i. New funds may be easily obtained from the stock exchange

ii. Pricing of shares is made easy

iii. Transfer of ownership of shares is made easier

iv. Valuation of the company for take-over or acquisition purposes is made easier

v. Wide ownership of the company in enhanced

vi. There is reduction in risk as perceived by the inventors

vii. The greater prominence and status given to listed companies create good will for the company

Kavungya answered the question on March 30, 2022 at 07:37

- Latex Ltd. has a paid up ordinary share capital of Shs. 4,500,000 represented by 6 million shares of Sh.0.75 each. The company has no loan...(Solved)

Latex Ltd. has a paid up ordinary share capital of Shs. 4,500,000 represented by 6 million shares of Sh.0.75 each. The company has no loan capital. During the last financial year, earnings after tax were Sh.3, 600.000.

The price earnings (P/E) ratio is 15. The company is planning to make a large investment which will cost Sh.10, 500,000 and is considering to raise this finance through a rights issue with a price of Sh.8 per share.

Required:

(i) The current market price per share.

(ii) The theoretical ex-rights price per share.

Date posted: March 30, 2022. Answers (1)

- Briefly explain the meaning of the term "deep-discounted rights issue".(Solved)

Briefly explain the meaning of the term "deep-discounted rights issue".

Date posted: March 30, 2022. Answers (1)

- Summarize four reasons that might lead to soft capital rationing in a limited company.(Solved)

Summarize four reasons that might lead to soft capital rationing in a limited company.

Date posted: March 30, 2022. Answers (1)

- Discuss any four factors that a company should consider when choosing between equity and debt as sources of finance.(Solved)

Discuss any four factors that a company should consider when choosing between equity and debt as sources of finance.

Date posted: March 30, 2022. Answers (1)

- Two firms, Alpha Ltd. and Beta Ltd., operate in the same industry. The two firms are similar in all aspects except for their capital structures.

The...(Solved)

Two firms, Alpha Ltd. and Beta Ltd., operate in the same industry. The two firms are similar in all aspects except for their capital structures.

The following additional information is available:

1. Alpha Ltd. is financed using Sh. 120 million worth of ordinary shares.

2. Beta Ltd. is financed using Sh.70 million in ordinary shares and Sh.50 million in 8% debentures.

3. The annual earnings before interest and tax are Sh.10 million for both firms. These earnings

are expected to remain constant indefinitely.

4. The cost of equity of Alpha Ltd. is 10%.

5. The corporate tax rate is 30%.

Required;-

Using the Modigliani and Miller (MM) model, compute:

i) The market values of Alpha Ltd. and Beta Ltd.

ii) The weighted average cost of capital (WACC) of Alpha Ltd. and Beta Ltd.

Date posted: March 30, 2022. Answers (1)

- Explain three factors that might influence the capital structure decision.(Solved)

Explain three factors that might influence the capital structure decision.

Date posted: March 30, 2022. Answers (1)

- In relation to the financial objectives of a business entity, distinguish between the terms “maximizing” and “satisficing”.(Solved)

In relation to the financial objectives of a business entity, distinguish between the terms “maximizing” and “satisficing”.

Date posted: March 30, 2022. Answers (1)

- Citing relevant examples in each case, distinguish between "agency costs" and "financial distress costs".(Solved)

Citing relevant examples in each case, distinguish between "agency costs" and "financial distress costs".

Date posted: March 30, 2022. Answers (1)

- Describe four ways that could be used to mitigate agency conflict between managers and shareholders.(Solved)

Describe four ways that could be used to mitigate agency conflict between managers and shareholders.

Date posted: March 30, 2022. Answers (1)

- Explain three causes of conflict of interest between shareholders and debt holders.(Solved)

Explain three causes of conflict of interest between shareholders and debt holders.

Date posted: March 30, 2022. Answers (1)

- Executive compensation plans hinder value creation in a company. Citing three reasons, justify the above statement.(Solved)

Executive compensation plans hinder value creation in a company. Citing three reasons, justify the above statement.

Date posted: March 30, 2022. Answers (1)

- Explain the term "agency theory" as applied in financial management.(Solved)

Explain the term "agency theory" as applied in financial management.

Date posted: March 30, 2022. Answers (1)

- Explain how the objective of wealth maximization differs from that of profit maximization for a company listed at the securities exchange.(Solved)

Explain how the objective of wealth maximization differs from that of profit maximization for a company listed at the securities exchange.

Date posted: March 30, 2022. Answers (1)

- State the different types of bond covenants which bondholders may impose on shareholders to protect themselves.(Solved)

State the different types of bond covenants which bondholders may impose on shareholders to protect themselves.

Date posted: December 15, 2021. Answers (1)

- State any 5 stakeholders of the firm and identify their financial objectives.(Solved)

State any 5 stakeholders of the firm and identify their financial objectives.

Date posted: December 15, 2021. Answers (1)

- The Salima company is in the fast foods industry. The following is the company's balance sheet for the year ended 31 March 1995:

Additional information:

1. The...(Solved)

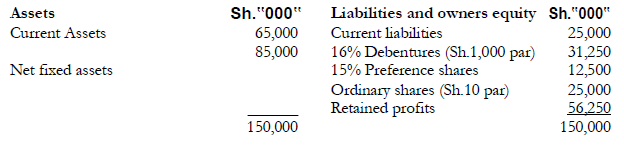

The Salima company is in the fast foods industry. The following is the company's balance sheet for the year ended 31 March 1995:

Additional information:

1. The debenture issue was floated 10 years ago and will be due in the year 2005. A similar

debenture issue would today be floated at Sh.950 net.

2. Last December the company declared an interim dividend of Sh.2.50 and has now declared

a final dividend of Sh.3.00 per share. The company has a policy of 10% dividend growth

rate which it hopes to maintain into the foreseeable future. Currently the company's

shares are trading at Sh.75 per share in the local stock exchange.

3. A recent study of similar companies in the fast foods industry disclose their average beta as 1.1.

4. There has not been any significant change in the price of preference shares since they

were floated in mid 1990.

5. Treasury Bills are currently paying 12% interest per annum and the company is in the

40% marginal tax rate.

6. The inflation rate for the current year has been estimated to average 8%.

Required:

(a) Determine the real rate of return.

(b) What is the minimum rate of return investors in the fast foods industry may expect to

earn on their investment? Show your workings.

(c) Calculate Salina's overall cost of capital.

(d) Discuss the limitations of using a firm's overall cost of capital as an investment discount rate.

Date posted: December 15, 2021. Answers (1)

- Westwood Ltd. has projected its working capital for the next 12 months as follows:

Required:

(a) Prepare a schedule showing the amount of permanent and seasonal funds...(Solved)

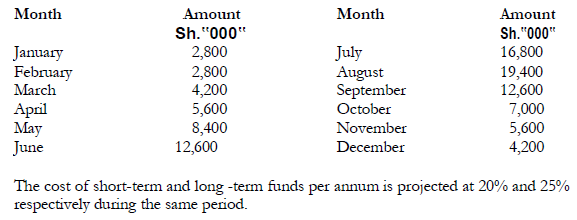

Westwood Ltd. has projected its working capital for the next 12 months as follows:

Required:

(a) Prepare a schedule showing the amount of permanent and seasonal funds requirements each month.

(b) What is the average amount of long-term and short-term financing that will be required each month?

(c) Calculate the total cost of working capital financing if the firm adopts:

(i) An aggregate financing strategy

(ii) A conservative financing strategy.

Date posted: December 15, 2021. Answers (1)

- State and explain two Theories used to explain when to time investment in the stock exchange.(Solved)

State and explain two Theories used to explain when to time investment in the stock exchange.

Date posted: December 15, 2021. Answers (1)

- What advantages do investors derive from investment in shares?(Solved)

What advantages do investors derive from investment in shares?

Date posted: December 15, 2021. Answers (1)

- Explain the case for and against development financial institutions.(Solved)

Explain the case for and against development financial institutions.

Date posted: December 15, 2021. Answers (1)