- Explain three factors that might influence the capital structure decision.(Solved)

Explain three factors that might influence the capital structure decision.

Date posted: March 30, 2022. Answers (1)

- In relation to the financial objectives of a business entity, distinguish between the terms “maximizing” and “satisficing”.(Solved)

In relation to the financial objectives of a business entity, distinguish between the terms “maximizing” and “satisficing”.

Date posted: March 30, 2022. Answers (1)

- Citing relevant examples in each case, distinguish between "agency costs" and "financial distress costs".(Solved)

Citing relevant examples in each case, distinguish between "agency costs" and "financial distress costs".

Date posted: March 30, 2022. Answers (1)

- Describe four ways that could be used to mitigate agency conflict between managers and shareholders.(Solved)

Describe four ways that could be used to mitigate agency conflict between managers and shareholders.

Date posted: March 30, 2022. Answers (1)

- Explain three causes of conflict of interest between shareholders and debt holders.(Solved)

Explain three causes of conflict of interest between shareholders and debt holders.

Date posted: March 30, 2022. Answers (1)

- Executive compensation plans hinder value creation in a company. Citing three reasons, justify the above statement.(Solved)

Executive compensation plans hinder value creation in a company. Citing three reasons, justify the above statement.

Date posted: March 30, 2022. Answers (1)

- Explain the term "agency theory" as applied in financial management.(Solved)

Explain the term "agency theory" as applied in financial management.

Date posted: March 30, 2022. Answers (1)

- Explain how the objective of wealth maximization differs from that of profit maximization for a company listed at the securities exchange.(Solved)

Explain how the objective of wealth maximization differs from that of profit maximization for a company listed at the securities exchange.

Date posted: March 30, 2022. Answers (1)

- State the different types of bond covenants which bondholders may impose on shareholders to protect themselves.(Solved)

State the different types of bond covenants which bondholders may impose on shareholders to protect themselves.

Date posted: December 15, 2021. Answers (1)

- State any 5 stakeholders of the firm and identify their financial objectives.(Solved)

State any 5 stakeholders of the firm and identify their financial objectives.

Date posted: December 15, 2021. Answers (1)

- The Salima company is in the fast foods industry. The following is the company's balance sheet for the year ended 31 March 1995:

Additional information:

1. The...(Solved)

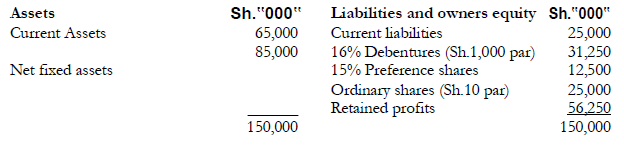

The Salima company is in the fast foods industry. The following is the company's balance sheet for the year ended 31 March 1995:

Additional information:

1. The debenture issue was floated 10 years ago and will be due in the year 2005. A similar

debenture issue would today be floated at Sh.950 net.

2. Last December the company declared an interim dividend of Sh.2.50 and has now declared

a final dividend of Sh.3.00 per share. The company has a policy of 10% dividend growth

rate which it hopes to maintain into the foreseeable future. Currently the company's

shares are trading at Sh.75 per share in the local stock exchange.

3. A recent study of similar companies in the fast foods industry disclose their average beta as 1.1.

4. There has not been any significant change in the price of preference shares since they

were floated in mid 1990.

5. Treasury Bills are currently paying 12% interest per annum and the company is in the

40% marginal tax rate.

6. The inflation rate for the current year has been estimated to average 8%.

Required:

(a) Determine the real rate of return.

(b) What is the minimum rate of return investors in the fast foods industry may expect to

earn on their investment? Show your workings.

(c) Calculate Salina's overall cost of capital.

(d) Discuss the limitations of using a firm's overall cost of capital as an investment discount rate.

Date posted: December 15, 2021. Answers (1)

- Westwood Ltd. has projected its working capital for the next 12 months as follows:

Required:

(a) Prepare a schedule showing the amount of permanent and seasonal funds...(Solved)

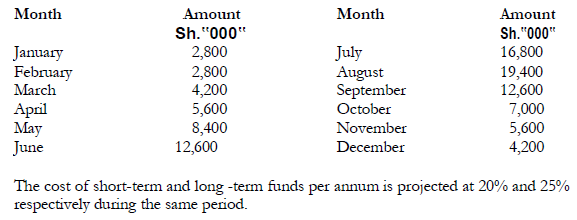

Westwood Ltd. has projected its working capital for the next 12 months as follows:

Required:

(a) Prepare a schedule showing the amount of permanent and seasonal funds requirements each month.

(b) What is the average amount of long-term and short-term financing that will be required each month?

(c) Calculate the total cost of working capital financing if the firm adopts:

(i) An aggregate financing strategy

(ii) A conservative financing strategy.

Date posted: December 15, 2021. Answers (1)

- State and explain two Theories used to explain when to time investment in the stock exchange.(Solved)

State and explain two Theories used to explain when to time investment in the stock exchange.

Date posted: December 15, 2021. Answers (1)

- What advantages do investors derive from investment in shares?(Solved)

What advantages do investors derive from investment in shares?

Date posted: December 15, 2021. Answers (1)

- Explain the case for and against development financial institutions.(Solved)

Explain the case for and against development financial institutions.

Date posted: December 15, 2021. Answers (1)

- Define development financial institutions and justify their existence in the economy concerns.(Solved)

Define development financial institutions and justify their existence in the economy concerns.

Date posted: December 15, 2021. Answers (1)

- The Pesa Company Unlimited is using a machine whose original cost was Sh.720,000. The machine is two years old, and it has a current market...(Solved)

The Pesa Company Unlimited is using a machine whose original cost was Sh.720,000. The machine is two years old, and it has a current market value of Sh.160,000. The asset is fully being depreciated over a twelve-years period. At the end of the twelve-years the asset will have a zero salvage value. Depreciation is on a straight line basis.

The Management is contemplating the purchase of a new machine to replace the old one. The new machine costs Sh.750,000 and has an estimated salvage value of Sh.100,000. The new machine will have a greater technological capacity, and therefore annual sales are expected to increase from Sh.10,000,000 to Sh.10,100,000. Operating efficiencies with the new machine will produce an expected saving of Sh.100,000 a year. Depreciation would be on a straight line basis over a ten-year life. The cost of capital is 12%, and a 40% tax rate is applicable. In addition, if the new machine is purchased, inventories will increase by sh.150,000 and payables by Sh.50,000

during the life of the project.

Required:

(a) Should the new machine be purchased? (Use Net Present Value (NPV) approach).

(b) What factors in addition to the quantitative ones above are likely to require consideration in a practical situation?

Date posted: December 15, 2021. Answers (1)

- RITE Ltd. maintains an average monthly balance of Sh.320,000 in accounts receivable throughout the year. The company is in need of additional working capital and...(Solved)

RITE Ltd. maintains an average monthly balance of Sh.320,000 in accounts receivable throughout the year. The company is in need of additional working capital and is considering two alternative methods of raising it.

METHOD 1 Factoring accounts receivable

METHOD 2 A commercial bank loan secured by accounts receivable.

The company's bankers have agreed to lend the firm 80% of its average accounts receivable at an interest of 30% per annum. The amount will be made available in a series of 30 day advances. The advances would be discounted and a 6% compensating balance will be required.

The factor is willing to establish a factoring arrangement on a continuing basis. It charges 2% for servicing the accounts and 15% per annum on any advances taken. Both charges are made on discount basis. In addition, the factor requires a 5% reserve to cover returned items. RITE Ltd. sells its merchandise on terms of net 30.

Required:

(a) Calculate the amount of advances RITE Ltd. can expect to have under each alternative.

(b) Calculate the effective rate of interest for each financing alternative.

(c) Which alternative would you recommend and why?

Date posted: December 15, 2021. Answers (1)

- The following are the financial statements of Richardo Ltd. for the year ended 31 March 1995:

Required

(a) Calculate the ratios shown above for Richardo Ltd. and...(Solved)

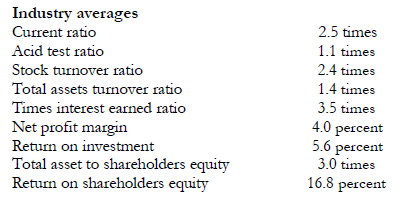

The following are the financial statements of Richardo Ltd. for the year ended 31 March 1995:

Required

(a) Calculate the ratios shown above for Richardo Ltd. and present them in columnar form

along the industry averages.

(b) Comment upon the following about Richardo Ltd. in relation to the industry averages:

(i) Liquidity position

(ii) Financial risk

(iii) Overall performance

Date posted: December 15, 2021. Answers (1)

- Gopher Ltd has issued 300,000 ordinary shares of £1 each, which are at present selling for £4 per share. The company plans to issue rights...(Solved)

Gopher Ltd has issued 300,000 ordinary shares of £1 each, which are at present selling for £4 per share. The company plans to issue rights to purchase one new equity share at a price of £3.20 per share for every 3 shares held. A shareholder who owns 900 shares thinks that he will suffer a loss in his personal wealth because the new shares are being offered at a price lower than market value. On the assumption that the actual market value of shares will be equal to the theoretical ex-rights price, what would be the effect on the shareholder's wealth if:

(a) He sells all the rights;

(b) He exercises one half of the rights and sells the other half;

(c) He does nothing at all?

Date posted: December 15, 2021. Answers (1)