- Describe a Purchases Journal.(Solved)

Describe a Purchases Journal.

Date posted: August 17, 2021.

- You are to enter up the sales journal from the following details. Post the items to the relevant accounts in the sales ledger and then...(Solved)

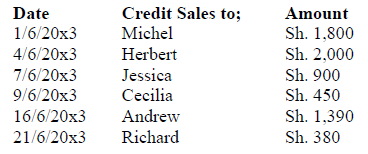

You are to enter up the sales journal from the following details. Post the items to the relevant accounts in the sales ledger and then show the transfer to the sales account in the general ledger.

Date posted: August 17, 2021.

- Describe a Sales Journal.(Solved)

Describe a Sales Journal.

Date posted: August 17, 2021.

- Define the term Journalizing.(Solved)

Define the term Journalizing.

Date posted: August 17, 2021.

- Explain a Credit note.(Solved)

Explain a Credit note.

Date posted: August 17, 2021.

- Explain a Purchase Invoice.(Solved)

Explain a Purchase Invoice.

Date posted: August 17, 2021.

- What is a Sales Invoice?(Solved)

What is a Sales Invoice?

Date posted: August 17, 2021.

- State the steps which the accounting cycle comprises of.(Solved)

State the steps which the accounting cycle comprises of.

Date posted: August 17, 2021.

- The following transactions relate to Kencom Enterprises. You are required to complete the double entry in the relevant accounts for the month of May, 2013.(Solved)

The following transactions relate to Kencom Enterprises. You are required to complete the double entry in the relevant accounts for the month of May, 2013.

01/05/2013: Started business by depositing Ksh 200,000 in the bank.

02/05/2013: Purchased goods worth Ksh 17,500 on credit from MM Wholesalers.

03/05/2013: Bought Equipment for Ksh 15,000 paying by cheque.

05/05/2013: Sold goods for cash worth Ksh 27,500.

06/05/2013: Bought goods on credit worth Ksh 11,400 from Pp Shah.

10/05/2013: Paid rent by cash Ksh 1,500.

12/05/2013: Bought stationery for Ksh 2,700, paying in cash.

18/05/2013: Goods returned to MM Wholesalers were amounting to Ksh 2,300.

21/05/2013: Received rent by cheque for Ksh 500.

23/05/2013: Sold goods on credit to Unity for Ksh 7,700.

24/05/2013: Bought a motor vehicle paying by cheque Ksh 30,000.

30/05/2013: Paid the wages by cash amounting to Ksh 11,700.

31/05/2013: The owner made cash drawings for personal use worth Ksh 4,400.

Date posted: August 17, 2021.

- Explain the accounts that record any decrease in stock.(Solved)

Explain the accounts that record any decrease in stock.

Date posted: August 17, 2021.

- State and explain two accounts that record any increase in stock.(Solved)

State and explain two accounts that record any increase in stock.

Date posted: August 17, 2021.

- Explain the Accounting for Expenses.(Solved)

Explain the Accounting for Expenses.

Date posted: August 17, 2021.

- Explain the Accounting for Income.(Solved)

Explain the Accounting for Income.

Date posted: August 17, 2021.

- Explain the Accounting for Purchases.(Solved)

Explain the Accounting for Purchases.

Date posted: August 17, 2021.

- Explain the Accounting for Sales.(Solved)

Explain the Accounting for Sales.

Date posted: August 17, 2021.

- Prepare Asset, Liability and Capital Accounts for Michael who had the following transactions for the month of January, 20x3.

01/01/2013: Started business by depositing Ksh 500,000...(Solved)

Prepare Asset, Liability and Capital Accounts for Michael who had the following transactions for the month of January, 20x3.

01/01/2013: Started business by depositing Ksh 500,000 in the bank.

02/01/2013: Purchased a Motor Vehicle paying by cheque Ksh 120,000.

05/01/2013: Purchased Fixtures & Fittings Ksh 40,000 on credit from ABC Ltd.

08/01/2013: Purchased another Motor Vehicle on credit from XYZ Ltd for Ksh 80,000.

12/01/2013: Withdrew Ksh 10,000 from the bank and put it into the cash till.

15/01/2013: Purchased extra Fixtures & Fittings paying by cash Ksh 6,000.

19/01/2013: Paid XYZ Ltd by cheque Ksh 80,000.

21/01/2013: Received a loan of Ksh 100,000 in cash from KK financers.

25/01/2013: Deposited cash amount of Ksh 80,000 into the bank account.

30/01/2013: Purchased more Fixtures & Fittings by cheque worth Ksh 30,000.

Date posted: August 17, 2021.

- Describe the Debit and Credit Entries.(Solved)

Describe the Debit and Credit Entries.

Date posted: August 17, 2021.

- Describe the Double Entry System.(Solved)

Describe the Double Entry System.

Date posted: August 17, 2021.

- The following assets and liabilities are owned by Jacob a sole trader as at 01/01/2013.

The following transactions were also captured during the financial period that...(Solved)

The following assets and liabilities are owned by Jacob a sole trader as at 01/01/2013.

.Ksh

Accounts payable 56,500

Machinery 150,000

Motor Vehicle 260,600

Stock 105,000

Accounts receivable 155,700

Bank 90,000

Cash 34,000

The following transactions were also captured during the financial period that ended 31/12/2013.

a) A new machine was purchased on credit worth Ksh 21,500.

b) Additional stock for Ksh 64,000 was purchased via bank.

c) Creditors were partly settled by payment of Ksh 20,000 by cheque.

d) The current debtors paid their account by Ksh 72,000 on cash.

e) Jacob deposited Ksh 5,000 into the bank account as capital.

Required:

i. Determine the capital amount for the business at the beginning of the financial period.

ii. Extract a trial balance that captures all the transactions reported.

Date posted: August 17, 2021.

- The following information relates to Alpha traders as at 31st December 20x3. You are required to prepare a balance sheet as at that date.(Solved)

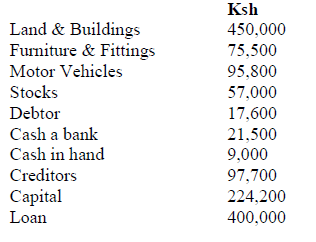

The following information relates to Alpha traders as at 31st December 20x3. You are required to prepare a balance sheet as at that date.

Date posted: August 17, 2021.

- Describe the Accounting Equation.(Solved)

Describe the Accounting Equation.

Date posted: August 17, 2021.