:

(a) Prepare a schedule showing the amount of permanent and seasonal funds requirements each month.

(b) What is the average amount of long-term and short-term financing that will be required each month?

(c) Calculate the total cost of working capital financing if the firm adopts:

(i) An aggregate financing strategy

(ii) A conservative financing strategy.

Date posted: December 15, 2021. Answers (1)

- State and explain two Theories used to explain when to time investment in the stock exchange.(Solved)

State and explain two Theories used to explain when to time investment in the stock exchange.

Date posted: December 15, 2021. Answers (1)

- What advantages do investors derive from investment in shares?(Solved)

What advantages do investors derive from investment in shares?

Date posted: December 15, 2021. Answers (1)

- Explain the case for and against development financial institutions.(Solved)

Explain the case for and against development financial institutions.

Date posted: December 15, 2021. Answers (1)

- Define development financial institutions and justify their existence in the economy concerns.(Solved)

Define development financial institutions and justify their existence in the economy concerns.

Date posted: December 15, 2021. Answers (1)

- The Pesa Company Unlimited is using a machine whose original cost was Sh.720,000. The machine is two years old, and it has a current market...(Solved)

The Pesa Company Unlimited is using a machine whose original cost was Sh.720,000. The machine is two years old, and it has a current market value of Sh.160,000. The asset is fully being depreciated over a twelve-years period. At the end of the twelve-years the asset will have a zero salvage value. Depreciation is on a straight line basis.

The Management is contemplating the purchase of a new machine to replace the old one. The new machine costs Sh.750,000 and has an estimated salvage value of Sh.100,000. The new machine will have a greater technological capacity, and therefore annual sales are expected to increase from Sh.10,000,000 to Sh.10,100,000. Operating efficiencies with the new machine will produce an expected saving of Sh.100,000 a year. Depreciation would be on a straight line basis over a ten-year life. The cost of capital is 12%, and a 40% tax rate is applicable. In addition, if the new machine is purchased, inventories will increase by sh.150,000 and payables by Sh.50,000

during the life of the project.

Required:

(a) Should the new machine be purchased? (Use Net Present Value (NPV) approach).

(b) What factors in addition to the quantitative ones above are likely to require consideration in a practical situation?

Date posted: December 15, 2021. Answers (1)

- RITE Ltd. maintains an average monthly balance of Sh.320,000 in accounts receivable throughout the year. The company is in need of additional working capital and...(Solved)

RITE Ltd. maintains an average monthly balance of Sh.320,000 in accounts receivable throughout the year. The company is in need of additional working capital and is considering two alternative methods of raising it.

METHOD 1 Factoring accounts receivable

METHOD 2 A commercial bank loan secured by accounts receivable.

The company's bankers have agreed to lend the firm 80% of its average accounts receivable at an interest of 30% per annum. The amount will be made available in a series of 30 day advances. The advances would be discounted and a 6% compensating balance will be required.

The factor is willing to establish a factoring arrangement on a continuing basis. It charges 2% for servicing the accounts and 15% per annum on any advances taken. Both charges are made on discount basis. In addition, the factor requires a 5% reserve to cover returned items. RITE Ltd. sells its merchandise on terms of net 30.

Required:

(a) Calculate the amount of advances RITE Ltd. can expect to have under each alternative.

(b) Calculate the effective rate of interest for each financing alternative.

(c) Which alternative would you recommend and why?

Date posted: December 15, 2021. Answers (1)

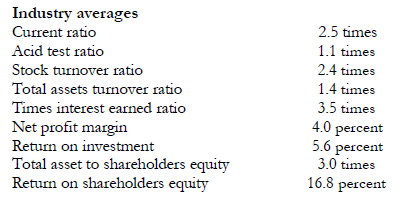

- The following are the financial statements of Richardo Ltd. for the year ended 31 March 1995:

Required

(a) Calculate the ratios shown above for Richardo Ltd. and...(Solved)

The following are the financial statements of Richardo Ltd. for the year ended 31 March 1995:

Required

(a) Calculate the ratios shown above for Richardo Ltd. and present them in columnar form

along the industry averages.

(b) Comment upon the following about Richardo Ltd. in relation to the industry averages:

(i) Liquidity position

(ii) Financial risk

(iii) Overall performance

Date posted: December 15, 2021. Answers (1)

- Gopher Ltd has issued 300,000 ordinary shares of £1 each, which are at present selling for £4 per share. The company plans to issue rights...(Solved)

Gopher Ltd has issued 300,000 ordinary shares of £1 each, which are at present selling for £4 per share. The company plans to issue rights to purchase one new equity share at a price of £3.20 per share for every 3 shares held. A shareholder who owns 900 shares thinks that he will suffer a loss in his personal wealth because the new shares are being offered at a price lower than market value. On the assumption that the actual market value of shares will be equal to the theoretical ex-rights price, what would be the effect on the shareholder's wealth if:

(a) He sells all the rights;

(b) He exercises one half of the rights and sells the other half;

(c) He does nothing at all?

Date posted: December 15, 2021. Answers (1)

- What is rights issue and what are the advantages?(Solved)

What is rights issue and what are the advantages?

Date posted: December 15, 2021. Answers (1)

- How can a firm overcome capital rationing problems?(Solved)

How can a firm overcome capital rationing problems?

Date posted: December 15, 2021. Answers (1)

- Distinguish between 'Hard' and 'soft' capital rationing clearly indicating the causes of each.(Solved)

Distinguish between 'Hard' and 'soft' capital rationing clearly indicating the causes of each.

Date posted: December 15, 2021. Answers (1)

- Explain how tax treatment of capital expenditure can affect investment decision.(Solved)

Explain how tax treatment of capital expenditure can affect investment decision.

Date posted: December 15, 2021. Answers (1)

- The Independent Film Company plc is a film company which purchases distribution rights on films from small independent producers, and sells the films on to...(Solved)

The Independent Film Company plc is a film company which purchases distribution rights on films from small independent producers, and sells the films on to cinema chains for national and international screening. In recent years the company has found it difficult to source sufficient films to maintain profitability. In response to the problem, the Independent Film Company has decided to invest in commissioning and producing films in its own right. In order to gain the expertise for this venture, the Independent Film Company is considering purchasing an existing

filmmaking concern, at a cost of Sh.400,000. The main difficult that is anticipated for the business is the increasing uncertainty as to the potential success/failure rate of independently produced films. Many cinema chains are adopting a policy of only buying films from large international film companies, as they believe that the market for independent films is very limited and specialist in nature. The Independent Film Company is prepared for the fact that they are likely to have more films that fail than that succeed, but believe that the proposed film

production business will nonetheless be profitable.

Using data collection from the existing distribution business and discussions with industry

experts, they have produced cost and revenue forecasts for the five years of operation of the

proposed investment. The company aims to complete the production of three films per year.

The after tax cost of capital for the company is estimated to be 14%.

Year 1 sales for the new business are uncertain, but expected to be in the range of Sh.4-10

million. Probability estimates for different forecast values are as follows:

Sales are expected to grow at an annual rate of 5%.

Anticipated costs related to the new business are as follows:

Additional Information

(i) No capital allowances are available.

(ii) Tax is payable one year in arrears, at a rate of 33% and full use can be made of tax

refunds as they fall due.

(iii) Staff wages (technical and non-production staff) and actors‟ salaries, are

expected to rise by 10% per annum.

(iv) Studio hire costs will be subject to an increase of 30% in Year 3.

(v) Screenplay costs per film are expected to rise by 15% per annum due to a shortage of

skilled writers.

(vi) The new business will occupy office accommodation which has to date been let out for

an annual rent of Sh.20,000. Demand for such accommodation is buoyant and the

company anticipates in finding future tenants at the same annual rent.

(vii) A market research survey into the potential for the film production business cost Sh.25,000.

Required:

Using DCF analysis, calculate the expected Net Present Value of the proposed investment.

(Workings should be rounded to the nearest Sh.‟000‟)

Date posted: December 15, 2021. Answers (1)

- A working capital policy of any business is critical to its viability as a going concern. The board of directors would ignore the information of...(Solved)

A working capital policy of any business is critical to its viability as a going concern. The board of directors would ignore the information of such a policy to its great disadvantage.

The finance director of Watu Limited is formulating the company's capital policy for next year.

Sales have been protected at Sh.240 million next year. Three alternative policies are under

consideration as follows:

1. Maintain current asset level at 40 per cent of projected sales.

2. Maintain current asset level at 50 per cent of projected sales.

3. Maintain current asset level at 60 percent of projected sales.

Required:

(a) Discuss the expected impact of policies (1) and (3).

(b) The fixed assets of Watu Limited are Sh.100 million and the company wishes to

maintain a 60 percent debt ratio. The cost of capital for Watu Limited is currently 12

percent on both short-term and long-term debt. This is the rate which the firm also

applies on its permanent capital structure. The company earns 15 percent on sales.

What is the expected return on equity under each of the three policies above?

(c) Are earnings and level of sales independent of current asset policy in real life? Explain.

(d) What is meant by “maturity matching”, in finance?

Date posted: December 15, 2021. Answers (1)

- Can market forces be able to eliminate insider trading? Explain.(Solved)

Can market forces be able to eliminate insider trading? Explain.

Date posted: December 15, 2021. Answers (1)

- One of the objectives of the Capital Markets Authority is “the protection of investor interests;” [Capital Markets Authority Act, Cap.485A, Section 11, (1) (c)].

Several statements...(Solved)

One of the objectives of the Capital Markets Authority is “the protection of investor interests;” [Capital Markets Authority Act, Cap.485A, Section 11, (1) (c)].

Several statements have appeared in the papers to suggest that some instances of share price manipulation have been observed in Kenya.

Required:

Specify those measures which the Capital Markets Authority has taken and publicized in order to protect the investor.

Date posted: December 15, 2021. Answers (1)

- Explain the term 'Invoice discounting' and the merits and demerits of its use as a way of improving cash flow.(Solved)

Explain the term 'Invoice discounting' and the merits and demerits of its use as a way of improving cash flow.

Date posted: December 15, 2021. Answers (1)

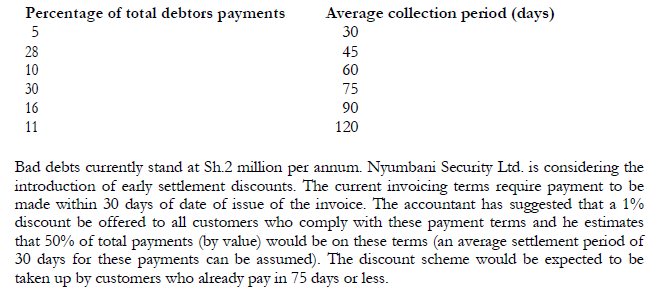

- Nyumbani Security Ltd. is a wholesaler of household security fittings. Over the last 12 months the company has encountered increasing problems with late payment by...(Solved)

Nyumbani Security Ltd. is a wholesaler of household security fittings. Over the last 12 months the company has encountered increasing problems with late payment by debtors. The last 12 months of credit sales of Sh.67.5 million show an increase of 10% over the previous year's sales, but the company's overdraft on which it is charged 20% per annum has also increased by Sh.1.8 million over the previous year.

The company wishes to reduce its working capital requirements by reducing the debtor collection period.

Nyumbani Security Ltd.'s accountant has extracted average debtors profile which is shown below:

As an alternative way of reducing the debtors figure, Nyumbani Security Ltd. would use a debt collection service which has quoted a price of 1% of sales receipts. It is estimated that using the service will have the effect of reducing debtor days by 20 and eliminating 50% of bad debts.

Required:

Calculate the change in working capital requirements and bad debts which would result from:

(i) The introduction of the early settlement discounts.

(ii) The use of the debt collection service.

(iii) Recommend which policy should be adopted by Nyumbani Security Ltd.

Date posted: December 15, 2021. Answers (1)